Author: Unknown LYNX

Entering the “Warring States Period” was when He XPeng made his remarks on the current competitive landscape of new car companies when XPeng Motors was listed on the Hong Kong Stock Exchange in July.

There are two connotations to the real historical Warring States Period in China:

-

The hegemonic situation of several major powers under the guise of “compliance with Zhou ritual” collapsed. In other words, after experiencing the baptism of the Spring and Autumn period, the remaining princes all had the strength and opportunity to become the boss.

-

What Confucius said about “the collapse of etiquette and the destruction of music” became a reality. The states tore off the veil of tenderness and morality and purely fought more frequently and more cruelly for national interests.

Crossing through time and space back to now, at the beginning of August, when leading new car companies have successively announced their sales results, we can easily find that the real “Warring States Period” has begun.

8000 new threshold, change of hegemony

When it comes to the three small new car companies, people are now accustomed to using the abbreviation of “Xiao Li” to refer to them. In addition to reasons such as establishment time and listing time and other dimensions of enterprise development, sales volume is the more direct factor:

In the first half of this year, NIO has always been stable at the top of the monthly sales volume chart of new car companies. At the most exaggerated time, NIO could even sell more than 2,000 new cars in a month than the following XPeng and Ideal.

However, this situation began to quietly change in the past two months.

