Tesla’s 2021 Q2 financial report: What Tesla Management Revealed

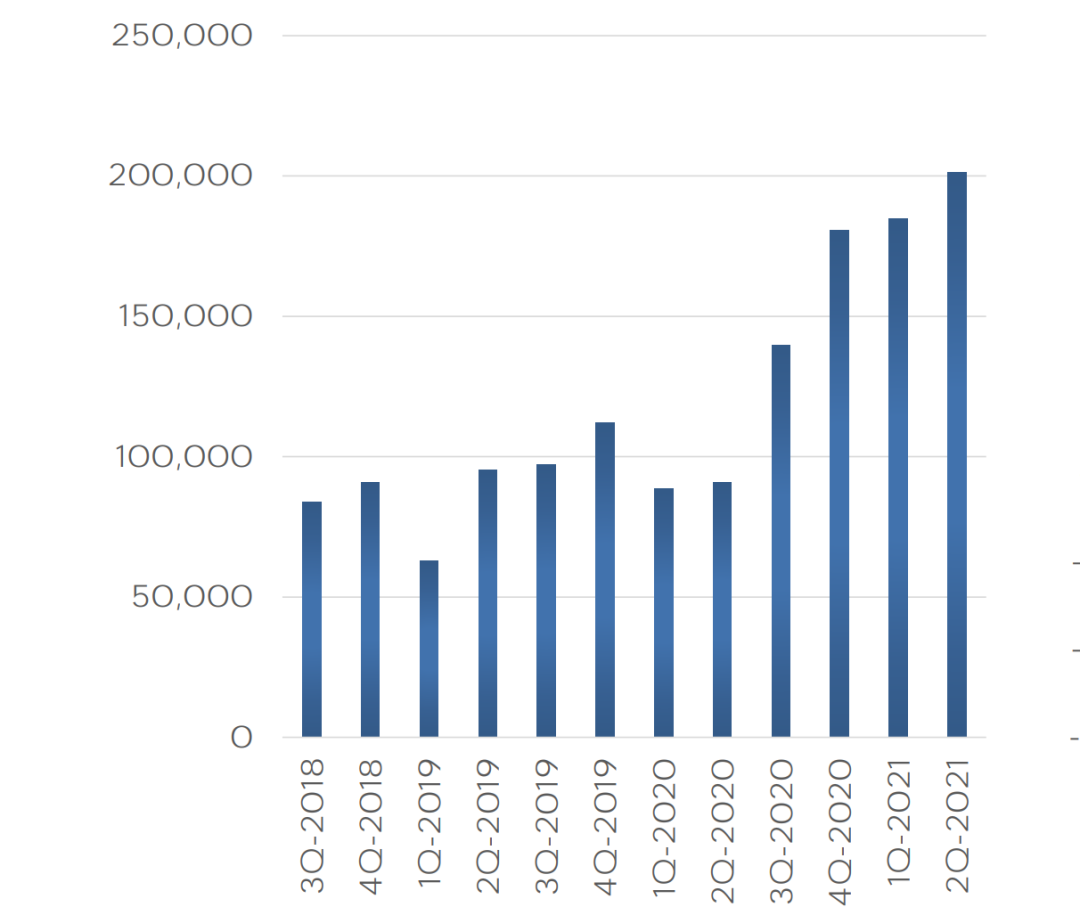

On the early morning of July 27th, Tesla released its Q2 financial report for 2021. A mere 25 days before that, Tesla announced their Q2 delivery figures, which saw a single quarter sales record of 201,250, not an unfamiliar sight, but more importantly, a 121% YoY growth.

Despite Tesla’s business becoming increasingly complex, the auto business is still the unequivocal driver of Tesla’s financial reports in 2021. All thanks to the current 121% growth, seemingly everything has become a possibility.

Following the financial report, Tesla’s CEO, the head of Autopilot, Lars Moravy, the Vice President of Vehicle Engineering, Andrew Baglino, and CFO Zachary Kirhorn, who are the most important four individuals in Tesla’s management team, all attended the financial report meeting together.

