Travel with 100 People’s Media: Focusing on the Evolution of the Automobile Travel Industry Chain

Author: Zheng Wen

We are all afraid of opening Pandora’s box, and what is even more frightening is that we may accidentally open it unconsciously.

In the past week, the automobile industry was in an uproar, and every event was enough to pluck the heartstrings of industry insiders and stimulate every nerve ending.

However, whether you believe it or not, these pulls are still a good signal, and the problems exposed by them have caused enough attention and action, giving the future development of the industry an additional positive force.

Data Security “First Case”

Last night was not calm.

The announcement issued by the Cyberspace Administration of China soon spread throughout the Internet: Due to the serious illegal collection and use of personal information in the “Didi Chuxing” APP, the platform was removed, and Didi Chuxing Technology Co., Ltd. was required to strictly comply with legal requirements, refer to relevant national standards, and carefully rectify the problems.

On June 30, Didi Chuxing, which has been established for 9 years, was listed on the New York Stock Exchange on the last day of the first half of 2021 in an incredible low-key manner, with no clanging of the gavel or any celebration ceremony. It is worth noting that this is the largest IPO of a Chinese technology company in the United States following Alibaba’s $25 billion offering.

Abnormal behavior begets unusual events.

Despite this low-key approach, the footsteps of regulation are still urgent. Just two days ago, new users were not allowed to register for Didi, and then the Network Security Review Office even added a shift and announced the removal of Didi on Sunday night.

All the signals indicate that “digital security” has been placed in a very important position.

In the wave of automobile digitization, “digital security” is a new challenge. Legislation on digital ethics and data privacy in the West is relatively strict. At this time, with Didi being regulated, China’s determination, strength, and speed of improvement in data security are accelerating.

Didi’s removal is the first case after the establishment of the Network Security Review Office in April of last year. Through rectification and review of the industry leader, it not only serves as the best demonstration for the industry but also serves as an immediate warning.

Didi’s monthly active users have reached 150 million people, and it has long become one of the basic infrastructure for Chinese people’s travel. Huawei executive Su Jing believes that Didi is an important role in the big data of travel. As such an important role, it is necessary to conduct strict reviews and rectifications in the field of data security.Just this morning, for the same reason, the Network Security Review Office announced a second round of network security reviews on freight platforms “Yunmanman” and “Huochetou”, and during the review, new user registrations would be suspended.

Motivated by the same reason, the Cyberspace Administration of China (CAC) cracked down on ride-hailing giant Didi Chuxing, initiating cybersecurity reviews, which caused repercussions in the industry. Even Full Truck Alliance (FTA), also known as ManMan, a digital freight platform that has 64% of the Chinese digital freight platform market share, became a listed firm on the New York Stock Exchange a month ago, and the largest digital freight platform in the world, fell into the same dilemma.

The crackdown is a demonstration of CAC’s determination to regulate and supervise data security in corporations, which is crucial for national security. This also highlights the urgent need for the industry to implement safety regulations to handle potential data security risks.

We are in an unprecedented era in which there are no guidelines or past experiences to follow, so we must cautiously navigate through it.

One wrong step could open Pandora’s box, but the CAC’s actions inspire the industry.

Software failure is a huge issue

Last week, the topic “Porsche recalls Taycan globally” surged on Weibo.

Porsche announced it would recall its first electric vehicle, the Taycan, worldwide to address an issue that can lead to a sudden loss of power, according to the company. The recall is due to software that can shut down the Taycan’s drive system. The Taycan’s control unit has an issue with the communication software between it and the battery that results in power losses when the 12V battery is fully discharged.

A total of 43,000 Taycan vehicles are being recalled, with 6,000 in China, accounting for almost all the Taycans sold in China since their shipment. According to public data, Taycan, which was launched on September 4, 2019, sold 20,015 units in 2020 and 9,072 units in the first quarter of 2021.

As electronic components multiply exponentially, software-related technical challenges will continue to become more expensive.There have been numerous cases of smart EVs encountering software problems: from NIO car owners getting locked in due to system updates, to Volkswagen delaying new car launches due to software issues, to Polestar 2 shutting down unexpectedly while driving, causing the vehicle to become immobile and unable to restart, and to Tesla recalling 285,000 vehicles in China due to Autopilot-related risks.

Porsche has acknowledged the existence of this issue, but claims that the probability of it occurring is only 0.3%, and that of the 43,000 recalled Taycan vehicles, less than 150 may be affected. Nonetheless, software issues still pose a menacing threat to car makers, even for a revered brand like Porsche.

Despite the strength of these companies, the fact that they all experience various software problems underscores the industry’s long-standing challenge in addressing these issues.

An independent research institute in the United States even predicts that “60-70% of vehicles will be recalled due to software security issues in the future.”

There is no doubt that software failure remains a major hurdle for the development of intelligent vehicles, and it must be overcome.

