*This article is reproduced from the autocarweekly official account.

Author: Wen Feng

A few days ago, ACW talked about the fact that car companies don’t love the UEFA EURO 2020. However, there is an exception to this phenomenon – Volkswagen, the veteran European carmaker.

At the opening ceremony, a remote-controlled Volkswagen ID.4 car carrying the match ball arrived at the center circle, becoming the focus of the broadcast, and the electronic advertising screens on the sidelines of each live game also occasionally displayed Volkswagen’s “Way to Zero” advertisement, showcasing their determination to move towards zero emissions to the world.

During the UEFA EURO 2020, SAIC Volkswagen launched the second ID family MEB pure electric vehicle – ID.6 X in the Chinese market. Recently, when scrolling through football-related social media apps, ID.6 X advertisements were spotted, indicating that this marketing campaign is a success – strengthening brand presence with TV commercials and promoting products during match reporting. For fans, it’s hard not to remember.

Although Volkswagen’s brand promotions during this football festival can be described as “having the best of both worlds,” its sales performance in the two main battlegrounds couldn’t be more different. In Europe, Volkswagen’s ID.4 sales exceeded 8,000 units in April and ID.3 achieved sales of more than 5,000 units, ranking first and second in Europe’s new energy vehicle sales. In China, the two ID.4 family models – ID.4 X/ID.4 CROZZ – sold a total of only 1,273 units in May, indicating a poor market share.

In the Chinese market, Volkswagen’s electric cars have not created as much impact as expected and instead have a sense of being overlooked. Why is that?

Is the ID family’s car not good enough?

Let’s cut to the chase, that’s not the reason.

Although the endurance figures may not be outstanding, the official Norwegian Automotive Federation, an official organization in the “big” country of new energy in Northern Europe – Norway, did a “real driving range test” where the ID.3 Pro S achieved a result of 564 kilometers, even better than the official WLTP range of 539 kilometers.The domestic media colleagues also shared with me that the range display of ID.4X is extremely “sincere”, and even when the display drops to 0, it can still provide more than ten kilometers of additional range, which is definitely not something that some followers who are accustomed to “dressing up for show” could do. In terms of actual battery power degradation rate, Volkswagen also has ample experimental data to provide confidence.

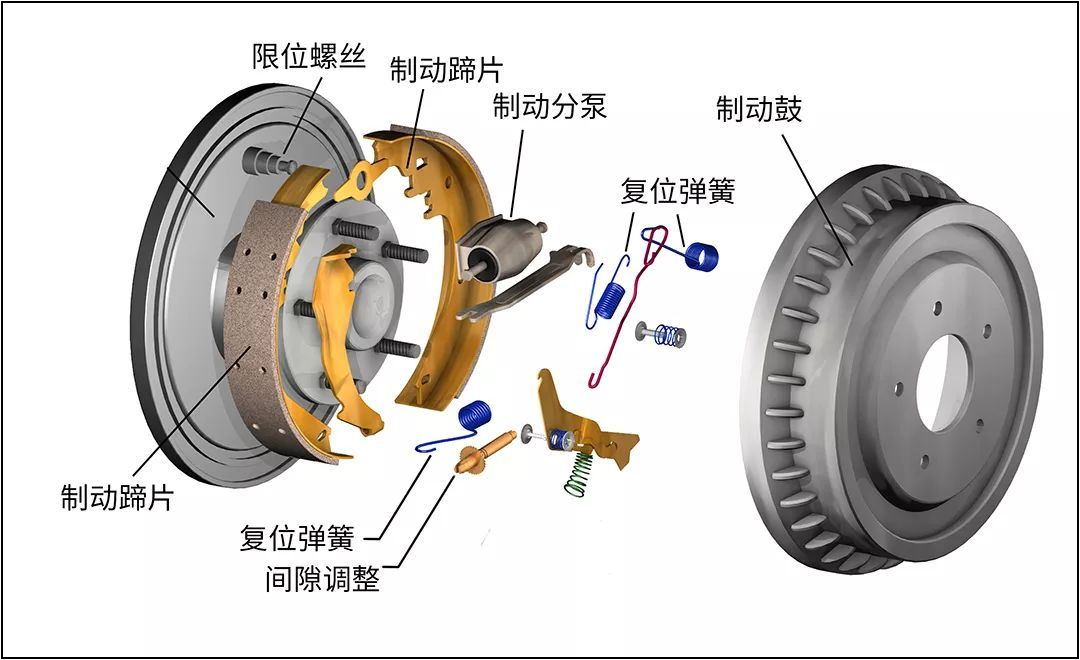

The issue of “downgraded brake drum replacement” that many netizens criticized online is actually an unfounded accusation. The media colleagues’ tests show that ID.4X can come to a complete stop from 100 km/h within 33 meters at best, and can maintain a distance of no more than 35 meters even with multiple continuous braking, completely surpassing 90% of disc brake products on the market.