What’s the meaning behind Tesla’s understanding of chip supply, 4680 battery development, Cybertruck EV, and long-term growth? Let’s take a look together.

Zach: This is only possible because our average cost per vehicle has reduced by more than the reduction in the average price.

Zach: The only option was to reduce the average vehicle cost per Tesla faster than the average transaction price reduction.

Let’s start with the financial report itself. To some degree, the idea at the beginning of the article that “sales figures mean everything” is not entirely accurate. For example, continued sales growth can improve many financial indicators, but it’s hard to say this will lead to significant improvement in gross margins. Nevertheless, Tesla’s Q2 had a 28.4% automotive gross margin, which even surpassed the 25% long-term gross margin guidance that Elon set for Model 3/Y.

If you consider that the new Model S/X is still in the early climb phase of “sell one, lose one,” while the Model 3/Y is expected to bring profitability to the company, Tesla’s ability to control vehicle costs becomes even more impressive.More importantly, if we look back from 2019 till now, it seems that the price of Tesla Model 3/Y has been rapidly decreasing?

Zach specifically mentioned this in the earnings conference: “In the past two years, Tesla’s sales have more than doubled, and this scale of growth is due to a steady decrease in the average selling price (ASP) by over 10%. This is driven by Tesla’s pricing roadmap – more affordable prices and model combinations to achieve greater sales volume.”

However, at the same time, Tesla’s automotive gross profit margin has increased by nearly 10 percentage points, reaching the highest level since the delivery of Model 3 in 2017. This leads us to the opening remark that only when the average vehicle cost of Tesla decreases faster than the ASP, can sales and profit margins grow synchronously while prices are decreasing.

Zach: “As we work through the uncertainty, we want to ensure we do our best to manage customer wait time.”

Zach: “In managing the uncertainty, we want to ensure we do our best to manage ‘customer wait time’.”

The second statement also comes from Zach, which sounds more down-to-earth than Elon’s statement, “Capacity is the fundamental limitation to Tesla’s sales growth” – first, the supply needs to be imbalanced, and the order backlog has to reach the point where customers need to wait in line, before there is a basis for discussing “managing customer wait time”.

However, this is indeed the reality for Tesla. Elon stated in a previous hearing that Tesla Powerwall currently has a backlog of approximately 80,000 orders, while Tesla Q2 can only produce 30,000-35,000 Powerwalls in the best case scenario. For next year’s demand, Elon believes Powerwall orders may reach an annualized one million.The even more critical product in the supply and demand situation is the MegaPack, a large-scale energy storage product with a single capacity of up to 3 MWh. Elon stated at the financial report meeting that Megapack’s production capacity up to the end of 2022 has all been sold out.

