Author: Wang Lingfang

On the afternoon of July 21st, a piece of news broke out in the new energy vehicle industry circle: CATL (Contemporary Amperex Technology Co., Limited) has been sued by CATL for patent infringement, covering all its products.

Patent wars among power battery companies are extremely common, with no shortage of related cases every year.

Last year, CATL sued Tafel NEW Energy, claiming that the latter had violated its patents related to battery explosion-proof technology and other aspects.

The focus in 2019 was the patent dispute between LG Chem and SK Innovation.

Whether the allegations against CATL by CATL are true, it remains to be determined by the court.

Behind the patent dispute, what is often contended are resources and customers; it is a way for enterprises to maintain their own position.

The two sides have their own words

In communication with the media, CATL confirmed the fact that it sued CATL and stated that the case has been accepted. CATL believes that the patents involved in the case cover inventions and utility model patents, and the batteries involved have been installed in tens of thousands of vehicles.

CATL believes that innovation is the driving force for development, and protecting intellectual property rights is essentially protecting innovation. For CATL, intellectual property rights are strategic resources for enterprises to improve their core competitiveness and important support for them to face fierce international competition. For a long time, CATL has attached great importance to the protection of intellectual property, and actively strengthened intellectual property cooperation to promote healthy and orderly development of the industry.

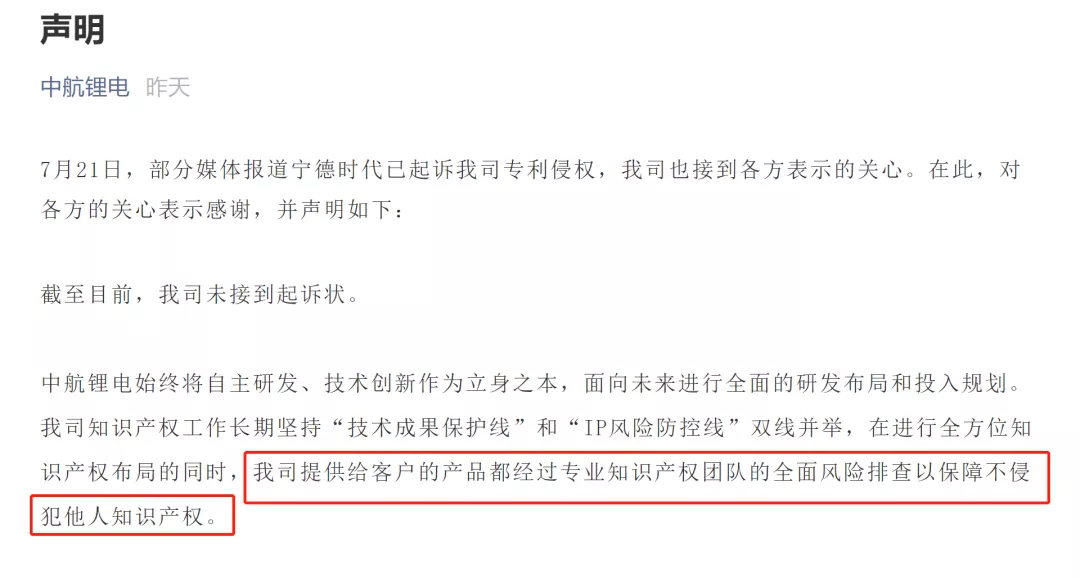

CATL, on the other hand, stated that it has not yet received the lawsuit.

Faced with CATL’s lawsuit, CATL is quite confident. CATL said that it has long adhered to the “protecting technical achievements” and “IP risk prevention” dual lines in intellectual property work. While carrying out comprehensive intellectual property layout, the products provided to customers have undergone full risk investigation by a professional intellectual property team to ensure that they do not infringe on others’ intellectual property rights.

Simply put, CATL believes that its products have undergone intellectual property investigation and do not infringe.

An individual from the CATL said to the EV Observer that the news that CATL sued them has been spreading for 1-2 years, “before they (CATL) may have thought that supply chain blockade was more reliable, but this year we held a partner conference and signed cooperation agreements with some suppliers. They know that this trick won’t work, so they switched to this one.”

The person said that CATL’s patents have been laid out for a long time, and they are not worried about infringing on CATL’s intellectual property. “In fact, it may be a good thing. Their attention to us indicates that we are becoming more and more competitive.”

The patent dispute behind is a customer dispute.The previous highly anticipated patent dispute in the industry belongs to LG Chem suing SK Innovation. In April 2019, LG Chem claimed that SK Innovation was suspected of stealing its trade secrets and sued it to the US International Trade Commission (ITC), accusing SK Innovation of using its former employees to steal its trade secrets.

After several rounds of confrontation, ITC finally ruled that SK Innovation products will be banned in the United States for 10 years.

On the surface, battery companies are pursuing patent infringement, but behind it is often a battle for customers.