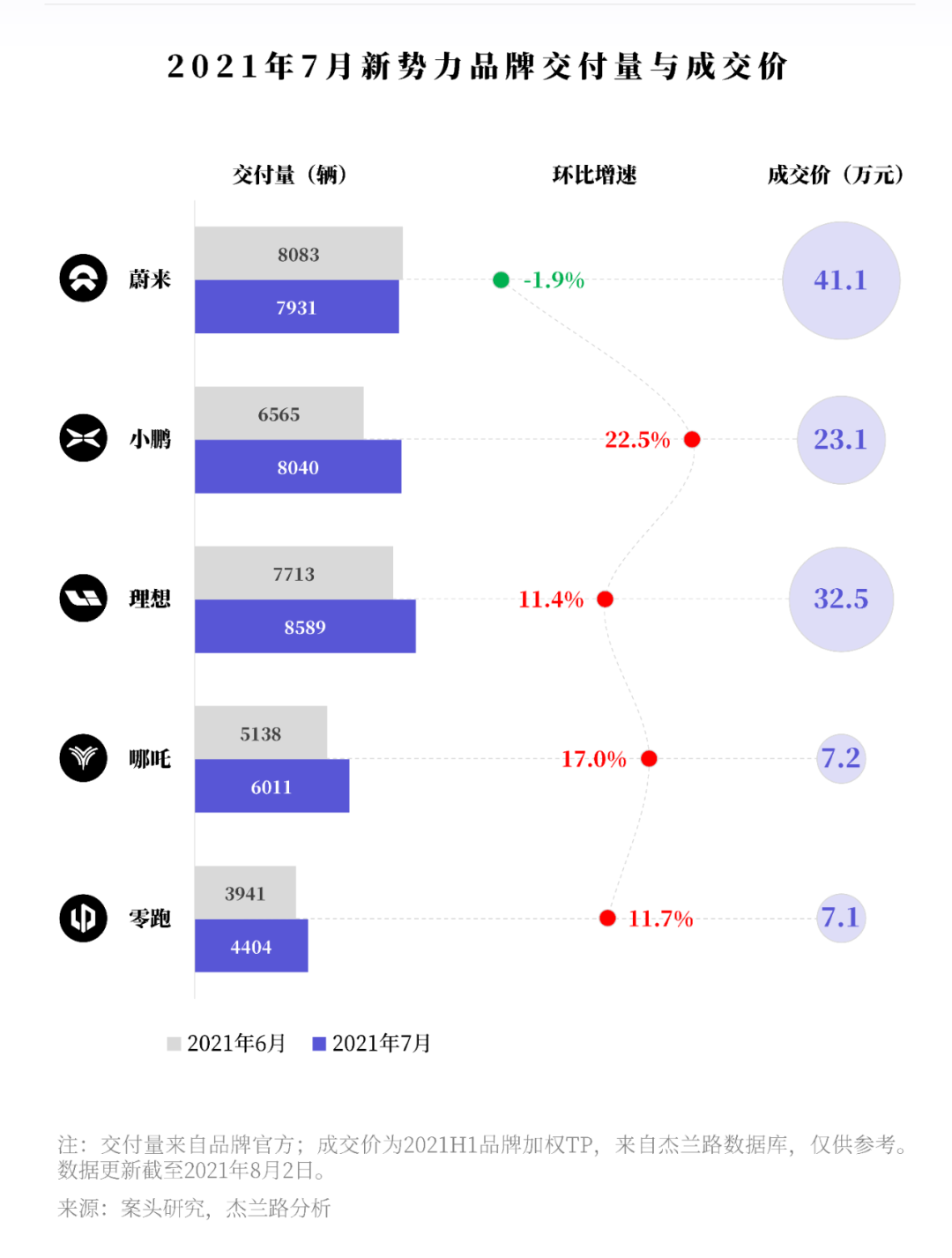

In June, although the official and China Passenger Car Association data both showed that NIO still ranked first with a delivery volume of 8,083 units, higher than Ideal (7,713 units) and XPeng (6,565 units).

However, according to data disclosed by relevant institutions later, Ideal’s actual sales volume of new cars actually reached 7,827 units, surpassing NIO (7,777 units) by a slight advantage.

At the time this number was announced, Ideal officials themselves also enthusiastically launched a wave of propaganda campaigns.

When August arrived, Ideal no longer had to spend time playing word games with delivery and insurance data. Joined by XPeng, they surpassed NIO in July and won the monthly sales champion:

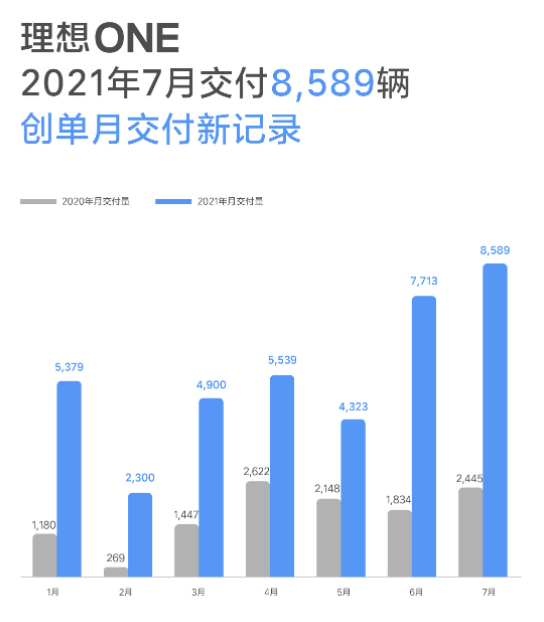

Ideal Motors’ delivery volume in July reached a record monthly high of 8,589 units, an increase of 11.4% month-on-month, legitimately winning the title of monthly sales champion.

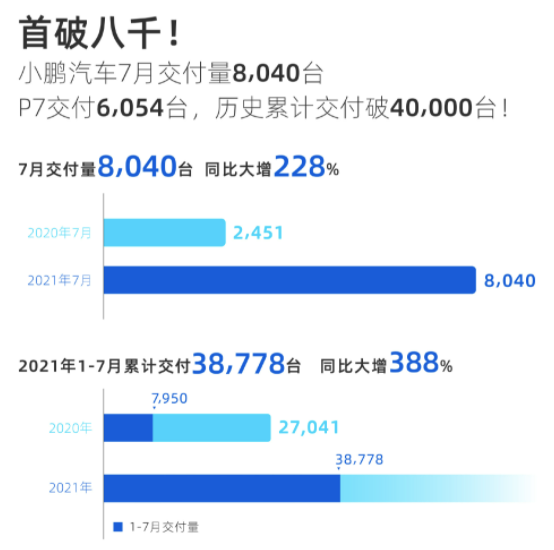

Following close behind, XPeng also created history, with the delivery volume in July breaking the 8,000 mark for the first time, reaching 8,040 vehicles, an increase of 22% month-on-month, ranking second on the sales chart.

