Special license plates for new energy vehicles

In order to better distinguish and identify new energy vehicles, and implement differentiated traffic management policies, the Ministry of Public Security launched special license plates exclusively for new energy vehicles in December 2017, which is commonly known as the green plate.

By the first half of 2018, the new energy vehicle license plates had been fully implemented in all cities nationwide except Beijing. Currently, new energy vehicle license plates are issued free of charge in all cities except Beijing.

Compared with ordinary vehicle license plates, the number of digits increases by one, from 5 to 6, and the capacity and coding rules of the license plate number are more scientific and reasonable.

In addition, there are some differences in appearance between the license plates for small and large new energy vehicles. The number area of the license plate for large vehicles is processed with a green background based on the yellow plate style.

The number and letters on the license plate of new energy vehicles are used to indicate the type of the new energy vehicle.

Among them, the letters for pure electric vehicles are DABCE, with D priority used and gradually A, B, C, and E used afterwards. The letters for plug-in hybrid electric vehicles are FGHJK, with F used first and gradually GHJK used afterwards.

National subsidies for new energy vehicles

In order to accelerate the promotion of new energy vehicles, the country provides purchase subsidies for new energy vehicles that meet the conditions.

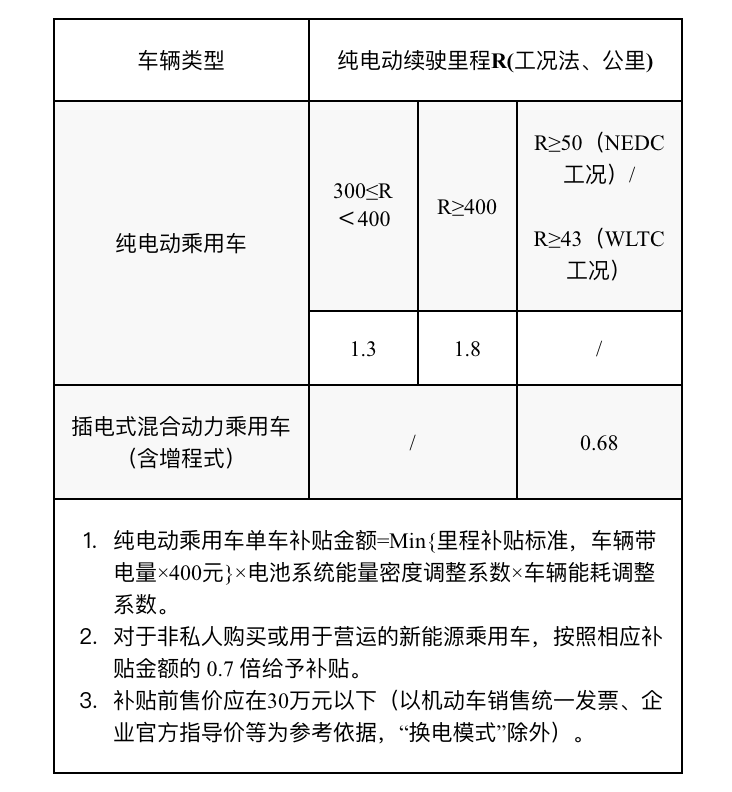

For pure electric and plug-in hybrid electric models, we summarize the main subsidy rules for new energy passenger vehicles in 2021 as follows:

Pure electric

- No national subsidies are provided for new energy vehicles with NEDC range less than 300 km.

- For new energy vehicles with NEDC range greater than or equal to 300 km and less than 400 km, a subsidy of 13,000 yuan will be provided.- A subsidy of 18,000 yuan is provided for plug-in hybrid vehicles with NEDC driving range greater than or equal to 400 km.

Plug-in Hybrid

- A subsidy of 6,800 yuan is provided for vehicles with NEDC driving range greater than or equal to 50 km or WLTC pure electric driving range greater than or equal to 43 km.

In addition to the above calculation method, new energy vehicle subsidies must also comply with the following regulations:

-

The pre-subsidy price of the subsidized model should be no more than 300,000 yuan (with reference to the unified invoice for motor vehicle sales, the official guidance price of the enterprise, etc., except for battery swapping mode).

-

For new energy vehicles that are not purchased for personal use or used for business, 70% of the corresponding subsidy amount shall be given.

-

For pure electric vehicles, if the amount calculated based on vehicle battery capacity x 400 yuan x battery system energy density adjustment coefficient x vehicle energy consumption adjustment coefficient is less than the subsidy amount based on mileage, the subsidy shall be based on this calculation.

Based on the above regulations, the maximum subsidy for a single new energy passenger vehicle in 2021 is 18,000 yuan, and the price limit of 300,000 yuan does not apply to vehicles that support battery swapping.

Usually, the prices of new energy vehicles announced by car manufacturers have already deducted the national subsidy, i.e. the post-subsidy price. The process of applying for subsidies is also handled by the car manufacturer, without the need for the consumer to worry.

Tax and Fee Reductions for New Energy Vehicles

In addition to subsidies for new energy vehicles, the state has also introduced policies to reduce the purchase tax of new energy vehicles to promote their use.

For example, if the price of the vehicle after optional equipment is N yuan, the value-added tax rate is 13%, and the taxable purchase tax rate is 10%, then the estimated amount of purchase tax that can be exempted is N ÷ 1.13 x 10%.

On the other hand, the policy also stipulates that pure electric passenger vehicles are not subject to annual vehicle and vessel tax.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.