On July 9th, Volkswagen officially announced that the CEO of the Volkswagen Group, Herbert Diess, will extend his term until October 2025. This means that Diess has won the final victory in the power struggle with his “nemesis,” Bernd Osterloh, the chairman of the labor council.

In fact, with the support of Hans Dieter Pötsch, the chairman of the Volkswagen supervisory board, and the implicit approval of Ultimate Boss Porsche and the Piëch family, Diess’s victory was already a foregone conclusion.

Not only did Volkswagen announce Diess’s extended term on July 9th, but the Group’s 2030 strategy, called “NEWAUTO,” will also be announced on the 13th.

“Court Intrigue”-the Main Theme of Volkswagen’s Transformation

It is not easy for Diess to achieve his current position. Just last year, he almost lost his position at Volkswagen. Therefore, let’s take a look back at the “court intrigue” among the Volkswagen leadership.

To understand the background, let’s go back to 2015. At that time, Herbert Diess, who was in charge of product development, lost the CEO position at BMW because he was considered too old. Meanwhile, Ferdinand Karl Piëch, the founder of Porsche and Diess’s distant relative, was planning for his succession, trying to find a regent for this huge and bloated empire. Therefore, Piëch invited Diess to come and serve as the CEO of the Volkswagen brand, which was the beginning of Diess’s “relationship” with Volkswagen.

Although at that time, Elon Musk also invited Diess to take the position of Tesla’s CEO, Diess chose Volkswagen eventually. Perhaps it was because the United States was too far from home, or maybe Diess likes challenges and wants to take on difficult tasks.

With the “early termination” of Matthias Müller’s term as Volkswagen Group CEO, Diess finally took full control of this nearly century-old giant. In order to implement the electrification transformation strategy in this complex “empire,” Diess increased some previously non-existent functional departments to implement policies and balance traditional departments, and also introduced his former colleagues from BMW or hired external employees for blood transfusions.

While the automotive industry is undergoing a transition, the contradiction between the “reformist” led by Diess and the conservative forces represented by the labor committee chairman Bernd Osterloh is becoming increasingly sharp.

While the automotive industry is undergoing a transition, the contradiction between the “reformist” led by Diess and the conservative forces represented by the labor committee chairman Bernd Osterloh is becoming increasingly sharp.

In the German corporate governance system, labor representatives occupy half of the seats on the supervisory board, and this “bigwig” who has been the VW union chairman and a member of the VW supervisory board since 2005, has led more than 600,000 employees for 16 years, and has a hard background and temperament.

In the first round, Diess suffered a crushing defeat on June 4, 2020, at the VW executive meeting, where the heated debate between Diess and Osterloh was over the speed and coverage of cost-cutting plans. The root of the disagreement was that the union did not agree with Diess’s layoff plan in order to safeguard the income and employment of current workers. During the meeting, Diess also accused supervisory board members of illegally leaking the refusal to grant Diess an extension by violating the confidentiality agreement. This was because Osterloh “resolutely” voted against Diess’s early renewal request.

A few days later, Diess apologized to the entire supervisory board and posted an apology message on the official website. It is noteworthy how rare and embarrassing it is for a group CEO to publicly announce his apology on the official website. Diess, who knew the situation, “softened up”, causing many domestic and foreign media to exclaim that he was a “pill” and VW was a “pill”.

However, in a statement jointly signed by Wolfgang Porsche and Hans Michel Piech from Automotive News Europe shortly thereafter, they stated that Diess and his executive team were “critical” and they “had complete confidence” in them.

Under the mediation of the two families, Porsche and Piech, Diess was able to remain as CEO of the VW Group but lost the position of CEO of the Volkswagen brand. However, in this round, the labor committee chairman Osterloh prevailed.

In the second round, Diess won back. Actually, as the most direct stakeholders, the two families expect VW to have long-term profitability, so they support the electrification transformation and Diess.

The turning point of the second round appeared in March this year, when Diess and Osterloh seemed to have reached a consensus to achieve layoffs through early retirement. Although VW did not want to disclose the significant cost of the layoffs, the foreign media speculated that the cost of the layoffs this time may be close to 500 million euros!On April 23rd, good news came again. Volkswagen officially announced that Austriolo will become the personnel director of Traton department from May 1st, which means that Austriolo withdraws from the power core of Volkswagen Supervisory Board. At this point, in the second round, Diess won and won thoroughly.

Austriolo’s successor is his former deputy Daniela Cavallo, although Cavallo agrees with Diess’s reforms, her job is to maintain the interests of existing workers, so Diess promised not to lay off existing workers before 2029 to gain the support of the new labor committee chairman for the reform.

Then Diess successfully extended his term and outlined the development path of the giant player Volkswagen for the next 10 years on July 13.