The trigger for the patent dispute between LG Chem and SK Innovation was that in 2018, SK Innovation snatched an order worth more than one billion US dollars from LG Chem.

The trigger for CATL’s lawsuit against CALB is highly likely to be GAC Aion’s battery procurement order.

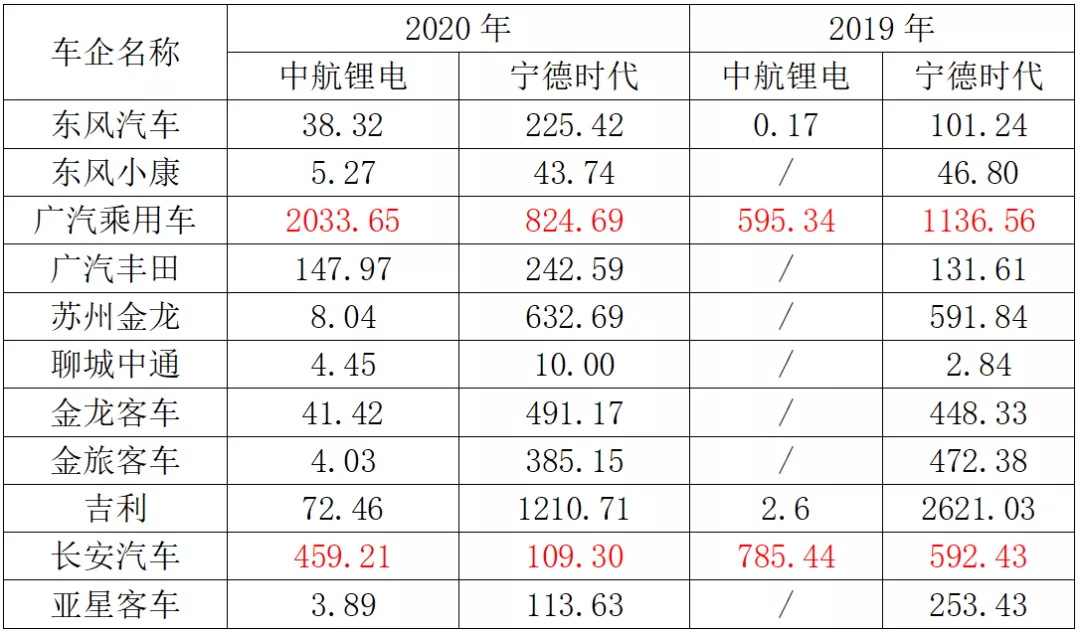

According to “Electric Vehicle Observer”, the two companies’ shared customers in the past two years have undergone significant changes in installation at Changan and GAC (including Aion, the same below).

In 2019, CATL and CALB installed 1.14 GWh and 595MWh in GAC passenger vehicles, respectively, with CATL being nearly twice that of CALB.

In 2020, this situation has reversed, and CALB’s installation volume in GAC passenger vehicles has reached nearly 2.5 times that of CATL.

A similar situation exists in Changan Automobile. In 2019, CALB installed 785.44MWh for Changan Automobile, exceeding CATL’s installation volume by 193MWh. In 2020, this gap widened to nearly 350MWh.

Changes in the shared customer installation between CALB and CATL in the past two years (unit: MWh)

From the perspective of insurance incidents last year, GAC (including Aion) ranked fourth with 63,000 vehicles. In the first half of this year, GAC passenger cars have accumulated 43,000 insurance incidents, especially in the past two months, with more than 10,000 incidents each month.

TOP20 of new energy vehicle companies insured in 2020

At present, GAC passenger cars’ sales volume still has an upward trend, which is a true big customer for battery companies.

In addition, the timing of CATL’s lawsuit is also very interesting, exactly on the eve of CALB’s IPO.According to previous plans, CATL (Contemporary Amperex Technology) plans to apply for an A-share IPO in the first quarter of 2022, and is currently conducting its last round of pre-IPO financing. The investment firm’s data shows that the post-investment valuation for CATL is around 60 billion USD. Based on the calculation of CATL’s production capacity, the estimated valuation after the company goes public in 2025 is expected to reach around 200-300 billion USD.

For reference, the current market value of Guoxuan High-Tech is around 11 billion USD, and Funeng Technology’s market value is around 5.7 billion USD.

It can be seen that CATL, which has not yet been listed, is already competing for customers with established companies. Once it goes public, with the leverage of capital, its growth rate will only be faster. At that time, what it takes away from Contemporary Amperex Technology Co., Limited (CATL) could be more than just Guangzhou Automobile Group and Changan that easily.

Faced with growing competitors, Contemporary Amperex Technology Co., Limited (CATL)’s competitor, Ningde Times, must take preemptive action. After all, one cannot allow others to sleep soundly by one’s bed.

Of course, using legal tools to protect one’s legitimate rights and interests is every company’s right. The fact itself is the basis for all arguments. Whether infringement exists or not, both sides need to show evidence to prove their arguments.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.