Recently, the overall top-level requirement in Europe and America is to accelerate the time when zero emissions are achieved. “The G20 draft communiqué shows that the EU is calling for the requirement of zero emissions from vehicles to begin in 2035.” Therefore, all European car companies are showing the management and shareholders the path to success in this transition. This is also the case with Stellantis’ electric vehicle demonstration. Therefore, Stellantis has confirmed an investment of 30 billion euros by 2025, partly by investing old assets, and partly by injecting certain help from the French and Italian governments to support this transformation work.

Electric Vehicle Platform

1) Vehicle Platforms

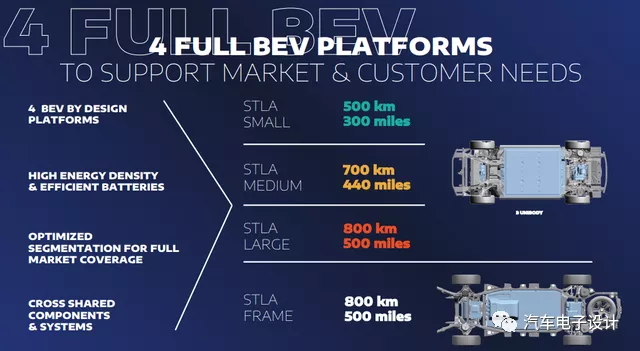

Stellantis is a product of the combination and fusion of French, Italian and American car companies, so it needs to cover four platforms: small, medium, large cars, and pickup trucks from a platform perspective. Therefore, Stellantis has planned four platforms, namely STLA-Small, STLA-Medium, STLA-Large, and STLA-Frame, covering different ranges from 300km to 800km, in terms of mileage.

Specifically:

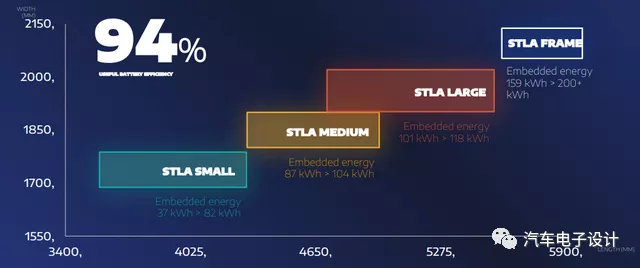

STLA-Small: The battery capacity ranges from 37-82 kWh. The vehicle dimensions are (1700-1800mm, 3500-4200mm), and the highest mileage support is 500km. Logically speaking, it supports cars from A0 to A level, and I personally think that this is mainly aimed at European demand and mainly covers Stellantis’ European brands.

STLA-Medium: The battery capacity is between 87-104 kWh, and the mileage can reach 700 km. This demand mainly covers the needs of Italian luxury brands and American Jeep. We can see that intermediate cars of luxury brands and the United States are starting to use large capacity.

STLA-Large: The battery capacity is between 101-118 kWh, and the mileage can reach 800 km. This is the large car of a luxury brand.

STLA-Pickup: The battery capacity ranges from 159-200+kWh, which should only be applicable to large pickup trucks in the United States.## Battery Layout

From this plan, the width of the battery is not fixed, which means four battery systems should make use of the length and width dimensions as much as possible to match the electricity capacity.

Battery Planning

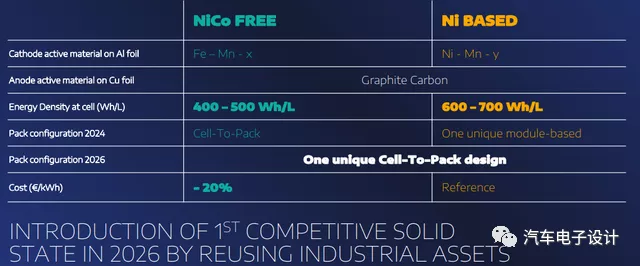

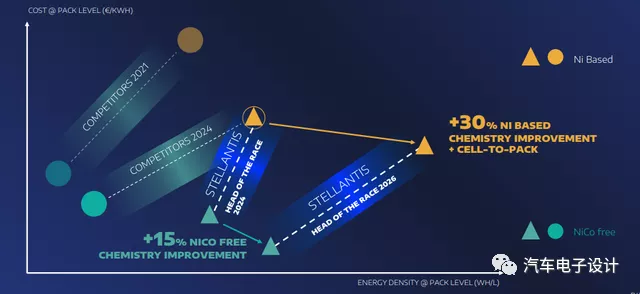

Like all car manufacturers, Stellantis also needs to choose among low cost, high energy density, and future solid-state battery technologies. The no-cobalt route will adopt iron lithium (400-500 Wh/L) combined with the Cell-to-Pack design concept in 2024, and further evolve into a unified plan according to optimization by 2026. High-nickel (600-700 Wh/L) will cover three large battery platforms with a demand above 87 kWh.

