Weekend, I want to spend some time summarizing and analyzing the situation of power batteries in the first half of 2021. It is divided into two parts, the first part (this article) mainly decomposes the overall situation, and the second part tomorrow will count and compare the situation of various suppliers.

Part 1: Overall situation of the power battery industry

1. General data situation

From a macro perspective, the China Automotive Power Battery Innovation Alliance released monthly data on power batteries as follows:

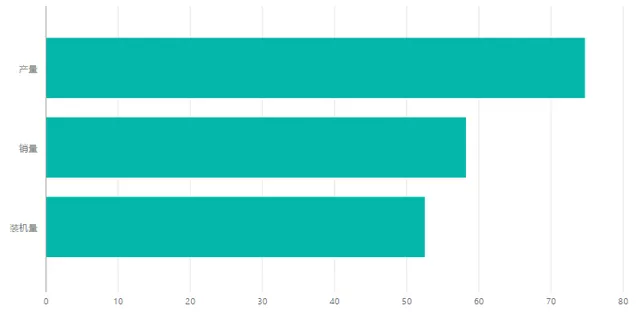

(1) In 2021, the cumulative production of power batteries reached 74.7 GWh, an increase of 217.5% year-on-year. Among them, the cumulative production of ternary batteries was 36.9 GWh, accounting for 49.3% of the total production, an increase of 149.2% year-on-year; the cumulative production of lithium iron phosphate batteries was 37.7 GWh, accounting for 50.5% of the total production, an increase of 334.4% year-on-year.

(2) In 2021, the cumulative sales of power batteries reached 58.2 GWh, an increase of 173.6% year-on-year. Among them, the cumulative sales of ternary batteries were 27.2 GWh, an increase of 115.6% year-on-year; the cumulative sales of lithium iron phosphate batteries were 30.8 GWh, an increase of 260.0% year-on-year.

(3) In 2021, the cumulative installation of power batteries reached 52.5 GWh, an increase of 200.3% year-on-year. Among them, the cumulative installation of ternary batteries was 30.2 GWh, an increase of 139.0% year-on-year, accounting for 57.5% of the total installation; the cumulative installation of lithium iron phosphate batteries was 22.2 GWh, an increase of 368.5% year-on-year, accounting for 42.3% of the total installation.

From this data, the difference between sales and installation is relatively small, and the production is in a rapid growth cycle, which represents that the industry is preparing for the demand in the second half of the year.

2. Battery demand for different uses

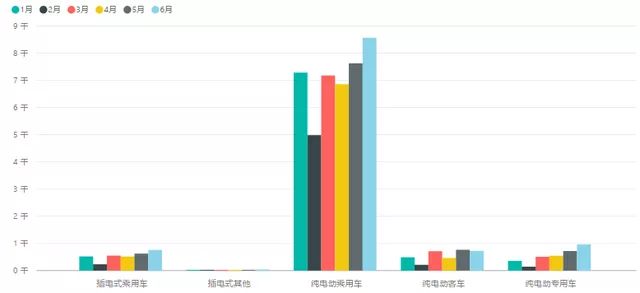

Currently, China’s batteries are mainly used in pure electric vehicles, with a total quantity of 49GWh, accounting for 93.71%; the usage on PHEV is 3.298GWh, accounting for 6.29%.

Among pure electric vehicles, pure electric passenger cars are the largest sub-market, with an installation of 42.485GWh in the first half of 2021, accounting for 81.09%; pure electric buses were 3.37GWh, accounting for 6.43%, which is the second largest sub-market, but not much different from the 3.24GWh of pure electric special vehicles and 3.2GWh of plug-in hybrid passenger cars.From the overall data, the electric vehicle market is showing a trend of explosive growth, mainly represented by the significant increase in demand for electric passenger cars. In relative terms, the demand for electric buses and electric special vehicles is relatively stable.

- Battery demand from different chemical systems

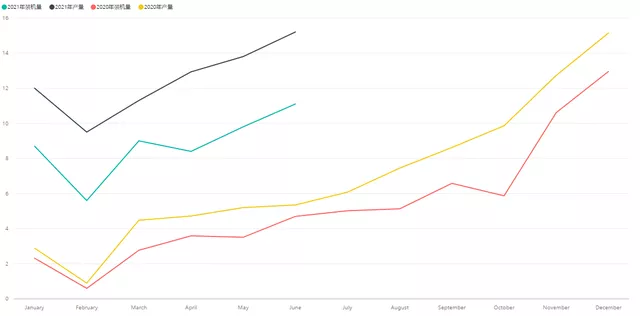

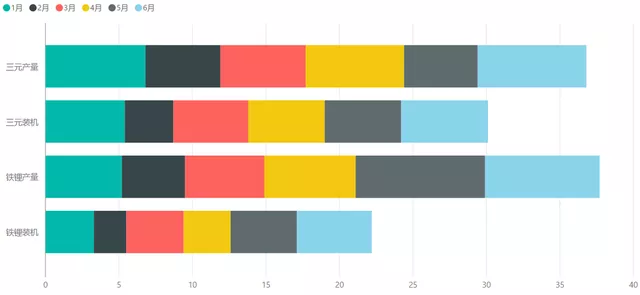

From the perspective of different types of chemical systems, the production of lithium iron phosphate in June was 7.8 GWh, exceeding the 7.4 GWh of ternary batteries for the month; At the same time, the cumulative production of lithium iron phosphate batteries in the first half of the year was 37.7 GWh, which also exceeded the production of ternary batteries of 36.9 GWh. This is a very obvious signal in terms of production.

If we only look at the current vehicle installation data, ternary batteries installed 5.9 GWh in June, which is still higher than the 5.1 GWh of lithium iron phosphate. The current trend is that although the total installed capacity of lithium iron phosphate in the first half of 2021 was 22.2 GWh, which is still behind the 30.2 GWh of ternary batteries, surpassing ternary batteries in vehicle installation is a very certain thing this year.

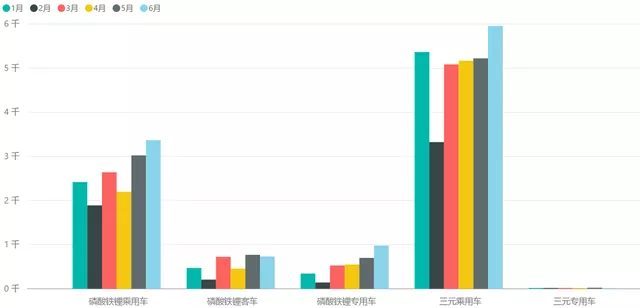

What is going on here? I did a breakdown, as shown in the following figure:

Currently, the cost of ternary batteries is still relatively high, so they are used extensively in passenger cars, with an installation capacity of 30.127 GWh in the first half of the year. Lithium iron phosphate, on the other hand, has gradually begun to break through in passenger cars, with an installation capacity of 15.5 GWh in the first half of the year, and 3.36 GWh and 3.242 GWh installed on buses and special vehicles respectively. From the trend, the installed capacity and penetration of lithium iron phosphate in passenger cars are gradually accelerating.

Summary: In today’s first article, let’s take a look at the production and sales data of batteries and their distribution by different demands. Tomorrow, we will look at battery preferences from different suppliers. From the perspective of different suppliers, there are some interesting and worth-sharing points.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.