On the morning of July 27th, 2021 at 4:00 AM, Tesla’s 2021 Q2 earnings report arrived as scheduled. The first thing I did after downloading it was to quickly convert the PDF to an image. After searching for a few tense and expectant minutes, I confirmed that Tesla did not release the Cybertruck during this earnings report.

I let out a sigh of relief mixed with a tinge of disappointment, as I thought there might be a surprise announcement this time. However, after quickly scanning the data, I found that this earnings report couldn’t have been any better.

New All-Time Highs Everywhere

200,000+ Vehicles Delivered in a Single Quarter

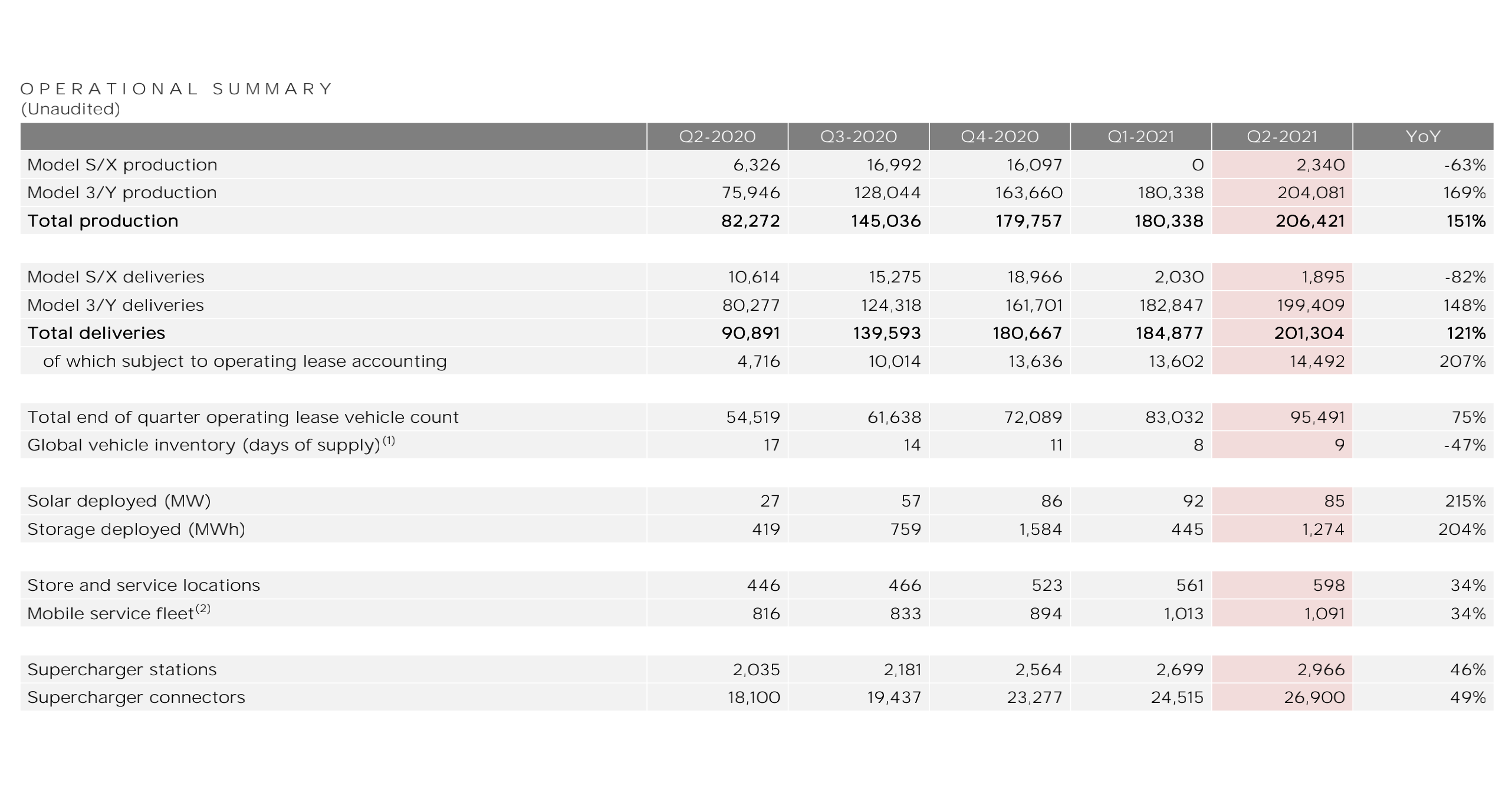

Starting with deliveries, Tesla delivered 201,304 vehicles in Q2 of 2021, including 199,409 Model 3/Ys and 1,895 Model S/Xs. This marks a new all-time high for quarterly deliveries and brings Tesla’s year-to-date deliveries to a record-breaking 386,181 vehicles. These two figures are more than double what they were during the same period in 2020 when the pandemic was at its height.

