The Evolution of the Automotive Industry Chain is the Focus of Outing Media

Author: Li Yizhi

People often complain that battery capacity has never been enough, and battery technology seems to have stagnated. Some even joked that feeling anxious about the red low battery symbol has become a basic characteristic of modern people.

China’s largest lithium-ion battery manufacturer, CATL, is not only trying to solve this problem but also thinking about some more far-reaching issues: Can the safety performance of batteries be further improved? Can the cost of batteries be further reduced? What do we do if there is not enough raw material for batteries? Should we open up a new battery technology roadmap?

Against this backdrop, CATL’s sodium-ion battery has emerged.

On July 29th, CATL held a press conference for its sodium-ion battery, which was also a Q&A session for various “battery mysteries”. Interestingly, to a certain extent, this was also a mobilization meeting for the entire industry chain, upstream and downstream, and even friendly forces.

Sodium-ion Battery Awakens from Silence

In terms of pedigree, sodium-ion batteries are actually the brothers of lithium-ion batteries.

In the 1970s, while searching for a new generation of energy storage devices, research personnel focused on two types of batteries that used alkali metals: sodium-ion batteries and lithium-ion batteries. However, the two diverged quickly.

In 1980, future Nobel Prize winner John B. Goodenough discovered cobalt oxide as a positive electrode material suitable for lithium-ion batteries, which combined with graphite, a negative electrode material discovered by Sony in Japan. As a result, lithium-ion batteries were commercialized in the 1990s and expanded from consumer electronics to electric vehicles, energy storage, and other fields.

Sodium-ion batteries, on the other hand, saw a decrease in attention after lithium-ion batteries became the “golden standard,” and remained trapped in the laboratory as experimental technology.

In fact, the technical system of sodium-ion batteries is similar to that of lithium-ion batteries. Both are “rocking chairs batteries” where charged ions move back and forth between the positive and negative electrodes. But why have lithium-ion batteries dominated for the past 30 years while sodium-ion batteries have struggled to leave the laboratory?

An excellent rechargeable battery requires that it can store and safely release as much energy as possible over a long period of use. At the micro-level, this requires that metal ions can be removed and inserted between the positive and negative electrode materials of the battery in a stable and ordered manner. Sodium ions have some innate disadvantages compared to lithium ions.

Compared with lithium ions, sodium ions are larger in size and more likely to cause damage to the structure of the positive and negative electrode materials when removed and inserted. At the macro level, this manifests as a shorter cycle life of the battery and rapid decrease in battery capacity and thermal stability.On the other hand, while releasing the same amount of electrons, sodium is heavier than lithium. At the macro level, the sodium ion battery has a lower working voltage and energy density than the lithium-ion battery, resulting in lower storage capacity for the same weight.

Therefore, in terms of key indicators for commercialization, the sodium-ion battery has long faced the problems of short cycling life and low energy density. Moreover, cycling life and energy density are usually two mutually exclusive indicators; occasionally, some research teams have developed sodium-ion batteries that have a relatively balanced performance on both indicators, but are unable to move beyond the laboratory due to difficulties in preparation processes and high manufacturing costs.

However, sodium-ion batteries have inherent advantages over lithium-ion batteries, such as higher safety and easier-to-obtain/raw materials with lower costs. Therefore, the academic community has never given up on exploring its potential and has focused on layered oxides (note: the positive electrode material of the widely used ternary lithium-ion battery on electric vehicles is layered oxide), Prussian blue (an iron-cyanide complex with a stereoscopic material lattice that is suitable for storing sodium ions; Prussian white, mentioned below, is a type of material in this category), and negative electrode materials mainly composed of hard carbon.

In the past decade, as lithium batteries gradually become the king in the manufacturing industry, more and more people have also smelled the opportunity for commercialization of sodium-ion batteries.

With the accumulated R&D achievements based on material research and development, some start-up companies have attempted to bring sodium-ion batteries to the market, such as Faradion in the UK, which plans to use sodium-ion batteries in electric bicycles and commercial vehicles, and China’s CSEIC Haina, which announced the development of a sodium-ion battery with an energy density of 150Wh/kg in 2018.

Now, Gigafactory powerhouse CATL has entered the market for sodium-ion batteries.

Key factors for emerging from the laboratory

At the performance conference in May of this year, CATL announced the development and impending release of sodium-ion batteries. Both inside and outside the industry were surprised – CATL, which holds nearly one-third of the global lithium-ion battery market, why would they target such a tough nut to crack?

At the sodium-ion battery release conference on July 29, CATL Chairman Zeng Yuqun personally answered this question.

