<video controls class="w-full" preload="metadata" poster="https://upload.42how.com/article/image_20210705143356.png">

<source src="https://upload.42how.com/v/%E9%9B%B7%E8%AF%BA.mp4"> </video>

Renault held an event called “Renault eWays Electro Pop”, which covered several aspects of information:

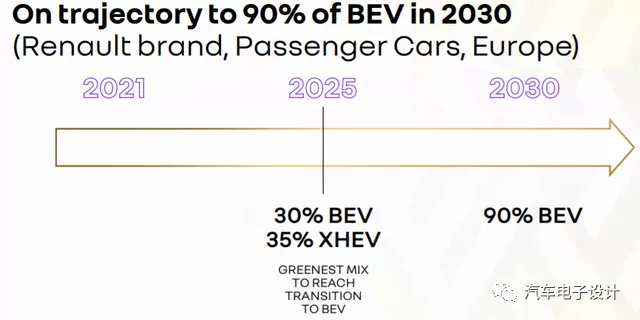

1) Starting from their products, Renault will launch 10 BEVs by 2025, including Renault 5 supermini, Renault 4ever SUV, and LCV based on the CMF-BEV platform. By 2030, the proportion of Renault’s electric vehicles will reach 90% for the entire group (I understand that this only applies to the European market).

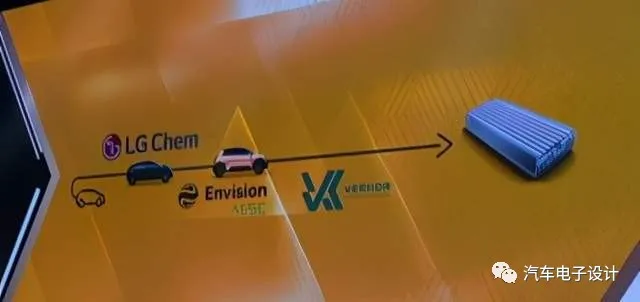

2) Regarding batteries, Renault still adheres to the soft pack route and plans to further reduce battery costs through the three-step process of using LG Chemistry’s existing batteries, Future Power’s upcoming batteries, and Verkor’s future batteries. Based on current information, Renault has no plans to use lithium iron phosphate.

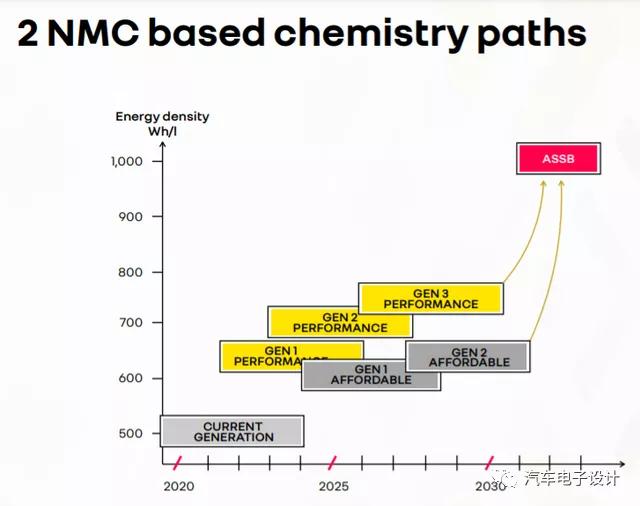

3) Unlike what was previously known, Renault has firmly chosen the ternary NMC route and is building two differentiated solutions based on performance and cost.

Battery Design and Selection

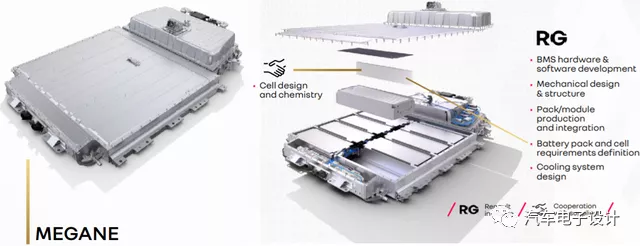

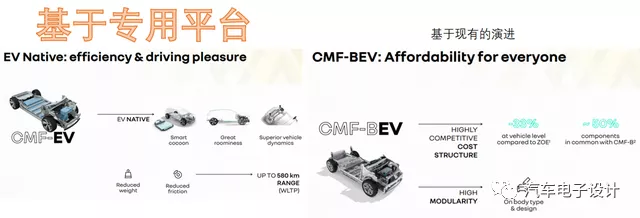

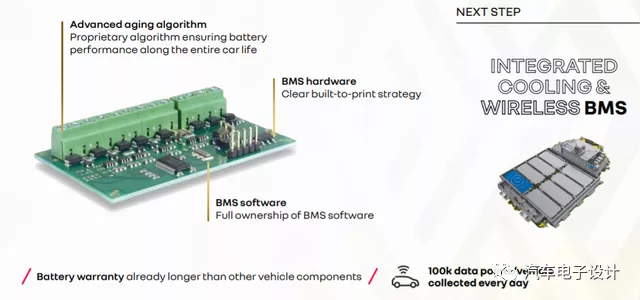

From the launch event, Nissan Renault Mitsubishi has differentiated designs based on CMF. Nissan uses a square shell battery, while Renault still chooses the modular soft pack battery solution. Among them, Renault has listed its in-house battery management system, software and hardware development, battery system structure design, battery system production and module design integration, battery and pack demand release, and finally the design of cooling system.

