AVP: Autonomous Valet Parking

Our friends who are familiar with us know that once this type of title appears, there’s a high probability that we’re going to create some messy content.

But don’t worry, we don’t have any plans to transform into a men’s lifestyle media.

Today, let’s talk about AVP (Autonomous Valet Parking) technology.

As a specific scenario of Level 4 autonomous driving at low speeds (not exceeding 10km/h), AVP hasn’t been in the public eye for a long time. But we believe that autonomous parking will be more popular than Level 4 autonomous driving on the road.

Last month, Mr.Yu was invited to attend the signing ceremony of a strategic cooperation agreement between Continental AG, a German centenarian brand, and China’s intelligent driving algorithm company CalmCar. This five-year-old Chinese supplier has secured $150 million in Series C financing led by Continental AG.

The AVP autonomous valet parking technology developed by the two sides can provide an economic and efficient solution without relying on parking lot infrastructure reconstruction or pre-made high-precision parking lot maps.

From the video shown by the organizers, vehicles equipped with this technology can autonomously choose a parking space to park in after entering the parking lot. The entire automatic parking process is almost at the level of experienced human drivers.

At that moment, Mr.Yu suddenly felt that one of the most sexy moments for men, as often highlighted in their teenage years, was when men turn their necks to look back while skillfully backing up and parking with one hand loosely “gripping” the steering wheel.

However, it seems that men are about to lose the privilege of enjoying this sexy moment.

These are popular jokes from the era of Internet songs, nowadays female drivers’ driving experience and skills are not inferior to male drivers.

Back to the topic. In 2015, Daimler cooperated with Bosch to develop AVP system for its car-sharing project Car2Go. Top companies such as BMW have also launched their own experimental solutions for semi-automatic/automatic parking.

There are currently three known routes for AVP technology: vehicle side, venue side, and cloud side of the arena.- Vehicle-end: The vehicle is equipped with production-ready vehicle-end sensors, and optimized algorithms for parking scenarios are implemented on chip-level for path planning and obstacle recognition. The AVP solution co-developed by ZF and Hikvision mentioned earlier belongs to the vehicle-end category.

-

Parking-lot-end: By installing perception and acquisition devices such as cameras and single-line lidars in the parking lot, interaction with the vehicle is established, and the guidance information is transmitted by the parking-lot end to guide the vehicle to complete the parking action. For example, the Parking-lot-end AVP solution demonstrated by Bosch and Daimler in China uses an industrial-grade single-line lidar installed as a pillar.

-

Cloud-end of the parking lot: With the combined sensor data from the vehicle-end and parking requests uploaded simultaneously, the cloud-end responds with parking route solutions and completes the parking action. This solution is more like a combination of the first two.

Certainly, as the two sides of a coin, each solution also has its own pros and cons:

Apart from the daily commuting that takes only two points and one line, we also need to face many scenarios of parking in public parking lots. Searching for parking spaces in narrow parking lots, avoiding obstacles, backing up, etc. According to the survey data from Sina Auto, 77.04% of users believe that parking problems affect their way of travel.

This is not an exaggeration. Take Mr. Yu himself, for example. The tight supply of public parking spaces in his residential area has already greatly affected Mr. Yu’s time for weekend activities. Even if he returns home before dark, he will still face the dilemma of not being able to park smoothly in his community after driving around for a while.

Currently, there are 400,000 paid parking lots in China, and still about 50 million parking spaces are missing, with a utilization rate of less than half. Currently, Chinese people spend about 30 minutes a day on parking behavior.

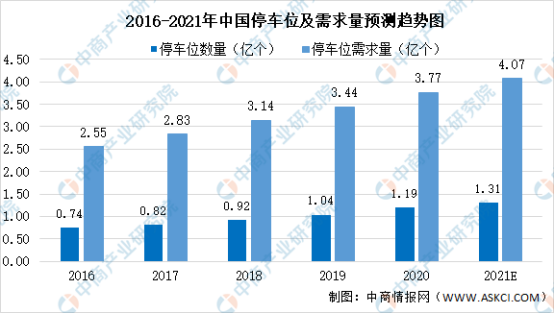

Overall, the construction speed of parking facilities in China lags far behind the growth rate of automobile ownership, leading to a huge gap in parking supply. The data shows that the number of parking spaces in China in 2020 was only 119 million, while the demand was as high as 377 million.