Volkswagen’s vision for future mobility

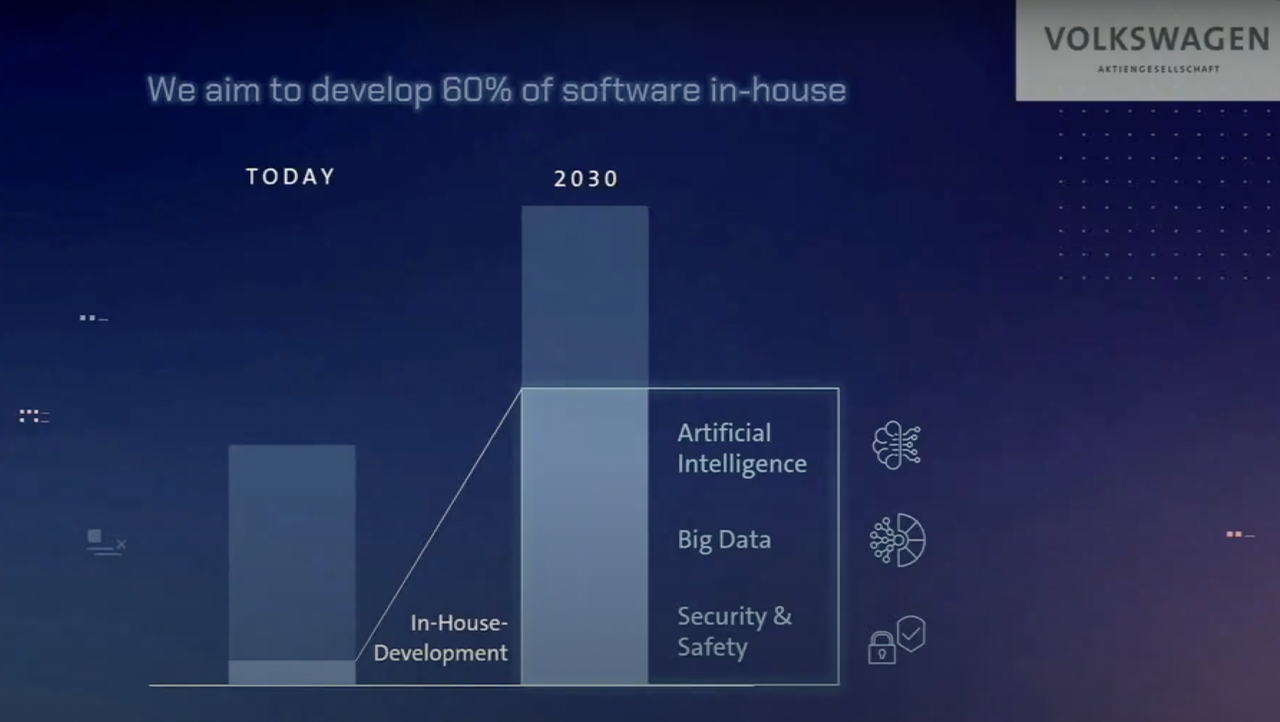

A few days ago, I introduced Volvo’s “Tech Moment”. Volvo said that self-developed software can shorten the product update cycle, quickly fix bugs, and improve user experience. But Diess went further on the 13th, saying that the fundamental reason for OEM’s self-developed software is that “by 2030, based on the sales of BEV (pure electric vehicles) and ICE (internal combustion engine vehicles), software-supported sales will increase the entire mobile market from the current approximately 2 trillion euros to 5 trillion euros.”

Behind the software is the key to future OEMs competing for profits.

Diess’s layout for software began in February 2019, when he formed a software department called “Digital Car\&Service”, which was headed by Christian Senger and began operating independently in 2020.

This guy, who looks a lot like Mr. Bean, is the “great talent” that Diess brought from BMW in 2015 and used to work in the BMW i department. After coming to Volkswagen, he was responsible for the technological breakthrough of the MEB platform. After Diess realized the importance of software, he quickly took charge of the entire group’s software department.

But last year, due to software problems with ID.3 and huge pressure from palace fighting, Senger still resigned.At the NEWAUTO conference, I saw the “Mr. Bean” Segler brother again, who became the head of MaaS (Mobility-as-a-Service) and TaaS (Transportation-as-a-Service) for the group.

Every time, Diess lets this “Mr. Bean” brother take on the most difficult and forward-looking business. This time, he has entered a “future” field and is laying out the groundwork for the public in advance.

How important are passenger transportation and cargo transportation?

For the future personal transportation methods, Diess has planned a scenario for everyone in front of the screen: “Whether you want to quickly call a vehicle for transportation in the city or your grandmother or 8-year-old son can independently travel without parents driving them, you can use Volkswagen’s app and then ID.Buzz will pick you up.”

In the future cargo transportation scenario, deliverymen do not need to take a driving test because the vehicle is fully automated and does not require human operation. Efficiency will also be greatly improved due to cloud online control. Workers will focus on delivery services, ensuring service quality.

“Mr. Bean” brother said that by 2030, Volkswagen expects the demand for self-driving vehicles in the five major markets in Europe to bring in $70 billion in revenue! Only in Germany, there are 4 billion parcels in the express delivery industry, so the market prospects for cargo transportation are also huge.

How to achieve this “fantasy” concept?

It seems that the future transportation scenarios outlined by Volkswagen are somewhat unattainable for us who are currently experiencing the transition from L2 to L3. However, to achieve this grand “unrealistic” concept, Volkswagen has carefully formulated a “four-step” plan.

In the first step of this plan, Volkswagen proposed the concept of “data-driven”, which is a “fictitious” concept.

The second step of the self-driving technology will be the cornerstone for Volkswagen to become a “software-driven mobile supplier”.

For self-driving technology, Volkswagen has two solutions: one for private use, managed by CARIAD; and one for shared travel, managed by ARGO AI.

We won’t go into detail about “data-driven” and CARIAD for now, but will focus on them later.This is ARGO AI, a self-driving company jointly invested by Volkswagen and Ford. Volkswagen is collaborating with ARGO AI to tackle the most complex urban traffic environment for autonomous driving.

The perception hardware of this autonomous driving system includes lidar, mmWave radar and cameras. The recently launched lidar by ARGO AI can detect objects up to 400 meters away, using “Geiger-mode” photodiodes and pixel merging to improve sensitivity, capturing low reflectivity objects in the dark.

This lidar will be used in the upcoming ID.Buzz AD which Volkswagen plans to commercialize for autonomous driving services in 2025. Each seat is equipped with a screen, with seats that can be moved around or even removed for cargo.

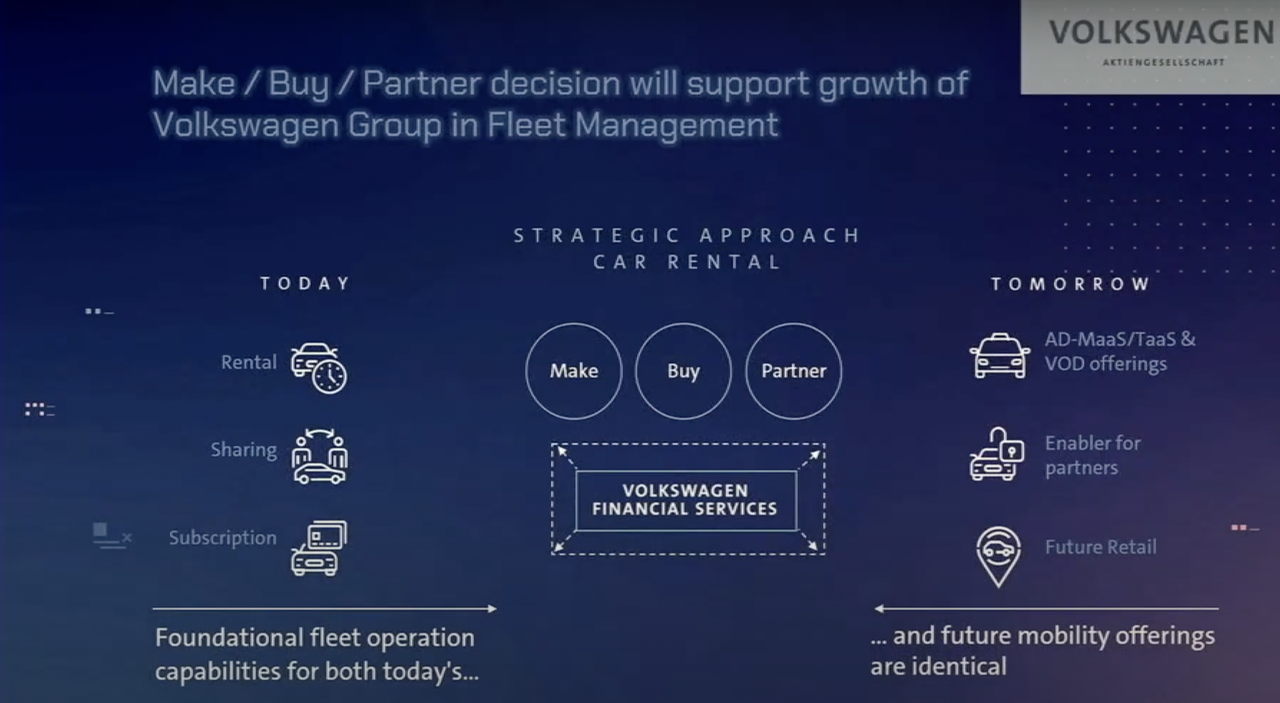

With mature autonomous driving technology and pure electric vehicle models, the plan now moves to its third step, which is fleet management.