“Carbon neutrality has promoted the vigorous development of the new energy industry, and new application scenarios continue to emerge, providing a stage for different technologies to shine. Sodium-ion batteries have unique advantages in low-temperature performance, fast charging, and environmental adaptability, which are compatible and complementary to lithium-ion batteries.”

As mentioned above, the short cycle life and low energy density are the hurdles that sodium-ion batteries have to face in commercialization. In order to meet the needs of application scenarios, relying on a research and development team of thousands of people, CATL has applied high-throughput computing platforms and simulation technology and further innovated the material system of sodium-ion batteries based on its rich experience in electrochemistry research.

As mentioned above, the short cycle life and low energy density are the hurdles that sodium-ion batteries have to face in commercialization. In order to meet the needs of application scenarios, relying on a research and development team of thousands of people, CATL has applied high-throughput computing platforms and simulation technology and further innovated the material system of sodium-ion batteries based on its rich experience in electrochemistry research.

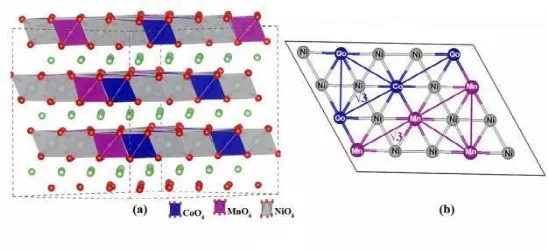

Huang Qisen, Vice President of CATL Research Institute, introduced that CATL selected the relatively mature Prussian white as the cathode material for sodium-ion batteries, with a capacity of 160 mAh/g. The innovativeness lies in CATL’s electronegativity rearrangement of the crystal structure of Prussian white and redesign of the material surface to solve the issue of rapid capacity attenuation.

In other words, CATL has optimized the microstructure of Prussian white, making it more stable and capable of withstanding the insertion and extraction of sodium ions for more cycles without damage.

Additionally, in terms of the anode material, CATL has developed a hard carbon material that can accommodate sodium ions, with a capacity of 350 mAh/g and good rate performance and cycle life, and the overall performance is equivalent to graphite used in lithium-ion battery anode.

Furthermore, as the cathode and anode materials of sodium-ion batteries have changed compared to lithium-ion batteries, CATL has also developed a matching electrolyte.

Finally, CATL’s sodium-ion battery has achieved impressive results in some key indicators:

The energy density of the single cell can reach 160 Wh/kg, which is currently the highest level among the industry’s released products, slightly lower than that of lithium iron phosphate;

The system efficiency of the battery pack is above 80%, which means that the system energy density of sodium-ion batteries can reach 128 Wh/kg, which exceeds the 110 Wh/kg of the battery system used in the Hongguang MINI EV and meets the requirements of low-speed electric vehicles and entry-level electric vehicles;

It supports fast charging, and can be charged to 80% capacity in 15 minutes at room temperature, and is not afraid of low temperature. Even at -20°C, the discharge efficiency can still reach 90%;

It has strong thermal stability, far exceeding the national mandatory standard for power batteries.

From these indicators, CATL’s first-generation sodium-ion battery is similar to lithium iron phosphate in its positioning. As for the next-generation sodium-ion battery, CATL plans to increase the energy density of the single cell to 200 Wh/kg. By then, its energy density will be at the same level as that of lithium iron phosphate, and the prospects for application in the passenger car market will be even broader.It is worth mentioning that, in order to meet the demand for energy density, CATL has innovatively proposed the technical solution of mixing AB battery cells in one battery pack, which includes high-energy-density lithium-ion batteries and low-energy-density sodium-ion batteries. This can balance performance indicators through unified management by Battery Management System (BMS).

If mass-produced, the sodium-ion battery from CATL will have moderate energy density, outstanding safety, cost-effectiveness, and cold adaptability, which will provide broad application scenarios.

Sodium-ion Batteries and Lithium-ion Batteries become Complementary Allies

After the release of CATL’s sodium-ion battery, some voices in the market have been asking: will sodium-ion batteries rob the ecological niche of lithium-ion batteries, especially lithium iron phosphate batteries?

However, in CATL’s plan, sodium-ion batteries and lithium-ion batteries are not to fight to death, but complementary allies.

In fact, when global carbon peak and carbon neutrality are imperative, a huge market will be created, which may make lithium resources in short supply.

At the electric vehicle forum held earlier this year, Chen Liqun, a member of the Chinese Academy of Engineering, called for “all the world’s electricity to be stored in lithium-ion batteries, which is simply not enough, so we must consider new batteries, and sodium-ion batteries should be the first choice.”