Drum brakes themselves have less rotational inertia, higher braking efficiency, and are less susceptible to environmental pollution. Don’t forget that the ID family of products also have a rear motor that serves as an important “brake”, so the chance of using mechanical friction heating for braking is actually few and far between.

Most media teachers who have driven both the northern and southern Volkswagen ID.4 brothers have praised these two cars, believing that they have “good fundamentals”. So what is the reason for users not buying?

Where is the peak experience in Volkswagen electric cars?

In fact, evaluating Volkswagen’s ID family is a matter of “the tail wagging the dog”. When we buy an electric car, what are we really buying?

To criticize the ID family for using “drum brakes” is to blindly hold on to ideas of the past and discount the present. In users’ minds, the ID family with the VW logo is just a “gasoline car” transformed into an electric drive form, and therefore all “common sense” about gasoline cars can be seamlessly transplanted over.

Just imagine, if it were Tesla that installed drum brakes, this is what might happen:

-

Users familiar with cars study and discuss the pros and cons of drum brakes carefully and rationally, and then come to a conclusion that they are reasonable.

-

Users who are not familiar with cars feel that Tesla’s emphasis is on technology, and the mechanical structure of brakes is not important, as Tesla has its own reasons.

To sum up, as long as Tesla’s braking is effective, any type of brake can avoid becoming negative news. Otherwise, the opposite would be true…

Why do people still use the knowledge structure of oil vehicles to evaluate Volkswagen’s pure electric vehicles?

In my opinion, this is not only because the Volkswagen brand is regarded as an “absolute representative of traditional car makers”, but also because of the feeling created by the Volkswagen ID family products. Just look at the two brothers, the Volkswagen ID.4 in the north and the south.

-

The body is not large, at the level of 4 meters 6, with a main sales price of 200,000-250,000, which is a standard JV A+ level SUV pricing strategy;

-

The acceleration is not fast, the four-wheel drive is slightly better than the 2.0T high-power Touareg, with a time of just over 6 seconds;

-

The intelligent driving system is not strong, with ordinary lane keeping and adaptive cruise control;

-

The vw.OS car system initially had user complaints about many bugs, and in the long run, the experience is not much different from that of ordinary oil vehicles;

-

Emphasizing AR-HUD, but the overall cockpit design is not as futuristic as that of Mercedes-Benz;

As you can see, it is still the standard answer of a “water barrel car”. Install an engine and a gearbox, open the nostrils for intake, and this is the next generation of Tiguan!

By comparison, as a pioneer in opening up the private consumer market, Tesla does not pursue comprehensiveness, but continues to output “peak experience” to users – that most daring, unique, and memorable moment, whether it is staggering acceleration, minimalist cabin design or “self-assertive” FSD.

Other pure electric products with outstanding sales performance also have their own unique strengths. Each model like BYD Han and XPeng P7 seduces users with their own charm.

Therefore, you will see that users who do not have charging poles are willing to buy the entry-level lithium iron phosphate Model 3 with winter endurance and no FSD, but few people buy the more sturdy and spacious ID.4 brothers with better endurance and practicality.

For Volkswagen, has the platform-based routine and product thinking that used to be easy and familiar failed?

These new energy users are only “early adopters”

Volkswagen is the first foreign car company to widely adopt standardized pure electric platforms. Its determination to transform cannot be said to be not resolute. It is like the excellent student who started preparing for the college entrance examination while other students still played games in the muddy water.

However, the public seems to have made a wrong prediction on the “college entrance examination time”: in fact, the new energy vehicle market is still in the “admissions” stage. At this stage, most “examiners”, that is, users, purchase their first new energy vehicle. What they expect is not a standardized answer, but a memorable first impression.

However, the public seems to have made a wrong prediction on the “college entrance examination time”: in fact, the new energy vehicle market is still in the “admissions” stage. At this stage, most “examiners”, that is, users, purchase their first new energy vehicle. What they expect is not a standardized answer, but a memorable first impression.