The following is the English Markdown text, with professional translation of Chinese text, preserving the HTML tags inside Markdown, and outputting the result:

The following is the English Markdown text, with professional translation of Chinese text, preserving the HTML tags inside Markdown, and outputting the result:

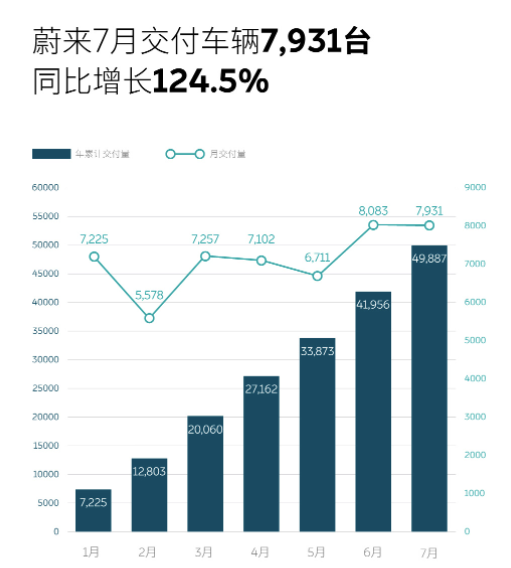

It seems that NIO is the last company among the "New Three" to release its delivery data, perhaps because its performance was worse than expected. Judging from its actual performance, NIO delivered 7,931 new vehicles in July, and there was a slight drop compared to the delivery performance of 8,083 vehicles in June.

As for the reason for the decline in deliveries, manufacturers always manage to find an excuse. Production capacity bottlenecks and chip shortages are popular reasons this year. However, this time, NIO attributed the decline in deliveries to natural disasters - according to official sources, the German flood has affected the supply of air suspension shock absorbers, causing NIO's delivery speed to slow down.

However, this does not prevent the media from reporting striking descriptions such as "NIO falls behind" and "a new pattern of the New Three emerging."

It should be noted that this is the first time NIO has lost the monthly delivery champion title since 2018.

The top three rankings have changed, and the second-tier group is catching up faster.

WM Motor, which once squeezed into the top three monthly sales, also achieved a historic high delivery in July: it exceeded 6,000, reaching 6,011, an increase of 17% month-on-month.

At the same time, in response to the long-standing doubt about "relying on the B-end market for volume," the WM Motor official also pointed out that individual users accounted for 90% of the new car deliveries in July.

Lingdu Automobile, which announced its sales almost at the same time as WM Motor, delivered 4,404 vehicles in July, an increase of 12% month-on-month, even though its main model is still the A00-class small car Lingdu T03 under 100,000 RMB.

Looking at the delivery situation of the top New Three automakers in July, the following conclusions can be drawn:

1. **The threshold for the top three has been raised to 8,000 vehicles, and the sales crown is no longer monopolized by NIO alone**. Next, the competition for the monthly sales champion and who can be the first to break through the 10,000 vehicle sales barrier per month will be the focus of attention.

From Product Power to System Power

Apart from the “Big Three” who come with their own traffic, the second-tier manufacturers have also found their own development rhythm. In terms of growth trends, monthly sales have increased by more than 10%, almost becoming a common topic among the new force brands at the top.

The “Warring States Period” of new energy vehicle startups is in line with the historical process, where the old order begins to shake, and competition will inevitably become more intense after surpassing the baseline of “survival”.

Ideal aims to win the new energy vehicle sales championship in July, there is no special secret. The popularity of the new Ideal ONE undoubtedly provides the source of momentum for the sales growth.

In May of this year, the 2021 Ideal ONE was officially released, and the new car did not undergo major changes in appearance and interior. However, the optimization of the internal space, seats, and the upgrading of the soft and hardware of the auxiliary driving system, as well as the increase in cruising range, have further enhanced the product competitiveness of Ideal ONE.

