This article is reproduced from the Autocarweekly official account.

Author: Financial Street Lao Li

Recently, the industry’s attention to Tesla has decreased, but the capital’s research on Tesla has not relaxed.

Perhaps Tesla consumed too much energy from users, media and the industry in the first half of the year, and its popularity has obviously cooled down in the second half of the year. Even explosive news such as Model Y’s price reduction of 70,000 did not cause a stir. Lao Li believes that there are two reasons for this: first, the media’s willingness to chase the heat has decreased, it is difficult to come up with new things, and it consumes users too much; second, the industry’s friends have become numb, thinking that they have “seen through” Tesla.

Just like stocks rising too much need to be adjusted, everyone has been watching Tesla’s changes during this period, but secondary market researchers have not been idle, and have been observing, learning and researching Tesla. Many researchers believe that: Tesla has only shown half of its strength, and there is still half of its strength to be released gradually next year, and the stock price will rise again.

Today, let’s explore together how Tesla will affect the market after the storm, what actions will Tesla release next year, and how will the capital market view it?

Walk your own way, let others talk

Tesla in the first half of the year was full of “negative news”. First, there was the issue of data security, and then at the Shanghai Auto Show, public opinion on the Internet was overwhelmingly negative, as if Tesla had only problems such as brake problems and autopilot issues. For three months, Tesla China’s official, media, and users staged a “play”.

In this play, most of the audience were eating melons. Lao Li indirectly restores the status of many friends: Tesla China friends were busy handling negative news every day; some media interviewed our researchers every day, and “chased” the heat by looking for problems; industry friends bet in WeChat groups about how much Tesla sales will decline, and the melon-eating index is no less than the current Kris Wu event.

Just as the earth can rotate without anyone, even bad public opinion cannot affect Tesla’s development pace. In the past month, Tesla has been making big moves unintentionally:

- On June 26th, Tesla recalled a total of approximately 286,000 domestic models including domestically produced Model 3/Y and imported Model 3 to resolve the issue of sudden acceleration caused by driver’s accidental touching of the ACC switch in some scenarios. That is to say, Tesla admitted to brake problems. In fact, Tesla’s cars only have one problem, which is brake problems.

! ## Tesla Model Y Standard Range Released with 525 km Range

On July 8th, Tesla released the Model Y Standard Range version which features a lithium iron phosphate battery with a 525 km range, and a 0 to 100 km/h acceleration of 5.6 seconds. The post-subsidy price is only 276,000 yuan ($42,464), with deliveries expected to begin in August.

Tesla’s First Integrated Solar Power and Energy Storage Charging Station in East China

On July 17th Tesla established its first integrated solar power and energy storage charging station in East China’s Baoshan District. Tesla has already promoted the solar power and energy storage charging station in large numbers in the United States, and this move indicates that Tesla’s efforts in the smart energy field in China is underway.

Tesla’s Improving Sales in China

Recently, a friend told me that Tesla is very smart and has a strong ability to learn. After experiencing three months of turmoil, they understood that their ability to establish government relations was poor and they started recruiting government relations talent. They also hired various methods to improve their public relations.

Now, Tesla has also learned the Chinese concept of “hidden and gain much”: while everyone thinks that Tesla’s sales have decreased, the company’s sales have actually rebounded in May and June. If it wasn’t for the strong performance of the Hongguang MINI EV, Tesla would have regained its position as the top-selling new energy vehicle.

According to official data released by Tesla China, their total sales in June were 33,155 units, with a total of 162,000 units sold in the first half of the year, accounting for 41.9% of the global market share. China remains Tesla’s most important market.

Many believe that the reason for Tesla’s sales rebound was due to the Model Y price reduction, but some analysts believe that the sales increase was mainly due to the strong market for new energy vehicles, coupled with Tesla’s preferential loans and full pre-payment discounts.

Although many analysts believe that Tesla does not lack orders, and their production capacity will determine their sales volume, as long as there are no problems with the supply chain of the Shanghai factory, the production capacity is there, and monthly sales of 50,000 units is only a matter of time. Therefore, many analysts believe that Tesla can achieve monthly sales of 50,000 units in Q3 this year, but our company’s opinion is relatively cautious about this goal.

In conclusion, what everyone cares most about is how much further Tesla’s prices will drop.## Translation

Old Li and many researchers and industry experts have discussed this issue, and the conclusion is that the Model 3 will likely drop to RMB 210,000-220,000 this year, and the Model Y can go down to RMB 250,000-260,000. After the 8000-ton die-casting machine, 4680 battery, and self-developed electronic control system are widely used, the cost of Model 3 will further decrease, and a relatively reasonable price can be calculated. Based on the rule that the price of the same Model Y is 10% higher than that of Model 3, the price of Model Y can be calculated.