This delivery performance is unsurprising in the larger context of the global market’s high demand and Tesla’s steadily increasing production capabilities. Furthermore, it appears that Tesla endured the ongoing MCU chip shortage in the automotive industry during the first half of the year, while these figures also suggest that the negative publicity in China did not impact Tesla’s overall sales much.

After all, short-term scrutiny can certainly have some influence on domestic demand, but prior to the completion of the Berlin factory, vehicles manufactured by the Shanghai factory could still be exported to supply the vast empty areas in Europe, Asia, and the Middle East, which feels like “filling the gaps”.

Finance: A Great Leap in Profitability

However, compared to delivery figures, the financial data for Q2 is even more impressive. Below are the main statistics:

-

Total revenue of $11.958 billion, up 15.1% QoQ and 98% YoY. Automotive revenue was $10.206 billion (including $354 million from selling carbon credits), up 13.4% QoQ and 97% YoY.

-

Automotive gross profit of $2.899 billion, up 21.6% QoQ and 120% YoY.- Total gross profit was $2.884 billion, with an overall gross margin of 24.1% and a vehicle gross margin of 28.4%.

-

Cash and cash equivalents reached $16.229 billion.

-

Operating cash flow minus capital expenditures (free cash flow) was -$619 million.

-

GAAP operating revenue was $13.12 billion, with an operating profit margin of 11.0%.

-

Net profit was $1.142 billion, up 998% year-over-year and up 160.7% sequentially in Q1.

To put it bluntly, in 2021 Q2, Tesla set new records for:

- Total revenue

- Total gross profit

- Overall gross margin

- Automotive business revenue

- Automotive business gross profit

- Vehicle gross margin

- Operating revenue

- Operating profit margin

- Net profit

It’s not an exaggeration to describe the financial data for Q2 2021 as a “smashing success”. When combined with record high delivery figures for the same period and the fact that only 2,340 units of the high-end Model S/X product line were delivered in Q2, what this data reflects is something that is sure to rally investors: as deliveries ramp up, not only is the Model 3/Y product line bearing more of the load in terms of sales volume, but per-vehicle profitability is actually increasing, thanks to lower costs and improved production efficiency.

The upshot of all this is that Tesla’s Q2 net profit was just $1 million shy of matching the net profits from the previous four quarters combined.

No longer just a “carbon seller”

Aside from the above, my other area of interest lies in Tesla’s carbon credit revenue for the quarter. Anyone could easily overlook this figure, but I believe it is of great significance, because although Tesla has now achieved eight consecutive quarters of profitability, in the previous seven quarters, revenue from the sale of carbon credits exceeded net profit.

In other words, if it weren’t for the sale of carbon credits, Tesla would still be operating in the red. This is why some of my colleagues jokingly call Tesla a “carbon seller”.

However, in Q2 2021, for the first time in Tesla’s history, net profit surpassed revenue from the sale of carbon credits. Even if we exclude the income of $354 million generated by the sale of carbon credits, Tesla’s profit for the second quarter still reached $788 million.

Although the company hasn’t made any special announcements about this, it is actually an important milestone in Tesla’s history. The company’s self-sustaining ability has reached a new level in this quarter. And breaking through the double-digit operating margin has begun to mark Tesla’s departure from the cycle of “selling more but earning less”, demonstrating its transformation from a traditional automaker to a tech company, from a financial performance standpoint.

Factories, New Cars, and FSD

Production capacity pressure still existsAs both the Berlin and Texas factories are still under construction, Tesla’s production capacity is still mainly supported by the Fremont factory and the Shanghai factory.

The current annual production capacity of the Fremont factory is 600,000 vehicles, including 500,000 Model 3/Y and 100,000 restyled Model S/X. However, Model X has not yet started delivery, and Model S is still in the process of ramping up, so it may take some time to reach the established annual production capacity target in the short term.

