Last August, I wrote an article about “Why Traditional Car Companies Cannot Succeed in Making Electric Cars”.

If this viewpoint had been put forward three years ago, many people wouldn’t even bother to refute it. At that time, there was such a view that as long as the traditional giants like Volkswagen and BMW began to make electric cars, then new forces such as Tesla and Nio would vanish into thin air.

When I wrote it again last year, there was still some debate.

If we were to talk about this viewpoint again this year, most people seem to agree. After all, the bloody satire drama is constantly being played out.

The much-anticipated Volkswagen ID series has already fallen short of expectations in China. Its recent surge in sales relies more on mobilizing employees and the supply chain. The Ford Mach-E has yet to be delivered but has already undergone an eleventh-hour price adjustment. BMW, Mercedes-Benz, and Audi have all successively introduced their own electric models, while the market presence of their gold-plated logos seems to fall short. Toyota, Mazda, and Lexus’ pure electric cars not only arrived late, but they continue to use old models for oil-to-electric conversions and boldly display them on showroom floors, demonstrating the meticulous product planning rhythm and steady execution of multinational car companies.

If, like me, you happened to be at a shopping mall in Futian central district in Shenzhen last weekend and saw a retro-styled C-HR pure electric car parked in an exquisite showroom, you would probably not be able to help recalling Tesla’s Model 3 launch event in California in April 2016. Even if the Toyota designer had watched Musk’s live show on TV in 2016 before starting from scratch to design and build a Toyota electric car, they wouldn’t have made a product like the C-HR.

Against this backdrop, the brand launched on April 15, 2021, called GeometryAuto (JiKe) seems somewhat different.

It too comes from Geely, a local large-scale traditional automobile group, but it does not use the oil-to-electric platform, does not share the same logo as the fuel-fueled vehicle brand, does not carry a smaller screen size, and does not develop third-party dealerships as sales channels, nor does it use opaque offline negotiable pricing models.

Before April 15th, hardly anyone knew about GeometryAuto. This brand is very young and lacks accumulated time.

But after April 15th, many people are paying attention to GeometryAuto, discussing it, praising it, and criticizing it.

GeometryAuto may be the world’s first truly ground-breaking sample of a large car company transforming into an intelligent electric car manufacturer. This article will analyze this interesting brand and explore the setbacks, achievements, and trade-offs it is experiencing.

The Pain of Reform

The saying “pain” is all hindsight.

Generally, those who are in pain do not dare to dismiss this as just pain.

The entire GeometryAuto team had been experiencing such pain for the two months prior to the 717 event.On the eve of July 17th, the entire senior management team of Xpeng, including CEO He XPeng, held a meeting until 2 a.m. The hottest topic of discussion that night was how to handle the motor selection issue and whether to completely hand over the power of choice to customers. This issue involves many aspects, such as supply chain, manufacturing, app reservations, and delivery, and small adjustments on the customer side can cause major problems for the brand.

From the amazing debut at the 415 brand launch event to the long queues for reservations at the Shanghai Auto Show in late April, to some media’s exclusive testing of the 001 at the Shanghai Tianma Mountain Racecourse, some car review experts have given it the title of “zero negative reviews” on the internet. Xpeng’s debut, like riding a colorful cloud, represents the traditional automakers coming to save the electric car industry, which has been dominated by Chinese and American start-ups.

However, after such a huge success, things turned sour. Problems started to emerge from all sides, and the entire Xpeng app community was filled with collective complaints and frustration for a long period of time from June to July.

Initially, users’ complaints were rational and mild, focusing on the product itself, such as criticizing the design of the steering wheel logo, the lack of seat ventilation for front passengers, and the lack of powerful performance for the car’s central processing unit.

Later, the problem gradually shifted from discussing the product objectively to discussing the image of a new brand.

For instance, some users found that when Geely released its new generation of intelligent pure electric SEA architecture, it claimed to support 800V high voltage charging. However, the Xpeng 001, which was built on the SEA architecture, only supports fast charging at 400V, causing some to say that this is false advertising.

Moreover, Xpeng did not completely list the differences between the standard WE version and the high-end YOU version in the official configuration comparison. When some WE version customers found unexpected differences, such as rear window privacy glass, glow-in-the-dark emblem, and lumbar supports in the seats, compared to the YOU version, they felt deceived.

On June 15th, Xpeng held a press conference, announcing that its production capacity was sold out for 2021 and that it would no longer accept preorder deposits. Subsequent orders could only be delivered after the Chinese New Year. This news caused a commotion in the industry, with many industry colleagues admiring Xpeng’s explosive order growth, but many potential Xpeng customers were not at ease. Those who were originally watching, considering, and carefully selecting this car found that if they continued to order the Xpeng 001, they would have to pay more than their friends who had ordered previously. Since the 2022 national electric vehicle subsidy policy has not yet been released, Xpeng temporarily displays subsequent pricing without factoring in subsidies, resulting in “apparent price increases of RMB 18,000.” Some of the affected customers were taken by surprise, and after the shock came disappointment and anger, which quickly spread throughout the Xpeng community.On the same day, Geek+ announced three new options in response to user feedback, including an EC light-sensitive panoramic sunroof, ventilated front seats, and a piano black sports package. These options were not priced or given a delivery date at the time. Geek+ intended to show their dedication to listening and responding to user demands, but some users were dissatisfied and complained that Geek+ was playing games. Some even suspected that GeeK+ had deliberately hidden some features and was now using the opportunity to raise prices on their top-of-the-line models.

On July 13th, the national product announcement revealed that in addition to Japan’s Nidec, Geek+ 001 motor suppliers also included Ningbo Weirui, but their performance parameters were not identical. Users were surprised by the appearance of a second supplier, and were concerned that a domestic supplier might not perform as well as a Japanese supplier, potentially harming their interests. Some users complained that buying a Geek+ 001 was like buying a blind box – you never know what you’ll get.

On the day after the Geek+ Shenzhen user meeting, I conducted an interview with Geek+ CEO An Conghui.

Regarding how to deal with negative public opinion in the community, he said, “I think this is a good thing. As Geek+ develops, there will inevitably be some setbacks, but as long as we do the right thing, these setbacks can be resolved. From another perspective, it also reflects the high level of concern and professionalism of our users towards Geek+. Geek+ is not perfect, but we are working hard towards perfection.”