From a cost perspective, the battery systems are built on two different platforms with different cost targets. The mass-produced version of the MéganE electric crossover, based on the CMF-EV platform, will be launched in 2022, offering a WLTP range of 580 km (360 miles), with a sales target of 700,000 vehicles by 2025. Its selling points include spacious cabin, low center of gravity, ideal weight distribution, quick steering ratio, and multi-link rear suspension from the perspective of traditional cars. In comparison, the smaller CMF-BEV of Renault 5 will continue to pursue low cost.

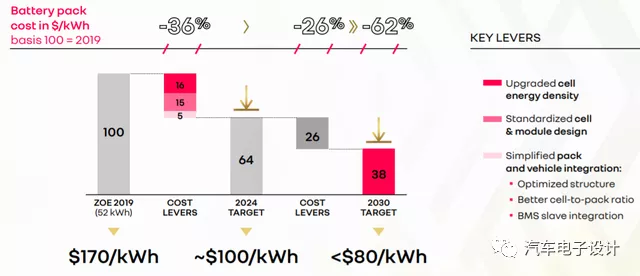

From a chemical system perspective, Renault has chosen the ternary route and plans to produce a total of 1 million NMC (Nickel-Manganese-Cobalt) batteries by 2030. The expected goal is to reduce the battery pack cost by 60% by 2030. (This is based on Renault’s Pack cost of $170 per kWh, 1.1 RMB /wh in 2019) and the target is to be below $100/KWh (6.4 RMB/Wh) by 2025. The use of solid-state batteries can further reduce costs, with a target of below $80/KWh (5.1 RMB/Wh).

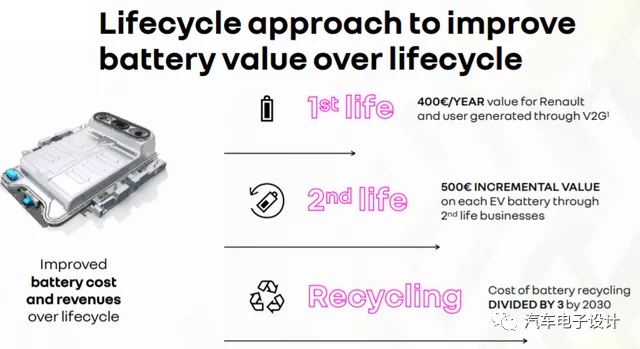

Battery Life-Cycle Management

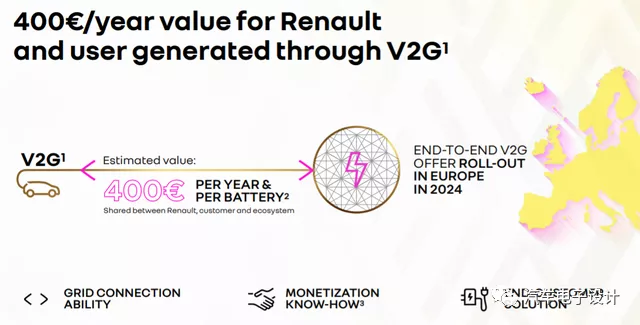

Europe and China have different development environments. After the overall industrial environment shifts towards decarbonization, V2G is being implemented in Europe to support the grid in moving towards a distributed and green direction, which is one step towards energy transformation.

Note: Renault has 500,000 vehicles in France per year, and they are relatively concentrated, making this method more viable.

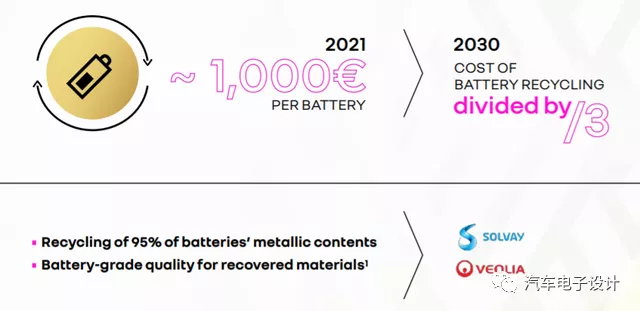

In Europe, the utilization of ladder has not been as fast as in China. It raises serious safety concerns to use ternary batteries in this context. Perhaps the best solution is to reduce the cost of secondary manufacturing by locking in recycling after use. This is currently the most effective path.

In Europe, the utilization of ladder has not been as fast as in China. It raises serious safety concerns to use ternary batteries in this context. Perhaps the best solution is to reduce the cost of secondary manufacturing by locking in recycling after use. This is currently the most effective path.

Summary: From the current situation, most car companies that primarily sell to Europe will need to complete their transition to BEV by 2030. This is due to the current political environment in Europe. It has accelerated the trend towards complete electrification in Europe. Recently, all European car companies have been discussing purely electric platforms and batteries, with companies without battery layouts unable to talk to governments and shareholders. This truly appears quite radical to us, but the overall situation is pushing for this.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.