Fortunately, the transformation and capacity improvement of the Model S production line have been almost completed in Q2, and Musk said at the Model S Plaid delivery ceremony on June 11 that “we will deliver hundreds of cars every week in the next few weeks, and then gradually increase to more than 1,000 cars per week.” After the capacity ramp-up is completed, the delivery volume of S/X in the second half of the year is expected to see the most vigorous growth in recent years.

Apart from Model S/X, the strong demand for Model 3/Y in the US domestic market has also consumed most of the production capacity of the Fremont factory. To mitigate this, Tesla has made two adjustments. First, the models produced by the Texas factory will be Model Y, which will improve the supply capacity to the local market. Second, Tesla will significantly increase the Model Y production capacity of the Shanghai factory to provide some export capacity for Model Y before the completion of the Berlin factory.

The Hero of the Second Half of the Year: Shanghai Factory & Model Y

Undoubtedly, the stable high output of the Tesla Shanghai factory played a crucial role in the record-breaking deliveries in the first half of the year. Meanwhile, the production capacity of the Shanghai factory still has room to grow in the second half of the year with the completion of the Phase II Model Y plant and further improvement in the supply chain.

On the demand side, the launch of domestically-produced Standard Range Model Y this month has added a lot of chips to Tesla’s sales expectations in the second half of the year. After the subsidy of 276,000 yuan, the starting price of the Model Y series has been lowered by 71,900 yuan.

New SUV offers more space and a NEDC range of 525 km, which is 57 km more than the standard range Model 3. Even with backseat heating, steering wheel heating, 14-speaker sound system, fog lights, and HEPA filter, the starting price is only 25,100 RMB more expensive than Model 3, with outstanding cost performance.

New SUV offers more space and a NEDC range of 525 km, which is 57 km more than the standard range Model 3. Even with backseat heating, steering wheel heating, 14-speaker sound system, fog lights, and HEPA filter, the starting price is only 25,100 RMB more expensive than Model 3, with outstanding cost performance.

It goes without saying that this vehicle will help boost Tesla’s sales in the domestic market, and it is only a matter of time before the Model Y becomes the best-selling mid-size SUV in China.

Furthermore, due to the delay in the construction of the Berlin factory, Tesla Shanghai will supply the European market with Model Y for the time being. The Model Y has gradually been added to the official websites of European countries since July 9.

It is easy to notice that the models added to the European market this time are the 4WD long-range and high-performance versions of Model Y. Demand for these two versions in the domestic market will undoubtedly be reduced compared to the standard Model Y. Therefore, exporting the surplus production capacity of high-end models to the European market is an intelligent choice that once again maximizes production capacity utilization, also known as “filling the valleys and flattening the peaks.”

What happened to the Cybertruck and Semi that were promised?

As expected, there has been another delay. Musk announced that the mass production of the Semi will be postponed until 2022. The reason is that Tesla wants to concentrate on building factories and the current supply chain and battery capacity is still insufficient to support mass production.

However, for consumers, everyone is more concerned about the Cybertruck. Before the financial report, Musk revealed the following information:

-

The design of the mass-produced Cybertruck will almost remain the same as the prototype.

-

The Cybertruck will not have door handles, and the doors will open through automatic passenger recognition.

-

The mass-produced Cybertruck will be equipped with four-wheel steering, which can effectively reduce the turning radius of the Cybertruck as a large vehicle and improve handling.

The bad news is that compared to the confident statement of “mass production by the end of 2021” earlier, Musk’s language is more cautious after the financial report this time. He emphasized that the production progress of Cybertruck will depend on multiple aspects, including the crucial node of battery production capacity. If the supplier can exceed expectations on supply capacity, the progress will naturally be faster.

The bad news is that compared to the confident statement of “mass production by the end of 2021” earlier, Musk’s language is more cautious after the financial report this time. He emphasized that the production progress of Cybertruck will depend on multiple aspects, including the crucial node of battery production capacity. If the supplier can exceed expectations on supply capacity, the progress will naturally be faster.

Undoubtedly, the main component affecting the mass production of these two cars is the 4680 battery cell. The good news is that Musk stated that the reliability verification of the 4680 battery cell has already been completed, but it should be pointed out that although it is reliable in small-scale production, there is still a long way to go before it can be reliable in large-scale production.