Specifically, he identified two areas where the problems lie: “Firstly, directly facing users’ concerns is a big challenge for us, and our experience and abilities need to be iterated and upgraded quickly. We do not rule out the possibility of management problems, but our attitude is candid. Secondly, there are misunderstandings, but as long as we have a sincere attitude and take quick action, these misunderstandings can be eliminated.”

Management theory tells us that many external problems often stem from lagging internal organizational issues.

Geek+ team structure is different from traditional large car companies and is more akin to the personnel structure of Tesla and NIO, recruiting personnel from various industries. Here, there are old soldiers who have served in Geely Group for many years and are well-versed in the Geely fighter culture, new recruits who have fought and practiced user enterprise skills at NIO, and many outsiders who do not have an automotive background, coming from energy, artificial intelligence, hotel, and short video companies.

Idealists would say that such a mixed genetic team can fuse the strengths of various experts to create an innovative organization. But realists know that the rapid formation of an Eight-Nation Alliance can be a great challenge for management. What will appear early on is not necessarily a fusion of different strengths, but rather difficulty in truly reaching a consensus and frequently acting under their own inherent values and experiences.Believers in the power of giants will continue to believe. It is precisely because of giant’s supply chain and cross-brand SEA architecture that the extremely high benchmark score of the Zeekr 001 at today’s price is possible.

Believers in the magic of user enterprises will continue to believe. It is precisely because of facing users that there was explosive discussion and social spread within the Zeekr user group after the 415 release conference, accumulating a potential user base of 3000 people over several months, which expanded 20 times in two days without advertising, relying on “word of mouth” from users.

Believers in the strict military discipline and systematic rules of giant enterprises will continue to believe. Believers in startups without KPIs and fast iterations will continue to believe.

While people may believe different things, the common denominator is believing in a verified power while reasonably being skeptical of other forces.

If Zeekr were to adopt traditional methods from the Geely system and outsource cars and services to dealerships that they have cooperated with for over 20 years, they could save a lot of investment in building stores, recruiting, training, after-sales service, and user operations. As an automaker, they would not need to learn these unfamiliar businesses, nor would they require the introduction of digital technology and new management methods to innovate these businesses.

If Zeekr had not taken a leaf out of the book of new power brands and avoided launching Zeekr 001 until everything was fully prepared, then there would not have been so many mistakes in the rush.

Even more important is that if Zeekr had not interacted directly with users, not aroused the appetite for users to express their views and contribute opinions, not invited users to meet and communicate, and not invited users to come up on stage at the release conference, then Zeekr would not need to quickly update a once-brand new product or strictly follow the original project schedule to push forward the vehicle production and delivery rhythm, nor balance the opinions and criticisms from all sides, nor endure the pressure that 95% of auto companies still do not bear today.

Zeekr could have completely adopted the system and practices that Geely Group and even the entire global traditional automotive industry excelled at, relying on a sincere and powerful car like the 001, orders would surely not be an issue, and dealer markups and long waiting times for cars would be foreseeable. Like the Highlanders, Tiguan, Q5, and Civic that made Chinese users wait and mark up, the Zeekr 001 could have chosen to be their successor.However, I believe that JingKe’s CEO, An Conghui, as well as other top managers, are very clear about what JingKe is doing and what it means. The JingKe team is not only working hard to sell Geely’s first truly strategic intelligent electric vehicle but also to integrate a diverse team from all directions, and create a new organization and a new business model. This new organization must be capable of embracing a business model that is completely different from the past century’s automobile industry, conversing and servicing customers directly, bypassing dealers, and quickly scaling up while accepting massive resources from a large group and attracting a dispersed user base externally. In order to achieve this goal, rapid and thorough reform must be undertaken, and true reform cannot be achieved without paying the price of learning.

In my interview with An Conghui, I asked a question, “Among the large car companies I have seen, JingKe is the closest to the users. However, I noticed that most of the official articles on the JingKe app are written under pen names, and there are few real-name articles. Even if there are, members of the JingKe team rarely communicate and interact with users with their real names in the comment section. It feels like the team still has some difficulty facing users directly. What do you think?”

An Conghui answered, “The problem does exist, and I do not deny that. But the key is the attitude and the speed of iteration, which is in line with the thinking of Internet development. Today, we should not be concerned with good or bad, but rather the attitude and speed. The attitude is the foundation of solving all problems. We already have this attitude, and with this foundation of iteration, the speed will increase.”

The Driving Force Behind the Order Numbers

JingKe is not perfect, but it has exposed various problems. Many people criticize JingKe, ridicule JingKe, and complain about JingKe, but we cannot ignore the achievements that JingKe has made in the past 100 days. JingKe has received five-digit orders, and the average transaction price for an order is as high as 336,000 yuan.

The specific number of orders has not been disclosed, but it can be inferred that the number of orders accumulated by JingKe has already exceeded 10,000, from the announcement that it stopped accepting intent deposits on June 15 and the new orders being directly scheduled for the second quarter of next year. JingKe has previously revealed that it will start delivering cars in October 2021, with a production capacity of around 8,000-10,000. Considering reasonable production capacity ramp-up, JingKe’s production capacity pace in the first half of next year is likely to be even higher than this number. Under the constant negative coverage on the internet, JingKe has successively appeared in car shows and mall exhibitions in Shanghai, Beijing, Hangzhou, Shenzhen, and other places, with high popularity wherever it goes. In the Shanghai and Shenzhen-Hong Kong-Macao auto shows that I experienced personally, JingKe was one of the most popular booths.Many people didn’t notice that Zeekr is the first intelligent electric vehicle (EV) manufacturer in China that only did a small amount of online promotion, held one or two offline launch events, and had several temporary exhibitions in shopping malls to receive a five-digit number of pre-orders for its EVs.

Super popular models such as Model 3 and Model Y indeed adopted a web release model and quickly secured tens of thousands of orders. However, they have Tesla stores, demo vehicles, Superchargers throughout the country, and countless social media product videos as endorsements to online buyers’ confidence.

On the other hand, Zeekr’s brand logo had just been released, its first directly operated store was still under construction, and the first test-drive vehicle for customers had not yet been produced. Even the most impressive PowerPoint (PPT) car manufacturers could not sell cars like Zeekr!

“Behind these sales figures, there is the power of Zeekr’s supporters from all over the country,” said Chen Xiaofei, Vice President of Zeekr’s User Development.

When I asked Chen Xiaofei a question about Zeekr 001 EV, which has many advantages but doesn’t seem to excel in any particular area, he told me that the target customers for Zeekr 001 are different from those of new brands, and they are not pursuing the earliest adopters but rather mainstream customers’ satisfaction.