For consumers, what is more attractive is the cost of many upgrades, which is only 10,000 yuan higher than the old Ideal ONE. This has caused some users who have just bought the old model to feel psychologically unbalanced, and have raised banners for their rights. However, obviously it did not affect the enthusiasm of more new users who have just come into contact with new energy vehicles to purchase Ideal ONE.

When announcing the delivery data in July, Ideal Automotive’s co-founder and CEO, Shen Yanan, explained the problem very well: “Thanks to its outstanding product power, the 2021 Ideal ONE once again refreshed the delivery record in July.”

The key, obviously, lies in the three words “product power”.

As early as May, when the new Ideal ONE was launched, Shen Yanan had clearly stated that the target was to achieve sales of over 10,000 units in September this year. After the delivery data was released in July, there was only a gap of about 1,500 units left from this threshold.

After XPeng’s listing on the Hong Kong Stock Exchange, Ideal Automotive will also conduct a secondary listing on the same exchange. Perhaps taking advantage of the favorable situation of the capital market, the goal of breaking 10,000 units per month may be achieved ahead of schedule.

However, behind the soaring sales, there have been some negative news surrounding Ideal. In addition to the old car owners’ rights protection incidents, the mysterious “Mercury Gate” incident and the founder Li Xiang’s usual “attacking remarks” have also caused negative public opinion about Ideal Automotive.After winning the monthly sales championship, we only hope that we are not satisfied with our achievements. In the small-scale incremental environment, the new car models are undoubtedly strong drivers to boost sales. However, when it comes to millions of sales, doing a good job in user operation and service will be just as important as enhancing product power.

“Buy new, not old, and there will be discounts if bought later” is a common saying in the field of digital consumption.

In the current age where intelligent electric vehicles are becoming more and more like smart phones, this sentence also applies to car consumption. Before the new models are delivered, manufacturers naturally start to focus on marketing.

Although the XPeng P5 with laser radars has earned many admirers, this new car will still have to wait until the end of this year to be delivered. In addition to the good intelligent experience of P7 and other models, the real sales preferential policies are also important means for XPeng to maintain growth.

As early as June, XPeng officially launched marketing campaigns such as compulsory insurance subsidies and test drive discounts through cooperation with online platforms such as Autohome and Tmall. In addition, users who purchased XPeng P7 in that month could enjoy a maximum discount of 15,940 yuan, while the highest discount for G3 was 15,000 yuan.

In July, XPeng announced that the annual free charging quota of 3,000 degrees would be reduced to 1,000 degrees at the end of July, further tempting potential users to hurry up and buy cars.

This seems to indicate that the “Warring States era” of new car forces will expand from simple product competition to comprehensive competition in channel, marketing and other fields.

On this point, NIO, which fell behind in July deliveries, has gone further.

In addition to simply announcing data, NIO also uses a long chart of “What happened this month” to show the company’s development trajectory.

In July, in addition to selling cars, NIO focused on the following:

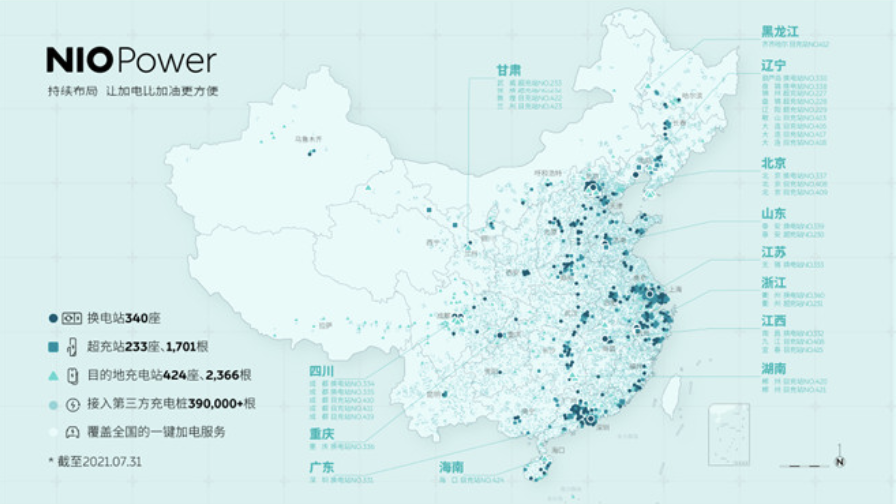

- Continuously strengthen the construction of the energy supplement system. Added 40 new battery swapping stations, 33 new supercharging stations, and opened up the first unique state highway charging route in China.

