Markdown English Text

In the first half of 2021, the number of new players in the automotive industry has shown a noticeable upward trend, with NIO, Xpeng, Li Auto, Hezhong New Energy, WM Motor, and LI delivering a total of 9.456GWh in battery installations. This article focuses on their current battery procurement and future developments.

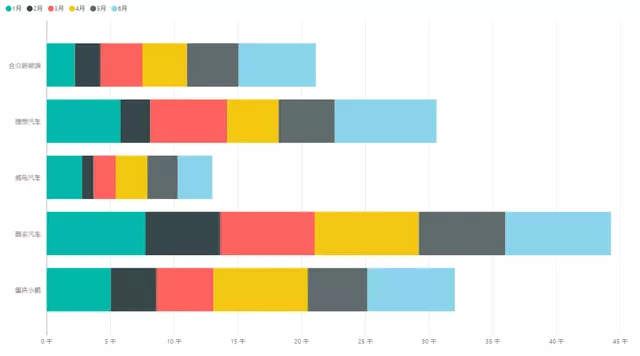

Production Volume of New Players

Based on the production data of power batteries, I estimate that in the first half of 2021, NIO will have a production volume of 44,000 units, Xpeng 32,000 units, Li Auto 30,500 units, Hezhong 21,100 units, and WM Motor 12,900 units.

Note: The data for NIO is combined with that of JAC, and I estimated the data based on a power capacity of 100kWh.

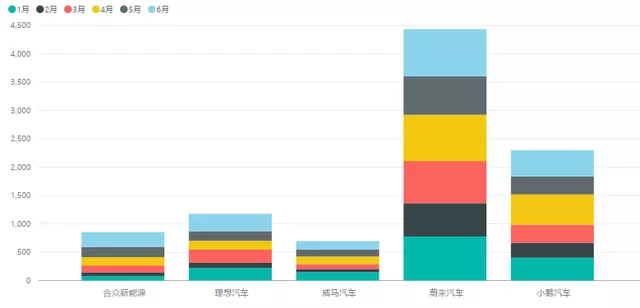

These automakers will need a total of 9.456GWh in batteries installations, with NIO ranking first at 4.433GWh, Xpeng at 2.298GWh, Li Auto at 1.177GWh, Hezhong at 851MWh, and WM Motor at 695.71MWh. It can be said that these companies have played a supporting role in the entire power battery market in terms of procurement. By way of comparison, we can see that Tesla’s domestic procurement is 8.572GWh, and that with overseas export it makes for the largest single purchase in the country at approximately 11GWh.

Procurement Strategy

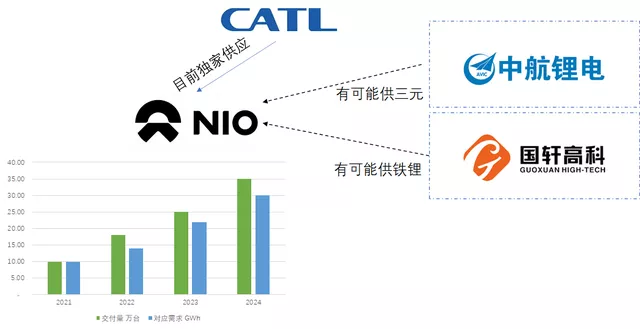

(1) NIO: CATL

In the first half of the year, NIO produced a total of 44,000 units, for an installation capacity of 4.433GWh. At present, NIO ranks second only to Tesla as CATL’s major customer. At this rate, NIO’s demand this year may exceed 10GWh, and it may be necessary to introduce second-tier and third-tier suppliers.

As NIO’s production volume continues to increase, the possibility of long-term exclusive suppliers will decrease. Currently, we can see that in the direction of low-cost iron-lithium, Guoxuan High-tech may make progress in the earlier stages. In the medium-high-end 100kWh version, Avic Lithium Battery has entered the Hefei Industrial Park, which may also open up the possibility of being chosen by NIO in the future. Of course, these are all speculations, and specific selection will still rely on substantial announcements.

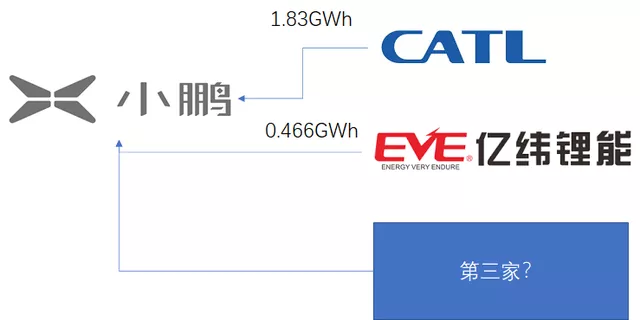

(2) XPeng Motors: CATL, EVE Energy

(2) XPeng Motors: CATL, EVE Energy

In the first half of this year, XPeng Motors produced 32,000 units of new energy passenger cars, with a installed capacity of about 2.298 GWh of power batteries. CATL provided approximately 1.83 GWh, and EVE Energy provided approximately 466 MWh. The data ratio between the two is about 4:1. Currently, XPeng Motors is in great demand for its iron phosphate version. However, a large part of Ningde’s iron phosphate production capacity is restricted by front-end materials, and meeting Tesla’s demand is a top priority. Therefore, with the increase in EVE Energy’s production capacity of iron phosphate for passenger cars in the future, XPeng will obtain a relatively large share. Moreover, since the difficulty of the iron phosphate version for the industrial chain is not particularly high, if Ningde’s supply pressure is particularly high in the second half of the year, it will also stimulate the supply opportunities of other third-party enterprises.

(3) Li Auto: CATL

In the first half of this year, Li Auto produced a total of 30,500 vehicles, with a single electric capacity of 38.5 kWh, and the corresponding battery installation capacity was 1.177 GWh. Currently, Li Auto’s BYD battery version has not yet been launched, and CATL is supplying Li Auto. This may be related to the development of the pure electric version in the future, and we will make separate predictions about this. At present, the current production capacity is still insufficient to open up special suppliers.

(4) Hozon Auto: CATL, JWEP, Huading Guolian

The most interesting thing this year is the counterattack of Hozon Auto. The production of new energy passenger vehicles in the first half of the year was 21,100 units, and the corresponding battery installation capacity was 0.851 GWh. In the first half of the year, the battery companies that provided power for Hozon Auto were CATL, JWEP, and Huading Guolian, respectively. Since there is no specific breakdown data, it is impossible to give a specific allocation mechanism here.

(5) WM Motor: Tafel, Lishen Power Battery, CATL

WM Motor is definitely a new force company that has performed unsatisfactorily this year. In the first half of this year, the production of new energy passenger cars was 13,000 units, and the corresponding installed capacity of power batteries was about 695.7 MWh. Regarding the battery suppliers, in the first half of the year, WM Motor’s battery suppliers were mainly Tafel, Lishen Power Battery, and CATL. Among them, Tafel’s supply capacity was 570 MWh, accounting for 81.9%.

Summary: In the beginning, the battery selection of new companies was mainly based on mainstream batteries, and was tied to Ningde CATL. However, as the overall supply pattern of power batteries became tight in the second half of the year, the power battery supply in the second half of the year will show some differentiation.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.