Chen Xiaofei said, “If you’re the pioneer of the EV industry, the long-tail theory would make it easier to get started, because early adopters can tolerate defects and shortcomings, and they crave for something that stands out.

“But 2021 is not the same as the market’s shape three or five years ago. The EV market is rapidly moving towards private consumers’ mainstream market.”

He added, “While other manufacturers stick to the long-tail strategy, Zeekr’s product strategy is to have no shortcomings. Today’s EV market is still relatively niche compared to the traditional gasoline-powered car market. At this stage, many users are not looking for differentiation among the 20 EV brands, but for common features. Many users want to find products that have excellent performance in terms of range, acceleration, appearance, space, comfort, intelligence, and price, and Zeekr 001 can meet their needs. Our users not only compare Zeekr with WmAuto, but also with gasoline-powered vehicles from brands like BBA that cost around 300,000 yuan, which shows that their source is diverse and dispersed, and they are actually a relatively mainstream group in society.”

Our team “Highway Flight” has been focusing on EV brand and user consultancy for a long time. In the past six months, my team members and I have visited over one hundred EV users from different brands across the country, including four Zeekr 001 pre-order customers.

We summarized the basic pattern of today’s mid-high-end EV brand users with the following chart.

## Introduction

## Introduction

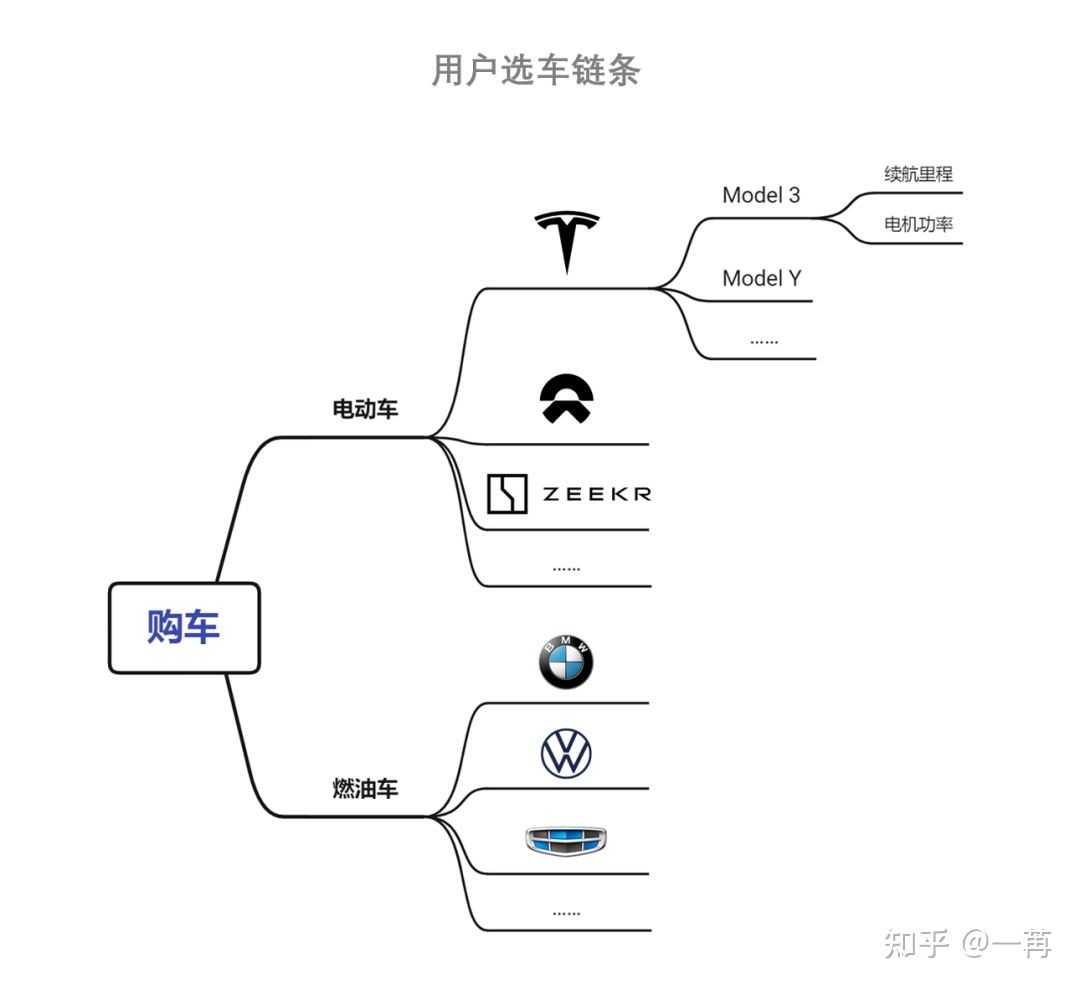

Unlike gasoline vehicles, which are stable and long-term consumer goods, electric vehicles are a new social phenomenon. Through direct communication with users, we have come to profoundly understand that differences in values, rather than differences in product functionality, are the key factors that segment user groups today.

Left-leaning users often believe that right-leaning brands are outdated and antiquated. They support revolutionaries like Musk and Li Bin, and believe that tomorrow electric cars will be more convenient than gasoline cars. Therefore, they are willing to endure the inconvenience of charging today. Right-leaning users believe that left-leaning brands are producers of cars made with fancy PowerPoint presentations, capital bubbles, and poor quality. They have a firm belief in their right-leaning brands, which have been renowned since before they turned 18. These brands are solid and can produce truly excellent cars.

The population of moderate users was previously small because the supply of products that met their requirements was very limited. Most moderate users have continued to drive gasoline cars, while a few have reluctantly purchased left-leaning or right-leaning electric cars that they are not very satisfied with. However, starting in the second half of 2020, moderate users began to rise, and by 2021, they had shown explosive growth. The users of Zeekr 001 are representatives of this rising moderate group.

Moderate users are curious and embrace new things, but they are not willing to pay a large price for the sake of pursuing novelty. They respect the basic rules of the century-old industry and value the quality assurance of big companies, but they do not mind changing to a totally new unfamiliar logo. In fact, because electric cars are a brand-new category compared to gasoline cars, they expect to see a completely new brand in front of them. However, the legitimacy of this brand’s birth must be very solid. In their eyes, Zeekr 001 seems to be a hybrid child with various unique features, such as “Tesla’s innovative technology, NIO’s user thinking, Lynk & Co’s trendiness, and Geely’s reliability”.