Regarding cost control, Stellantis has given a fuzzy strategy, which is to compare with oneself. However, it can be seen that the iron-lithium-based technical plan still has advantages in terms of absolute price. In my understanding, in this round of comprehensive electrification, all car companies have a high demand for cost reduction, which is not far from the future of comprehensive import. On the one hand, the expansion of iron-lithium-related production capacity is relatively easy, and on the other hand, it can be seen that the future manufacturing barriers are not high, and the technology and design thresholds are relatively high. The iron-lithium battery should be easier to enter the fiercely competitive market.

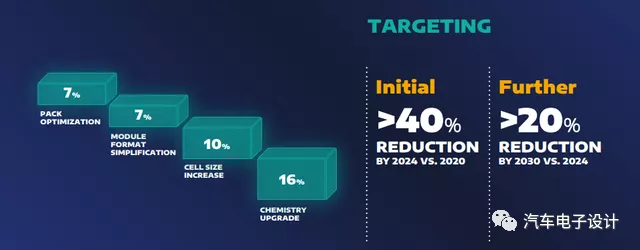

Regarding the path of cost reduction, it mainly focuses on pack optimization, module simplification (increasing and optimizing module size), increasing cell size (large battery route), and increasing electrochemical systems. In my understanding, this round of Stellantis basically reused what has already happened in China and learned from it.

Looking at the battery capacity planning:

- Approximately 130GWh (90GWh in Europe and 40GWh in North America) for the whole of Europe and North America in 2025, with three super factories located in Germany, France, and Italy.

- It will reach 260GWh (170GWh in Europe and 90GWh in North America) by 2030, with an additional two super factories.## Drivetrain and Charging

1) Drivetrain

In the future, all drivetrains may be produced in-house by car manufacturers. This trend is already apparent in China, where Stellantis has indicated that power components may be outsourced, but control boards and EDM systems will be self-produced. This system covers 70 kW, 125-180 kW for intermediate cars, and EDM3 covering 150-330 kW, compatible with 400-800V for large vehicles.

Note: The motor is the first component to be brought in-house. In the future, the design of the inverter will also be mostly done by the car manufacturers themselves. Aside from battery cells and power devices, car manufacturers need to fully master the core components of the three-electric system.

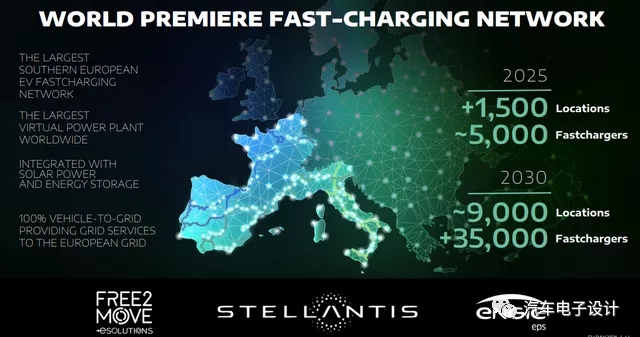

2) Charging Network

When all European car manufacturers began aggressively deploying fast charging networks, the government needed to support just one pathway. So, we can see that regardless of whether it is Volkswagen or Stellantis, fast charging networks will be the backbone of major European countries under their combined push in the future.

Note: NIO, if they go to Europe to promote swap stations, would face major technological differences with the current main technological pathway in these European countries, and their advantage would be minimized, as the characteristics of short swap time under the support of 350 kW fast charging are not obvious.

Summary: The situation in Europe is more radical in 2021 than it was in 2020. The rapid increase in Europe’s BEV penetration rate in 2020 gave the EU sufficient confidence in the chosen path. This has also driven European car companies to invest heavily in electric vehicles, leaving them with no other choice.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.