Automakers Refuse to Deliver Their Souls

Mixed emotions including hidden concerns about the future of the industry and fears of losing control in the present are brewing.

Among those feeling the pressure most intensely are traditional automakers who once stood at the center stage. This is the reason why the statement by Chen Hong, Chairman of SAIC Group, has sparked discussions.

“Huawei and others may offer comprehensive solutions, but they have become the soul while SAIC has become the body. SAIC cannot accept such a result, and has to hold the soul in its own hands.”

Chen Hong said that they will not accept any supplier’s comprehensive solution, but only cooperate at most.

“The assertion that third party suppliers have taken over carmakers’ souls” portrays the crisis vividly and urgently.

In the current period of change, collaboration has already become a consensus in the industry. “The combination of technology companies’ software advantages and differentiated service capabilities, and traditional automakers’ stable industrial chains and manufacturing capabilities can only create a symbiotic entity that becomes the head player of the automotive digital wave.” Wang Jun, President of Changan Automobile, described a common situation.

When it comes to strategic cooperation, who holds the power is always an issue. This is also Chen Hong’s most immediate concern.

What he refers to as the “soul” is the electronic and electrical architecture of intelligent vehicles and the complete software architecture.# Huawei BU Product Series

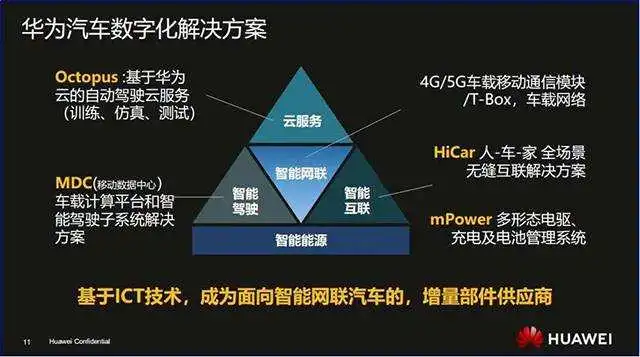

The Huawei BU product series consists of five sections: intelligent driving, intelligent cockpit, intelligent electric, intelligent network connectivity, and intelligent vehicle cloud. “Huawei inside” is the so-called mode designated by Huawei.

Huawei has stated that the “Huawei inside” mode is currently only used with three companies and it is impossible for them to deal with all automakers. “Huawei inside” is defined and jointly developed by Huawei and automakers, and is not suitable for all car manufacturers.

In fact, the vast majority of automakers have strategic partnerships with Huawei, such as Guangzhou Automobile Group, BYD, Geely, and SAIC themselves have cooperated with Huawei. However, for more companies, Huawei provides only parts or vehicle software solutions, not a full range of services.

Therefore, for most independent automakers who survive such fierce competition, they have their own pride and refuse to give up their “soul” in cooperation with technology companies.

Technological Equality

If for traditional automotive companies, retaining the existing market position is their top priority during the transformation, then internet companies, as “barbarians outside the gate,” have “subversion” in mind.

After investing in NETA Automobile, Zhou Hongyi publicly announced to build a CNY 150,000 smart car to achieve technological equality. He believes that NETA and 360’s opportunities lie in smart cars below CNY 150,000, where the Moore’s Law and network effects will enable everyone to use smart cars, thereby maximizing technological equality.

“When the tipping point of new technology appears and users start to enter on a large scale, the network effect will further dilute the cost of hardware and software. And scaling can also promote the Moore’s law to take effect, thereby thoroughly overturning the entire industry.”

Zhou Hongyi used the mobile phone industry as an example. The experience in using WeChat and other apps is not significantly different between the CNY 1,000 and high-end models. Smart electric vehicles below CNY 150,000 account for about 70% of total vehicle sales in China. If this market is not opened up, it means that smart electric cars will always be niche products.

His words actually indicate the “dumbbell-shaped” development characteristics of the Chinese electric vehicle market, and this characteristic is still expanding. In this market, hot-selling models are either A00 or high-end models of B and above, while the mainstream price range has formed a collapsed effect.The top five sales of pure electric vehicles in the first quarter of this year are very typical. Hongguang Mini EV and Ora R1 are small cars, while Model 3, Model Y, and BYD Han EV are high-end models of class B and above. The wholesale data of pure electric vehicles from the China Association of Automobile Manufacturers also shows that the share of A00 class has reached 40%, and the share of class B has exceeded 30%.

This is obviously unreasonable and means that intelligent electric vehicles have not achieved the “technological equality” as mentioned by Zhou Hongyi. Hopefully, the slogan “serving the people” in the 360 office building also confirms his declaration in the automotive industry.

In Shanghai, SAIC is trying its best to defend its territory, while in Beijing, Xiaomi and 360 have decided to challenge the mainstream of this industry that has existed for over a century. Decision-makers are also working hard to suppress Pandora’s box.

Unprecedented times mean unprecedented risks and opportunities, and different roles are carrying out their historical missions. We are witnessing history and also creating history.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.