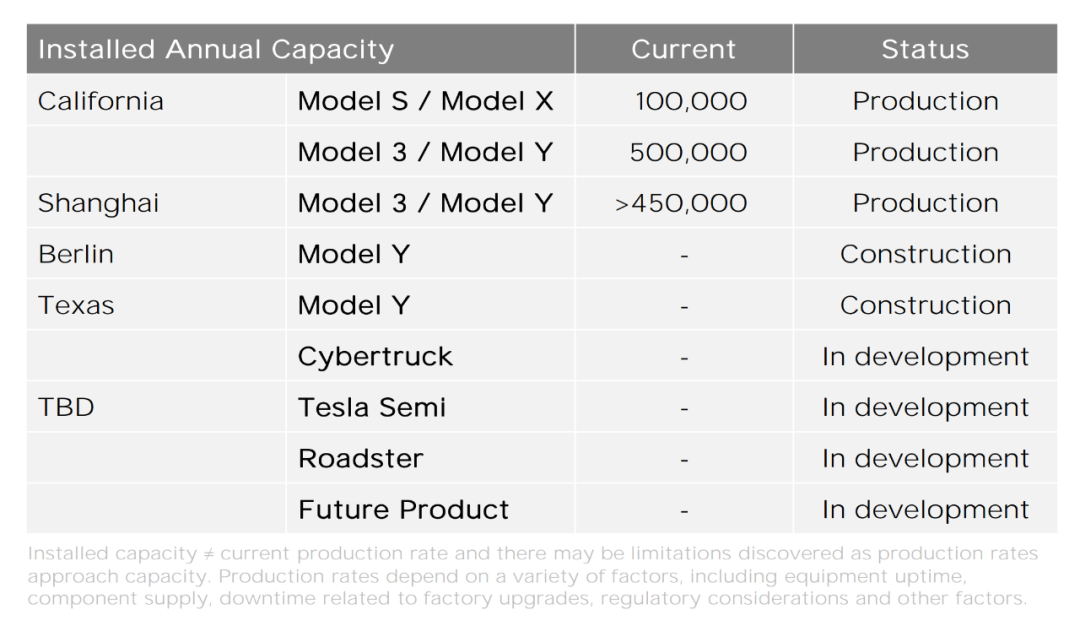

As for the production capacity of Tesla’s latest version of global vehicle distribution shown below:

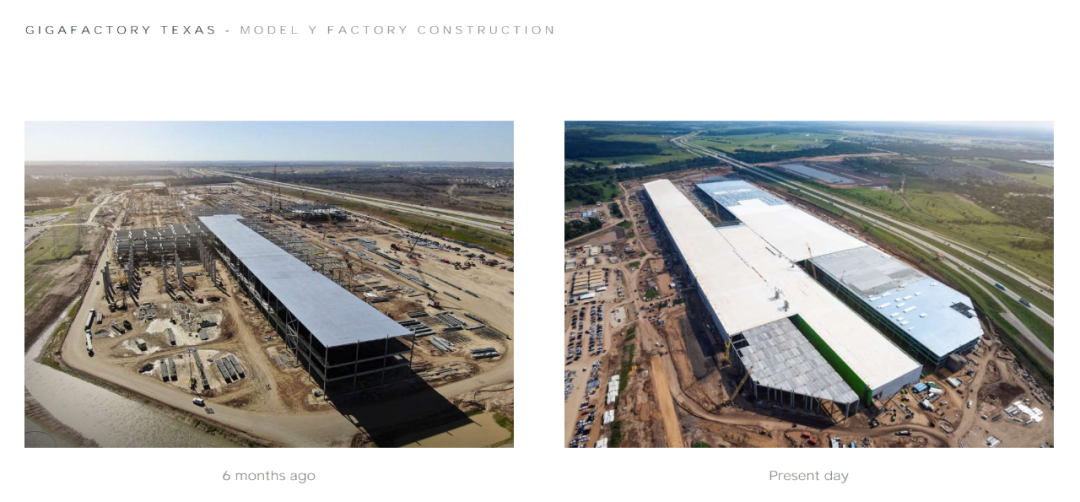

The dramatic conflict between the delayed Gigafactory Berlin and the rapidly progressing Gigafactory Texas, with a 5-month difference in their groundbreaking, both planned to officially start production at the end of this year. By then, Tesla will have four large-scale car factories in three major markets.

Currently, due to strong demand in North America, the “veteran” factory in Fremont, California, continues to focus on satisfying the North American market. The Gigafactory Shanghai serves as a dual location for the Chinese market and export to Europe and the Asia-Pacific region. The original words were “we have completed the transition of Gigafactory Shanghai as the primary vehicle export hub.”

The production capacity of the Shanghai factory has reached more than 450,000 vehicles per year. As Elon said, how long does it take to establish a factory overseas and fully localize the supply chain to a full production state? Tesla’s answer is two and a half years.

Elon: The chip supply is fundamentally the governing factor on our output.

