Translation in English Markdown

Author: James Yang Jianwen

In May of this year, power battery supplier CATL announced at a shareholder meeting that it would release sodium-ion batteries in July. And now, the company has delivered on its promise, as it released its first-generation sodium-ion battery on July 29th.

Interestingly, the pre-recorded launch event lasted only 10 minutes, with about 7 minutes of actual, informative content. It’s very characteristic of a tech company to save people’s time.

However, these seven minutes could mark a new beginning for the power battery industry.

Without further ado, enjoy.

CATL’s Sodium-Ion Battery

CATL has come up with a solution for sodium-ion batteries.

Sodium-ion batteries work in similar ways to lithium-ion batteries, mainly utilizing the movement of sodium ions between positive and negative electrodes to enable charge transfer.

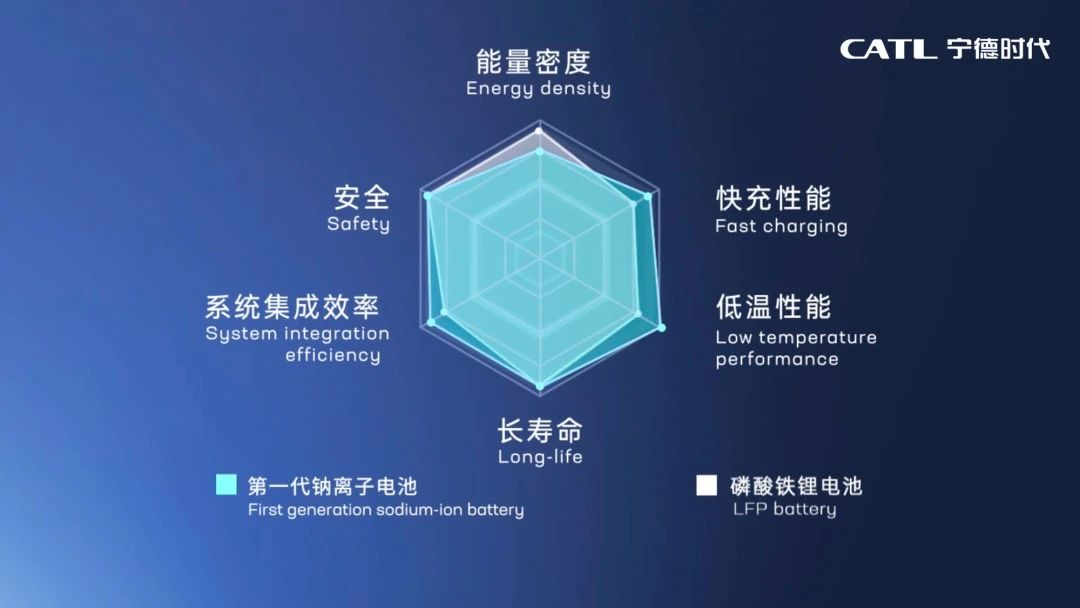

Given that, CATL’s first-generation sodium-ion battery boasts these features:

-

The energy density of a single cell can reach 160 Wh/kg.

-

At room temperature, the battery can be charged to over 80% in just 15 minutes.

-

The battery can retain more than 90% of its discharge capacity at temperatures as low as -20°C.

-

Sodium-ion batteries can currently be cycled about 3,000 times (similar to ternary lithium batteries).

-

The system integration efficiency can reach 80% or more.

-

Thermal stability exceeds the safety requirements of national standards.

In terms of manufacturing processes, sodium-ion batteries can achieve perfect compatibility with lithium-ion battery production equipment and technology. Production lines can be switched quickly, enabling rapid capacity deployment.

CATL has already initiated the industrial layout for sodium-ion batteries and intends to form a basic industry chain by 2023.

Why Develop Sodium-Ion Batteries?

In May of this year, from January to May of 2021, China’s cumulative output of phosphate iron lithium batteries accounted for 50.3%, surpassing ternary batteries’ 49.6%. Phosphate iron lithium batteries became more car makers’ first choice due to their safety and low cost.

So, why did CATL turn its attention to sodium-ion batteries while phosphate iron lithium batteries are in demand?

Even people outside the automotive industry can sense the trend: the world is rapidly transitioning towards new energy. That means the global demand for lithium-ion batteries will skyrocket.

Let’s take three companies as examples:# Mercedes-Benz:

Mercedes-Benz will be fully prepared for all-electric vehicles before 2030. The demand for battery production capacity is expected to exceed 200 GWh in the future. In addition to the 9 battery factories that have been put into production or planned, Mercedes-Benz will build 8 battery cell factories with partners.

BMW:

By 2023, it is expected that about 90% of the niche market will be covered by electric vehicles. The average annual sales growth rate of BMW’s pure electric vehicle models is expected to exceed 50% from now to 2025. By 2025, BMW will sell more than 10 times the pure electric vehicles sold in 2020 and deliver the 2 millionth pure electric vehicle model. By 2030, at least 50% of the global sales will be pure electric vehicles. It is estimated that about 10 million pure electric vehicles will be sold globally in the next decade.

