I want to write about Tesla’s sales breakdown in the last quarter, especially tracking changes in volume in California, which has a certain leading indicator. The pioneer representative of 800V, Ioniq 5, has surpassed 8,000 units in global sales, representing the forming force of the product development focusing on fast charging. As Tesla also iterates Super Charging V4 to 300kW, the next generation powertrain based on 800V is beginning to show its potential.

Tesla’s Sales in California

I have been tracking Tesla’s quantity in California based on “California Auto Outlook” and refer to registration data from Cross-Sell for Q2.

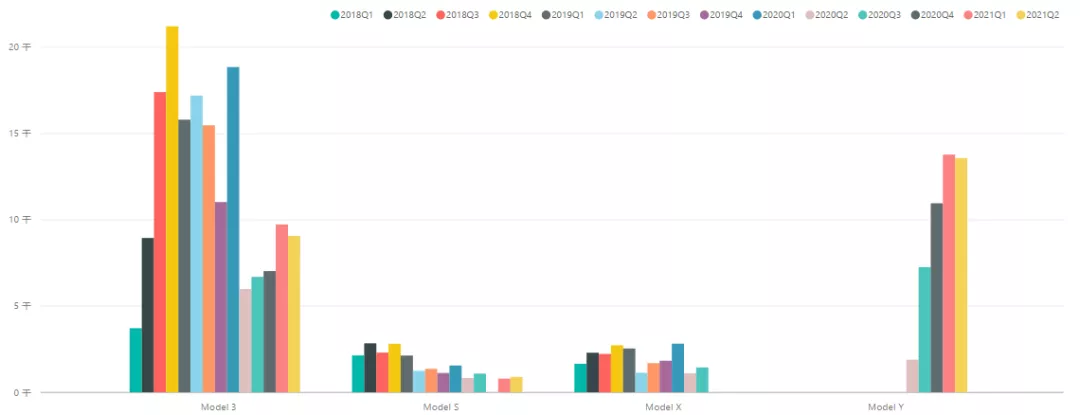

The data for Model 3 in Q1 was 9731 units, and in Q2 it was 8075 units, accumulating to 18806 units.

The data for Model Y in Q1 was 13786 units, and in Q2 it was 13581 units, accumulating to 27367 units.

From the data, Tesla prioritizes Model Y in a limited battery production capacity. From the overall trend, the steady-state data for Model 3 in California may be around 9,000 units, and Model Y may have another wave, potentially reaching up to 15,000 units. Tesla’s sales in California are estimated to be around 48,000 units.

Note: The highest single-car volume of Model 3 was previously maintained at around 16,000-20,000 units, and now two cars combined are approximately 22,000 units.

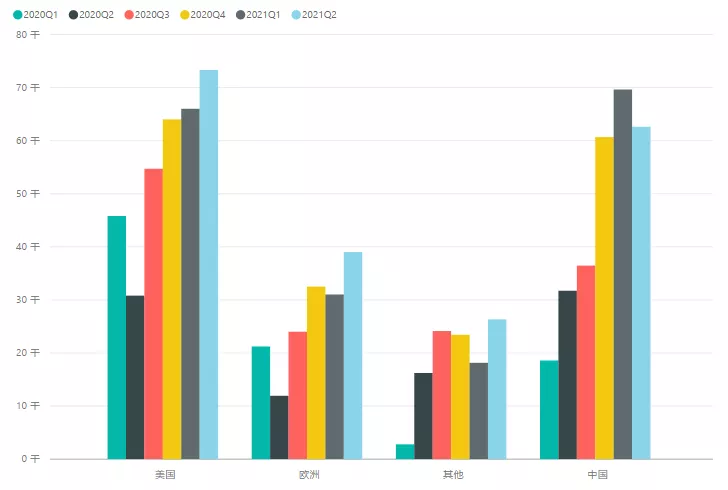

From a global market perspective, for Tesla, China has already grown into a market comparable to the United States. The next step is to increase their strategy for Europe and other regions, with the Model Y delivery beginning from Q3 being the task.

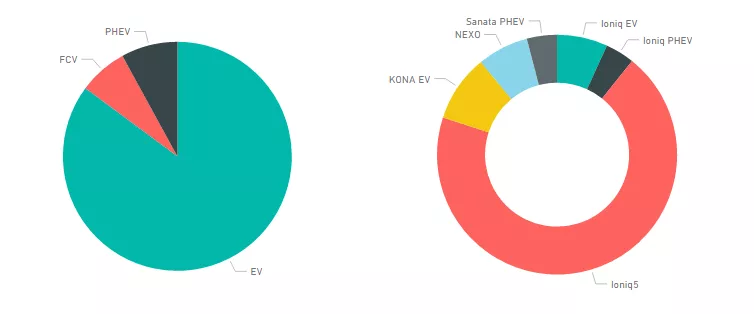

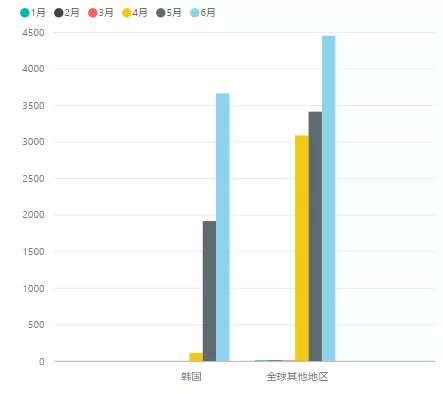

Ioniq’s salesTracking the sales of new energy vehicles in the automotive industry is mainly about monitoring the volume of Ioniq 5. In June, Hyundai’s new energy sales reached 10,912 units, with the most important feature being the plug-in hybrid electric vehicles (PHEVs), which accounted for only 934 units, equivalent to the 808 fuel cell vehicles, while pure electric vehicles (BEVs) accounted for 9978 units. Looking at the monthly sales, Ioniq 5 sold 8122 units in June, accumulating to 16676 units in 2021, surpassing KONA EV’s 1057 units sold in a single month and 13362 units sold cumulatively. In fact, this number was achieved within 3 months. What I want to say is that Hyundai’s transformation in the new energy vehicle market has been very successful, transitioning from the previous PHEVs to BEVs and from the oil-to-electric platform of Kona EV to Ioniq 5’s pure electric platform.

In other words, among a bunch of 400V electric vehicles, Ioniq 5’s 800V has to some extent allowed Hyundai to get rid of the negative effects of the Kona EV recall. The overall design positioning of the product, combined with fast charging support, allows Hyundai’s Ioniq to quickly reach a monthly sales volume of nearly 10,000 units. This data is still very impressive, achieved in only 3 months.

Faced with these changes, Tesla has further increased its charging power from 250kW to 300kW, which objectively reflects the global trend of fast charging.

In summary, I personally think that PHEVs are not impossible products, but instead require a focus on the polishing of BEV products. Currently, the competition in the BEV market is really intense. Focusing too much on PHEV volume may distract management’s attention. The most important observation at the moment is still who can stand their ground in the field of pure electric vehicles, where Tesla’s product strength continues to improve.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.