Let’s take a look at the latest electric platform SSP (Scalable Systems Platform) that Volkswagen Group officially released on its 2030 strategy day. In fact, Volkswagen’s PPE platform has not yet entered the mass production stage, but it rushed to release a new mechatronics platform at this time point.

The release of the SSP platform in 2021 is very interesting and reflects several issues:

1) Based on traditional thinking, the MEB that took 4-5 years to build has achieved certain success in Europe, but overall has not met the previous expectations in China. To ensure the combat effectiveness of the Volkswagen Group as Europe continues to push for zero-carbon emissions, improvements must be made from the perspective of the automotive platform.

2) The SSP platform is based on previous modules and aims to further reduce the complexity between different Volkswagen Group platforms, while strengthening the modularity and scalability in a similar way to building blocks. The focus of SSP is on battery and software, which are the most core aspects of future intelligent vehicles.

How to Maintain Traditional Profit Sources

The deep-rooted problem of traditional automotive companies is that the profitable business comes from the existing fuel vehicles. Therefore, the first step forward is how to deal with their own fuel vehicle business. In the eyes of all investors and corporate management, there are three major challenges to the fuel vehicle: declining demand, increasingly stringent emission regulations, and punitive tax measures. This makes the current profitable business decline year by year.

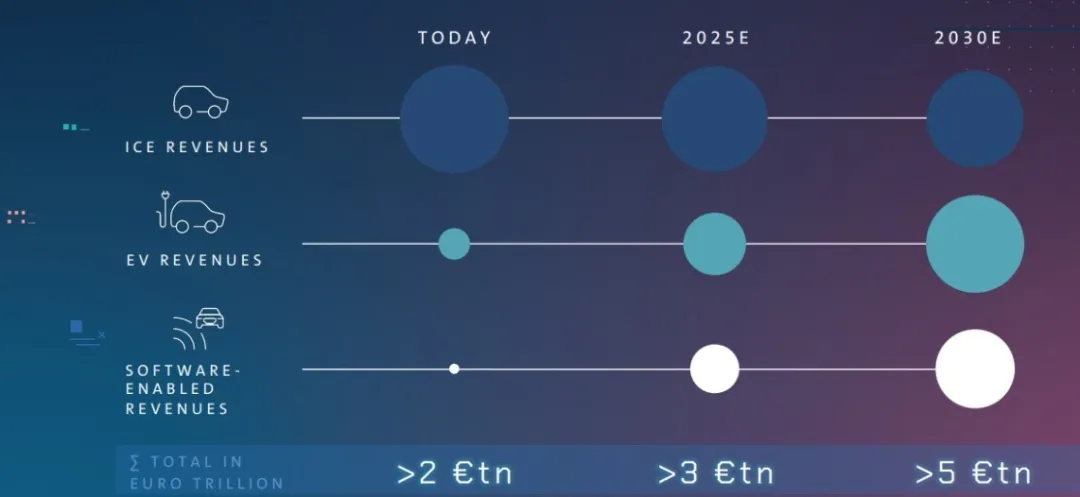

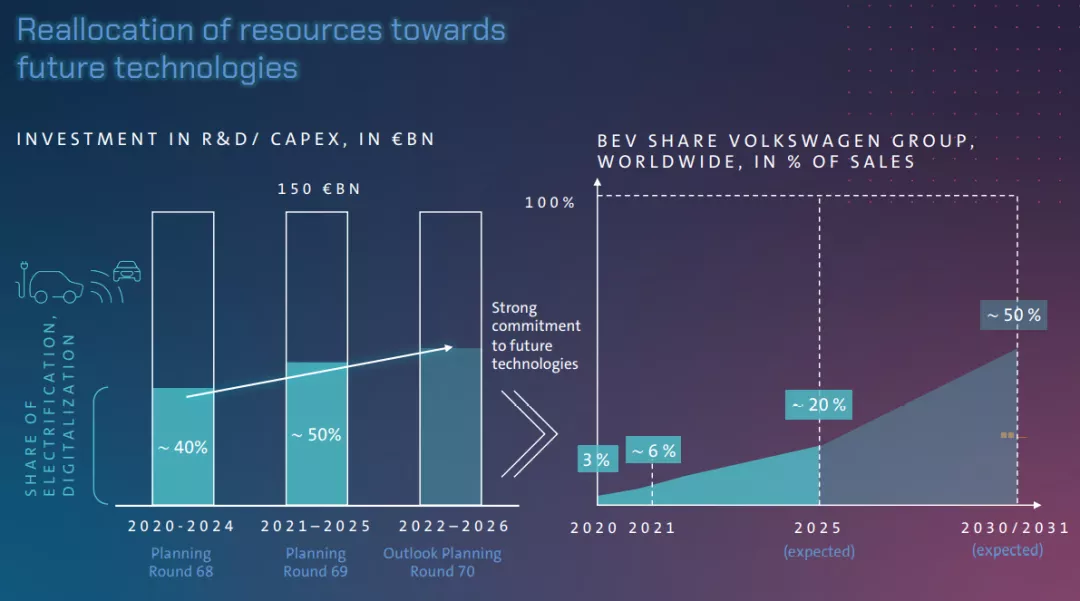

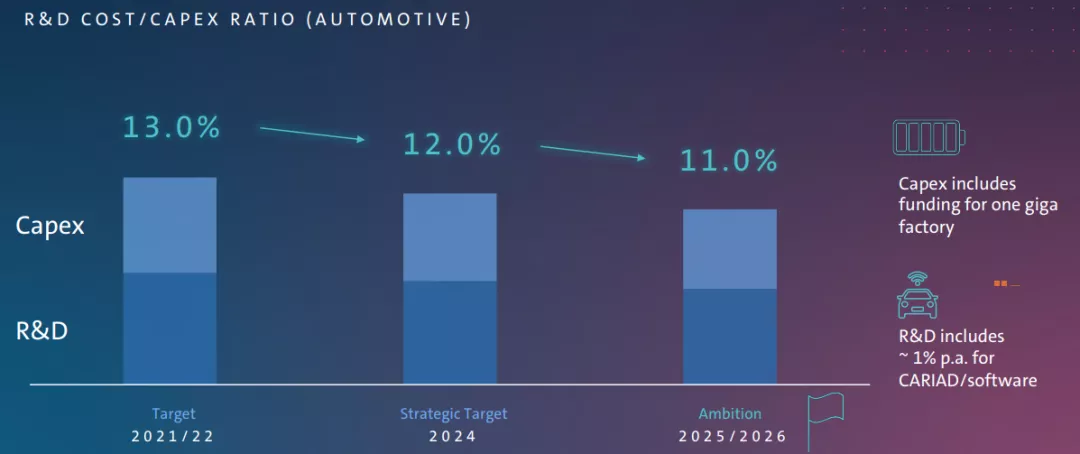

Therefore, the primary measure is still to maintain certain production capacity of fuel vehicles with less investment, in order to support economies of scale under the above unfavorable conditions. As shown in the figure below, Volkswagen’s most important task is to continuously invest resources in the future. Among European automotive companies, no one believes that the previous full promotion of the MEB pure electric platform was a wrong choice. In front of these colleagues, Volkswagen made the right judgment and took the initiative, but now Tesla, which keeps moving forward, has come to challenge. Therefore, it can be seen that most of Volkswagen Group’s R&D resources are still being invested in electrification and software, even if pure electric vehicles only account for 3%, 6%, or even 20% by 2025. From a planning perspective, the proportion of resource allocation is gradually increasing from 40% to 50% or even higher.