Musk’s production capacity prediction for the 4680 battery cell is to achieve an annual production capacity of 100 GWh by the end of 2022. Converted, if a Tesla car using a 4680 battery cell has an average energy capacity of 100 kWh, then by the end of 2022, the supply chain of Tesla’s 4680 battery cell can meet the demand for one million cars per year. This is equivalent to a monthly production capacity of 83,000 cars.

It can be seen that Tesla has made sufficient preparations for the large-scale production of Cybertruck next year. From a supply perspective, the 4680 battery cell will inevitably become the next battleground for Tesla’s battery suppliers. The competition for this supply volume is already sufficient to affect the market structure between power battery suppliers. Currently, Panasonic, LG, and many upstream and downstream suppliers in China have already entered the preparation for this competition.

FSD: Full Self-Driving, subscription launch

In July, FSD Beta V9.0 software started to be mass-distributed in the United States. The new version of the software uses the surround-view visual algorithm that was previously pushed on a small scale. Now, when a vehicle under FSD Beta 9.0 software is removed, all ADAS camera images are called to splice and undistort the surrounding road environment to fit a 3D model, which is then displayed on the central control visualized UI.

The new surround-view visual neural network has made significant leaps in accuracy, perception range, and other capabilities, and combined with higher-order control algorithms, FSD 9.0 software has opened up city street autonomous driving capabilities to users, which can achieve actions such as turning at intersections and avoiding vehicles and obstacles. In addition, the DMS camera inside the car is also enabled for driver status monitoring in the new version of FSD.Tesla did another thing this year, which was to remove the front millimeter-wave radar on Model 3/Y vehicles and rely entirely on visual algorithms for distance detection. Tesla’s view on this is that it has trained with data from over a million vehicles, and currently the vision system has enough reliability to replace radar in some scenarios.

In addition, this month’s FSD subscription service has been launched in the U.S. region, with a subscription price of $199/month for basic assisted driving users and $99/month for EAP users. To activate FSD, the user’s vehicle needs to have HW3.0 hardware, otherwise an upgrade needs to be purchased.

The Q2 earnings call after the earnings report contained some key information, summarized as follows:

Chip shortage

Although Tesla’s total revenue in Q2 2021 exceeded $10 billion, the impact of the chip shortage was significant and difficult to predict how long it would last. Tesla cannot control this issue, and software would also need to be rewritten if the chips were swapped out.

In the earnings report, Tesla also stated that to alleviate the shortage of semiconductors, its firmware and electrical engineering team has been working on designing, developing, and verifying 19 new different controllers.

Production capacity

The construction progress of the Texas Gigafactory is very fast, rising from the ground within a year. We are now holding a conference call with you from the Texas Gigafactory, and this year the Model Y will also be produced in Texas and Berlin as planned. Mass production is very complex and there are many uncontrollable variables. It is easy to start an electric vehicle start-up, and there are many such companies in the United States. But Tesla is the one that has not gone bankrupt, which is the hardest part.

The Model Y production line in Texas and Berlin Gigafactories will be similar to the existing ones, but there will also be many differences. The Berlin Model Y will use a one-piece die-cast rear and front body, and the 4680 battery will be directly used in the mass production of the Berlin Model Y.

More details on open supercharging

For non-Tesla users of other brand vehicles, using Tesla’s Supercharger is easy, with full app operation. However, there may be time limits and the rates may fluctuate with electricity usage peaks, with valley pricing being implemented.# Translation in English Markdown

Musk: Tesla’s Goal is to Promote Sustainable Energy Transition, not to Build Barriers against Competitors

Musk reiterated that Tesla’s goal is to promote sustainable energy transition, not to build barriers against competitors. In addition, the openness of the Supercharging network can help dilute costs and enable faster and more scalable development of Tesla’s Supercharging network.

Mass Production of 4680 Battery Cells

Tesla is collaborating with its existing suppliers to produce 4680 battery cells. With sufficient battery supply, Tesla’s Powerwall production could reach one million units next year. In the long term, Tesla and its suppliers’ total annual battery production capacity will reach between 1,000-2,000 GWh.

The performance and service life of the 4680 battery cell have been verified at the Kato factory in California. The production verification is also nearing completion, but 10% of the process is currently the bottleneck limiting production.