It should be noted that these two prices only represent the lowest prices for this year, not the future minimum, which may be lower.

Buying a Tesla Car or Stock?

Some friends may ask, at such a low price, is it still Tesla? This is a good question. To put it deeper, what is the positioning of the Tesla brand?

This question has reached a consensus among the industry and capital, which is one of the few consensuses about Tesla: everyone believes that the main product positioning of Tesla cars is mass-market Toyota, which means that this is a high-volume brand. From the current pricing system, as long as Model 3 and Model Y drop a little further, they will enter the range of 200,000 yuan or less.

Here, Old Li wants to mention the “7-layer pyramid” theory in the automotive industry, which was proposed by a senior industry expert. He believes that the global automotive industry can be divided into a 7-layer pyramid according to the brand and price, and Tesla’s strategy is to gradually penetrate from high to low:

Establish the top-level (7th) image through sports cars, then penetrate the ultra-luxury level (6th) represented by Porsche through Model S/X, and then penetrate the luxury level (5th) represented by BBA through Model 3/Y, and finally establish a foothold in the mass-market level (4th) represented by Volkswagen and Toyota.

Everyone has always thought that the main competitor of Model Y’s electric vehicle is NIO ES6 (starting at 358,000 yuan), and the gasoline vehicle competitor is SUVs of BBA. After this round of price cuts for Model Y, it has officially declared war on Volkswagen ID.4. It is believed that XPeng will also face pressure in the near future.

That is to say, in the future, both joint venture brands and high-end independent brands in China will be widely impacted by Tesla, but the reality seems to be that everyone is still immersed in the Tesla storm and cannot extricate themselves.Why Can Tesla Achieve Layer-by-Layer Penetration So Quickly? Some people summarize that it’s because Tesla started from scratch and has a high degree of innovation. Some people summarize that it’s because Musk uses first-principles thinking well and does things steadily and resolutely. Old Li believes that these are all deep-seated reasons behind it, and the most intuitive reason is technology.

After the three-element lithium wave, Tesla became the fastest company to promote lithium iron phosphate batteries to the consumer market, and the most responsive Chinese brand is BYD. In terms of supply chain management, Tesla’s localization rate is high and cost control is low, thanks to the Chinese. On the one hand, it is because the supply chain is in China, and on the other hand, it is because the Tesla supply chain is mainly managed by Chinese people.

Tesla uses lithium iron phosphate batteries to compete with other companies’ three-element lithium battery products, coupled with its brand effect, it has formed a very good dislocation strategy. Although other companies are also exploring low-cost solutions such as lithium iron phosphate batteries, the speed is too slow. When related products come out, Tesla will once again take the lead with new models or new technologies.

Musk’s approach is the favorite of the capital market. The capital market talks about expectations. Which enterprise has the highest expectations? Enterprises that dare to innovate, and Tesla is such an enterprise.

From 2019 to now, Tesla’s stock has been on the rise, and it is currently in a volatile adjustment. Some researchers believe that the adjustment is one quarter, while others believe it is two quarters, depending on market liquidity and industry outlook. Both aspects of the current US stock market’s performance have great uncertainty, and Tesla’s stock price adjustment is actually the best state.

Adjustment is to better move forward, and Tesla will definitely pull out a second growth curve. Old Li believes that the driving force behind the second growth curve is not autonomous driving, but intelligent energy. Many people say that if it were not for carbon neutrality, the concept of intelligent energy might not be so hot. The capital market seeks to follow the trend. Regardless of the progress of the commercialization of intelligent energy, as long as the concept of carbon neutrality exists, the capital market will continue to push it.

That’s why pessimists are often right and optimists are often successful.