It is clear that we are seeing a changing era, and Volkswagen’s management is also intelligently allocating resources. Internal combustion engines feel like middle-aged people quietly working in a large family. With the changing times, they are given fewer and fewer resources and allocations. Batteries and software are like two underage sons who will become Volkswagen Group’s future core competitiveness after being aggressively invested. All of this is driven by Tesla’s rapid development, which has prompted European and American government officials and in turn, forced companies to adjust their strategies. This is a certain trend in the long term.

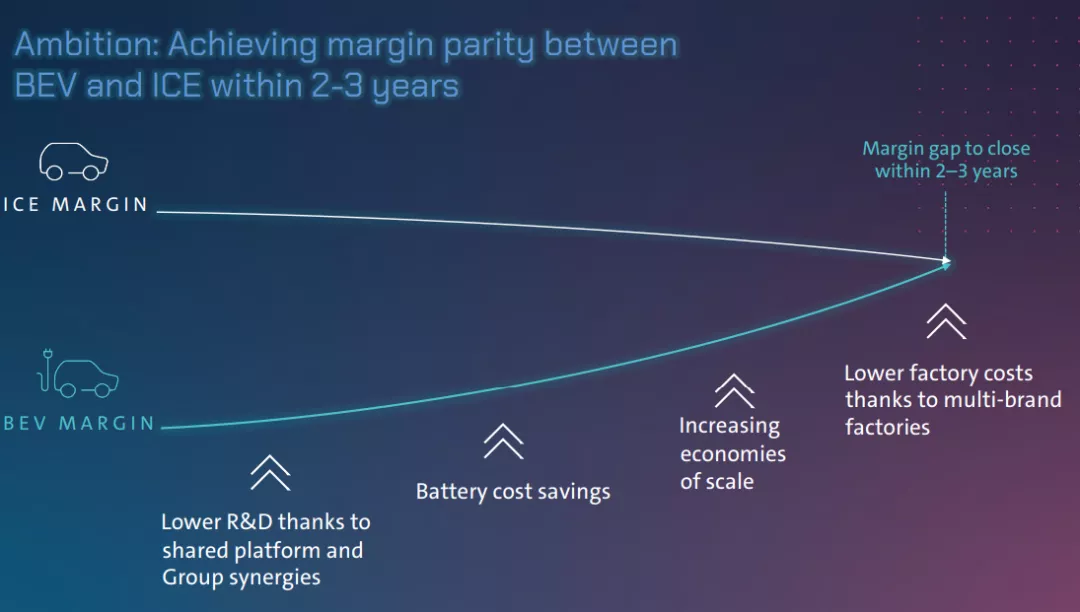

Of course, Volkswagen Group’s money is not given for nothing. The electric vehicle business needs to achieve the same return on investment as internal combustion engines within 2-3 years. My only thought is, why does Volkswagen want to make batteries in the first place? The core should still be to make money in the electric vehicle business. From Volkswagen’s product pricing and economies of scale, the cost of batteries cannot be reduced by themselves, mainly because it is difficult to convince suppliers to lower battery procurement prices. This is a challenge that must be overcome.

Batteries and Software

- Software

As of now, Volkswagen has already planned to reuse the software platform for future use. The evolution of software architecture on the MEB and PPE platforms is moving towards greater efficiency.