First, considering actual scenarios, all fleet operators need to operate physical fleets and provide facilities for parking, charging and maintenance.

With the continuous growth of the leasing business, revenue will gradually increase, becoming the profit cornerstone of the mobile business. Volkswagen is considering whether to operate the fleets themselves, or acquire or partner with others in order to accelerate the development of commercial fleets.

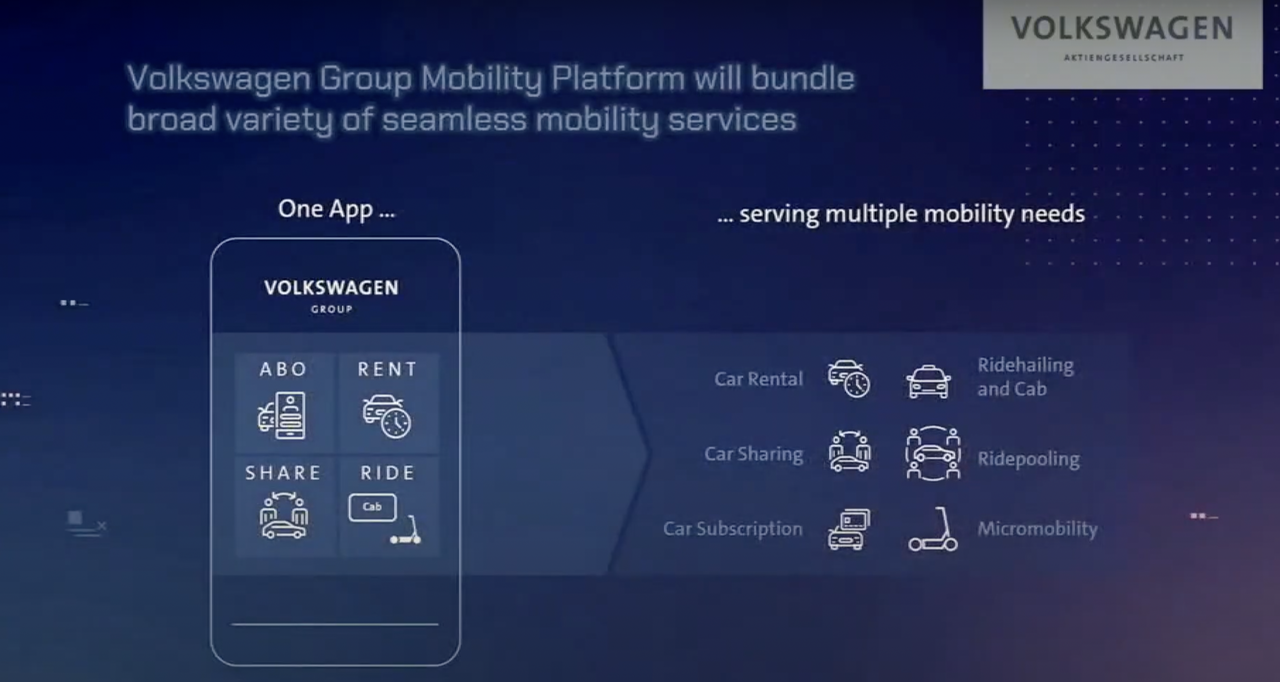

The final step is to connect the fleets with users, which requires an App that supports real-time data exchange. At the same time, this App will be compatible with various functions about future travel, such as self-driving rentals, sharing travel, and even short-distance travel by two-wheeled vehicles. It is clear that the intention is to grab business from travel platform software companies such as Didi and Uber. I wonder what the top executives of Didi think about Volkswagen’s NEWAUTO strategy.

Volkswagen has also mentioned the actual landing time and execution method.

In 2025, MOIA, a subsidiary of Volkswagen in Hamburg, Germany, will be the first to provide fleet management and booking platform, opening the first commercial service of Volkswagen’s autonomous driving. Regardless of success or failure, this valuable experience of fleet operation will become the advantage of Volkswagen’s future mobile travel.The next step for Volkswagen is to collaborate with more companies and platforms to advance the commercialization of autonomous driving services and improve fleet management solutions. Volkswagen also expects to provide tailored mobile travel solutions according to the different markets in each city, and form partnerships with local suppliers to provide comprehensive and all-round services derived from autonomous driving, ranging from the sales of autonomous vehicles themselves, to autonomous delivery trucks, and even to all-scenario travel solutions for people.

This reminds me of the Robotaxi companies in both China and the United States, which almost all use OEM produced cars for data collection, and then gradually conduct preliminary commercial trials in various places by loosening policies, but have not yet reached a large scale. Volkswagen Group sold 422,000 new energy vehicles last year and is expected to have 40 million vehicle models on the road by 2030. This scale advantage is an advantage that Robotaxi cannot compete with through algorithms.

CARIAD, the spearhead of the software war, is closely related to “data-driven”. CARIAD originated from the automotive software department led by “Mr. Bean”, who left last year and was succeeded by Dirk Hilgenberg, who also came from BMW’s IT department. Hilgenberg was recruited by Diess, and in a live broadcast, he directly said that Diess sent him a text message asking him to do it again. With the same vision as Diess, he came to Volkswagen without hesitation and became the CEO of CARIAD.