The chip supply issue has led to reduced or suspended production to varying degrees for almost all mainstream automakers, becoming a must-talk topic for every automaker at financial report meetings. Tesla is no exception.

In February 2021, Tesla’s Fremont factory was briefly shut down, and in April, the Model Y production line at the Tesla Shanghai factory was suspended for two weeks. However, as mentioned earlier, Tesla delivered a total of 386,181 vehicles in the first half of the year, an increase of over 115% year-on-year. Therefore, Tesla undoubtedly faced problems, but they solved them and continued the growth trend.How to solve the problem? Elon shared two details in the Q1 and Q2 earnings calls:

Due to a shortage of USB cables, production of the new Model S was forced to cease. Tesla employees stormed every electronics store in the Bay Area, and for days, no one could buy a USB cable in the Bay Area as Tesla bought them all up and put them in their cars, quite literally.

The chip shortage-induced controller substitutions are a systems engineering challenge, requiring software to be rewritten, new firmware to be written, and vehicle integration testing to be conducted, all while replacing the chip. Tesla’s electrical and firmware engineering teams have been talking to chip suppliers at 1:00 a.m. multiple times in order to simultaneously design, develop, and validate 19 new controllers to address the chip shortage issue.

According to Elon, Tesla has hundreds of such stories, and the company’s supply chain spans 50 countries globally and is regulated by dozens of regulatory regimes, and Tesla’s team has demonstrated “unparalleled ability to react quickly.”

On the one hand, Tesla’s team has indeed displayed exceptional agility in the face of adversity, and as Tesla puts it, this agility is “unmatched.” We are truly unable to find a second automaker in the auto industry that can completely overturn the traditional V-shaped development process and quickly develop replacements after large-scale production of cars. This is undoubtedly a model of innovative efficiency.

However, on the other hand, innovation and risk always go hand in hand, and it remains unclear whether this extremely efficient development process will bring more uncertainties to the product’s lifecycle usage experience.

Drew: It’s not like a science problem, it’s an engineering problem. It’s not a question of if, it’s a question of when.

Drew: It’s not a science problem, it’s an engineering problem. It’s not a question of whether it’s feasible, but a question of when it can be achieved.

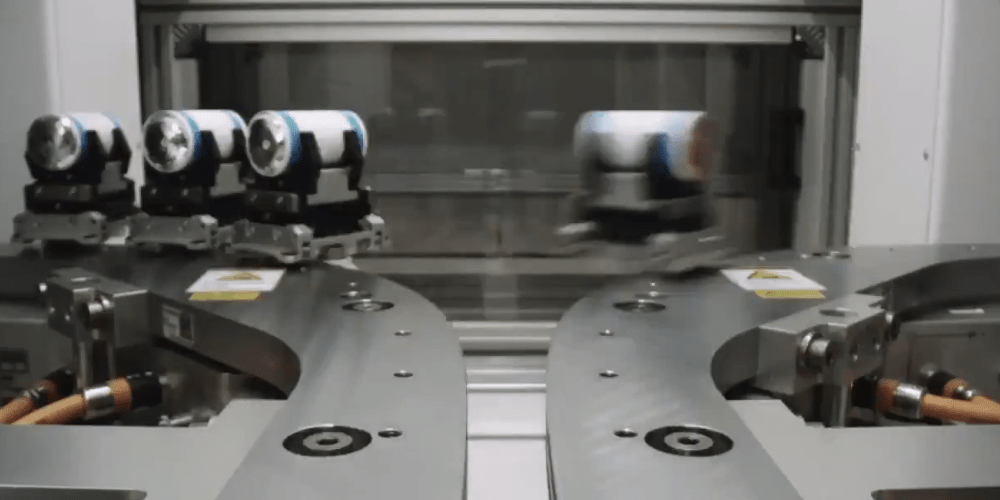

Without a doubt, the large-scale production of 4680 batteries is one of Tesla’s most important projects in the next phase. Tesla also revealed the progress on 4680 at this earnings conference:

Tesla has verified the performance and cycle life of the 4680 battery produced at the Kato factory in California and is currently performing reliability testing. The 4680 battery, which has accumulated over one million equivalent miles, is being produced.