Volkswagen:

By 2030, the delivery volume of electric vehicles will account for 50% of the group’s global total delivery volume. In Europe, it is expected that this proportion will reach about 60%. Volkswagen will jointly establish 6 “super factories” with partners to meet the future 240 GW battery production capacity gap.

As you can see, the demand for battery production capacity and lithium batteries is huge. Moreover, as the world is transitioning to new energy sources, battery supply will inevitably become a problem.

This phenomenon has already been highlighted. In order to obtain battery supply, automotive industry leaders personally wait at the door of battery manufacturers to secure battery supply, and this has been happening for a long time. It’s just that now it has attracted everyone’s attention.

Not only battery suppliers like CATL, but also host factories like Volkswagen and Tesla have extended their tentacles to upstream lithium mines to ensure the supply of battery raw materials.

Moreover, in terms of global supply, the content of lithium in the earth’s crust is only 0.0065%, which is not much, and coping with such a high demand globally has always been a problem.

An obvious phenomenon is that in recent years, the price of lithium carbonate has been increasing year by year, and it has now reached about 90,000 yuan/ton. What is this concept? It was only about 38,000 yuan/ton at the lowest point last year, and the increase has exceeded 130%.

However, from the current trend of large sales of new energy vehicles, the demand for lithium mines will still rise in the second half of the year, and the price of lithium mines will continue to rise, and the cost of power batteries will increase. In addition, automakers also have cost reduction requirements for batteries, bringing double pressure to battery suppliers.

At the shareholders’ meeting in May, Zeng Yuqun said: “If the (raw material) price rises very high, it will definitely have a greater impact on our costs. But to what extent will it be passed on downstream, we are also considering this issue.”

Moreover, China has limited lithium mine resources, and its import dependency is about 70%, which is easily constrained. These are important reasons for the development of sodium-ion batteries by Contemporary Amperex Technology.

Starting to challenge the Lithium Iron Phosphate batteries with sodium-ion batteries

However, from the various aspects of the press conference and various comparison charts of Contemporary Amperex Technology, it is obvious that sodium-ion batteries are aimed at lithium iron phosphate batteries, and are clearly superior to the latter in low-temperature and fast-charging performance.

However, at present, sodium-ion batteries do not pose a great threat to lithium iron phosphate batteries. Let’s take a look at a data comparison:

-

Contemporary Amperex Technology: The single energy density of the sodium-ion battery is 160 Wh/kg, the system integration efficiency is 80%+, and the estimated system energy density is 125+ Wh/kg;

-

BYD: The energy density of the blade battery system is 140 Wh/kg, and the system integration efficiency is 72% (the single energy density is estimated to be 190+ Wh/kg);

-

Guoxuan High-tech: The single energy density of the soft pack lithium iron phosphate is 200 Wh/kg, the system energy density is 160 Wh/kg, and the group efficiency is 80%;

At the shareholders’ meeting in May, Zeng Yuqun had already stated: “Contemporary Amperex Technology’s sodium battery is not very cheap as soon as it comes out, because the entire supply chain is currently small.”

That is to say, whether from the perspective of battery energy density or application costs, sodium-ion batteries do not have a significant advantage. However, from the press conference, sodium-ion batteries have now planned two forms of cylindrical batteries and square batteries, and have already begun preparing for vehicle integration.

Although the first generation fell short in some ways, Contemporary Amperex Technology stated that the second-generation sodium-ion batteries have already been arranged: the research and development goal of battery energy density is above 200 Wh/kg. Obviously, the second-generation sodium-ion batteries can challenge lithium iron phosphate batteries.

Of course, all of this is still talk.

What I am really interested in is Contemporary Amperex Technology’s “genius” AB battery system solution, which instantly makes me feel that the imagination space for sodium-ion batteries is huge.Ningde Times has boldly blended sodium-ion batteries with lithium-ion batteries. The two types of batteries are mixed in a certain proportion and integrated into the same battery system, and then precise algorithm control is performed through BMS to balance different battery systems.

The benefit of this approach is to make up for the shortcomings of the sodium-ion battery’s energy density in the current stage and also take advantage of its high power and low-temperature performance.

Compared with a pure ternary lithium battery, this “hybrid battery” also has certain cost advantages (in the later stage) and will bring new sales growth, greatly increasing the availability of sodium-ion batteries in the current stage.

In summary, the current sodium-ion battery is like a weakling that cannot threaten lithium iron batteries. In the future, when the energy density of the sodium-ion battery is improved from an electrochemical perspective, this disadvantage will be eliminated, and it will become a real “hexagonal warrior” with the gradually forming industrial chain, achieving “low cost + mass production”.

At that time, it will be the moment to compete with lithium iron phosphate batteries.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.