Author: The Office

On July 12th, the China Automotive Technology and Research Center released the retail sales data (insured vehicles) for June 2021. Among newly established carmakers, the only mass-produced model under the brand of Li Auto, the 2021 Li ONE, sold 7,827 units, surpassing NIO and XPeng, and ranking first.

However, just a month ago, if you searched for “Li Auto” and “top three” on Baidu, you would find a lot of news about Li Auto losing its position and dropping out of the top three of newly established carmakers in terms of sales.

We are pleased to observe and record the trends of this company behind its sales figures. Earlier, we wrote about “Breaking through 30,000 units: the essence behind the comeback of Li ONE”. Today, we will talk about how Li Auto went from “hitting the bottom” to “climbing to the top” in just one month.

From 4th place to 1st place, and then to 10,000 units per month

In May 2021, Li ONE sold 4,844 units, ranking fourth among newly established carmakers. In June 2021, Li ONE’s sales surged to 7,827 units, ranking first among newly established carmakers. Even taking into account the factors of Li Auto being a publicly listed company in the US, with a focus on quarterly sales, the increase of over 60% is still surprisingly sudden.

There are three reasons behind this. The first reason lies in the new product launch. On May 25th, Li Auto held a spring new product launch conference and officially released the 2021 Li ONE. May thus became a transition period, and it is not surprising that sales declined.

People tend to attribute a complicated result to superficial reasons alone. Behind Li Auto’s sales surge of 7,827 units in June lies the question: is Li Auto’s bottleneck in demand, production capacity, or delivery capability?

According to Classist Channel, demand is clearly not the bottleneck for Li Auto.

This brings us to the second and third reasons behind Li Auto’s climb to the top. First and foremost, it is undeniable that Li ONE’s two core product values, “electric for urban use and fuel for long-distance travel” and “building cars for families”, have gained more consumer recognition and less controversy in the end-consumer market.

English Markdown text:

With further improvements in energy consumption and range, intelligent cockpit and driving assistance, and comfort, the value proposition of the previous version of the Ideal ONE has been significantly amplified, and the sales growth is a natural response to the product-side improvements.

The more important change came from the adjustment of Ideal’s expansion strategy. In February 2020, Ideal’s offline stores covered a total of 60 stores in 47 cities across the country. On February 22, Li Xiang announced in an internal company letter his 2025 strategy: to reach sales of 1.6 million vehicles by 2025 and become China’s top intelligent electric vehicle company.

According to a report from LatePost, Ideal’s offline channel expansion has also been adjusted, with a target of reaching 200 stores during the year. On July 10th, Ideal’s offline retail center exceeded 100 stores. According to the expansion target of 200 stores for the year, Ideal’s channel expansion in the second half of the year will continue to accelerate.

Li Xiang, founder, chairman and CEO of Ideal Motors, shared in “Why am I ramping up the expansion?” at Hupan University that in the same city, the market share with or without Ideal Motors stores differs by 8 times.

Therefore, the replacement of the old and new is more like the background of Ideal’s sales growth, the supporting role, while the product value proposition of the 2021 Ideal ONE and the high-speed expansion of offline channels are the core support for Ideal Motors to rise from NO. 4 to NO. 1, and to the next 10,000 vehicles per month, it is the fighter himself.

User value is more important than corporate desires.

Two months later, let’s talk about the 2021 Ideal ONE again. What can we see through its updates?

Ideal ONE was launched on October 18, 2018, and redesigned on May 25, 2021. From the perspective of traditional car companies, this time period is a typical “mid-term renovation”. What do mid-term renovations change? From the perspective of the input-output ratio of enterprise management, adjusting the styling and interior to stimulate test-drive sales is the most cost-effective business strategy.

The new styling and interior will not generate too much R&D investment but can maximize the impulsive consumption of test drives by consumers. The English term for a car’s “mid-term renovation” is Facelift, which has another meaning of “cosmetic surgery,” which is thought-provoking.

However, if we compare the 2020 and 2021 versions of Ideal ONE, we can see that Ideal’s redesign logic is completely opposite from that of traditional Facelifts:# What’s New in 2021 Ideal ONE?

The biggest change in the overall styling of the car comes from the grille adjustment of the front air intake, but even in this area, unless you are a new audience who cares about the previous model, you can hardly tell the difference; as for the interior, except for the steering wheel shape, there are almost no changes throughout the car.

2021 Ideal ONE updates include:

- Adopting a “three-in-one” rear-drive motor

- The fuel tank capacity has been increased to 55 L, and the NEDC comprehensive range reaches 1080 km.