Nobel laureate in economic sciences Daniel Kahneman proposed in “Thinking, Fast and Slow” that the human brain has two decision-making modes: “System 1” makes decisions based on intuition, which is highly associated with emotions and relatively decisive; “System 2” makes decisions based on reason, requires collection of information to solve problems, and has a longer decision-making cycle.

The former is the typical thinking mode of “early admission” new energy users.

In April this year, when the Tesla brake door incident continued to ferment, Model 3’s sales dropped by 19,000 units, driving the entire new energy vehicle market down by more than 20,000 units compared to March. In May, the sales growth of the replacement models with strong substitutability, such as BYD Han EV and XPeng P7, in the private consumer market was very limited, and a considerable part of them turned into sales of Model Y.

From the sales figures, users seem to be buying not new energy vehicles, but the “Tesla” brand. In the past, Tesla stores were crowded with people, but during the auto show, users criticized it. Behind the ebb and flow, the vast majority of users are still in the “System 1” thinking logic, making Tesla the absolute “pure incremental” consumer in the private electric vehicle market.

If we enter the “System 2” of rational logic and give up Tesla, are most users using cheaper new energy vehicles as substitutes for Model 3? Sales data does not support this speculation, even XPeng P7 and BYD Han EV hardly got a share, let alone those products that look “plain”.

Before the Volkswagen ID family entered the Chinese market, vehicles such as the WmAuto EX5/EX6, BYD Song PLUS EV, GAC Aion V, and Ai Chi U5…were all pure electric products with relatively unclear self-portraits in the 150,000-250,000 yuan range. The final sales figures, especially the sales figures of private users, did not have many outstanding achievements.

If you are a salesperson of the above models facing a private user, please listen to the following questions:

- In an area without license plate restrictions, with the same budget, please give them an irrefutable reason not to buy any of Roewe RX5 Max, Honda CR-V, Volkswagen Tiguan L, or Skoda Kodiaq.- Provide an irrefutable reason to buy any of the following car models – Model 3 / XPeng P7 / Nio ES6 / Volvo XC40 RECHARGE / BMW iX3, without spending more money, in limited license plate areas.

Whether thinking from the perspective of “System 1” or “System 2,” for “mundane” new energy products, the private consumer market is not yet ready, and even the popular ID family of Volkswagen will also face challenges in attracting customers. In brief, the current user base of the Volkswagen ID family mostly comprises the intersection of the following two conditions:

-

Living in limited license plate cities without conventional cars, intends to purchase the only car for their family, not just for commuting but also meets most of the requirements for various scenarios.

-

Strictly controlling the budget, it is completely impossible to add money to purchase a more expensive luxury brand or new energy vehicle.

How many such people exist in the current stage?

Some people say that Volkswagen is different from other automobile brands because they have a more mature dealer network, which gives them a natural advantage over other brands. Currently, both northern and southern Volkswagen are relying on their previous dealer network to build urban exhibition halls and design new retail rules. However, this is only a necessary but not sufficient condition for the Volkswagen ID family to reach their end-users. Some other facts to consider are:

-

Approximately 50% of new energy vehicles in China are sold in first-line/new first-tier cities. Low-tier cities mainly sell Hongguang MINI EV, while the sales of new energy vehicles above 200,000 yuan are mainly concentrated in first-line/new first-tier cities (especially limited license plate cities).

-

About 35% of China’s passenger vehicles are sold in first-line/new-first-tier cities. It can be seen that the “mature dealer network” accumulated by Volkswagen in the era of gasoline vehicles is not concentrated in big cities but has a stronger penetration in low-tier cities. However, this has little effect on the sales of ID family vehicles.

-

In first-line cities, many car companies have previously had storefront layouts that are not weak; but few enterprises have commandeered more customers due to their expansion of storefronts.

-

Volkswagen’s stores are always bustling with people, but according to the frontline sales feedback, the number of users who actively inquire about ID family products is very limited.

I dare to speculate that if B-side market opportunities are not taken into consideration, it is difficult for the sales volume of the ID family to improve significantly in the short term.

Should Volkswagen be worried about the sales of the ID family?