Tesla conducted collision tests on the front cast body with CTC single-cell structured battery pack internals, and the results were fine.

Expectations for FSD Subscription

Currently, setting a specific target is meaningless. Tesla focuses on promoting FSD. From a regulatory perspective, at least in the US market, it has not affected Tesla.

Musk stated that once it is proven that autonomous driving systems are safer than human drivers, they may become more welcomed by regulatory agencies. During the period, he gave an example of elevator operators. Elevators used to be manual, but now they are fully automatic. The same thing could happen with autonomous driving.

Thoughts on Q2 financial report

Another Quarter as a Prelude

Although Q2 2021 set new records in terms of financial data such as deliveries, revenue, profit, and profit margins, etc., looking at the second half of this year, Q2 2021 is still just a prelude.

As for the reason, it is still the same: looking at the global market, Tesla is still in a clear state of insufficient supply to meet demand.

Last year, due to the impact of the pandemic, Tesla’s export capacity to Europe was very limited, and Model 3’s sales in Europe performed poorly. At that time, we saw many analyses online about “European customers not favoring Tesla.” However, in reality, every batch of Tesla’s new cars that arrived at ports in Europe was quickly sold out, and there were no cars available for delivery at other times, waiting for the next batch of shipments.

And now, at any automotive market worldwide, the market appeal of Tesla Model 3/Y still has no rival.

So the conclusion is still the same: looking at the global market, Tesla’s sales are still dependent on the factory’s production capacity.

Perhaps due to the large-scale shipment of the LFP battery cell Model 3, during the time Tesla stopped production and converted its high-end production line in Q2, there was a historic high in gross margin per vehicle. As a result, it is predicted that when the production capacity of Model S/X climbs, the following financial data will still have a chance to refresh profit margin records.

In addition, after the production capacity increase of the Model Y in Phase 2 of the Shanghai factory, the delivery volume can also be expected to grow.And don’t forget, Tesla still holds several products, including the Long Range Rear-Wheel Drive Model Y, Long Range Rear-Wheel Drive Model 3, and Long Range All-Wheel Drive Model 3, to cope with changes in demand. The release of the newly updated Model Y with longer range in China and the high-end Model Y exported overseas is a typical example.

In terms of this year’s delivery expectations, based on Tesla’s annual target of 50% growth, the delivery volume for this year is expected to reach 750,000 units. Given that the delivery target for the first half of the year has already been achieved, I believe that completing this goal this year will not be difficult. The suspense remains on how many more units they can deliver beyond expectations.

Tesla’s “Tetris game”

Looking back at the past few years, you will find that the second quarter of 2021 was relatively calm for Tesla. Compared to previous quarters, Tesla’s focus this quarter was primarily on “implementation.”

The Model S Plaid, which has been delayed for months, has finally started deliveries. The Pure-Vision FSD V9.0, which has also been delayed for months, has finally been pushed out, and the long-awaited FSD subscription model has finally been launched. “Tesla has finally fulfilled many long-standing promises this quarter.”

The reason why people have been waiting for these promises to be fulfilled is that they are “worth looking forward to.” When these promises are finally realized, as users, fans and even peers, everyone will feel excited and thrilled.

For Tesla, even if the timeline is delayed, the accomplishments are still recognized and celebrated because these goals are genuinely challenging and valuable. Furthermore, Tesla has already achieved many incredible things.

This feeling is like leaving a deep groove for the long rod in Tetris. Even if other areas are stacked up while waiting for the long rod to appear, when it finally appears, the feeling of crushing several layers of blocks after speeding it into the reserved groove is always an unbeatable satisfaction.

“So when Tesla tells everyone that they are going to do something, people will keep paying attention to it until they eventually do it. People know that Tesla will eventually accomplish its promises; they know that if they wait a little longer, Tesla will still come to fill that gap with that long rod.”

It is often said that Tesla does not understand user operations, but what Tesla is actually doing is a type of customer engagement that other companies cannot replicate.

So let’s take a look at the current gaps Tesla has left: Die-cast body Model 3, self-contained battery pack, 4680 cell, FSD China region push, FSD China region subscription opening, Cybertruck mass production, Model S/X China region delivery, Superchargers officially open to third parties, and to a certain extent, these are all sweet spots left for the future.And consumers will continue to curse Tesla for delaying delivery while also expecting the day when these problems will be resolved.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.