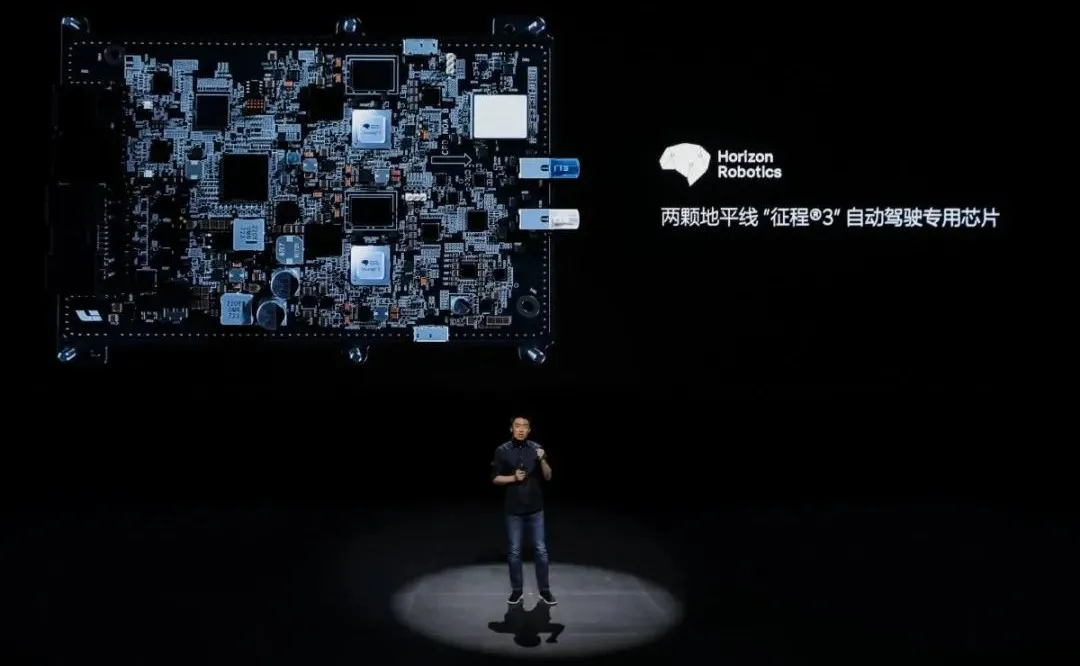

- 8-megapixel camera, Horizon dual journey 3 chip, 5 Bosch fifth-generation millimeter-wave radar, advanced driving assistance system standard NOA.

- Added comfort sponge, electric seats for the front and rear rows with seat massage function.

- The space of the third row has increased by 41 mm.

- Maximum external discharge power of 2200 W.

- Free conversation across sound and lock zones in the entire car.

These key updates appear to have a wide range, involving vehicle energy consumption, endurance, human-computer interaction, assisted driving, and comfortable space experience. Their only commonality is that most updates cannot be experienced by consumers without deep long-term use of the car – at least a simple test drive cannot have a deep perception, such as a larger fuel tank or 2200 W external discharge.

At the same time, whether it is replacing powertrains, assisted driving systems, voice chips, or seat layouts, the investment required far exceeds the “plastic surgery” of traditional revision.

In a sense, this is a revision that makes the experts of Ideal’s products in the front-line sales feel puzzled, which requires a lot of effort but not shortcuts.

So what is the underlying logic of Li Xiang’s revision? After the sales volume of Ideal ONE exceeded 30,000, Li Xiang once posted a Weibo: “We always insist that user value is more important than businesses’ ambition.”

What is the ambition of the enterprise? For a car company, it is to sell cars. Facelift, objectively, can indeed stimulate impulsive consumption for test drives and satisfy companies’ desire to increase sales, but it cannot bring substantive improvement to users’ car experience.

What is user value? The positioning of Ideal ONE is a mid-to-large-sized SUV designed for families, and all of the above updates will be presented in the classic usage scenario of “family long-distance travel,” bringing users a better experience.The choice between these two facelifts is very much like the classic business rule of “doing the difficult and right thing”. The ideal is to resist the temptation of immediate growth and choose a more fundamental and sustainable user value. In fact, in every industry, you can find such companies, but in the highly competitive auto industry where Facelift is everywhere, the 2021 model of the ideal ONE stands out.

From Zero to Top Ten Chinese Luxury Brands

There is another important “update” of the 2021 Ideal ONE that affects sales but has not been mentioned: compared to the old model, the price of the 2021 Ideal ONE has increased to 338,000 yuan.