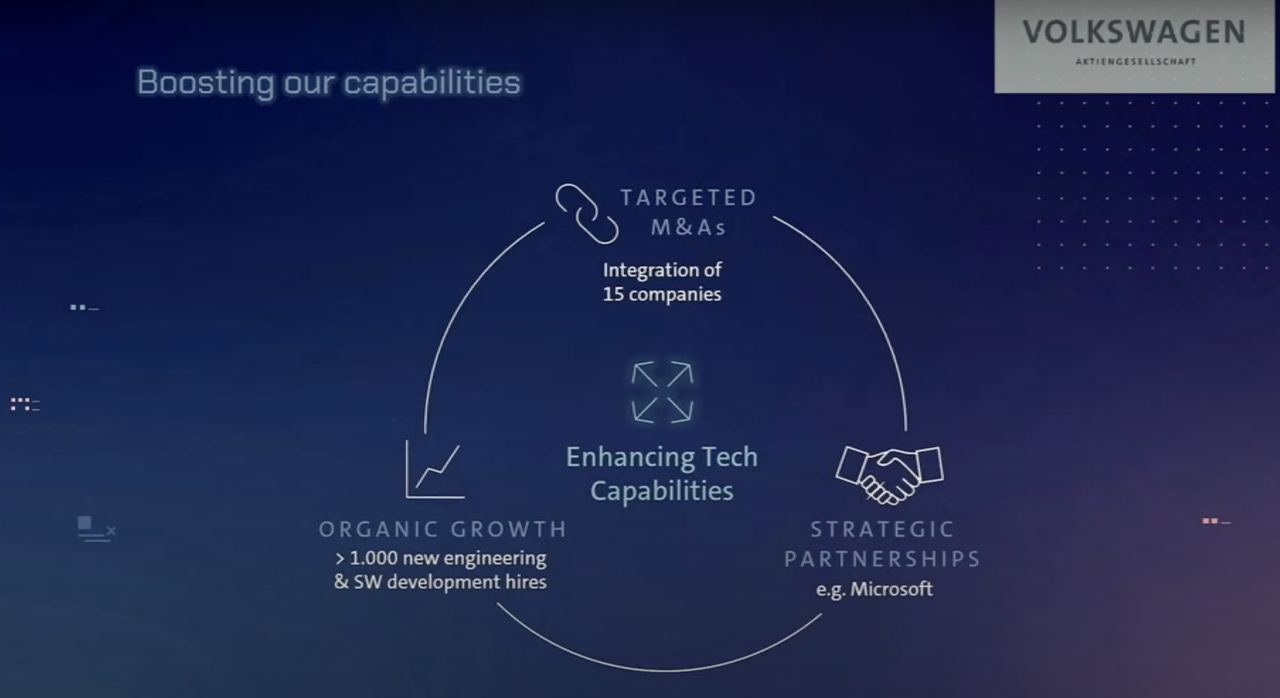

In Hilgenberg’s first year, about 4,500 engineers were attracted from Porsche, Audi and Volkswagen brands, and another 1,000 engineers were hired from outside. After a year’s work, 15 software companies were integrated into CARIAD to form a unified department, laying a solid foundation.

Volkswagen’s emphasis on its software department is reflected in its investment, and Volkswagen plans to invest 2.5-3 billion euros into CARIAD every year in order to achieve breakeven in 2025 as the business scales up.

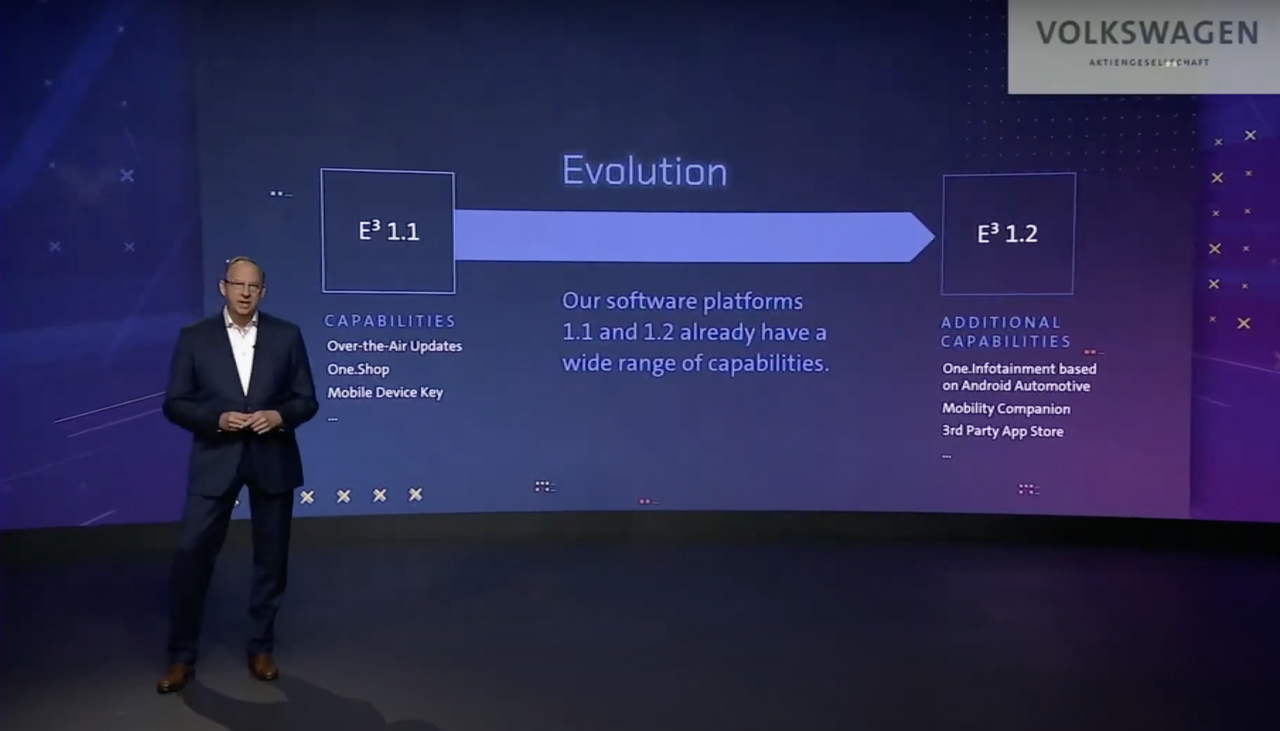

As Volkswagen Group’s software department, CARIAD has top talents within the group and can operate the vehicle software between various brands, with equivalent permissions and importance. CARIAD is mainly responsible for E³ electronic and electrical architecture (including VW.OS) and VW.AC.The E³ 1.1 version is already in use, such as Volkswagen’s ID.4, Skoda’s Enyaq, and CUPRA Born. This version allows OTA updates for the MEB product portfolio.

For instance, in early July, Volkswagen released the “ID.Software 2.3” update package, which updated the global ID.3, ID.4, and ID.4 GTX. Hildegard Wortmann stated that the ID family will be upgraded every three months.

The E³ 1.2 version will be released in 2023, featuring an Infotainment system (in-car entertainment) based on Android with a third-party application store offering various software choices. The key point is its support for VW.AC, which is Volkswagen’s cloud service. Vehicle data will be migrated to the cloud.

The pure electric macan and Q6 e-tron, which will be launched in 2023, will be the first to use this version.