Moderate users also have a characteristic. These people are not as avant-garde and active as left-leaning individuals, nor are they as persistent and conservative as right-leaning individuals. Their personalities are relatively neutral. They work diligently, make money, raise families, and lead their lives. They generally do not like to spend too much time actively communicating with others, do not like to take the initiative in crowds to coordinate and organize, do not become opinion leaders, and do not express their ideas and values.

In fact, from 415 until today, supporters of Zeekr have always been the vast majority in the Zeekr community. However, when the Zeekr community encountered a lot of turbulence, the strength of those who support Zeekr appeared quiet and mild, and their voices have never been expressed. This is a phenomenon often seen in sociology. Free competition of loudness does not necessarily bring true democracy. Because those who are in the minority and hold extreme views often stimulate the loudest voices, most quiet and moderate people avoid public expressions of their opinions, and sometimes the result is that a minority controls the direction of the majority.Until the CEO An Conghui, also known as “Cong Cong,” wrote a customer letter and further explained the measures taken by JiKe in terms of motor open selection, new configuration pricing, and delivery rules at the user meeting in Shenzhen.

Until JiKe 001 entered the large order lock-up phase on July 20th and locked up more than 5,000 orders within 8 hours.

Until JiKe 001 received high praise in recent professional media test drives, its dynamic performance, comfort, and comprehensiveness have begun to be conveyed through smartphone screens.

These brand actions, user voting, and third-party evaluations are like a powerful ammunition depot, which has been delivered to the silent but vast supporter of JiKe in time.

With the support of these weapons, these people began to speak out, and the public opinion atmosphere of JiKe’s App community appeared to have an astonishing 180-degree reversal, with supporters of JiKe in the App quickly mobilizing and assembling like the power of the mobile internet.

In the following two days, I inquired in a JiKe user WeChat group and on the JiKe App if anyone was transferring a large order and wanting to take over a pre-order placed before 615 that could be delivered within the year.

A few days ago, there seemed to be countless people in the community clamoring to cancel their orders, and there were also many posts on idle fish about transferring large orders. But now, no one wants to respond to me.

Another hotly debated issue in the community a few days ago was about choosing motors. Many people felt that switching from Denso (a Japanese brand produced in Zhejiang) to Weirui was a downgrade in terms of quality and configuration. However, among the locked-in users, the proportion of those choosing Japanese Denso and local Weirui motors was reportedly quite similar.

Many users also suggested to JiKe that they should add another option called “whatever” in the motor section of the App in addition to “Denso” and “Weirui.”

JiKe: Breaking Away from Geely

Many people would ask the question: If Lynk & Co exists, why does JiKe exist?

For JiKe, this is an unavoidable question because everyone knows that JiKe 001 was originally Lynk & Co Zero, which was launched half a year earlier at Guangzhou Auto Show.# Geely Group’s Preparation for the Era of Intelligent Electric Vehicles

Geely Group has been investing in the tripartite technology (Ningbo Vireo), which involves power batteries, motors, and electronic control, seven years ahead of time, and has started to develop the SEA native intelligent electric platform five years in advance. These preparations on the supply chain and technology side were made early on due to the long cycle characteristic of the automotive industry.

However, in terms of the commercial and user side, Geely has always been closely observing and considering. The emergence of the brand JEEKE indicates that Geely has made a cautious and firm decision at the end of 2020. With this decision, JEEKE was created as an independent brand.

This can be further summarized as organizational independence, brand independence, business model independence, and product independence.

Organizational Independence

The predecessor of the JEEKE team was the electric vehicle business unit under the Lynk & Co brand.

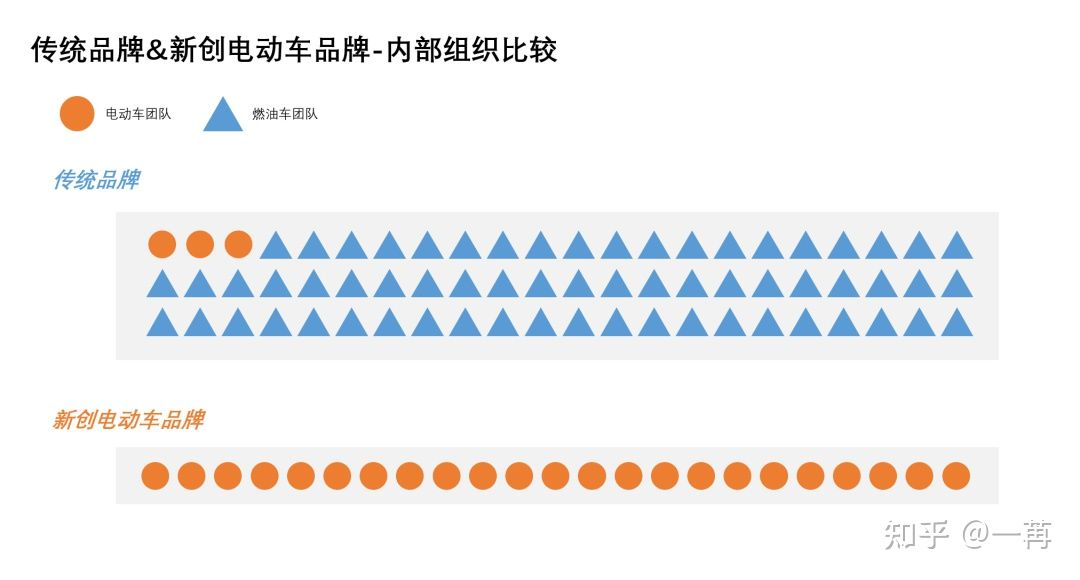

Over the past ten years, many domestic and foreign fuel vehicle giants have been trying to develop electric vehicles. There are basically two solutions, one is to set up an electric vehicle business unit in the original system for special development and sales of electric vehicle products. The other is to establish an independent company focusing on electric vehicles.

Those who adopted the former method have hardly achieved any decent results. Those who adopted the latter method have achieved some success. For example, Guangqi New Energy under Guangqi Group has performed relatively well among state-owned enterprises. And Polestar, an independent company incubated by the power of Volvo in the Geely system, has a strong presence in the European market.

JEEKE belongs to the latter. Developing electric vehicles is a big deal, and it is not simply modifying and painting over a fuel vehicle. If the organization is not independent, neither can the strategies, culture, nor funding be independent. It is not realistic to rely on a CEO whose 99% of sales performance relies on fuel vehicles to take care of the healthy development of electric vehicles.