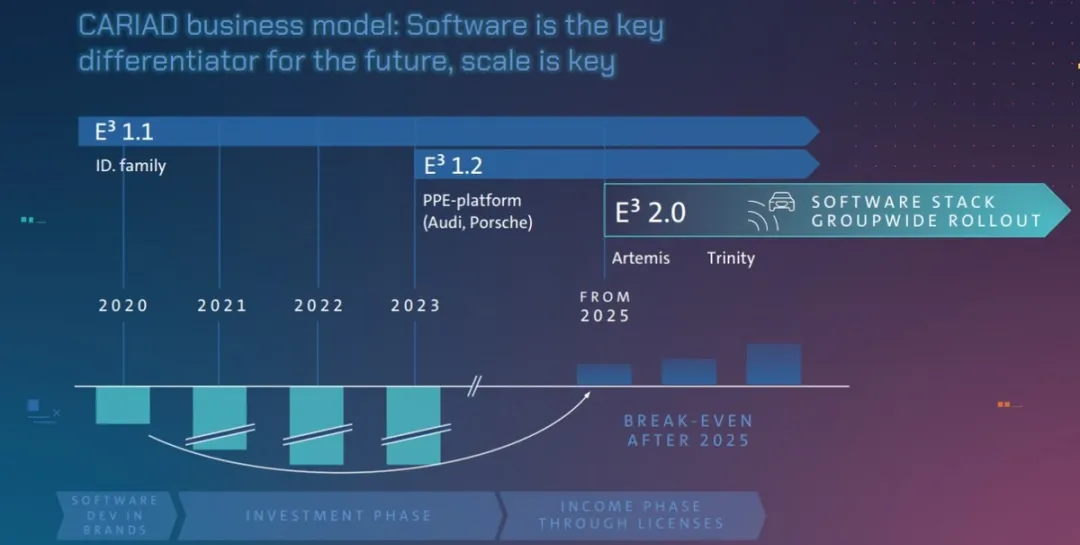

There are currently three electronic and electrical architecture types that Volkswagen is working on:

First, the E³ 1.1 architecture focuses on solving wireless OTA upgrades and updates;

In 2023, CARIAD will launch the advanced software platform 1.2 (E³ 1.2), which mainly innovates in intelligent cockpit and autonomous driving functions;

By 2025, CARIAD’s scalable software platform and electronic architecture 2.0 (E³ 2.0) includes a competitive unified operating system and prepares for autonomous driving Level 4.

- Battery CellOn the last Power Day, Volkswagen actually talked about its standardized battery cell plan. This time, it mainly elaborated on its plan for standard battery cells and production capacity. The goal of standardized battery cells is actually to achieve the same profit margin as internal combustion engines for Volkswagen’s electric vehicles, so the goal is to reduce the cost of the battery system by 50%.

According to the positioning and product sequence of Volkswagen Group’s different brands, Volkswagen’s technology roadmap adopts three different material systems to respond to different market positions, namely the entry-level lithium iron phosphate, the high manganese for high volume, and the high nickel for high-end.

What Volkswagen can currently see is also following Tesla’s battery cell technology cost reduction strategy, dry coating and silicon negative electrode technology. From the design of the MEB and PPE modules to the system to the SSP stage, it quickly switches to CTP and CTC.

Note: I understand that if Volkswagen does not have its own independent battery production capacity, the initiative will be completely transferred to the battery companies at the CTP stage; at the CTC stage, if there is still no in-house battery cell, then it can only purchase the chassis from the battery companies, which is basically only one step away from the decline of the automaker.

Volkswagen Group has spent a lot of resources on the US QS, so the development direction of standardized battery cells must include solid-state batteries, which has been repeatedly emphasized in different occasions.

During this strategy meeting, Volkswagen once again emphasized its plan of 240GWh, and to maintain its share, Volkswagen continued to invest 500 million euros in Northvolt in Sweden, which will start mass production in 2023. This is Volkswagen’s Leading project. In Salzgitter, Volkswagen brought Guoxuan to Germany as its flagship, planning to start mass production from 2025.

Volkswagen has confirmed that its third battery plant will be located in Spain with a planned production capacity of 40 GWh. This is an inevitable foothold for Volkswagen’s phased implementation in three regions of Northern, Western, and Southern Europe. Establishing these three battery plants without the support of European governments is impossible.

Summary: Currently, Tesla’s Berlin factory is still delayed. Personally, I think that as Tesla’s European factory kicks into full gear in early 2022, it will indeed exert pressure on European car companies to respond. This effect is similar to the impetus Tesla’s Shanghai factory provided for Chinese car companies. If carmakers do not respond with all-out effort, they may really have no concept of a “future”.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.