*This article is reposted from the Autocarweekly WeChat account

Author: Du Debiao

What will be the future form of automotive companies in your mind? Perhaps Tesla has already given us a sneak peek.

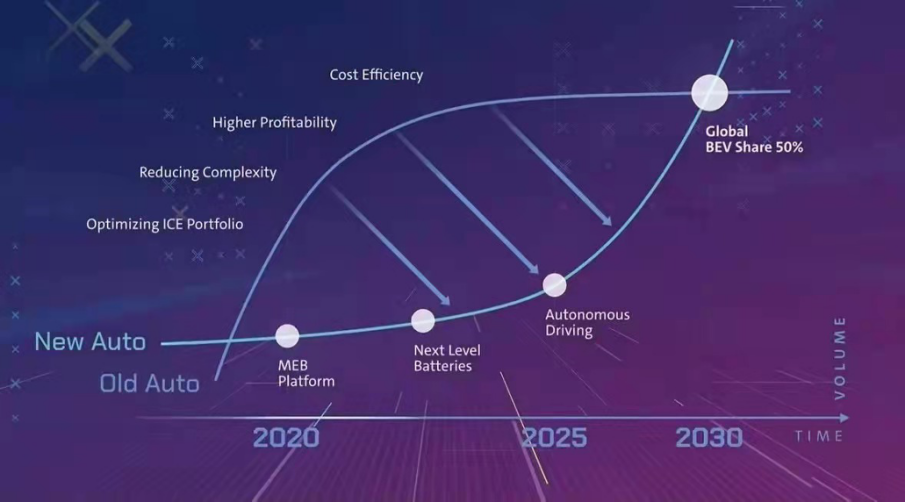

Yesterday, Volkswagen released its 2030 strategy, which generally did not “break the mold.” The sales ratio of traditional fuel vehicles and electric vehicles will change gradually, the establishment of the CARIAD software platform, and the self-developed battery cells all basically replicate the template provided by Tesla. However, for traditional automotive companies in transition, Volkswagen’s strategy still has explanatory and even comparative significance.

We can discuss this issue from two aspects: the corporate level and the user level.

At the corporate level, the play of domestic independent automakers is to have an independent electric vehicle business unit, such as NIO. To a certain extent, this means that both traditional fuel and pure electric vehicles need to be strong, which comes from judgments and predictions about the present and future: the future market share growth of pure electric vehicle models remains uncertain. On the other hand, companies such as Great Wall, BYD and others bet on hybrid vehicles, which can be seen as a gradual route for the transformation of the automotive market and a national strategy for the coming years.

Volkswagen is promoting a holistic transformation, and pure electric vehicles and traditional fuel vehicles are in a state of gradual replacement. For example, Volkswagen proposes that electric vehicles will account for 50% of total sales by 2030. In 2020, this automaker’s global sales were 9.3 million, which means that pure electric vehicle sales will exceed 4.5 million vehicles in ten years.

This number puts forward two requirements: first, Volkswagen must maintain its current size, and second, pure electric vehicle models must maintain continuous appeal.

Yesterday, Diess stated at the strategy release conference that China, the United States, and Europe will still be the three core markets in the future. Volkswagen sold around 230,000 pure electric vehicles in Europe last year, and this year’s ID series sales in China are not optimistic. Although Volkswagen has successfully suppressed Tesla in Europe, it remains uncertain whether the Chinese market can recover to normal as soon as possible and continue to provide strong support, which also involves the user level.

Today, Volkswagen’s internal combustion engine research and development remains basically unchanged. For example, the 1.5T engine of the eighth-generation Golf has no connection with the Chinese market (the entry of the new-generation internal combustion engine into China is likely to wait until the Euro 7 standard is released, but this also has nothing to do with performance; the main purpose is energy-saving and emissions reduction). The main theme is still to reduce costs (different spokespersons of Volkswagen at the press conference yesterday all mentioned cost simplification inadvertently). This tests not only product appeal but also user loyalty.To some extent, the limitations of joint ventures in internal combustion engines can be seen as opportunities for domestic automobile manufacturers. On the other hand, Volkswagen’s plug-in hybrid technology lacks appeal and aggressiveness in both brand and positioning. Therefore, it is estimated that Volkswagen’s top management is uneasy when mentioning the Chinese market. On the one hand, Volkswagen is actively “cooling down” the internal combustion engine, including streamlining its product line, while on the other hand, the ID series has had a difficult start in China. Volkswagen still has a lot of work to do to boost sales in the electric vehicle sector. Hopefully, Diess will not lose too many hairs.

