According to the data from the Automobile Association, the production and sales volume of new energy passenger vehicles in the first half of 2021 reached 1.149 million and 1.14 million respectively, which is still a remarkable number (the data from the Association of Passenger Cars’ wholesale and retail sales were 1.087 million and 1.001 million respectively). For me, the impact of this data on the second half of the year, especially after the consecutive increase in May and June, is particularly noteworthy, as it differs significantly from what I had previously deduced.

Note: Tesla exported 41,000 units, and with other companies, there may be a difference of about 60,000 to 70,000 units, which objectively caused the difference between the data from the Automotive Association, the retail data from the Passenger Car Association, and the insured data.

Where is this difference from the first half of 2021:

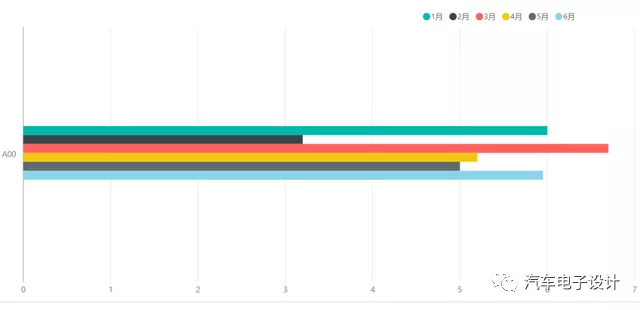

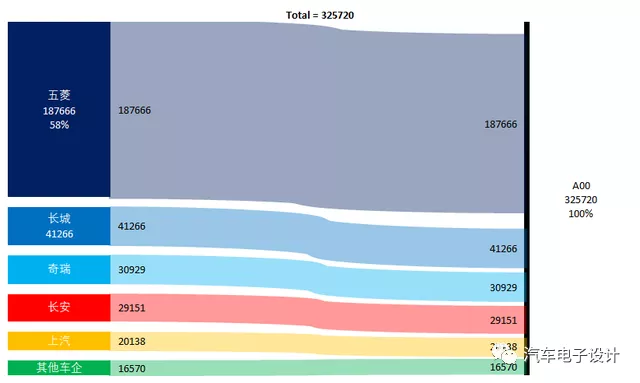

1) Support from A00 level: According to the grading data from the Passenger Car Association, the wholesale volume of A00 level was 320,500, with a pure electric proportion of 35.22%. This market can survive well even without or with limited subsidies.

That is to say, even under the dual conditions of rising raw material prices and chip shortages, traditional automakers can establish a foothold and plant long-term seeds in this market once they adapt to the demand characteristics of this market. From the development model perspective, the path of cost optimization is the way out of this segmented market, without considering fuel vehicles and other competitors (even fuel vehicles cannot survive here).

That is to say, with the easing of the situation in the second half of the year, it is not impossible to reach a total of 680,000 to 750,000 vehicles, with 320,000 in the first half of the year and an additional effort to achieve this goal in the second half of the year (about 60,000 per month, which is close to 700,000).

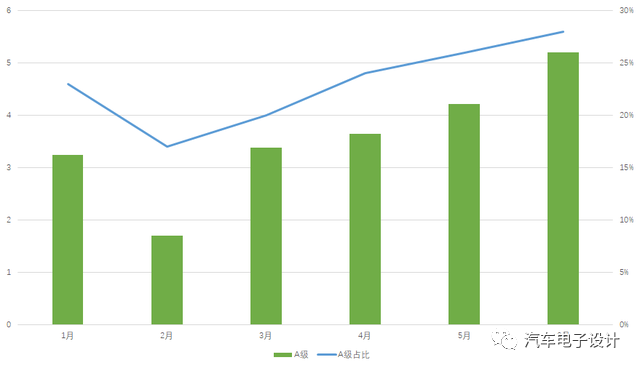

2) Recovery of A-level market:

In 2021, with the overall economic recovery and especially under the current dual-carbon targets, various regions still have the motivation to specify a clear timetable to replace taxis and public vehicles with pure electric vehicles in the 2B market. Therefore, after the pure electric proportion fell in February, the 2B model has been slowly recovering. The wholesale data of A-level in the first half of the year is about 214,000. Over the years, this data has usually experienced a surge since September, so it is expected that this data will reach 300,000 to 350,000 in the second half of the year, bringing the demand for A-level back to the level of 2019. This market can reach 510,000 to 560,000 vehicles.