Brand Independence

In this industry, adding a new logo is not wise for 95% of the time cycle. Most people who try to do so end up self-destructing. Prior to Tesla, the last successful domestic automotive brand in the United States was Chrysler in the 1920s.

Before purchasing a car, a typical user can only remember up to five logos in their mind. After visiting two to three different brand stores, they usually make their purchase. The fiercest competition in this industry has never been about engine technology, transmission smoothness, steel strength, or the computing power of the in-car system, but about brand awareness.

The rise of electric vehicles has provided a once-in-a-century opportunity for brand building. Tesla and NIO have both benefited from this wave, successfully creating their own brand. JEEKE is just another player who has seized this opportunity.One fuel car user, in 95% of cases, will choose Volkswagen over Skoda, because in the stable and static fuel car category, users crave a trusted big brand, and the more unfamiliar the logo is, the less likely they are to choose it.

When we interview electric car users from all over the country, which brands come to mind when they think of electric cars? Most likely, they will mention the following five names: Tesla, NIO, XPeng, Li Auto, and BYD. Of the five brands, three position themselves as pure electric car start-ups, plus one plug-in hybrid start-up and one large company that focuses on electric cars and batteries, but also produces fuel cars.

Roewe, GAC, BAIC, Volkswagen, Nissan, and Buick also produce electric cars, and their scale and cycle may be larger and longer than start-up companies like NIO and XPeng. However, users seem to have a very limited impression of them.

Behind this is a critical problem: users do not view electrification of cars as a type of power technology change adjustment, but they consider electric cars as a completely parallel new category compared to fuel cars.

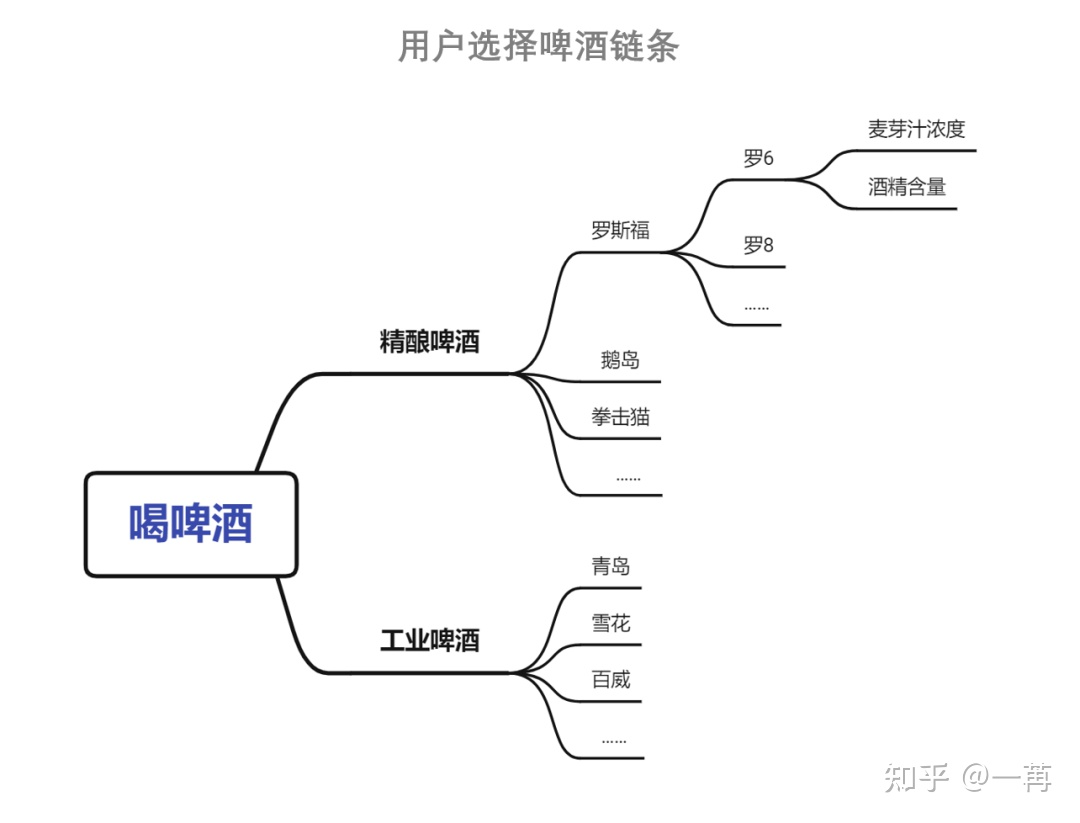

The law tells us that once users view something as a completely new category, they will crave new brands in that category. Just like when you and your friend are dining at a restaurant in Shanghai, and your friend says they want to drink craft beer today, you are most likely to call the waiter to bring two bottles of Boxing Cat, Goose Island, or Panda Brew for them. You are unlikely to say, “I want two bottles of Budweiser/Qingdao/Snow Craft Beer.”

In the real world, the main brand of Budweiser is difficult to tackle the emerging craft beer category, so its backing capital purchased Goose Island and Boxing Cat to ensure that the Budweiser Group can still please users in this new category.

The conclusion is obvious. In this era of making electric cars, an independent and pure electric car brand image is what users need. The establishment of Xpeng conforms to the innermost desires of the vast majority of users.All users who purchase electric cars in this era have paid a large learning cost to understand what charging is, what OTA is, how to find a high-power charging station without occupying a gas-powered car’s parking space, what NEDC and EPA are, what winter range degradation and heat pump air conditioning are, and what automatic driving assistance is and the applicable scenarios. They have made so many sacrifices to enter a new product category, not to buy a car that “drives like a gasoline car, looks like a gasoline car, and has no difference from a gasoline car” . They may not tell you directly during the research, but the fact is that they hope everything is different from the past, so that they can truly drive a smart electric car and show off in front of their neighbor Wang and colleague Li, saying: “Look, this is an electric car, it’s so different.”