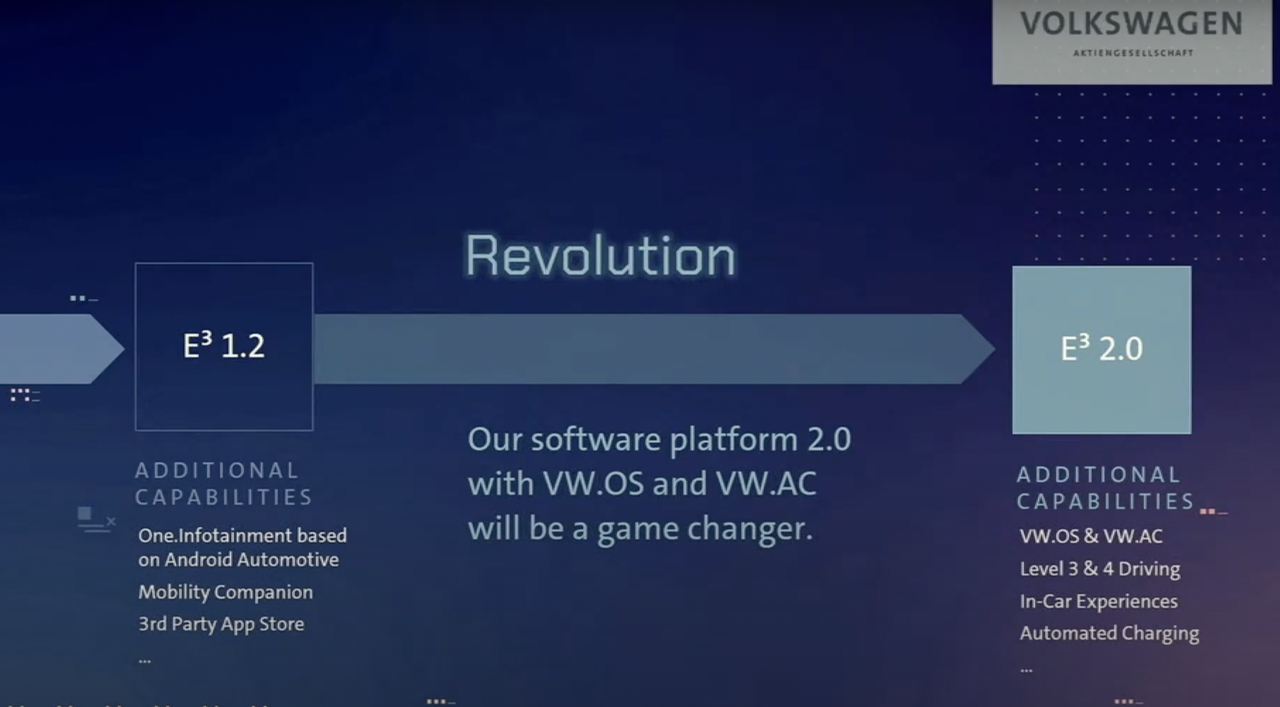

The E³ 2.0 version, referred to as a “game changer” by Hildegard Wortmann, will be launched in 2025, bringing VW.OS into a new era. The Volkswagen Group’s entire fleet will use this system, maximizing synergies while maintaining differentiation of brands and user experiences.

Audi’s Artemis project will showcase E³ 2.0 for the first time in 2025, along with the Volkswagen Group’s full autonomous driving capability and the SSP platform’s capability. These technological dividends will be transferred to Volkswagen’s Trinity project in 2026. Volkswagen optimistically predicts that by 2030, 40 million vehicles will be traveling worldwide, and software will become one of the most important profit pools!

As an ever-evolving EE (electro-electric architecture), Hildegard Wortmann also briefly described the ongoing work at three levels:

-

Firstly, the hardware level, consisting of cameras, sensors, actuators, and powerful computing platforms. CARIAD is further integrating a dozen controllers into more streamlined and robust control units, simplifying the system and achieving software and hardware decoupling.

-

Secondly, the software level, which includes VW.OS, connecting to VW.AC to keep news, applications, and other functions up-to-date in real-time.

-

Finally, the development of new features and services. Hildegard Wortmann stated that cars will become “personal mobility companions,” a smart and intelligent assistant that can organize trips and conduct video conferencing at any time.

Volkswagen, according to Herbert Diess, sells 10 million vehicles each year, which translates into 10 million data sources that would become the company’s assets, offering huge business opportunities.

This huge amount of data will give rise to big data on vehicle circulation, which will be used for iterative optimization by constantly acquiring massive amounts of data, thereby extending the life cycle of a vehicle through over-the-air (OTA) upgrades. Previously, as soon as a car left the factory, the production updates would stop, but now, the vehicle leaving the factory marks the beginning of the upgrades.

Diess stated that EE 2.0 version of E³ is ready to change the business model. This does not refer to the business model of shared travel, but rather derives from the profit space based on services such as automatic driving, data connectivity, and other software. Simply put, it is like paying to upgrade advanced automatic driving and to utilize cloud connectivity.

Volkswagen’s goal is to develop 60% of its software in-house by 2025, expecting to fully master all key technologies, including big data, security, and AI capability.

VW.AC

Cloud is another essential part of future software. As the domain control architecture moves toward one or two central computing platforms, the “cloud brain” becomes increasingly necessary.

However, the technology barrier in this area is high, and it has been almost entirely occupied by various technology giants. It is not necessary for Volkswagen to spend money on independent research and development, as cooperation with international technology giants can quickly fill the technology gap. Volkswagen has chosen Microsoft.

Diess stated that Volkswagen’s strategic partnership with Microsoft will be a “key factor” in Volkswagen’s development into a software-driven mobile service provider.

In fact, as early as 2018, Volkswagen and Microsoft reached a strategic partnership on the VW.AC business, dedicated to integrating all digital services and mobile products of Volkswagen’s group brands and models.

Volkswagen’s engineering team in Seattle has already established data exchange between vehicles and VW.AC through Microsoft Azure.

In addition to cloud data management for private vehicles and OTA, I believe that VW.AC will play an important role in the commercial operation of Volkswagen’s autonomous driving fleet, as Volkswagen plans to promote commercial fleets worldwide, and cloud connectivity will help Volkswagen manage more effectively.

Of course, to ensure the satisfaction of demand differences around the world, Volkswagen has a software development team of approximately 600 people in China to meet the demands of Chinese consumers.## SSP: I Want Both Cost and Scalability

When the Volkswagen software division was in its early planning stages, the company aimed to gather 10,000 IT talents. So far, CARIAD has already recruited approximately 5,500 IT experts (including those overseas), which is half of its initial target. However, let’s be frank, the European internet atmosphere or software talent is not as developed as in China and the United States. Therefore, CARIAD needs to “expand its horizons” to eventually complete the talent collection plan.

The platform is mainly overseen by Audi’s CEO Markus Duesmann. Yes, you guessed it correctly, he used to work directly under Diess and was responsible for the procurement and supplier network department at BMW. Last April, he officially became the CEO of Audi and even took charge of Lamborghini and Ducati.

Duesmann is quite ambitious. In the first month of his tenure, he launched the Artemis project, which is the origin of the SSP.

The Artemis project can be directly interpreted as the origin of the entire SSP platform. With the Artemis project as its starting point, Volkswagen will release the first car, Apollon of the Audi brand, in 2025, symbolizing the transition from the PPE platform to the SSP platform. By 2026, all new cars belonging to the Volkswagen Group will be built on this platform, including the Trinity model of Volkswagen brand, and all of them will be equipped with the E³ 2.0 version of EE.

I have already provided a detailed introduction to the Trinity project in my article “Trinity – Volkswagen’s Graduation Dance”.

We all know that Volkswagen has had a lot of success with platform design in the field of traditional fuel vehicles. Based on Volkswagen’s decades of experience in cross-brand platform design and production, Duesmann confidently declared that Volkswagen is an “unchallenged platform hero”!

Scalability

Although Diess has repeatedly emphasized the role of software and services in future vehicles, stating that “in the future automotive world, customers will still choose distinctive designs, brands, and services, but compared to before, the differences among brands will come more from software and services,” the SSP platform focuses primarily on hardware. By combining different sizes and modules, the platform strives to maximize the differentiation of hardware among various brands within a cost controllable range to ensure the final differentiation between brands within the group.

