Translation in English Markdown

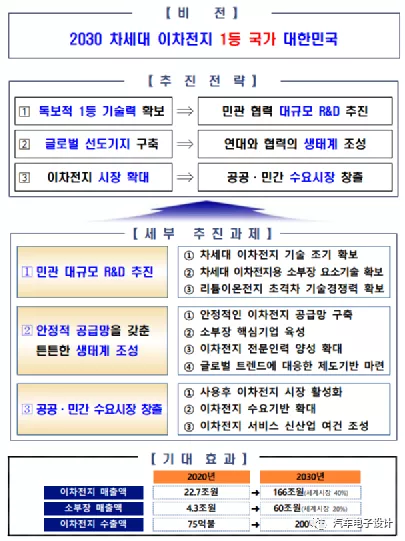

On July 8th, the South Korean government released the “2030 Secondary Battery Industry (K-Battery) Development Strategy”, which designated the core technology of batteries as a national strategic technology parallel to semiconductors, highlighting the overall pattern and importance of the current international technological competition. Through investment from South Korean battery companies, they plan to invest over 40.6 trillion won (approximately RMB 230 billion) in the battery industry by 2030.

With this document in hand, today I will do a simple translation and sorting of the overall plan.

K-battery’s Strategic Text

1) Global Competitive Landscape

In this document, it is clear that the current battery strategy is the internal development mode of China in the domestic market and the situation where South Korea and Japan aim to compete in the global (European and American) market. Since South Korea relied on public-private joint technology development in 1997 to gain its current position, it still needs to continue efforts to enhance its global leadership.

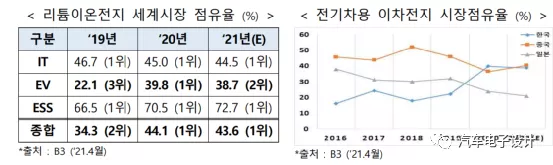

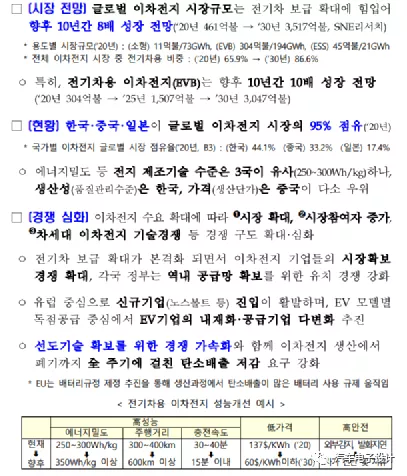

The global secondary battery market size is driven by the expansion of electric vehicles and is expected to grow 10 times in 10 years( from 461 billion in 2020 to 3.517 trillion in 2030), especially in power batteries (EVB). Currently, South Korea, China, and Japan account for 95% of the global secondary battery market (in 2020). According to B3 data, South Korea accounts for 44.1%, China accounts for 33.2%, and Japan accounts for 17.4%.

The current technology level of battery manufacturing, such as energy density, is similar in the three countries (250 ~ 300Wh/kg). South Korea has an advantage in production quality, while China has an advantage in production capacity and price. As the demand for rechargeable batteries expands and more market participants emerge, the competition for next-generation power battery products will become more intense. New companies (like NorthVolt) are actively entering Europe.

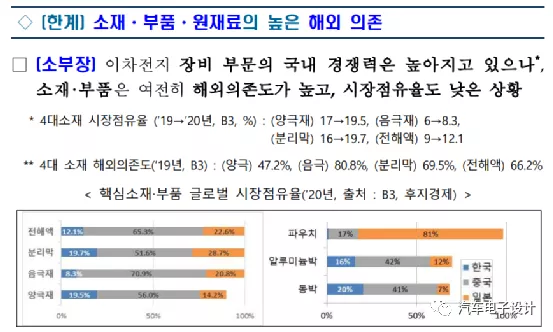

The competitiveness of the South Korean power battery equipment industry has been strengthened, but the dependence on battery materials and components from foreign sources is still high, resulting in a low market share. The dependence on four major materials are: negative electrode (47.2%), positive electrode (80.8%), separator (69.5%), and electrolyte (66.5%).

2) Characteristics of the secondary battery industry

There are several main ones: technology-intensive, supply chain management, and consumer-oriented.

A) Technology-intensive means that continuous R&D investment is needed to lead the technological direction.

Materials – Long-term and continuous development is required to achieve performance differentiation, such as special gravity control, balance, stability, etc.

Design – Trendy design technology to meet consumer needs (“battery formulation”).

Process – Promote process management and improve production efficiency.

B) Supply chain management means that, currently, material costs are high, and stable procurement management is needed.

Material/component costs – Account for over 70% of production costs → the proportion of secondary battery price reduction is increasing.

Source of raw materials – Major raw materials are concentrated in specific countries → stable procurement and price fluctuation management is crucial.

C) Consumer-oriented means optimizing design based on consumer demands.

Customization – Various demands of consumers in electric cars, mobile phones, etc. (shape, performance, quality, price, etc.)

Meet all kinds of needs – Focusing on various industries, such as electric cars, mobile phones, drones, robots, aerospace, defense industry, etc. As the scope of application of the industry expands, battery development needs product customization.

Measures taken by the South Korean governmentThe South Korean government will carry out large-scale research and development, provide tax and financing support for enterprises, and cultivate more than 1,100 professionals annually. The government will invest KRW 306.6 billion from 2023 to 2028 to strive for the commercialization of solid-state batteries, lithium-sulfur batteries, and lithium-metal batteries ahead of schedule. The government will establish a battery research and development innovation fund. Based on the existing KRW 30 billion technical innovation professional fund, an additional KRW 20 billion donated by the three major battery manufacturers and KRW 30 billion of private investment will form an KRW 80 billion fund to support the R&D projects of medium-sized backbone and small enterprises in the battery industry. The government will provide tax deductions and incentives of 40% to 50% and up to 20% respectively for R&D activities and equipment investment. The number of participants in master’s and doctoral-level talent training projects involving various universities will increase from 50 to 150 people. The government will also establish a system of hiring long-term professors for energy, electronics and other related subjects at national universities and local key universities for battery education.

The road map for the development and demonstration of power battery technology promoted by the South Korean government is as follows:

Summary: The latter half of the document is written in a rushed way. We will supplement important information and ask readers to refer to it on the weekend.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.