Business model independence

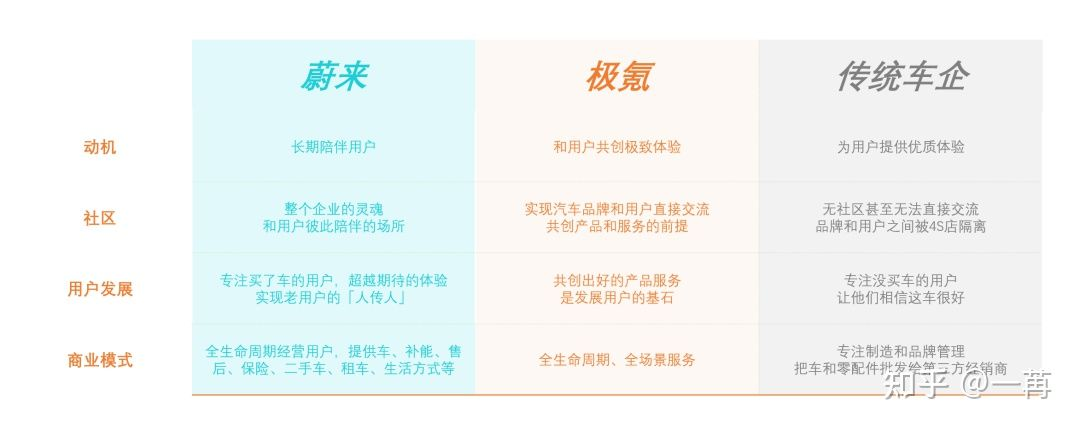

Ji Ke announced the slogan of user enterprise at the 415 brand launch conference. Many people may mistakenly think that Ji Ke is following NIO’s path.

After observing for three months, I think the two are still clearly different.

NIO has taken a very distinctive path of user enterprise. This idea of the route may be traced back to Li Bin’s 3.0 concept proposed in 2012. It was not until the establishment of NIO at the end of 2014 that Li Bin had the opportunity to gradually implement his business ideas. Too many people criticized this approach on NIO’s user enterprise road for not focusing solely on their business and deviating from the norm, including some people who did not understand it internally. However, NIO has shown its confidence in its own path with great firmness and courage.

Just as there is not only one democratic model in the world, not only one way to fight the epidemic, there will not be only one user enterprise in this world. In the long river of human history, every great enterprise in each era has almost used its own methods and combined the most advanced technology and business thoughts of that era to efficiently implement its own path of user enterprise.

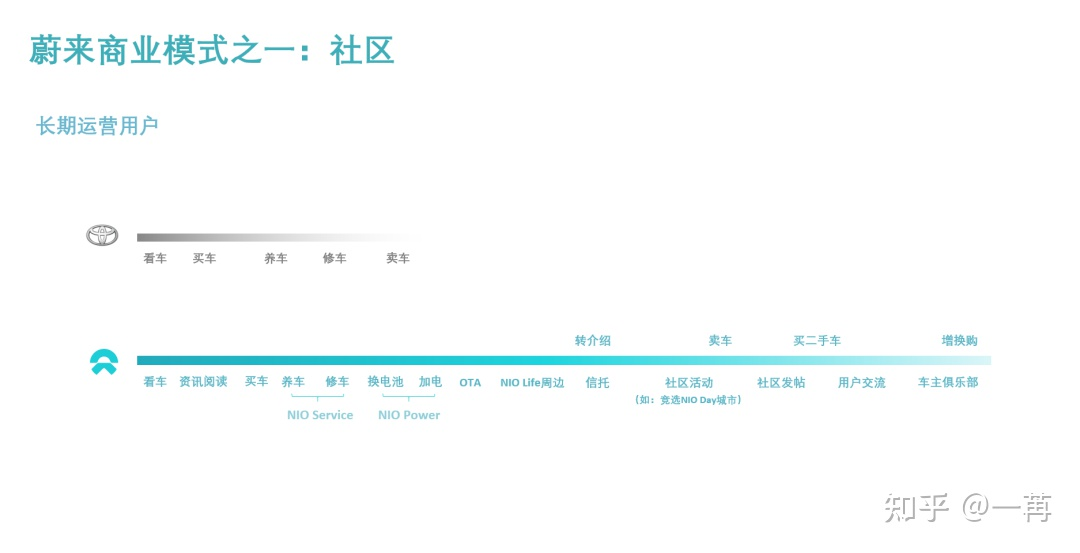

I think the user enterprise paths of Ji Ke and NIO are similar in form but different in essence, and the difference can be seen by comparing the following chart.

NIO’s user enterprise road proposes a unique value system, based on which a community or club is built to attract specific people to join and play together. The founder, brand team, and users live here together. The relationship between the brand and users is not just a transactional or service relationship, but rather a relationship of companionship. NIO’s car is just a ticket to this club. After joining, everyone hopes to be together for a long time, share happiness and grow together. Therefore, NIO is not really just an automobile company. Once this club is thoroughly mature, the car is only the first part of this business’s imagination, and there can be many more parts in the future. This was something that many people could not understand three years ago, but now more and more people are starting to understand NIO.The user-enterprise path advocated by Zeekr is to eliminate the persistent problem of traditional car companies and users not being able to communicate directly, and truly bring the marketing team, product managers, and engineers closer to users, listen to their voices, and work with them to create good products and services which ultimately drive the company forward with outstanding products and services. From this perspective, the community model is the platform for Zeekr and users to communicate, it is a means rather than an end. Zeekr emphasizes co-creation with users, but co-creation is also a means, not an end. The essential goal is only one, which is an excellent product and service experience. The slogan of user enterprise may make people feel that Zeekr is more like NIO, but Zeekr is actually a company that thinks more like Tesla.

Specifically, looking at the business model, the transformation pace of the expensive, low-frequency, and huge consumer goods industry of the automotive industry is obviously later than other fields.

In the early days of the e-commerce industry, they relied on subsidies, advertising, and other means to attract a large number of consumers to enter the platform, doing business of increasing user volume. This is very similar to the tricks of traditional car companies, where 99% of marketing people’s thoughts are on users who have not yet bought your car, and even on users who are not familiar with your automobile brand, CRM (customer relationship management department) is an edge department in all car companies.

China’s e-commerce industry began to focus on the continuous operation of old users about 5 years ago. The Plus member launched by JD.com and the 88 member of Tmall have emerged as key businesses within their respective systems. At the same time, JD.com and Alibaba have been continuously extending their service chain, allowing users to buy more and more categories of products, including fresh food, medicine, cross-border online shopping, travel, and other derivative services such as logistics, insurance, finance, and second-hand goods. The big logic is to manage users throughout their life cycle and provide long-chain services that penetrate into various scenes.

Looking back at the automotive industry, the first player to break through was Tesla, which, compared to traditional car companies, increased direct sales of cars, some direct sales of after-sales services, photovoltaics, energy storage, and supplementary energy services. They even tested the insurance business in the United States, while some supercharging stations began to provide catering services. Tesla was the first player to completely change the business model of automobile brands.