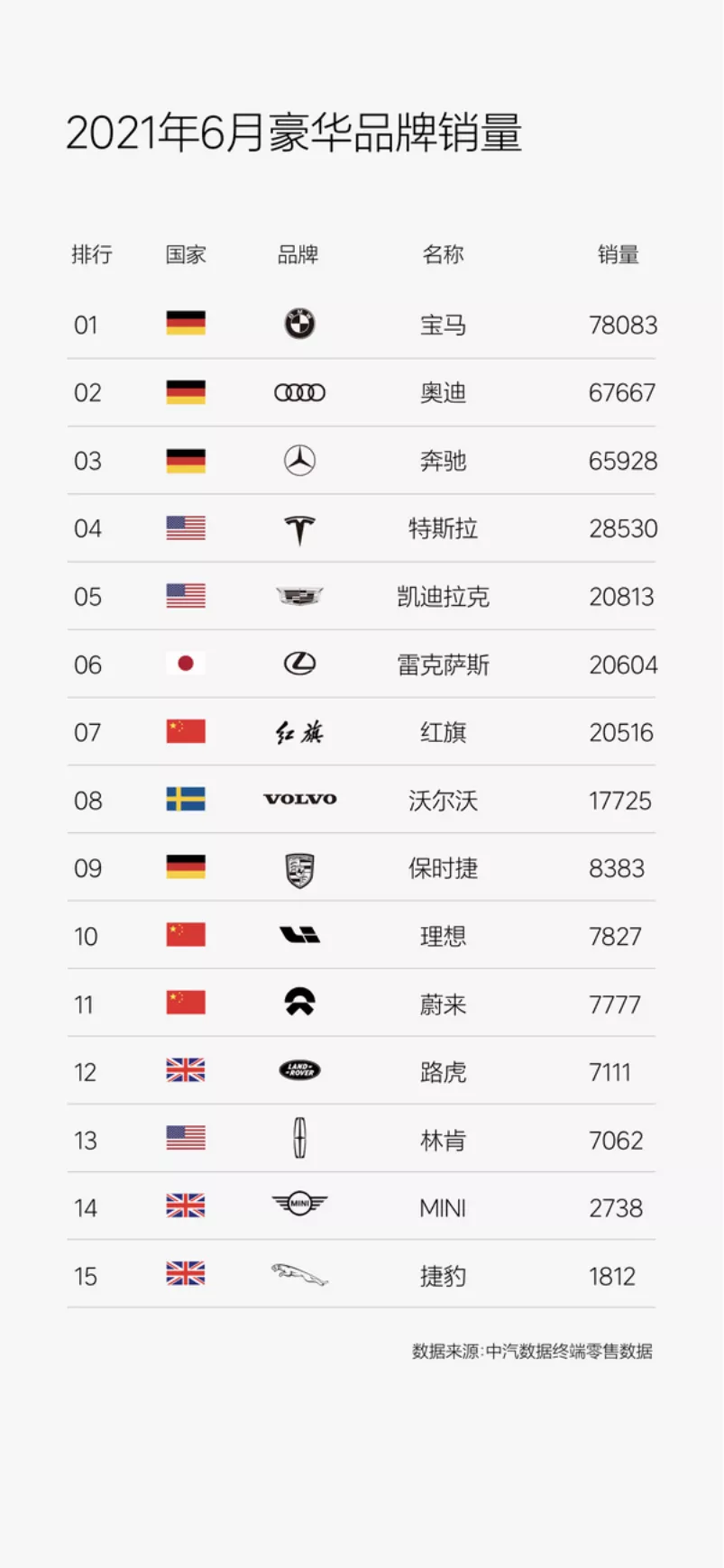

The result of 33.8 million and 7,827 vehicles sold in June has brought Ideal Auto up to the top ten in total sales of luxury brands in China, alongside Mercedes-Benz, BMW, Audi, and Tesla.

From the perspective of transaction price, the average transaction price of 338,000 yuan for the ideal ONE exceeds that of Audi (319,100 yuan), Tesla (310,500 yuan), Cadillac (268,800 yuan), and Volvo (325,900 yuan) in the top ten. It is a Chinese domestic luxury brand verified by consumer votes.

This reminds me of a statement made by Li Xiang before the launch of the Ideal ONE event in October 2018:

No matter what our brand is called, what the logo looks like, or what business I have created in the past, the value of the brand is zero when it first comes out. So our core is to start from scratch.

Consumers’ perception of the brand is made up of three things. First, we solve the problem for the consumer. Second, we provide what kind of products. Third, we fulfill the products with what kind of quality. These three aspects will form our brand after being verified by the market and recognized by users.

Three years later, today, the Ideal ONE has entered the top ten of Chinese luxury brands with an average transaction price of 338,000 yuan, and Li Xiang’s brand building has made initial progress, but he clearly does not intend to stop here.

At the China Electric Vehicle Forum three years later, Li Xiang talked about a new flag- with the development of the Chinese economy and smart electric vehicles, China will give birth to the world’s top car brand in the next 10-15 years.The sales volume of vehicles is the most fundamental and purest standard to evaluate the quality of work of an automaker, whether it is ranked first in new car sales in June or among the top ten luxury auto brands in China. IDEAL is currently at the best position in history. It broke the 10,000 sales mark in September and faces numerous challenges both domestically and from top global auto brands in the distant future, which require IDEAL’s determination and potential.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.