If we trace the development of intelligent electric vehicles represented by Tesla, we will find that the development of intelligent vehicles has had a direct impact on Europe’s entire vehicle and supply chain. The most obvious effect is that most automakers are forced to bring their core capabilities In-House, with the first priority being the Three Electrics, followed by autonomous driving. In these two areas, we can see fewer and fewer suppliers.

Let’s back up a bit-autoliv (Autoliv) spun off Veoneer; Veoneer branched out with Zenuity; and most recently, Veoneer was acquired by Magna. Let’s think about how Magna will play this game.

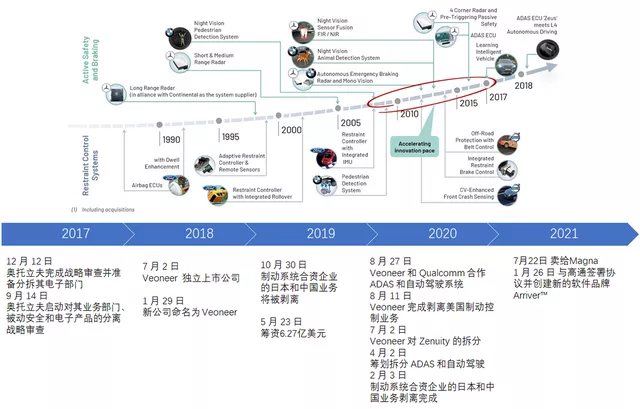

From breakup to acquisition, Veoneer was Autoliv’s core business before that, with 70 years of glorious history. Autoliv made the right decision at the time-in the era of intelligent vehicles, ADAS and autonomous driving businesses require not only a lot of capital investment, but also strategic alliances with entire vehicle companies. Therefore, if these businesses continue to be bundled together, the operational risk for Autoliv as a whole is very high. Management needs to find a way to extract these businesses independently for listing and financing. So, strategically, they took a few steps:

(1) Together with Volvo to develop autonomous driving-I think this is the most harmful step. Veoneer’s original intention was simple. Following the routine of ADAS, they would work with automakers first, and once mature, the business would be done through joint ventures. However, the misjudgment was that the collaboration path was too long, and Volvo also invested a lot of projects and human resources. The overall listing time was later than Veoneer’s initial estimates.

(2) Cooperation with Nissin Kogyo-this newly added business chain had problems. What Veoneer wanted to do was to integrate perception, computing, and execution into three links, so they launched the Veoneer-Nissin Brake System (VNBS), which accounted for 19%-20% of Veoneer’s business volume. However, as overall operations encountered problems, Veoneer had to sell its equity in Japan, China, and the United States to Nissin Kogyo, and eventually completely exit this area.

(3) Cooperation with Qualcomm on autonomous driving systems, aiming to transform and increase investment in software. Because the assets injected into Veoneer originally revolved around traditional ADAS components, more resources were needed for the new investment in software and hardware platforms.

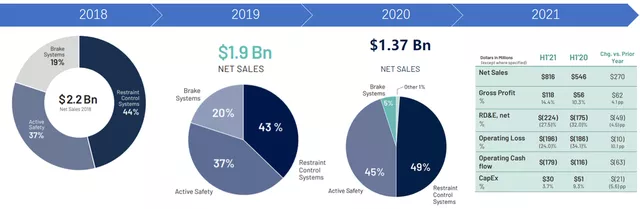

The revenue chart below shows a clear picture: sales reached a peak of $2.2 billion in 2018, plummeted to nearly half to $1.37 billion in the 2020 trough, and only slightly recovered to $0.816 billion in the first half of 2021. The full-year sales forecast for 2021 is between $1.7 billion and $1.8 billion. Veoneer incurred a loss of $0.196 billion in the first half of 2021, and has been losing money every year.

The revenue chart below shows a clear picture: sales reached a peak of $2.2 billion in 2018, plummeted to nearly half to $1.37 billion in the 2020 trough, and only slightly recovered to $0.816 billion in the first half of 2021. The full-year sales forecast for 2021 is between $1.7 billion and $1.8 billion. Veoneer incurred a loss of $0.196 billion in the first half of 2021, and has been losing money every year.