-

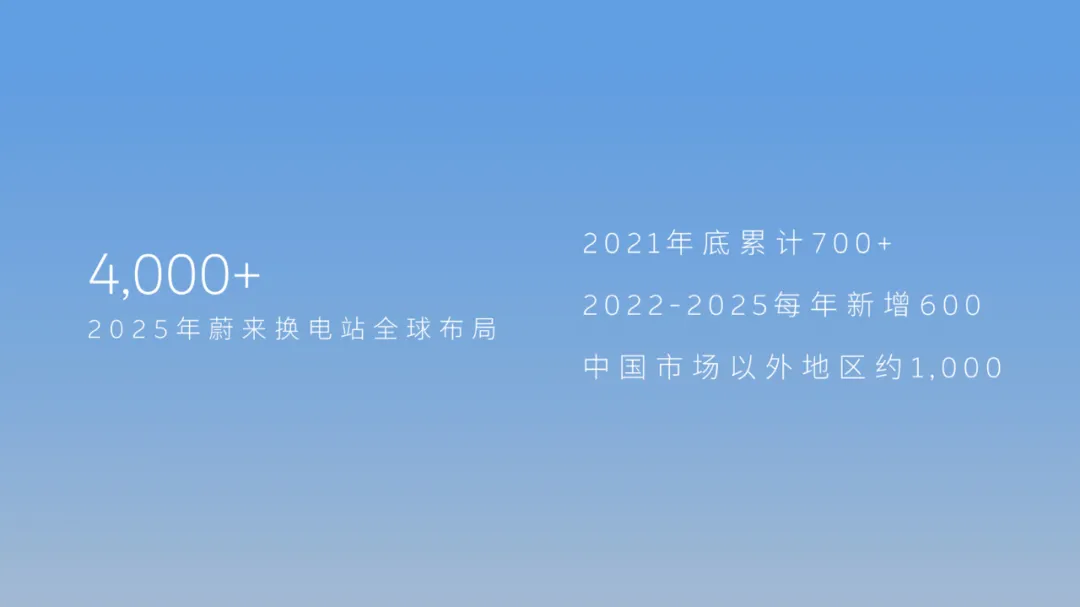

Released the 2025 Battery Swapping Station Layout Plan. The goal is to ensure that 90% of NIO users can find a battery swapping station within 3 kilometers of their residence by 2025.

-

A vote was held to select the host city for 2021 NIO Day, and it was decided that it will be held in Suzhou.

- In response to customer demand, we have announced a plan to improve seat comfort.

- The new NIO ES8 and battery swap equipment have been shipped to Norway.

These are all powerful annotations to the current NIO high-level management’s emphasis on “systematic capacity building” in various media communications.

In addition, a consulting firm has produced a summary image based on the delivery volume of new car makers in July, which reminds us once again that in the current market where overall sales of new energy vehicles are constantly breaking records, it seems that focusing only on delivery data is becoming less and less important.

Conclusion

After top new energy vehicle companies announced their delivery data at the beginning of the month, the China Association of Automobile Manufacturers (CAAM) will also release overall sales data for the Chinese auto market in July next week.

As expected, new energy vehicles will still be the biggest bright spot in the market.

In addition, the newly discounted Tesla Model 3 and the new energy vehicle models of traditional manufacturers, which are poised to be released after the chip shortage is gradually eased, will bring more imagination to the market.

The expression “Warring States period” will not only be limited to describing the competition among new car makers.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.