Translation

Translate the Chinese text below into English Markdown text, in a professional way, preserving the HTML tags inside the Markdown, and only outputting the result.

Previously, we planned to sort out and summarize the situation of power batteries in the first half of 2021. Two days ago, we released the first part, which elaborated on the overall situation, such as battery production and sales volume, battery types, and car models using batteries. This article is the second part, focusing on the analysis of battery companies and supply patterns. We also included some data visualizations.

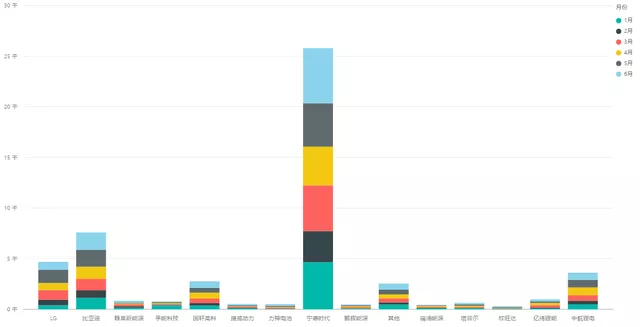

According to the data from the China Automotive Power Battery Industry Innovation Alliance, in the first half of 2021, the top five battery manufacturers produced over 1GWh, namely: CATL with 25.76GWh and a market share of 49.1%; BYD with 7.65GWh and a market share of 14.6%; LG Chem with 4.72GWh and a market share of 9%; followed by CALB with 3.63GWh and a market share of 6.9%, and Guoxuan High-tech with 2.76GWh and a market share of 5.3%. These make up the first, second, and third tiers, respectively.

Overall Supply Pattern

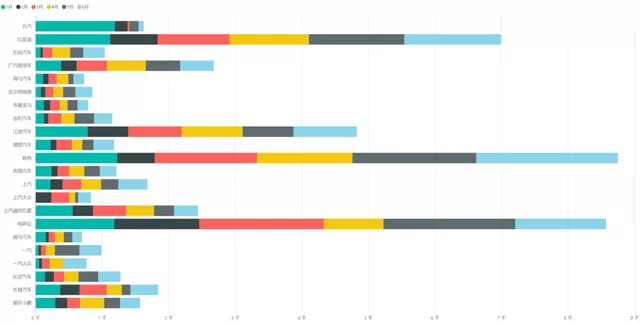

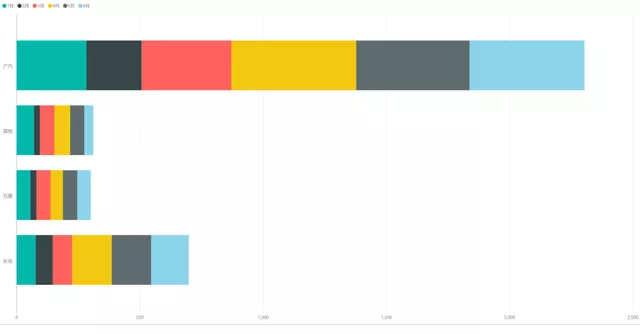

Let’s take a look at the supply pattern. In the first half of the year, the largest demand for batteries in China came from Tesla, which installed a total of 8.57GWh, followed by BYD with 6.995GWh, and JAC (mainly NIO) with 4.826GWh. GAC Motor also used 2.67GWh of batteries, and Wuling used 2.439GWh. These are the top five, all exceeding 2GWh. The following are, in descending order: Great Wall Motors, SAIC, BAIC, XPeng, Changan, Chery, Ideal, Geely, and Dongfeng, with a total of 12.567GWh within the 1-1.8GWh range.