Although Diess has repeatedly emphasized the role of software and services in future vehicles, stating that “in the future automotive world, customers will still choose distinctive designs, brands, and services, but compared to before, the differences among brands will come more from software and services,” the SSP platform focuses primarily on hardware. By combining different sizes and modules, the platform strives to maximize the differentiation of hardware among various brands within a cost controllable range to ensure the final differentiation between brands within the group.

For example, the E³ 2.0, autonomous driving, and power systems modules used in Porsche’s entry-level models will also be used in the performance versions of Volkswagen models. However, with its strong extensibility, SSP allows Porsche’s top models to use specially designed modules to maintain uniqueness. As a platform feature, SSP also comes standard with an 800V voltage platform.

Cost

SSP has extremely strong scalability, but at the same time, costs must be kept to a minimum. This is a major challenge that Volkswagen must overcome.

First, during the life cycle of the SSP platform, Volkswagen plans to produce 40 million vehicle models and, like MEB, open it to other automakers to share platform development costs.

Although SSP will be compatible with various brand models within the group, with unified components and proximity to the limit, Volkswagen clearly wants to control costs even lower, so it cut more than 60% of the vehicle categories directly.

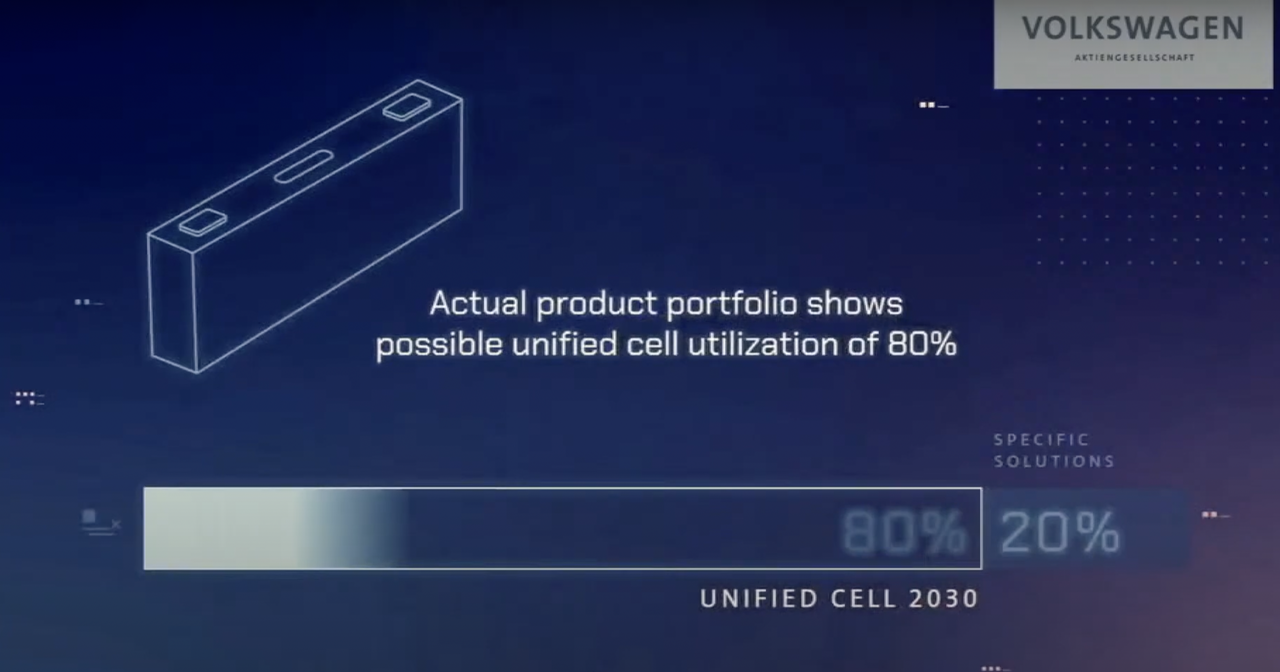

Finally, Volkswagen has also unified and reduced the type of battery packs, planning to cut the peak of 22 battery packs to only eight.

In order to make this “Super platform” applicable to all Volkswagen models, with the ability to carry advanced autonomous driving technology and E³ EE, and to be able to replicate production in other Volkswagen factories, Volkswagen plans to invest 800 million euros in Wolfsburg to establish a new research and development center, and it will be led by Hiltrud Doreis, the chief officer of Volkswagen Group’s legal and integrity department, and Thomas Schmall.

Steady Progress in Battery and Charging Business

Diess said that in the group’s future profitability direction, it mainly relies on four businesses: hardware sales of vehicle transactions, software businesses, battery and charging businesses, and mobile travel businesses.

Battery Technology

In order to ensure the development of battery and charging businesses, Volkswagen announced ambitious plans months ago at Power Day. They plan to increase the energy density of batteries while also lowering costs. This is yet another dilemma.However, Thomas Schmall, the head of Volkswagen’s battery and charging business, said that “Size” is the key to determining who can win the game.

Volkswagen aims to reduce costs by half by 2030 through unified cell specifications, covering 80% of vehicle models, and using Volkswagen’s “million-level” scale effect to win the battery cost competition.