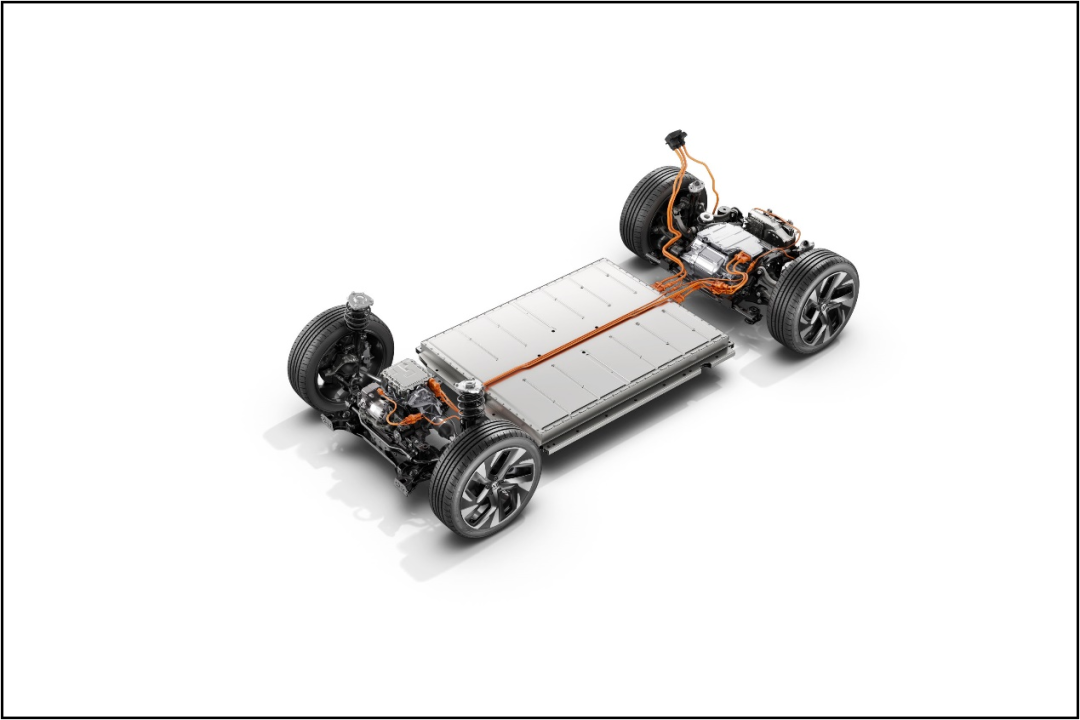

If the sales volume of the ID family is not expected to improve significantly in the short term, should Volkswagen be worried in the Chinese market? Actually not, Volkswagen’s layout with the MEB architecture is not backward but “ahead.”The outstanding sales of Volkswagen ID family in Europe are not accidental. Compared with high-performance, autonomous driving, and intelligent connectivity, European consumers prefer to pay for the environmental concept and cost advantages of electric drive itself. What Volkswagen ID family provides is a product that is very consistent with local market expectations.

In Europe, driving gasoline cars is already very expensive. According to statistics, the average price of 95 gasoline in 30 European countries last year was about 1.32 euros/liter (about 10.16 yuan/liter in RMB), not including other additional taxes and fees generated by driving gasoline cars. Under the pressure of the trend of environmental protection, ordinary people choose pure electric forms accordingly, which is normal. Even Shell gas stations have started to build charging facilities.

In China, new energy and autonomous driving and intelligent connectivity have been strongly linked by new forces for a long time, but some traditional users do not have a strong perception of these emerging things. Coupled with the scarcity of charging infrastructure, they also lack the willingness to actively switch to new energy models.

However, this does not mean that these users will completely exclude electric vehicles, because as time goes by, the cost of driving gasoline cars will also increase. China will complete carbon peaking in 2030 and carbon neutrality in 2060. At present, many regions across the country have started demonstration transactions for carbon offset. If someday, users driving gasoline cars have to pay a substantial fee for their carbon emissions, then under the pressure of cost, regardless of the development of autonomous driving technology and vehicle restriction policy, most rational users will still eliminate gasoline cars and turn to electric vehicles.

For electric vehicles, this is the most anticipated market opportunity. By then, Volkswagen will be able to take advantage of its platformization just like in the gasoline car era, rapidly deliver new products like making dumplings, and deliver them to users across the country. This is where Volkswagen’s early layout strategy lies.

Now, what Volkswagen brand needs to do is to hold its share in the gasoline car market and remain one of the top choices for mainstream users.

Then wait quietly until the oil price rises.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.