In mid-July, the specific ranking of pure electric vehicle sales in most European countries has been compiled. Based on existing data, including regions with relatively large sales such as Germany, France, Norway, and Sweden, as well as the situation in Spain, Switzerland, Denmark, Ireland and Finland, have been summarized.

Sales Ranking in Main Countries

- Germany

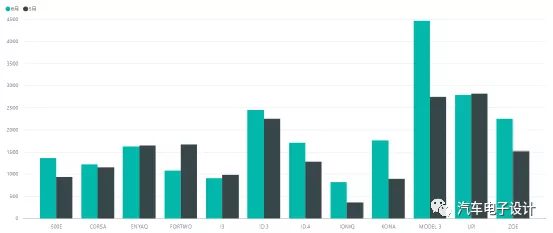

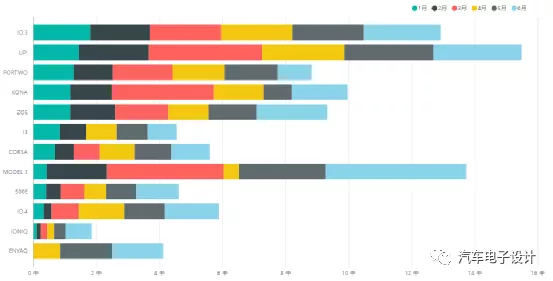

In June, Model 3 ranked first in sales in Germany with 4462 units, totaling 13719 units in H1 2021, slightly behind Volkswagen E-up’s 12915 units. Currently, the monthly sales of the top-ranking pure electric vehicle models in Germany remain stable at around 2000-3000.

Note: Due to Tesla’s quarterly impact strategy, data from May can generally be compared with other automakers, while data from April and June can be compared based on average values.

From the following chart, we can see that the sales of Volkswagen Group are currently shifting from E-up to ID3 and ENYAQ (with a total sales of 22913 units in the first half of the year). Currently, the sales volume of these several MEB models is around 2000 units per month. Judging from the trend, the sales volume in Germany around the MEB platform should easily exceed 40,000-50,000 units in the second half of the year.

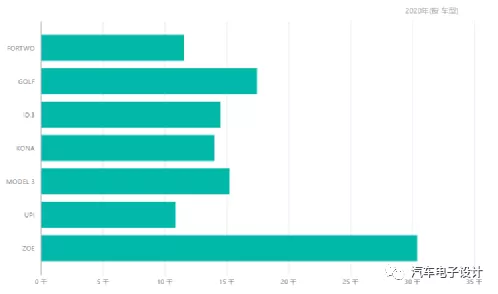

If we compare the situation in H1 2021 with that in 2020, we can see that the sales volume of models like ZOE has declined after the introduction of MEB. With the determination of Volkswagen’s promotion, sales of E-up have surpassed the total sales of 2020 already. The modern Ioniq 5 is intended to replace KONA EV, and the transition between the two models will be more obvious. In this half-year period, we can see the optimization of the pure electric vehicle market in Germany.

With Model Y also starting to sell in Europe, Model 3 + Model Y and the models on Volkswagen’s MEB platform will compete directly in Germany’s market in the future. If old electric vehicle models are not updated, they will soon face a lack of competitiveness. We can understand that the competition of electric vehicles in Germany is gradually intensifying.

- FranceThe situation in France is that Tesla sold 5,000 vehicles in a single month, totaling 13,084 units in 2020. Meanwhile, the ZOE sold 3,349 units in a single month, with a total of 10,797 units. Volkswagen’s MEB platform has not had a smooth rollout among pure electric vehicles in France. The pace of vehicle iteration in the French market is relatively slow, with small cars and old models from French automakers dominating the mainstream. Overall, 2022 may be a turning point for French automakers to iterate their pure electric car models, but there is no clear indication of any major changes yet.

In Sweden and Norway, which are both in northern Europe, various automakers’ platform-based models have achieved good results, thanks to a relatively competitive market. However, since the overall market capacity is limited, there should be no significant change in the overall market structure. Interestingly, the sales volume of the MEB platform in small markets is not much different from that of the Model 3, and there is even a trend of exceeding it.

Other European countries, such as Ireland, Denmark, Finland, and Switzerland, are compared in terms of the sales of the ID3, ID4, and Model 3 in Figure 8.

In summary, Volkswagen is in a relatively prominent position in the pure electric market in Europe. Overall, the MEB platform has been relatively successful in Europe, and has achieved certain strategic expectations.

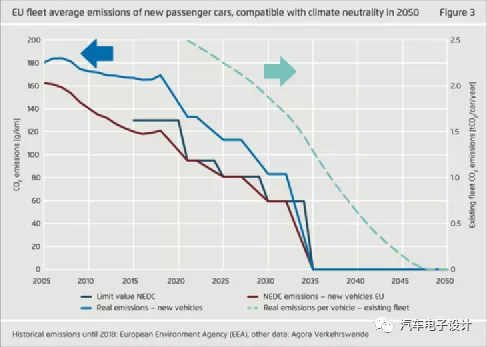

Regarding whether zero emissions in Europe by 2035 is feasible, Figure 9 shows the financial and taxation policies that European countries have implemented to support electric vehicles.## Analysis of European Market: Focus on the “European Climate Law”

The most important aspect of analyzing the European market at present is to focus on the “European Climate Law”. This legislative proposal was put forward in September 2020 and achieved political consensus by April 2021, with the final legislative process currently underway.

The “European Climate Law” will set the EU’s emissions reduction targets for the next 30 years: by 2030, net greenhouse gas emissions will be reduced by at least 55% compared to 1990 levels; by 2050, carbon neutrality will be achieved across the EU, with negative emissions following after 2050. As for vehicles, Europe’s goal is to reduce new car emissions by 65% by 2030, with new vehicles sold in Europe achieving zero emissions from 2035 onwards.

In fact, the emphasis of this goal is on infrastructure. The European Commission estimates that by 2040, the EU will need to invest between 80 billion and 120 billion euros into public and private charging facilities.

The real question here is: Is Europe being too radical in their approach? Even if the general direction is good, if there is no room for compromise, then all European automakers will only have one way to go – electric.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.