# Recovery of A-level car market, Figure 3

# Recovery of A-level car market, Figure 3

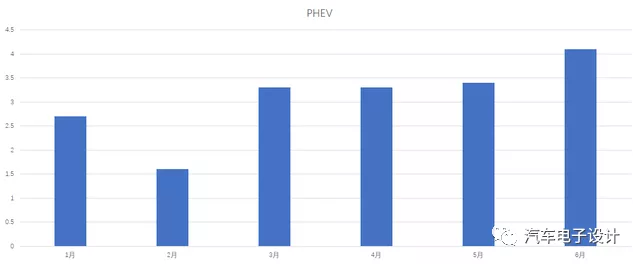

3) PHEV and range-extended EV market

I found these two markets quite interesting, as shown in the figure below based on China Association of Automobile Manufacturers (CAAM) data. The incremental change was mainly caused by DM-i, which led to sales of up to 20,000 units per month earlier. With the introduction of several range-extended EV models such as Liangxiang Ideal One and Seres SF5, the market’s monthly peak could reach up to 60,000 units in the second half of the year. The market may achieve a half-yearly figure of 280,000-320,000 units.

Note that this market may be subject to constraints in cities with license plate restrictions in the second half of the year.

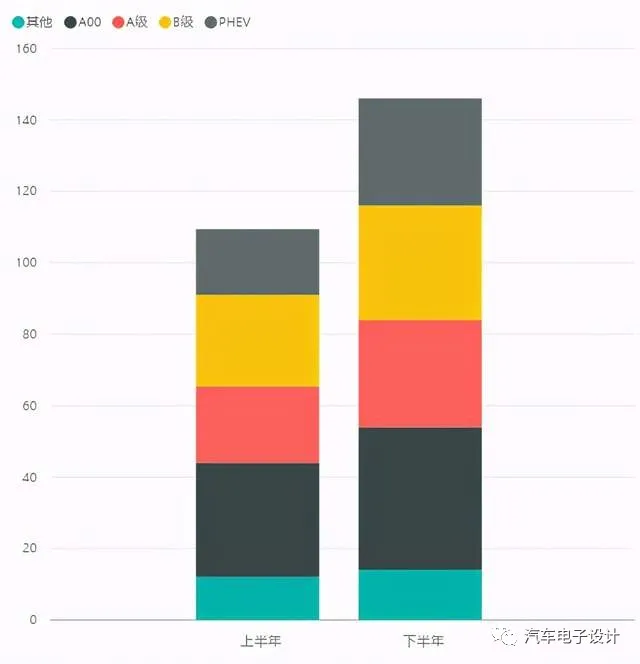

4) Overall expectation for the second half of the year

Breaking it down, an optimistic estimate projects that there will be demand of more than 1.4 million units in the second half of the year alone, driving annual demand to 2.55 million units. The sudden and unexpected growth is mainly due to several factors:

- A00 vehicles with low prices found their way to markets below third-tier cities

- New EV startups priced above CNY 200,000, newly emerged and driven by national demand upgrades and replacement needs, were boosted by purchase restrictions in some cities.

- The public and 2B sectors have been promoted at the local level under the carbon neutrality policy, and pure EVs with a driving range of 500 km are gradually recovering in the A-level market. Although the plan for battery-swapping taxis is not yet mature, EVs with a driving range of 500 to 600 km could still meet the demand for replacements.

- PHEVs with the selling point of low price and fuel-saving have become a penetration point.

When all these factors are combined, the goal of achieving 2.5 million units in 2021 seems more realistic. Monthly sales growth has been stable reaffirming the situation in May and June. It is estimated that NEVs will hover around CNY 200,000 in July and August, and it is unlikely that they will drop significantly.

Note that the consumption of luxury brands and pure EVs priced at around CNY 250,000 is increasing simultaneously, which has always been a trend. However, with demand being gradually squeezed in limited purchase and first-tier cities, this segment is not expected to see major breakthroughs in the second half of the year.

Summary: Of course, what I said earlier is my updated view, and I will still track this process with a cautious attitude. It’s just that since April, conservative predictions (chips are sold so expensive, so many new energy vehicles are sold, I don’t quite understand) have diverged from reality. But indeed, in the macro background, while ensuring demand, there is a contradiction between the current cost growth and target sales planning from the perspective of battery and car companies (the numbers are good, but they can’t make money, and they are lonely after selling). This will be reflected in corporate profits, which is indeed inconsistent. You can see that the contraction of the supply of low-priced fuel vehicles is a very obvious thing. This round is a bit like the shrinkage of fuel vehicles and the increase in electric vehicles in Europe last year. There is no reason to talk about it, but companies have to talk about their dual carbon responsibilities.

Summary: Of course, what I said earlier is my updated view, and I will still track this process with a cautious attitude. It’s just that since April, conservative predictions (chips are sold so expensive, so many new energy vehicles are sold, I don’t quite understand) have diverged from reality. But indeed, in the macro background, while ensuring demand, there is a contradiction between the current cost growth and target sales planning from the perspective of battery and car companies (the numbers are good, but they can’t make money, and they are lonely after selling). This will be reflected in corporate profits, which is indeed inconsistent. You can see that the contraction of the supply of low-priced fuel vehicles is a very obvious thing. This round is a bit like the shrinkage of fuel vehicles and the increase in electric vehicles in Europe last year. There is no reason to talk about it, but companies have to talk about their dual carbon responsibilities.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.