Intelligent Energy Company + Big Data Company + Electric Vehicle Company

What is Tesla’s valuation code? It is “Electric Vehicle Company + Big Data Company + Intelligent Energy Company”. The electric vehicle company corresponds to the electric vehicle product, the big data company corresponds to the autonomous driving technology, and the intelligent energy company corresponds to photovoltaic integration. From the current market performance, Tesla has achieved the goal of the electric vehicle company + big data company, and the capital market has also made corresponding valuations for it.# Future Growth of Tesla Relies on Intelligent Energy

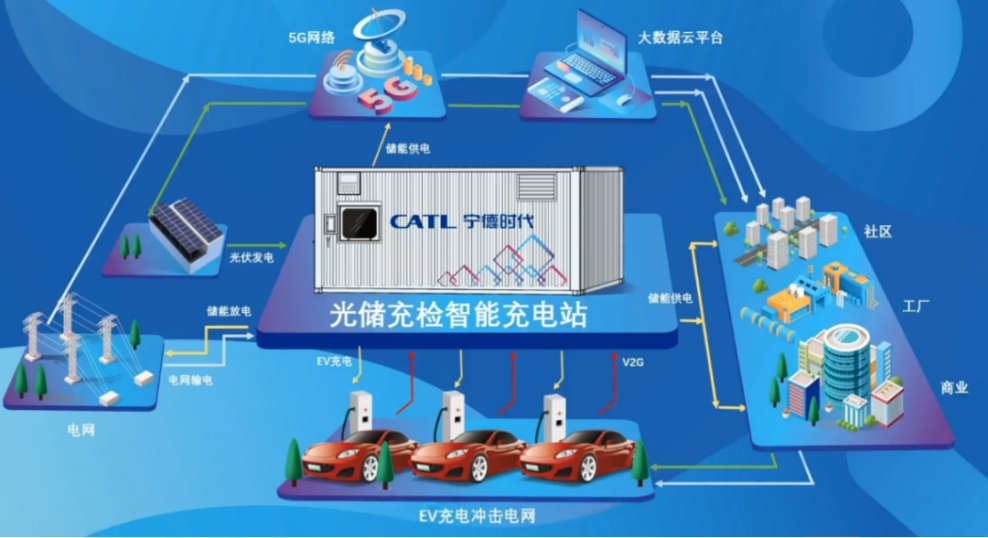

Tesla’s growth curve is being powered by intelligent energy, which is a broad concept that focuses on integrating solar power generation, energy storage and charging. Domestic enterprises in China’s photovoltaic and energy storage fields are also developing these capabilities. The most well-known of these is Ningde Times’ photovoltaic energy storage and charging integration technology. At present, photovoltaic energy storage and charging integration is like new energy vehicles 10 years ago. The direction is not the problem, the problem is who can be the first to do it. Tesla is likely to be the first one to achieve this.

On July 17th, Tesla landed the first solar power and storage integration supercharging station in East China’s Baoshan District, Shanghai Wisdom Bay Science and Technology Innovation Park with little media attention. A month ago, China’s first Tesla solar power and storage integration supercharging station was completed in Lhasa but also received little attention.

As the name suggests, solar power and storage integration supercharging incorporates a solar power roof system that stores electricity in Powerwall batteries, which can then be used to charge some of the pure electric vehicles for daily use. The solar panels, Powerwall storage batteries and charging piles are linked to form a “use, store, reuse” clean energy circular ecosystem, which is not reliant on city power grids and can provide power, storage and charging without any cost. From a commercialization perspective, everyone can install this microgrid system in their home for personal electricity use, whether or not they own a Tesla. Tesla has thus become an intelligent energy company.

Undoubtedly, this product has high technological barriers. The core of solar power and storage integration is the battery and inverter, which not only need to ensure high photoelectric conversion efficiency, but also quick discharge. Domestic automakers cannot develop this product, although Ningde Times and some photovoltaic enterprises have started to establish their own positions. It is also said that Huawei will enter this field. The stronger the competition, the higher the barriers, the better the market prospects.

The capital market is very optimistic about Tesla’s solar power and storage integration products for two reasons:# The Trend and Ecological Advantages of Tesla

First, the trend is clear. Musk was not the first person to invent electric cars, nor was China the first to develop photovoltaics, but Musk’s execution made it happen. The creativity of one person and the execution of one country will completely change the world. Musk has vowed to fundamentally change the way the world uses energy, and countries around the world are vigorously promoting carbon peaking and carbon neutrality. At this juncture, Musk is the easiest person to accomplish this.

Second, there are ecological advantages. CATL has batteries, so it wants to lay out, and Huawei wants to develop intelligent power, and it also wants to lay out. Tesla not only has batteries but also supercharging stations, tens of thousands of vehicle terminals, and real-time monitoring of energy operation data. From this perspective, Tesla’s advantage is obvious.

Musk once said in an essay: “Physics tends to electric transportation, batteries are used for fixed energy storage, and solar/wind power is used for power generation.” This may be the origin of Tesla’s ability to become a “electric car company + intelligent energy company + big data company”.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.