The second player to break through is NIO, with no less service chain than Tesla. Their feature is that they operated a user community with high traffic and stickiness, built a brand that is “particularly loving” to old users, and implanted their own comprehensive services based on this community.

Zeekr can be regarded as another important player choosing this vertical integration approach. An Conghui said that “the full-life cycle management and the full-scenario coverage of users support our corporate mission.”

Several developments of Zeekr’s full-cycle and full-scenario business:- App: The beta version was launched on July 1st and had reached 430,000 registered users with visible activity and freedom of speech by July 17th. While the negative voices from users on the app were significant, the Zeekr team showed a strong sense of patience.

- Directly operated stores: The first Zeekr Center will be located near the West Lake of Hangzhou with the goal of becoming a popular local shop.

- Power supplementation: The core business in the first stage is to promote the construction of self-owned ultra-fast charging stations (named Jicharge Stations by Zeekr), with site selection and other work currently in progress. The manager of this business, Lu Hong, told me that the first batch of stations will start landing in September.

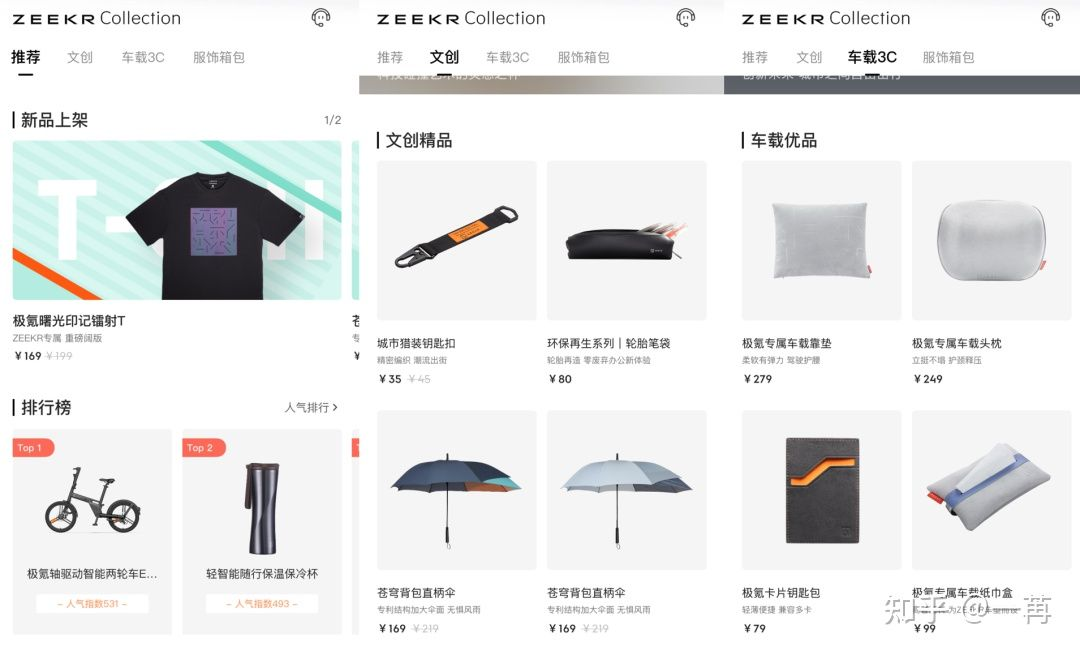

- Peripheral products: The app has opened a section for peripheral products, but the current selection is relatively limited.

In addition to the above mentioned initiatives, An Conghui further discussed potential innovation in other areas during the interview, which shows that Zeekr may be considering new directions for future expansion.

For example, the integration of real-time data accumulation for intelligent vehicles, a platform for direct communication between brands and users, and the integration of the used car business could generate a new, reliable and flexible official used car business with highly precise real-time pricing. Imagine driving a Zeekr 001 and one day, feeling the need for a change, you open the app to check your car’s mileage data, condition, maintenance and repair records, and the AI system provides you with an accurate and instant appraisal. After clicking “sell”, the car’s information immediately enters the second-hand car store in the app, where another potential Zeekr user, Xiao Wang from another city, sees it. Xiao Wang makes the purchase from the app, along with a 3-year official extended warranty. In this scenario, the Zeekr app plays the role of both Tmall and Alipay, making both parties feel transparent, reliable and trustworthy.

Another example is the transportation market. Young people are increasingly averse to buying, owning, and managing assets and tools. They prefer instead to adopt a “light-asset model”, paying only for the flexible use of these assets. From iCloud to QQ music, from rental housing to shared power banks, this trend is apparent. Zeekr 001, targeting a high-end audience, may not consider this market, but Zeekr in the future could seize this significant emerging opportunity with other weapons.

Product Independence# Geely’s New Product Strategy: From Benchmarking to Co-creation

Geely’s recently-launched brand, JiKe (pronounced “gee-ker”), aims to bring about complete independence in product strategy. Geely used to benchmark other companies in the industry, but now they are moving towards a co-creation culture.

Benchmarking involves learning from the strengths of other brands. As a relatively new player in the automobile industry, China’s domestic brands had to learn quickly from the long-established brands. When designing a new product, Chinese companies could analyze and evaluate the wiper designs of brands such as Mercedes-Benz, Volvo, Toyota, or Volkswagen, and finally create their own version. But benchmarking has its limitations, as it can only be used when other companies are ahead of you.

According to Hangzhou-based JiKe’s president, An Conghui, the automobile industry has undergone three major transitions in the past century. The first was the invention of the modern car by Germans, led by the Mercedes-Benz brand. The second was the large-scale efficient production of cars by Americans, led by the Ford family. The third was the development of efficient and energy-saving cars by the Japanese, led by Toyota. Each leader in the new field of innovation has become a great automobile brand and has made history.

Now, the fourth industrial transition to electric and intelligent vehicles is starting, with Chinese local brands leading the way. This is due to a combination of factors, including the accumulation of experience in the local automobile industry over the past 30 years, China’s growing economic power, its relatively young population, and a culture that embraces innovation and change. If you take 100 Uber rides in the United States, you will quickly see what kind of cars Americans drive and how much they use touch screen interactions, voice recognition, and autonomous driving technologies. You will understand the great opportunities for China to lead the wave of intelligent electric vehicles. Although Tesla is quite impressive, Elon Musk can’t do it alone.