In terms of crustal elements, lithium accounts for about 0.0065%, and the global proven lithium reserves are about 80 million tons, not only a small total amount, but also mainly distributed in South America. Currently, China’s use of lithium resources relies heavily on imports from Chile and Australia.

From the perspective of national energy security, over-reliance on imported lithium not only brings more risks to energy security, but also brings more uncertainties to business operations.

In contrast to the scarce lithium, sodium accounts for about 2.75% in the crust and is easy to obtain. China is the world’s largest producer of soda ash, which is needed to produce sodium-ion batteries. It has sufficient production capacity with an annual output of nearly 30 million tons and the potential for further expansion.

The development path of sodium-ion batteries is of great significance because it helps reduce reliance on imported lithium and avoid situations like Huawei where they were caught in a difficult situation.

Meanwhile, compared with lithium, sodium is priced much more affordably. According to the latest market real-time quotations, lithium carbonate is close to RMB 90,000 / ton, while soda ash is about RMB 32,000 / ton. The material system of sodium-ion batteries, which does not contain expensive metals such as nickel and cobalt, can further reduce costs.In the cost estimation presented by Academician Chen Liqun, the raw material cost of lithium iron phosphate batteries is 0.34 yuan/Wh, while the raw material cost of sodium ion batteries can be as low as 0.26 yuan/Wh, approaching that of the well-known cheap lead-acid batteries (approximately 0.2 yuan/Wh).

Some industry insiders believe that under the condition of insufficient lithium resources, lithium can be “used on the edge”, mainly supplying the high-priced high-energy density battery market, such as middle and high-end electric vehicles with high requirements for battery capacity. The market with low energy density requirements but high sensitivity to cost and safety and large demand for raw materials is highly compatible with sodium-ion batteries.

For example, China currently produces more than 200 GWh of lead-acid batteries each year, one-fifth to one-quarter of which are used for electric bicycles. With the growing demand for electric bicycle endurance, many electric bicycles have begun to switch to high-energy-density lithium-ion battery cells, but this has brought negative effects of frequent safety incidents (mainly spontaneous combustion). If sodium-ion batteries can be widely used in the electric bicycle field, it will effectively reduce safety hazards.

In the field of energy storage, according to the recently released “Guiding Opinions on Accelerating the Development of New Energy Storage” by the National Development and Reform Commission and the National Energy Administration, the domestic plan is to achieve a new energy storage installation capacity of 30 GW by 2025, which is 10 times the current energy storage installation capacity. The National Energy Administration interpretation stated the 30 GW installation capacity is only a basic goal, and in the next decade, new energy storage will “keep enough room for full expectations.”

In fact, the energy storage sector has already put forward an urgent market demand for energy storage batteries. For example, in 2018, there were billions of kilowatt-hours of “abandoned wind and solar” in China’s renewable energy generation that were wasted because suitable energy storage mediums could not be found.

Ningde Times’ sodium-ion batteries, after making up for the shortcomings of cycle life and energy density, have highlighted their high safety and low price characteristics, which are highly matched with the demand of the energy storage market, not only can provide energy storage services for renewable energy generation, but also have great potential in peak shaving and load shifting of power grids, with broad prospects.

In addition, industry insiders also believe that the electrification of ships, especially large ships, will also provide a huge potential market for sodium-ion batteries.

Therefore, sodium-ion batteries actually have considerable market potential. Behind this is the good performance potential and strong cost potential of sodium-ion batteries. However, to tap into these potentials, we rely on the establishment of a complete industrial chain, the scale effect brought by significant increase in production, and the continuous improvement of material electrochemical systems.

Therefore, at the end of the press conference on July 29th, CATL not only declared its primary goal to establish a basic sodium-ion battery industry chain by 2023, but also called on allies, and issued invitations to industry upstream and downstream, as well as scientific research institutions, hoping to jointly expand the cake of sodium-ion batteries.

Therefore, at the end of the press conference on July 29th, CATL not only declared its primary goal to establish a basic sodium-ion battery industry chain by 2023, but also called on allies, and issued invitations to industry upstream and downstream, as well as scientific research institutions, hoping to jointly expand the cake of sodium-ion batteries.

While lithium-ion battery demand is still growing rapidly, as the world’s largest lithium-ion battery manufacturer, CATL has not stopped at the success of lithium-ion batteries, but instead has a full awareness of crisis and pioneering spirit, bravely entering the second battlefield of sodium-ion batteries, using technological innovation to solve the risks of being strangled and better meet the diverse needs of the market, continuing to act as a “pathfinder” in the electrochemical world.

Nowadays, the industry leader has already issued a heroic call, and the spring of sodium-ion batteries is coming.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.