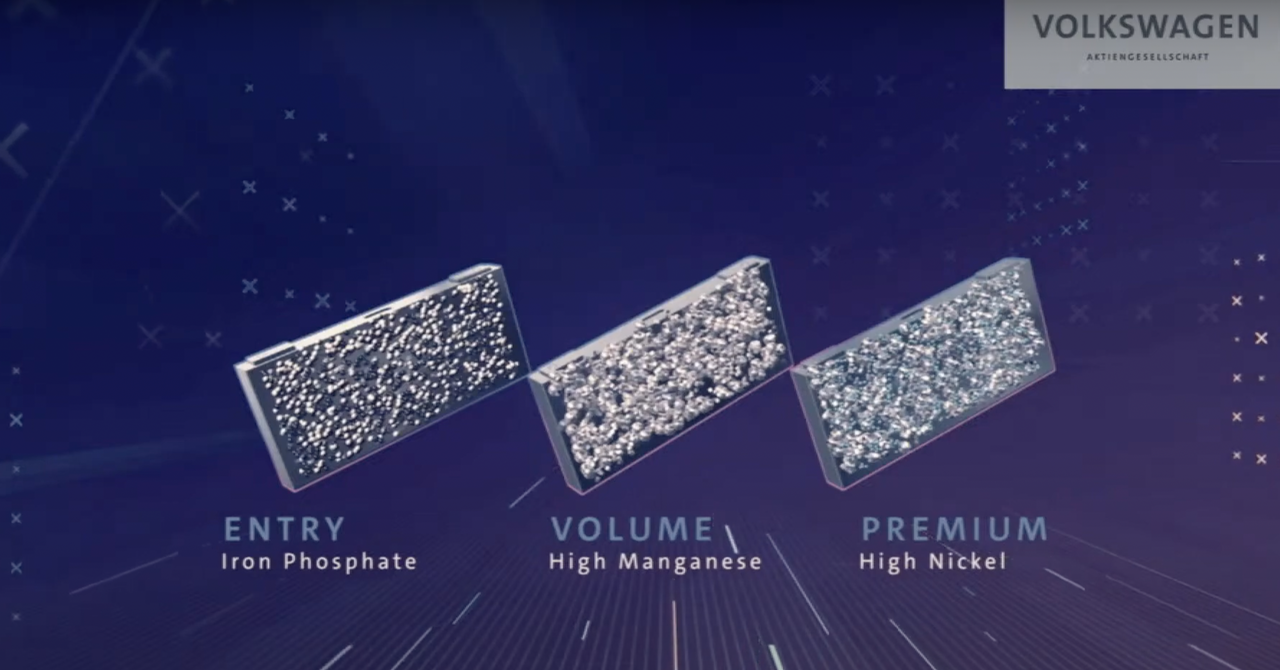

According to different brand product positioning, Volkswagen will adopt three different chemical formulations to match unified cell specifications: entry-level lithium iron phosphate battery, mid-range (wide range) high manganese batteries, and high-performance orientation with high nickel batteries.

In terms of solid-state batteries, Volkswagen is partnering with US solid-state battery manufacturer QuantumScape to establish the first QS-1 experimental production line in Salzgitter, Germany before the end of this year.

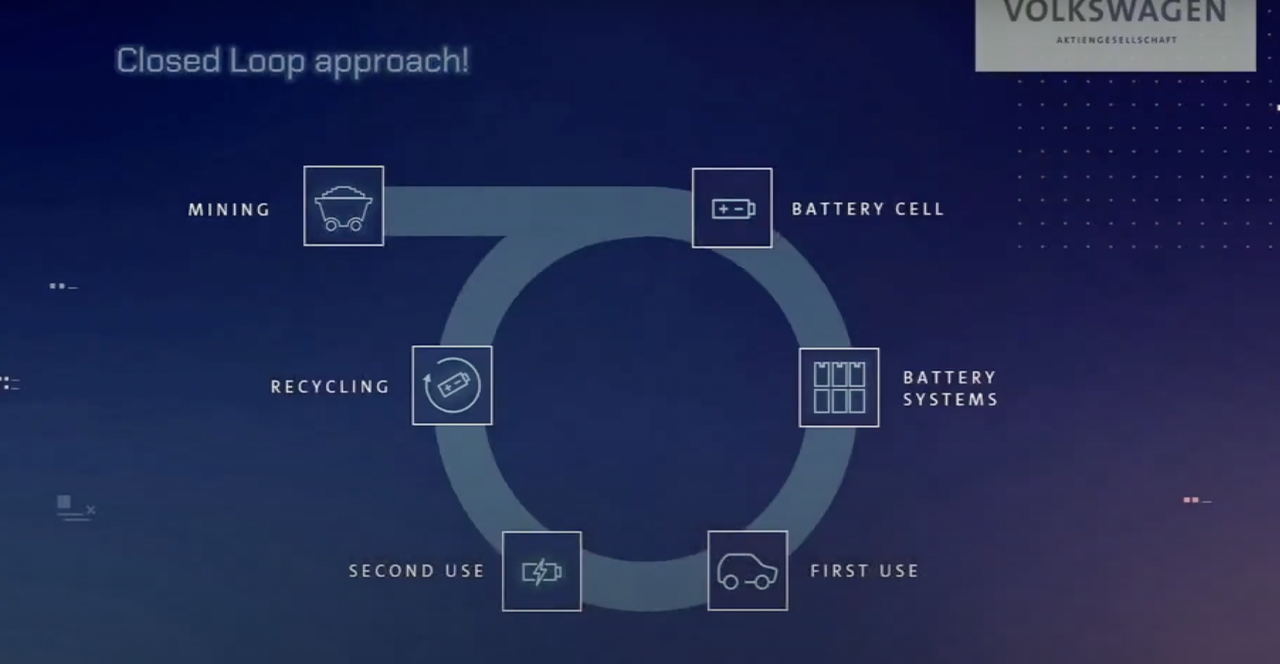

The biggest cost of batteries comes from raw materials, and Volkswagen hopes to expand its supply chain from raw material acquisition to recycling to form a closed loop and establish control in many aspects of this closed loop, so as to effectively control battery costs and form a virtuous circle.

In short, controlling the raw materials, production, first and second use, and recycling of batteries makes their circulation a loop, maximizes the utilization of batteries, enhances benefits, and reduces waste. This also strengthens resistance to market risks.

Fully establishing this ability alone is as difficult as Volkswagen’s difficulty in fully self-developing a full-stack software. Therefore, Volkswagen made the smart choice of collaboration.

Battery Factories

Volkswagen’s first battery factory chose to collaborate with Northvolt. This factory located in Skellefteå, Sweden is planned to achieve battery production in 2023.

At Volkswagen’s Power Day, Volkswagen announced plans to establish six battery factories in Europe with a total capacity of 240 GWh by 2030, and also announced that the second factory’s partner is Northvolt.

However, at the press conference on July 13th, Volkswagen decided not to continue its investment in Northvolt, which was worth 500 million euros, and instead joined hands with Guoxuan High-Tech. The factories of Salzgitter in Germany will be transformed into Volkswagen’s second 40 GWh battery factory, with production starting in 2025.

As for the location of its third factory, it is set to be in Spain, where Volkswagen and its subsidiary SEAT SA are collaborating to build a new factory. “Spain could become a strategic cornerstone of our e-mobility initiative. We want to establish the entire value chain for electric cars in Spain – from electric vehicle manufacturing to EV components to a Group battery plant. The small BEV family can be produced in Spain from 2025,” said Diess.

Of course, Spain’s government has provided many benefits, partly through its “PERTE” revitalization plan, which focuses on electric vehicles and has facilitated Volkswagen’s third battery factory and the establishment of small BEV factories.

