In the field of electric vehicles, Tesla and other new car companies show no mercy and seem to have a taste for knocking out traditional automakers.

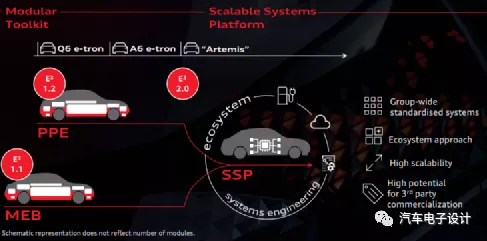

While Volkswagen’s MEB platform is slow to gain traction, their SSP platform has made an appearance in their 2030 strategy. As traditional luxury car brands, Audi & Porsche face an important question: does the high-end Premium Platform Electric (PPE) have enough power to be a key player as they move forward?

To shed some light on the PPE platform, Audi’s Oliver Hoffmann and Fermín Soneira Santos gave a presentation called “Premium Platform Electric (PPE) Deep Dive” at a UBS conference. Here’s what they shared:

PPE Platform

1.1 Audi’s overall strategy for electric cars

After the first wave of Audi E-tron attempts, Audi plans to use the J1, PPE, and MEB platforms to promote the adoption of electric vehicles. These platforms are currently positioned as follows:

● J1: Based on the Porsche Taycan, to enhance the personality of Audi’s electric car brand

● PPE: Mainly used for high-end sedan models, leveraging the 800V platform and design characteristics to achieve higher sales volume

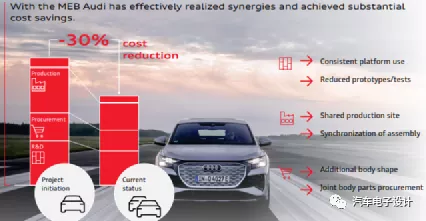

● MEB: Takes advantage of group resource sharing to reduce costs, leading to an estimated 30% savings in production, procurement, and R&D, including shared platform testing costs, shared factory investment costs, and shared body part procurement costs across different models. Audi believes that MEB platform models will sell better than those of the Volkswagen brand, thanks to the Audi brand’s reputation and cost advantages.

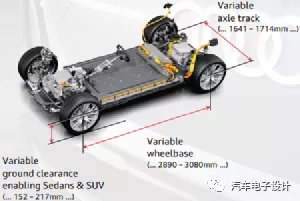

1.2 Configurability of PPE platformThe PPE platform supports multiple vehicle models, mainly in the X-axis wheelbase range of 2890 to 3080mm, Z-axis ground clearance range of 152-217mm (meaning it supports both sedan and SUV models), and Y-axis track width range of 1641-1714mm. This basically covers the B-D vehicle classification and supports Volkswagen’s most important platform for large vehicles.

Audi’s first electric vehicle launched on the PPE platform is the A6 etron, with a design coefficient of drag of 0.22, a WLTP range of over 700km for 100kWh, an 800V voltage platform, and support for 270kW charging power. It can increase the range by 300km after a 10-minute charge, and charge from 5% to 80% in less than 25 minutes. The maximum output power reaches 350kW, and the torque is 800Nm. It adopts air suspension and adaptive shock absorbers.

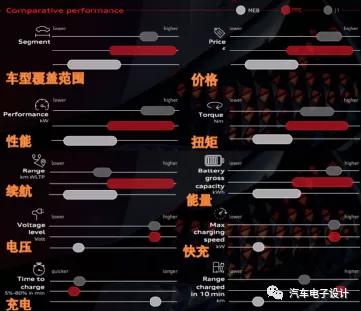

The dimensions of the features shown by Audi this time are relatively few and mainly grouped into: vehicle classification coverage range, vehicle price, vehicle performance (power and torque output), range and battery capacity, and charging characteristics, including charging platform voltage, maximum charging power, 5%-80% charging speed, 10-minute charging range, and so on. Compared to MEB, PPE is positioned as a high-performance platform with higher voltage and charging speed comparable to J1, hence it’s more expensive.

Note: Based on this expectation, and referring to the current pricing of the MEB platform, it’s unrealistic to expect the models on the PPE platform to have a high cost-performance ratio.

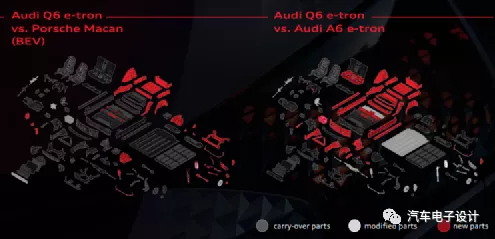

From the PPE platform perspective, Macan BEV, Q6 e-tron, and A6 E-tron actually reuse many parts. The differences between Q6 e-tron and Porsche Macan mainly lie in the shock absorbers, anti-roll bar, rear subframe, rear drive, and some parts of the rear sheet metal. Most of the parts of the two cars are shared. A6 e-tron shares many parts with Q6 e-tron (the battery cover is adjusted), and Volkswagen tries to reuse the basic design on different models as much as possible.

Powertrain

2.1 Battery

It is reported that the first batch of batteries for PPE adopt the solution of SDI. This meeting clearly stated that Volkswagen has chosen the solution of prismatic cells (which is not compatible with soft-pack design in PPE scheme). The PPE battery adopts an 800V system, with a battery energy of 100 kWh and 12 prismatic battery module.

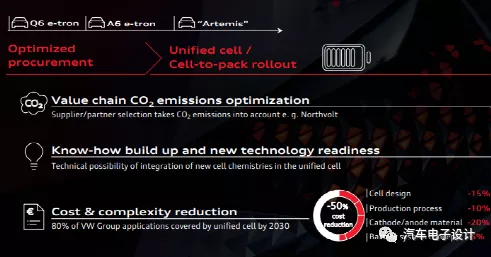

This is a somewhat embarrassing thing: with the launch of the subsequent Unified cell battery, from the future point of view, due to the long preparation period of PPE in the early stage, the final life cycle may not be long.

2.2 Drive system

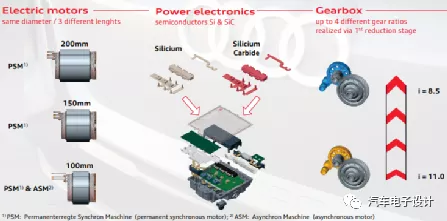

The drive design of PPE is also based on modular reuse. Three motors adopt permanent magnet synchronous (minimum can support asynchronous) and realize different power changes by adopting rotors with different lengths. At the same time, two power chip solutions of IGBT and SiC are supported, and four types of tooth ratios (11 to 8.5) are divided.

The drive system supports an 800V voltage and adopts silicon carbide module. The lubrication system uses an electronic oil pump and a dry skid method to achieve low friction and high energy consumption. The motor adopts hairpin and direct oil cooling to achieve high energy consumption, while considering using rare earth elements as little as possible.

2.3 Electrical and electronic architecture

Due to the software problems on the MEB architecture, Volkswagen is facing the problem that the software used in PPE adopts the SSP of E3 1.2 electrical architecture, and it needs to be planned to E3 2.0 version in the future. Personally, there is no need to expect too much for this part, which is mostly an upgraded version on MEB.

In summary, PPE demonstrates basic features that are essentially upgraded from MEB, with no significant differences in terms of performance as compared with J1. It is my belief that PPE will achieve certain sales volumes in Europe after its launch in 2022, but may not necessarily have a particularly advantageous edge in the competition in China.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.