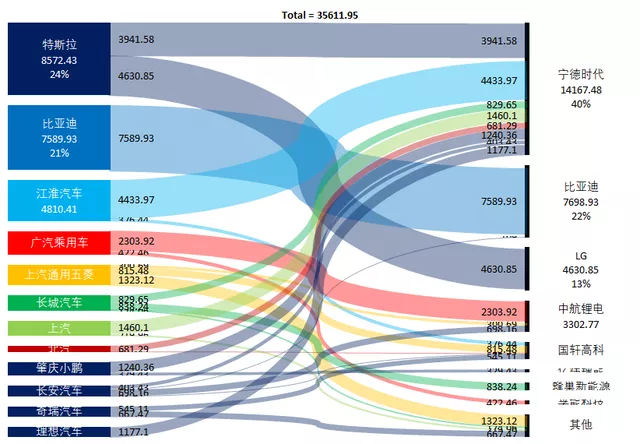

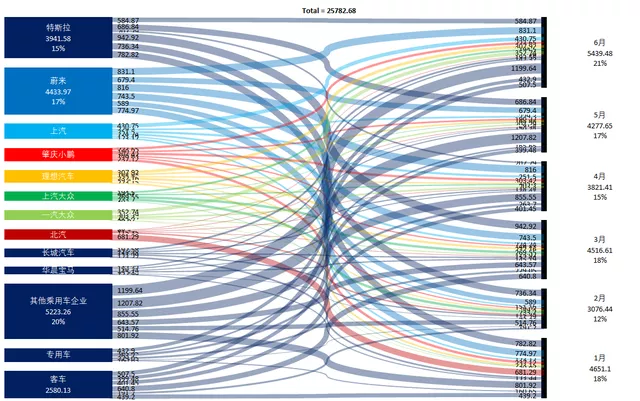

In the overall supply pattern, several companies are worth paying attention to, as shown in the following figure. I think this graph accurately reflects the supply situation. For example, in China, Tesla is still mainly supplied by LG, but with the approximately 2.5GWh of Model 3 exported abroad, CATL’s supply exceeds that of LG. In this supply pattern, Tesla still holds a very dominant position. I plan to write another article specifically on interesting supply relationships in the future.

Major Suppliers Analysis

(1) First-tier: CATL

The Ranking with No Suspense

There is no suspense in this ranking. It mainly depends on the supply relationship, and I have disassembled some supply information. Of course, most of them are provided to NIO and Tesla, and NIO accounts for a large proportion in providing new forces. Since the supply to joint ventures has not started, the new forces have taken the lead, which also proves that the previous strategy of Ningde Times to disperse risks was correct. In addition, Ningde Times has a powerful feature: “other passenger car companies” in Figure 4 directly adopted its standard solution, which also accounts for a large market share, approximately 5.2 GWh, with a share of 20%, even more than NIO, which has the largest share.

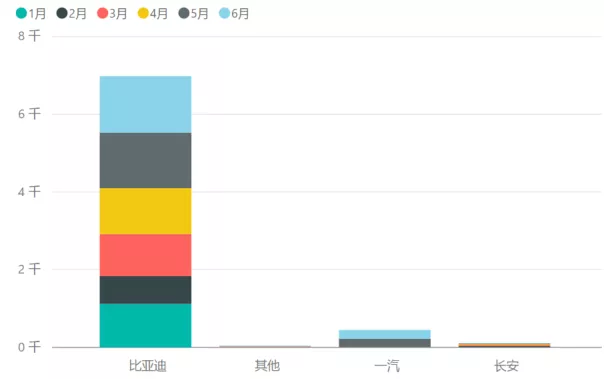

The Second-tier BYD

In addition to using it for its own, BYD has gradually increased its supply to FAW since May, and this part is still worth looking forward to.

The Third-tier CALB

CALB currently has a potential patent dispute with Ningde Times. From the overall supply perspective, CALB accounts for most of GAC’s supply and half of Changan’s supply, as well as part of Wuling’s supply. Overall, CALB still has some breakthroughs in the future domestic customers.

It can be seen that BYD and CALB, these domestic competitors, have a greater impact on Ningde Times’ domestic market share. They have opened second-tier supply relationships with many car companies.

Conclusion

Later, I would like to combine other data to talk about the selection of battery cells by new car companies. For this part, the strategies of each company are not the same, and they are much more diverse.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.