Charging Business

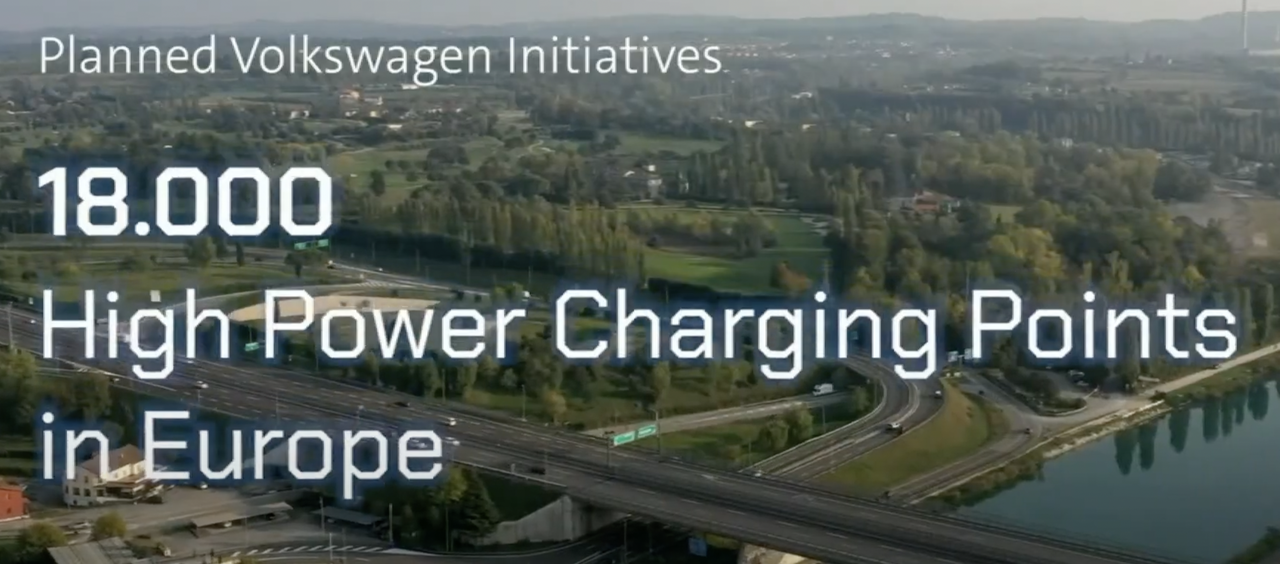

In terms of its charging business expansion, this can be seen as a summary of Volkswagen’s Power Day several months ago: by 2025, the company plans to build 18,000 fast charging stations in Europe and 17,000 in China. In North America, the number of charging stations has jumped from 3,500 to 10,000.

Volkswagen’s North American subsidiary, Electrify America, announced on the 13th that it plans to build 1,800 fast charging stations and 10,000 fast-charging stations by 2025, and will deploy 150 and 350 kW chargers.

In Italy, Volkswagen has established a joint venture with Enel X to deploy more than 3,000 high-power (>350 kW) ultra-fast charging stations within Italy by 2025.

Transformation of 660,000 peopleSo far, we have basically sorted out the key content of this NEWAUTO launch.

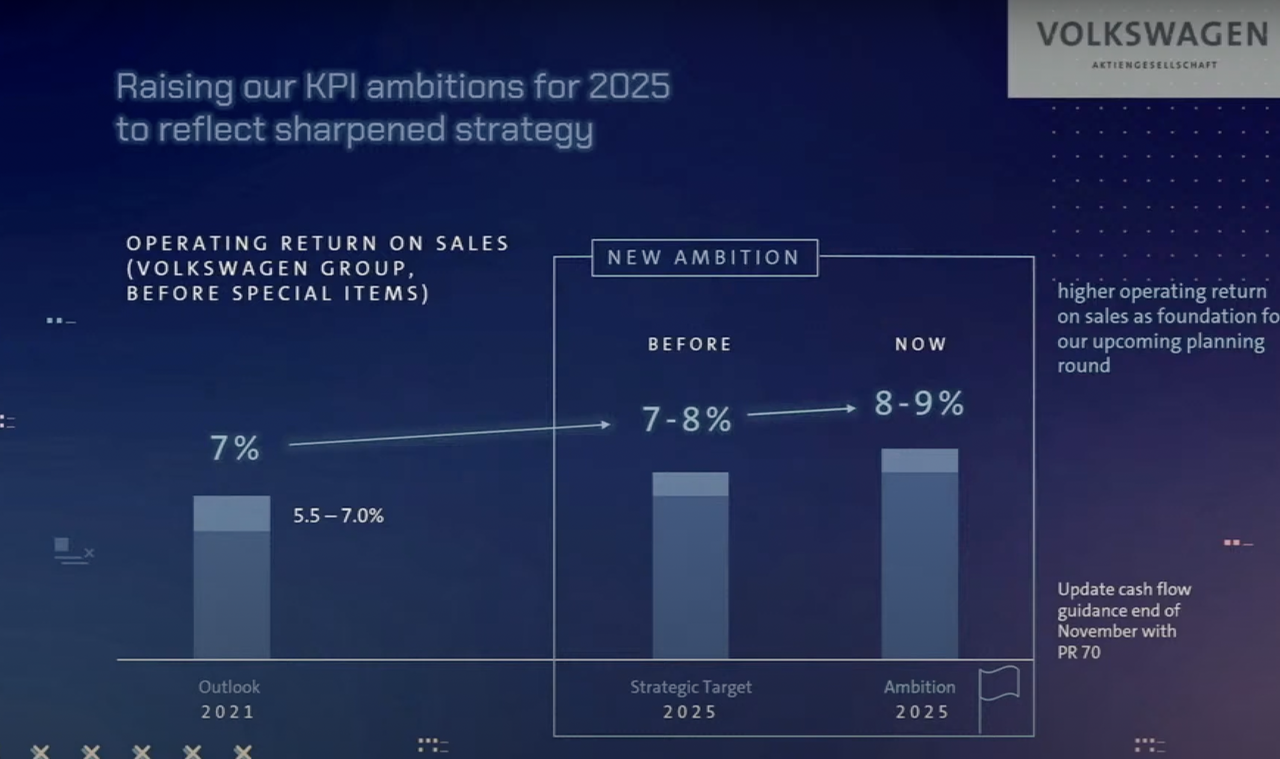

But what impressed me was not the surprising numbers mentioned by Diess, such as “€73 billion investment”, “revenue return rate up to 8-9%”, “annual sales in tens of millions”, and “30% reduction in carbon footprint”.

Instead, it was the 660,000 Volkswagen employees.

They include factory workers, software developers, and tens of thousands of mid-level executives. Half of them are engaged in the production of traditional cars. No matter how Diess shouts “Electric Father”, they can only smile and return to the ICE-related work positions.

Maintaining the competitiveness and stable cash flow of ICE is crucial for distributing the Group’s revenue to electric vehicles, software, and other investments. For Diess, ICE still has a strong “residual value” to be fully tapped.

Due to the promise made with the newly appointed labor committee chairman Cavalcante, Diess cannot spend money to “retire early” for workers like before, nor can he immediately cut off these marginalized workers.

At present, Diess’s solution seems somewhat helpless. He chooses to cooperate with the labor committee to train employees to achieve the overall transformation of the Group, which is a time-consuming and painstaking process. And for mid-level management and ICE-related executives, Diess needs a thorough personnel organization restructuring.

At this moment, Diess holds the “sword of power”, sits on the “iron throne”, and is supported by a powerful consortium, surrounded by capable assistants. Diess gazes at the distant city that is about to be conquered, with a high and far-sighted vision. However, there are always some tangled messes that cannot be cut off and will create unexpected troubles near at hand, confusing Diess’s strategic vision.

It is difficult to conquer a city, and it is also difficult to defend it.

For the power game that Diess is engaged in, I can only use the classic lines from Act III, scene 1 of Shakespeare’s Hamlet to comment:

To be, or not to be, that is the question.

However, those of you who have watched Game of Thrones also know that Littlefinger said:

Chaos is a ladder.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.