In fact, one thing can be confirmed: Tier 1 companies in Europe all want to learn Bosch’s package solution, from sensors, domain controllers, to actuators, this set of solutions can give Tier 1 companies a certain sense of security. However, things did not go as planned, and currently, the car manufacturers are effectively separating the sensors, domain controllers, and chassis electronic systems, on the one hand, by separate bidding, on the other hand, by building their own core integration capability.

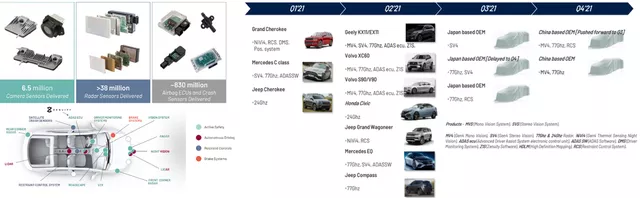

As shown in the figure below, Veoneer’s business lines seem very strong, but the problem is that each business is isolated:

(1) Monocular vision system and binocular vision system capabilities: The main customers are Mercedes-Benz (SV4) and Subaru (SV4), Geely’s KX11 and EX11 platforms, and monocular systems cover Volvo and Geely’s platforms;

(2) ADAS ECU and Z1S software services mainly target Volvo and Geely, and Mercedes-Benz also uses this software system;

(3) In terms of millimeter-wave radar (77GHz and 24GHz), the main customers are Jeep, Ford, Geely, Volvo, Honda, and Mercedes-Benz, but this business is fiercely competitive;

(4) Veoneer’s DMS driver state monitoring system is used by two North American customers, Jeep and Ford;

(5) There are also potential lidar (Velodyne contract manufacturer) and high-precision maps.

The products are indeed gaining market share, but it is far from the previously planned level of synergy and higher gross margin.

I think the biggest problem is that Veoneer’s business is where the car manufacturers and other major Tier 1 companies have invested heavily. To maintain the moat of the business and ensure that it can continue in the future, continuous investment is required (R&D and engineering expenses were $0.562 billion in 2019, lowered to $0.407 billion in 2020, and still need to be invested in 2021). Business volume will not increase significantly in the short term, losses are continuing, and investment is still required, which puts Veoneer in a dilemma.

Magna’s Acquisition

As mentioned earlier, investing in automotive electronics is a game that only rich Tier 1 companies can play. Magna had a revenue of 32.6 billion dollars in 2020, and overall sales are expected to recover in 2021.

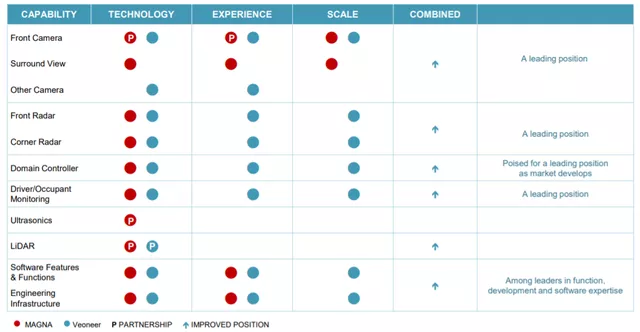

Of all the reports, this image best reflects the integration effect of the two companies’ ADAS product lines:

(1) In the field of vision, Veoneer’s monocular and binocular solutions, especially based on accumulated visual perception algorithms, are indispensable for Magna.

(2) In the field of millimeter wave radar, the combination of Veoneer’s solutions and customers has great synergy.

(3) In the field of LiDAR, both companies choose to cooperate with LiDAR enterprises – Magna works with Innoviz, while Veoneer integrates Velodyne + Baraja. It is estimated that some LiDAR enterprises will need to be eliminated in the final step of the integration.

After all, even if Magna is a big company, it still needs to grow in the ADAS field to maintain long-term growth. Veoneer does not have the scale and ability to stick to independence, so the combination of the two is a kind of helplessness in reality.

Conclusion: With chip companies’ platform solutions available and whole vehicle companies entering the software field, small-revenue automotive electronics Tier 1s cannot retreat under the pressure of both.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.