Tesla has verified the performance and cycle life of the 4680 battery produced at the Kato factory in California and is currently performing reliability testing. The 4680 battery, which has accumulated over one million equivalent miles, is being produced.

Tesla is currently focused on improving the manufacturing process that hindered mass production in the final 10%. Elon stated that the 4680 battery is not a minor improvement to advanced technology, but a brand new product with a large amount of innovation integrated. There are still many challenges in transitioning from prototype production to mass production.

Since Battery Day in 2020, Tesla has completed six major improvements and dozens of minor improvements. Drew indicated that these issues are not scientific problems, but engineering ones. The 4680 battery has passed the “feasibility” checkpoint, and Tesla’s main question now is “when it can be done.”

Therefore, Tesla has ordered a large number of 4680 battery production lines for the production of Giga Texas and Giga Berlin batteries. Tesla aims to achieve an annual production capacity of 100 GWh by the end of 2022.

Elon stated that in mass production, 4680 batteries and structural packs are preferred. From a physics standpoint, this is the best architecture, and from an economic standpoint, it is the cheapest way to go, making it the lightest and lowest-cost option.

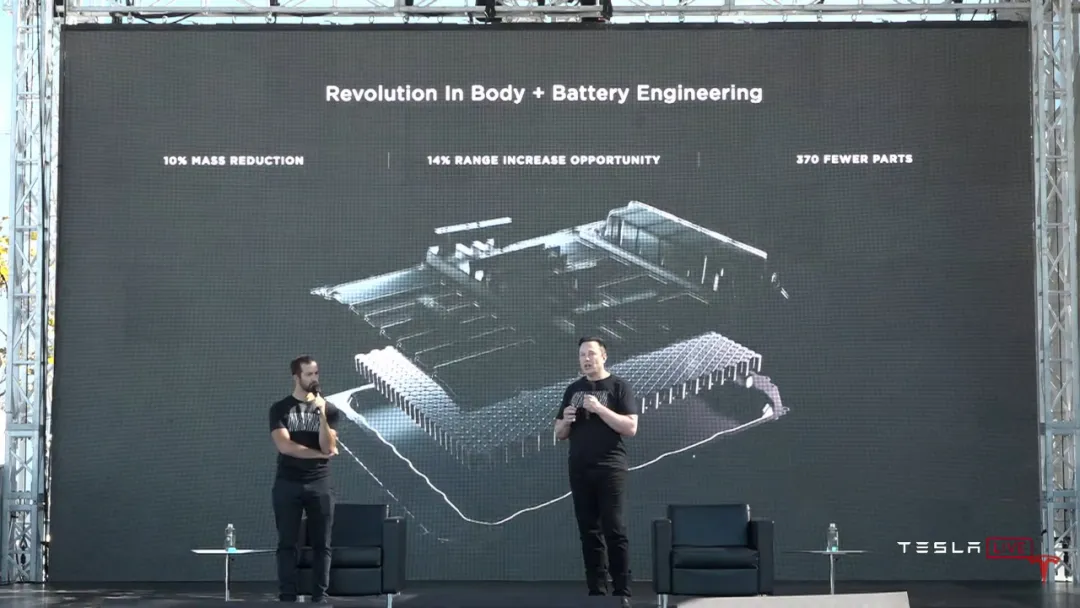

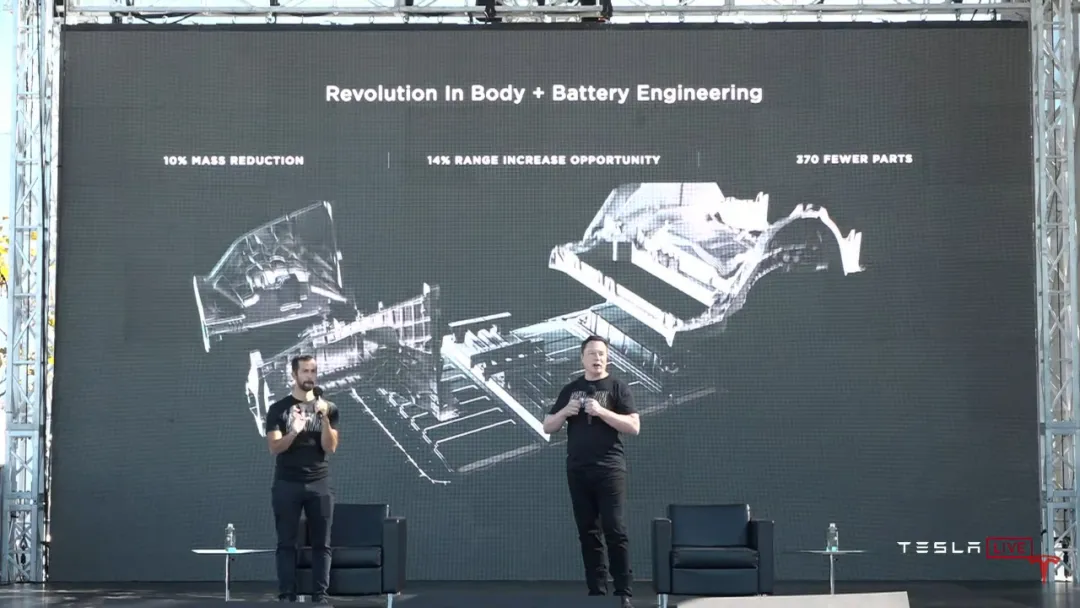

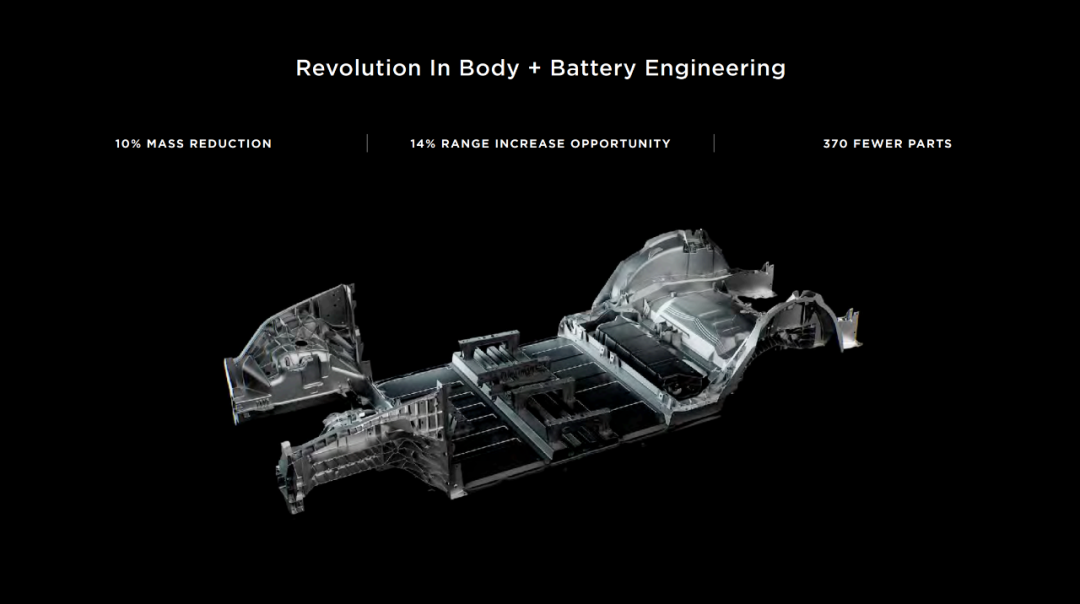

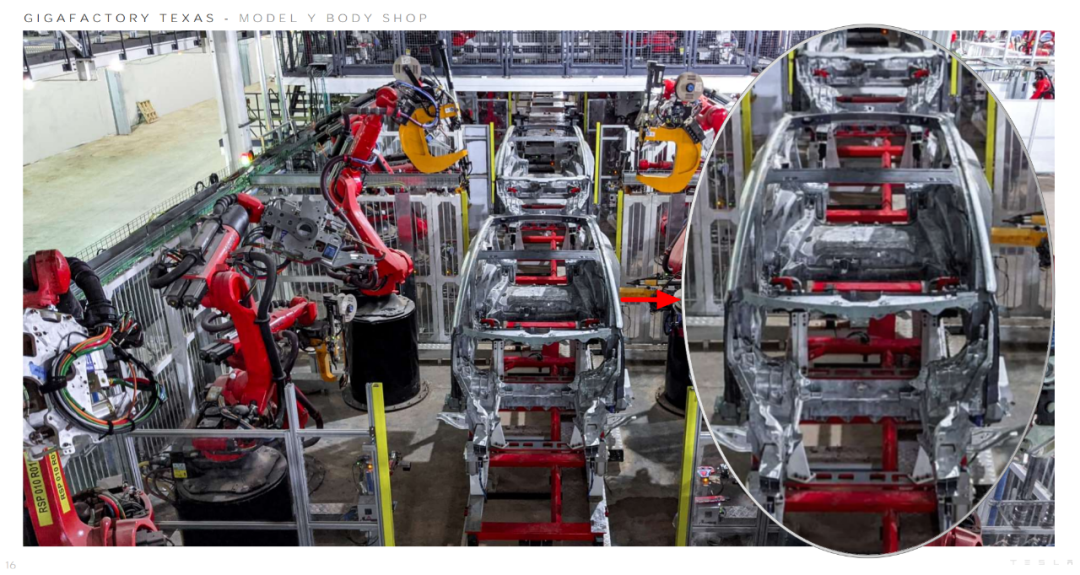

Regarding the Model Y white body, the current version appears as shown below:And Elon’s 4680 cells + structural pack concept, which Tesla showcased last year on Battery Day, has already eliminated modules, various protective plates, and crossbeams. The cells are directly integrated into the chassis to form the structural pack.

Next, by utilizing a 6000-ton press, the front and back of the car can be manufactured through integrated casting. Three super large components are combined to form the lower half of the white body.

According to Tesla’s calculation, this improved white body design method can reduce 370 components, decrease the weight of the car body by 10%, and increase the range by 14%.

In its earnings report, Tesla stated that internal crash tests have been successfully conducted on the integrated cast front body (and the integrated cast rear body has already entered mass production) and the structural pack. The earnings report also displayed the new-generation white body with the integrated cast front and rear bodies + structural pack already off the production line at the Giga Texas factory.

Using the standard range Model Y as an example, assuming the battery capacity remains unchanged, the curb weight of the newly designed Model Y that’s off the production line can be reduced from 1929 kg to 1736 kg, and its NEDC range could increase from 525 to 598.5 kilometers.

Tesla’s Giga Berlin and Giga Texas factories are both planning to begin production of the new generation Model Y within the year 2021. However, considering the uncertainty around the production capacity of 4680 cells, the existing design of Model Y with 2170 batteries has been planned as a backup.

Lars: With the Cybertruck, we’re redefining how a vehicle is being made.

Lars: 通过 Cybertruck, 我们正在重新定义汽车的制造方式。Since its launch, the Tesla electric pickup truck Cybertruck has had a strange popularity without any active promotion from the official. According to the order number, Cybertruck orders have been steadily increasing and have exceeded 1.2 million. The good news is that Tesla will start mass-producing Cybertruck once the Model Y production capacity at the Giga Texas plant is ramped up.