Regarding the strategy itself, as an expert in modular platforms, Volkswagen has provided templates for other brands, including MQB, MEB, Audi’s MSB, MLB, and PPE platforms, all of which will be integrated into a new platform called SSP. The primary goal is still to save money. As for how fuel-powered cars can share structures and components with pure electric cars, the first step is believed to be simplifying the product line of fuel-powered cars. According to Markus Duesmann, Chairman of the Audi Board of Management, the SSP platform not only reduces capital expenditure but also copes with challenges in a software-driven era.

A rough interpretation suggests that hardware consistency facilitates software collaboration, thereby paving the way for autonomous driving businesses. This leads to another core feature of Volkswagen’s strategic briefing yesterday: the CARIAD software platform. However, this platform is not only emphasized by Volkswagen as an integrated mobility service provider from hardware, software, autonomous driving, car rental business and charging support (integration is the keyword that Volkswagen mentioned repeatedly), but also seems to foreshadow the possibility of future channel changes.

Perhaps because the various platforms have not yet been highly integrated into the SSP platform, the R&D process of CARIAD will be divided into three steps. At present, it mainly targets MEB platform products, such as ID.4. In 2023, a high-end software platform will be launched, which can achieve functional diversification, mainly to support remote online upgrades for Audi and Porsche models. In 2025, a unified software platform and end-to-end electronic architecture will be launched.

Contrasting with the timeline for the production of electric vehicles on the SSP platform beginning in 2026, the software system is born one step ahead. The basic idea can be summarized as a software-defined car. Furthermore, this architecture not only provides an operating system but also supports L4 level autonomous driving technology.

In essence, this strategy is similar to Tesla’s gradually established full-stack R&D strategy, while Volkswagen is referred to as an integrated mobility service provider. At the press conference, a short simulation video of a future scenario was also played, showing a female customer taking an autonomous driving taxi from home to the airport and arriving smoothly in a fully unmanned driving state.

Volkswagen did not emphasize the road conditions in the video, so it can be assumed that the autonomous driving system is adaptable to all road conditions. Currently, autonomous driving is a shadow part of Volkswagen’s technology sector, a bit like singing against the Musk era. While Musk is increasingly focusing on expanding sales volume, Volkswagen is starting to set futures.

Volkswagen did not emphasize the road conditions in the video, so it can be assumed that the autonomous driving system is adaptable to all road conditions. Currently, autonomous driving is a shadow part of Volkswagen’s technology sector, a bit like singing against the Musk era. While Musk is increasingly focusing on expanding sales volume, Volkswagen is starting to set futures.

In terms of the overall estimation of electronic architecture and software business capabilities, Volkswagen regards it as the core profit sector. Volkswagen expects software-related sales to reach 1.2 trillion euros by 2030, more than the combined sales of gasoline and electric vehicles.

Therefore, compared to the release of the SSP module platform, software is the leader. Maybe in the future, you’ll see a Volkswagen that looks more like Google.

This may trigger a series of revolutions, such as channels. At the end of last year, Tesla abandoned SAP and developed its own EPR (which can be understood as an enterprise management system) to better serve Tesla’s direct sales model. In other words, a highly developed software system actually breaks down the barriers between manufacturers and customers. The so-called customized pre-product stage is not new to you. Domestic new forces are keen on this.

Highly developed artificial intelligence can handle autonomous driving and even parts of work that were once done by manpower. Therefore, it can be speculated that Volkswagen’s channels may undergo changes in the future and may also adopt image centers like new forces, but this depends on Volkswagen’s software development capabilities. Therefore, even though Volkswagen mentioned a lot of actions within the traditional business scope of manufacturers yesterday, such as modularization, Volkswagen has actually decided to become a software-driven mobility service provider. This is the most critical part of the change.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.