In the field of intelligent electric vehicles, China’s leading domestic brands are no longer able to benchmark themselves against Mercedes-Benz, Ford, or Toyota. The historical mission of benchmarking culture has been accomplished. After 30 years of perseverance, frustration, low-profile work, and challenges, the Chinese automobile industry and JiKe are now leading in the new era of electric and intelligent vehicles. In just three months since the release of their first product, the JiKe 001, they have received inquiries from more than 50 countries, without any advertisement campaigns. JiKe is definitely looking to expand overseas, but their sole focus is to serve Chinese customers for now.

When there are no more competitors to imitate or learn from, where do you find inspiration when you need to lead the industry? JiKe’s answer is the user. All great products and experiences are created not only by product managers, engineers, and expert technicians, but also by user needs.Geely’s Extreme: Co-creation with Users

By building a user community, establishing direct communication channels with users, and emphasizing a user-centric corporate culture, Geely’s Extreme, in fact, aims to “co-create with its users”. The purpose is to bring together collective wisdom from its internal team and its users to ensure that its product planning and service design lead the industry as much as possible.

Guo Xin, the Director of Product at Geely’s Extreme, explained to me in detail the company’s strategy for co-creating with users.

In traditional automotive product development processes, user research is conducted at several key milestones. The core purpose of this standardized operation is to solicit user feedback on the existing product plan. While the workflow design is ideally logical, it is easy for the process to fall short of expectations when executed in reality. Are feedback responses too few? Are they too vague? Is the research aimed at finding evidence to drive projects forward or actually aimed at engaging users and listening to their voices? The confidentiality of innovative and unique ideas versus the risk of leaking them creates a dilemma for product developers.

The reason this dilemma has persisted for a long time in the past is mainly because large automakers have always lacked direct communication channels, systems, and mindsets to engage with users.

According to Guo Xin, “What used to be impossible is now possible because Geely’s Extreme has many external users with whom they can have direct communication. Many of these users are highly rational, have extensive knowledge in their respective fields, and are very savvy about products. Co-creating with these users means not just collecting and sorting out user demand like filling out an order form, but rather in the team and user’s bi-directional interaction, subtly and implicitly, discovering opportunities for defining new scenarios and revealing emotional needs beneath the rationality. Users do not purchase a tool for an existing lifestyle, but with Geely’s Extreme, users acquire a brand new future of life. This is the goal of our product and user co-creation.”

Geely’s Extreme: Adhering to Geely

Geely’s Extreme has made a lot of efforts in “leaving Geely and living out its own style”.

However, Geely’s Extreme will always belong to Geely and inherit some of its genes.

The Power of Giants

First of all, Geely’s Extreme will inherit Geely Group’s power of giants.

Talking about Geely’s Extreme’s intelligent electric vehicle cannot be separated from Geely Group’s SEA architecture. This intelligent pure electric platform, which was created at a cost of tens of billions over five years, is the foundation that the Geely’s Extreme 001 model is built upon to meet with users.

On the other hand, at least seven other brands including Lotus, Volvo, Polestar, LYNK & CO, Smart, and Jidu (a joint venture between Baidu and Geely) will also build their own products based on the SEA architecture. This is thanks to the platform’s broad adaptability, which can cover products with different wheelbases ranging from 1800 to 3300 mm. More external brands are also in discussions to obtain technology licensing for the SEA architecture.This will give all brands using the SEA architecture an advantage in joint operations. To give a rough example, if it costs 35 billion yuan to build an international standard smart electric vehicle architecture, seven brands using this architecture would have an average cost of only 5 billion yuan per brand. However, if an independent brand develops a smart electric vehicle architecture that is less flexible and only suitable for their own use, it may cost 15 billion yuan. The difference between 15 billion and 5 billion is the natural gap between independent and joint operations.

This advantage is not only reflected in terms of money, but also in the valuable time saved. The market is constantly changing and brands must closely monitor changes on the user side, quickly plan their products, and invest in research and development and manufacturing. If a brand has to develop architecture from scratch while also working on specific products, it can easily miss opportunities.

More important than money and time is safety. An Conghui believes that the automotive industry must place great emphasis on safety, as this is the most important responsibility and bottom line for customers. The development of a highly-level and safe new car has its necessary path. There are no shortcuts to use the Internet mentality to gain an advantage. As he put it, “even if you kill me twice, I dare not make cars in that way!”

On the other hand, Geely’s entrepreneurial culture will be inherited by JiKe. This entrepreneurial culture is not just about the struggle of individuals, but the collective struggle of the entire team.

When it comes to how to cultivate the JiKe brand and give it a unique label, An Conghui firmly expressed a different view.

First, he does not believe that he alone can nurture the JiKe brand. Shaping the JiKe brand is not something that one person can accomplish, it is the job of the entire JiKe team. As CEO, he only plays a leading role from stage 0 to stage 1. When the entire brand needs to learn about user thinking, face users, and master new skills they have yet to grasp, he believes that only by leading the way can things be done faster and better.

Secondly, he also believes that he should not give the JiKe brand a label. In fact, he thinks that the era of brands actively designing labels and then forcing them on users has passed. The final label and characteristics of a brand like JiKe will not be given by the automaker or any individual within the automaker. Instead, it will be defined by its myriad of users over a potentially very long period of time.In An Conghui’s view, it’s the appropriate approach for car companies to create actual products and user experiences, and let users summarize and generalize them. Guan Yu, Zhang Fei, and Zhao Yun are vivid and well-known figures not because they have the best personal brand consultants, but because they accomplished amazing feats during the Three Kingdoms period, such as passing through the Five Passes and cutting through the Six Armies and crossing the Long Slope seven times, which led to people endowing them with certain character traits. The well-known brand labels for Mercedes-Benz, BMW, and Volvo today were not established on the first day of their companies’ existence, but gradually formed in customers’ word-of-mouth over the past hundred years.

As a new brand full of organizational change and business model innovation that grew up on the shoulders of giants, Jicoo is the focus of a very long article.

From the past General An to today’s “Cong Cong”, from Geely (with an average price of 90,000 yuan, comparable to Chevrolet) to Lynk & Co (with an average price of 170,000 yuan, surpassing Toyota), and then to Jicoo (with an average price of 336,000 yuan, comparable to Audi), we can see the resilience and courage of Chinese traditional car brands on their journey from grassroots to palace.

I used 16 words to summarize what I saw in Jicoo’s title: “endure growing pains, surpass benchmarks, cocreate with users, and bet on products.”

But what exactly is Jicoo as a brand?

As Cong Cong says, let its users evaluate it.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.