*This article is reproduced from the autocarweekly WeChat account.

Author: Du Debiao

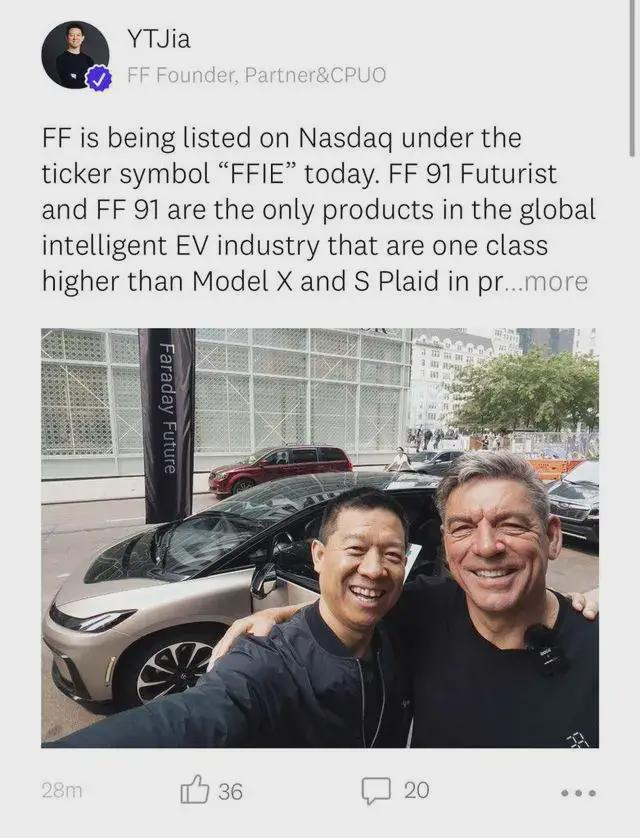

Unintentionally, Jia Yueting appeared again in our sight.

Until FF went public in the United States, we began to pay attention to FF and Jia Yueting’s timeline in the past two years. There are several important time points:

- At the end of 2018, Evergrande finally reached an agreement with FF, exchanging 800 million US dollars for 32% equity;

- After that, FF faced financing difficulties. In 2019, it once sold the headquarters building and the factory land in Los Angeles;

- In April 2019, FF received a debt financing, which may have played a prelude to Jia’s personal bankruptcy restructuring in the future;

- In September 2019, FF appointed Bi Fukang as global CEO;

- In May 2020, Jia Yueting achieved debt and FF separation through personal bankruptcy restructuring. However, the cost was to give away his shares to creditors;

- In July 2020, against the background that Jia was no longer the actual controlling shareholder of FF, he published an article titled “Work and Entrepreneurship, Restart Life, Bringing My Apology, Gratitude, and Commitment” and went to a new job position related to the product and user officials;

- About a year later, FF went public in the United States, obtaining a loan of nearly 1 billion US dollars and having its own financing platform.

According to this timeline, it can be seen that Jia Yueting and FF are gradually separating. The actual controlling rights left by Jia at the time of the struggle with Evergrande were eventually given up. Whether it is fate or tactical consideration, it is impossible to draw a conclusion. In theory, now we can discuss the future of FF without Jia Yueting, but his early layout and starting point still let FF carry a distinctive Jia style —

“The strategy is fine, but the tactics are not.”

This summary is excerpted from a fan comment below our article “Capital Still Prefers Tesla“.

There are also several historical information points that can be singled out for criticism:

- Including the nearly 1 billion US dollars in financing obtained after going public, FF has accumulated more than 2.8 billion US dollars in capital injection. This includes the 613 million US dollars in capital that Jia Yueting paid for FF during the time of harvesting leeks at LeTV Net, the 324 million US dollars in financing, and the subsequent 800 million US dollars that Evergrande spent to purchase 32% of FF’s shares, including other unspecified financing.- The comparison can be made that in August 2019, Li Auto completed its C round of financing with a total amount of 1.575 billion US dollars, and currently sells nearly 8,000 units of Li ONE per month; whereas the biggest move made by FF at the product level so far is the debut of FF91 prototype and the live-streamed test drive by Jia Yueting and Bi Fukang on the day of the bell-ringing ceremony.

-

After the IPO, FF’s next move is to fully devote itself to achieving mass production of FF91 as soon as possible. It is said that FF91 has already received pre-orders. The same scenario was staged at the CES Electronics Exhibition in 2017, when Jia Yueting announced that it would be mass-produced and put on the market that year.

-

However, what is more suspenseful than the delayed delivery is the price of FF91. According to the IPO document, FF91 is priced at about 180,000 US dollars, which is equivalent to 1.15 million RMB, positioning and pricing higher than Model S. Against this backdrop, FF claims to have received 60,000 orders, which does not need to be taken too seriously.

-

According to the model of Tesla, NIO (including GWM), and other new forces, the way they play is to establish a system from top to bottom. For example, Model S and Model X add a layer of performance and technology halo to Tesla, but the real volume is Model 3; Similarly, NIO’s sales force is ES6 rather than ES8; luxury products are prepared for a few people, and the market is most sensitive to prices. In fact, the initial price of FF91 doesn’t matter. The key is whether subsequent products can pull the price down to a relatively reasonable level and pave the way for mass production.

-

However, at present, there is no news about FF’s subsequent products. Does FF really want to bet its future on FF91 alone?

-

According to the prospectus, FF is expected to achieve revenue of $504 million in 2022, $4.038 billion in 2023, and $10.555 billion in 2024. This means that FF91 is expected to sell about 3,000 units next year, followed by 22,400 units, then 60,000 units. Last year, the combined delivery volume of Tesla Model S+X was 57,000, and it has been declining year by year. For example, the delivery volume in 2019 was 67,000. In the Tesla system, it is needless to say who the sales force is, and the mission of the S+X tactical fulcrum has also been completed.

-

There are good reasons not to be optimistic about FF’s future, not because of Jia Yueting’s past unreliability, nor because of debt or losses, but because in the strategy of making cars, FF’s tactics and model are not clear.Loss is not fatal to new forces. For example, NIO’s 2020 financial report shows a loss of 5.3 billion yuan for the whole year, but the loss narrowed by nearly half (112.95 billion yuan in 2019). In addition, with the gradual and steady increase in sales, NIO’s gross profit margin turned positive to 11.5%, with a good trend. Based on this, the model can prove to be correct and effective.

The model is exactly what FF lacks. For example, in addition to making cars, NIO has also created a “Fan Base” label, which is the tactic.

Under the strategy of Jia Yueting’s “making cars”, FF seems to have failed to provide a template for the market to refer to, while companies like Li Auto have provided extended-range hybrid routes and WM Motor has adopted steady strategies to face 150,000-yuan fuel vehicles. Although we always like to measure the success or failure of a company with the binary theory of victory and defeat, the bright spots in tactics can always be abstracted to recognize whether it is reliable or not.

The most profound impression Jia’s FF leaves on people is not on the car level, but on Jia Yueting’s personal persistence in the car dream.

Although from the indicators, FF has shown a zero-to-100 km acceleration time of just over two seconds, zero-gravity seats, and some scenes of automatic driving technology, which were attractive in 2017, indicating that Jia Yueting has foresight (but these indicators today lack relevance).

However, in the past four years, Jia Yueting has not given a clear answer on how to make the dream a reality. Instead, his personal label has gradually become heavier – whether it is to pay off debts or to turn over, to prove himself as a hero in the car industry, or to throw off the hat of “cheater” on his head, or as the article we previously published writes, “Jia Yueting: If you cheat, you should cheat to the end”, only Jia Yueting knows.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.