Elon Musk said that, in his view, Cybertruck is the best product Tesla has ever made. Lars succinctly pointed out Cybertruck’s differences, “It inherits the front and rear integrated casting design and structure Pack of Berlin and Texas factories. Through Cybertruck, we are redefining the way cars are made.”

First of all, let’s talk about the integrated casting design. Tesla has customized a 6000-ton press for producing the front and rear of the Model 3/Y. However, Cybertruck is a larger pickup truck and therefore requires a new 8000-ton press. This is the first risk.

Secondly, because the Cybertruck body is made of stainless steel and cannot be stamped, the manufacturing process for Cybertruck does not include the stamping workshop, one of the four major processes in automotive production. Tesla needs to explore a method to mass-produce stainless steel bodies.

Both the 8000-ton super press and the stainless steel body are being applied to mass-produced cars for the first time. Therefore, Elon expressly stated, “I think production ramp of Cybertruck is going to be difficult. Nobody has ever made a car like this before. There are too many unknowns, so it’s going to be a challenge.”

Lars stated that Cybertruck is currently in the Alpha stage, and Tesla has completed the basic engineering of the vehicle architecture and plans to move on to the Beta stage later this year.According to publicly available information, the Cybertruck will be equipped with Tesla’s highest energy density battery cells, and the top configuration will feature the same Plaid three-motor powertrain as the Model S Plaid, with rear-wheel steering and no physical door handles or shift levers.

When it enters mass production in 2022, the Cybertruck will compete head-on with the Ford F150, the best-selling American car for 42 years.

Elon: I think this is the Until the last time I’ll do earnings calls.

Elon: “I think this will be the last time I participate in a earnings conference call.”

Before Tesla, many successful CEOs in the United States scorned the idea of participating in earnings conference calls.

For example, the late former Apple CEO Steve Jobs did not attend an Apple earnings conference call after 2000 until the financial crisis broke out in 2008. He appeared at the earnings conference to boost shareholder confidence. Amazon’s board chairman Jeff Bezos deliberately kept a distance from Wall Street and never participated in earnings conference calls, spending only six hours a year communicating with investors.

But why is it generally considered bad news for Elon to stop participating in earnings calls?

I think this may be related to the “Elon First” marketing culture that Tesla has formed for a long time. Former head of Tesla’s automotive business, Jerome Guillen, once sent an email to all employees, telling them, “Don’t disclose company information to the outside world, leave this to Elon.”

Elon’s Twitter, Tesla’s quarterly earnings conference calls, and Elon’s speeches at the annual shareholder meetings have become the most important ways for investors to understand Tesla’s trends. Against this backdrop, Elon’s announcement that he will no longer participate in earnings conference calls is obviously not good news for investors who have been following Tesla for a long time.

However, if you listened to Tesla’s Q2 earnings conference call, you would find that Elon’s logic is consistent with Steve and Jeff’s. After saying “this will be the last time I participate in an earnings conference call,” Elon added, “Obviously, I have to participate in the annual shareholder meeting. Unless there is something very important, I probably won’t participate in earnings conference calls anymore.”Elon has long expressed his disdain for Wall Street analysts and prefers individual shareholders who are long-term investors in Tesla. This logic is consistent with what Jeff said, that “those who hold Amazon stocks for the long term are investors, and those who hold them for the short term are traders.”

Hiro Mizuno, a director of Tesla, also stated after the earnings call that for most well-operated companies, quarterly earnings reports are not the best use of CEO time. These issues often focus more on short-term finances and operations, where the CFO and COO are the best combination.

As for those who speculate that leaving the earnings call is the first step in Elon’s fading from Tesla, Elon actually responded in detail in the Q1 earnings call about whether he would resign as Tesla CEO:

“I hope to continue as CEO of Tesla in the coming years. I am still super excited about many things and I think it’s very hard to leave here. So I hope to continue operating this company in the coming years.”

“I don’t think the mission is over yet. We still have a long way to go before we can make progress in accelerating the emergence of sustainable energy.”

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.