We believe you are also included in this figure.

In addition to building more public parking lots and strengthening parking selectivity, improving the efficiency of public parking lot operation has also been included in the solution.

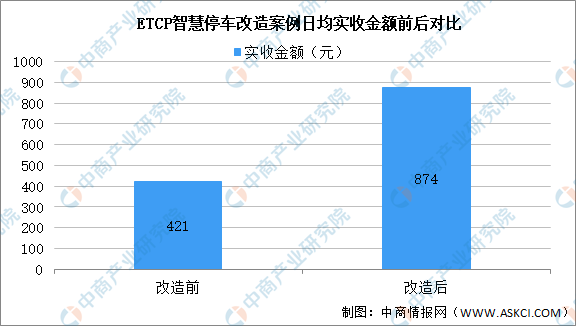

How many car owners have not experienced the annoyance of being blocked by the car in front while queuing to pay in the underground parking lot of a shopping mall or office building before the large-scale deployment of ETCP?According to data from CBNdata and CCID Consulting, after adopting the ETCP smart parking solution in a rundown neighborhood in Beijing, the electronic payment rate for parking increased from 0% to 8%, the turnover rate increased from 0.39 to 0.43, and the parking lot generated an additional income of about 450 yuan per day on average, with a 33% decrease in parking lot personnel.

This is a simple yet practical example, and ETCP is just one part of improving parking efficiency.

Not only car owners without parking space are in a hurry, but the industry also has its own difficulties.

After experiencing a downturn in the industry in 2019, the autonomous driving industry only regained some momentum in the first half of 2021. In addition to the “topping the rights” incident at the Shanghai Auto Show in April, manufacturers have also claimed to have the technical conditions for landing L4 autonomous driving, which has also released a signal of collective anxiety to some extent.

No matter how strong the reserves are and how advanced the technology is, it is useless if it cannot be put into practical use beyond demos and booths. Both in the field of automobiles and artificial intelligence, the investment in research and development and manufacturing is far beyond what ordinary people can imagine. The ability to achieve self-sustaining hematopoietic function as soon as possible is the right path.

If even the industry giants are struggling, it is harder for those start-up companies that hold both the technology and the solutions.

Compared with the comprehensive implementation of L4 autonomous driving on the road, which requires controlled costs and mass production, AVP solutions have advantages in limited area and low-speed scenarios in terms of technology, business, and policy support.

Companies that focus on AVP technology also have their own reasons.

In an open environment, L4 level automated driving faces various challenges in external environment and speed requirements. AVP solutions have some advantages in application scenarios:

-

External environment: The lighting environment in places such as office buildings and large commercial parking lots is relatively stable, which is much more “friendly” than the weather changes that often happen in open environments such as highways and city roads.

-

Speed: The low-speed scenario in a closed space requires less braking distance for automated driving vehicles.

The founder of Chinese autonomous driving technology supplier ZongMu Technology, Tang Rui, believes that the fundamental reason AVP can be deployed faster is that “the laws and regulations are simpler, and the willingness of car manufacturers to produce orders on a large scale will be stronger.”

The founder of Chinese autonomous driving technology supplier ZongMu Technology, Tang Rui, believes that the fundamental reason AVP can be deployed faster is that “the laws and regulations are simpler, and the willingness of car manufacturers to produce orders on a large scale will be stronger.”

AVP manufacturers can generate revenue in a relatively short period of time and have certain self-replication capabilities.

As for the self-parking we are discussing today, after the user getting off the car, the vehicle automatically completes the search for parking spaces and parking; when picking up the car, the user can call the vehicle through a mobile phone or other smart wearable devices, and the vehicle will automatically start and drive out of the parking space to pick up the user.

Just as the popularity of ride-hailing services has to a certain extent prospered the nightlife market in cities, rather than seeing AVP as a technological category, we would rather view it as a service and experience – a service that solves the dilemma of not finding a parking space, or the situation where the car cannot find you. In the closed loop of parking-driving-parking, self-parking will become an important component of the complete autonomous driving experience.

The industry generally believes that self-parking will be the earliest deployed L4 level autonomous driving scenario, and we also share this view.

Apart from the high intelligent threshold and the reliability yet to be verified of the single car smart parking, and the high investment and slow popularity of the end-side solution, there are still some difficult problems that need to be solved for self-parking:

-

Many communities, especially old ones, are resistant and reject the installation of new energy charging piles. During the time when shared bicycles were prevalent, many communities posted signs that prohibited shared bicycles from entering. Apart from the cost factor, can public parking lots accept the entrance of self-parking, badged area solutions from a management perspective?

-

As everyone knows, indoor, especially underground public parking spaces, tend to have a more complex environment, with dim lighting, narrow space, many corners, unclear markings, and so on. In addition, it is difficult to avoid sudden ‘turning a corner and meeting love’ during the process of self-parking due to the difficulty of environmental perception, differences in behavior logic between AVP vehicles, drivers and non-drivers. Can the current level of technology maximally avoid such situations?

-

The last is something we are least willing to see, but something that everyone must face. If there are collisions, scratches or crushing accidents during the self-parking or pick-up process, who is responsible? The driver who is not in the car, the vehicle manufacturer, the technology provider or the venue owner? From the perspective of law and technological ethics, is it possible to establish a set of rules to solve such problems?

As of now, we believe that the car park cloud is the most likely solution to solve the safety problem.

On the one hand, the fusion sensor matrix on the car side provides the hardware basis, optimized algorithms for low-speed parking scenes, and redundant systems and functional safety requirements to ensure the effect of automated parking actions such as point-to-point autonomous driving and parking spot scanning. The car intelligence system can recognize dynamic obstacles such as vehicles and pedestrians and realize automatic braking and evasive decision-making to ensure everyone’s safety.

On the one hand, the fusion sensor matrix on the car side provides the hardware basis, optimized algorithms for low-speed parking scenes, and redundant systems and functional safety requirements to ensure the effect of automated parking actions such as point-to-point autonomous driving and parking spot scanning. The car intelligence system can recognize dynamic obstacles such as vehicles and pedestrians and realize automatic braking and evasive decision-making to ensure everyone’s safety.

On the other hand, the intelligent field relies on real-time detection data provided by parking area sensing devices such as cameras, lidar, and weight sensors to provide real-time safety assistance decisions for the car’s automatic parking actions and realize dynamic scheduling and allocation of parking spots for AVP vehicles.

As for the ultimate beneficiaries of AVP technology, car owners and drivers, whether they are willing to spend money on this attractive service is still uncertain.

It may be more like a “skill” than a service.

For upstream companies, becoming a pure sales technology/solution role may no longer be possible. Alternatively, following the model of paying for copyright fees based on the number of song requests in Japanese KTVs, they can charge for the number of times AVP services are called upon.

Oh, by the way, we cannot forget the role of property management in the profit model since the venue still belongs to them.

Final Words

According to statistics from the Traffic Management Bureau of the Ministry of Public Security, the number of new energy vehicles owned in China has reached 6.03 million. In the first half of 2021, 1.103 million new energy vehicles were newly registered and recorded, an increase of 774,000 from the same period last year, with a growth rate of 234.92%.

The overall growth rate is undoubtedly rapid.

China has become the world’s largest new energy vehicle market, and we believe that companies such as Baidu, WM Motor, Continental, and Hikvision still have plenty of room for development in the field of autonomous parking.

It seems that there is not much time left for men to show themselves off anymore.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.