After a discussion with a colleague responsible for plug-in hybrid electric vehicles (PHEVs), I think it is necessary to summarize the situation of PHEVs in 2021 and provide a summary of the DM-i models that may have a significant impact on this segment in the second half of the year. Overall, the situation can be summarized as follows:

- Putting aside DM-i and the Ideal One, the development of PHEVs in this period has not been smooth. Companies from Germany, the United States, France, Japan, and Korea all have their own PHEV plans, but the results have been disappointing in 2021. Currently, it seems that foreign companies committed to PHEVs have not been successful.

- The technological path of the Ideal One is more inclined towards a pure electric range (plug-in) system. It is feasible for SUVs and MPVs but has been difficult for sedans due to the limited arrangement space.

- The DM-i path focuses on low cost, low fuel consumption, and is more like a hybrid (consumers do not need to plug in to use). The core difficulty here is to persuade consumers to install charging stations to obtain policy benefits, such as tax reductions and new energy credits. This requires convincing consumers to charge their vehicles, which may be constrained by the market, especially after the incentives for tax reductions and license plate discounts are eliminated in 2022.

PHEV Market in 2021

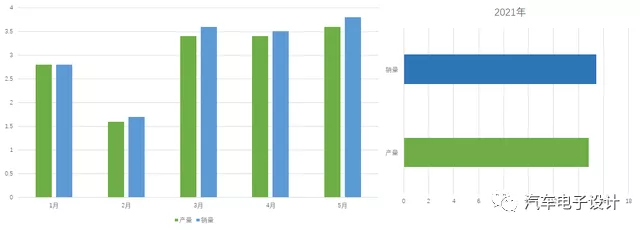

As shown in the following figure, the production and sales of PHEVs in 2021 were 148,000 and 154,000 units respectively, and the market was in a stage of overall destocking. Stable data is maintained at around 35,000 units per month.

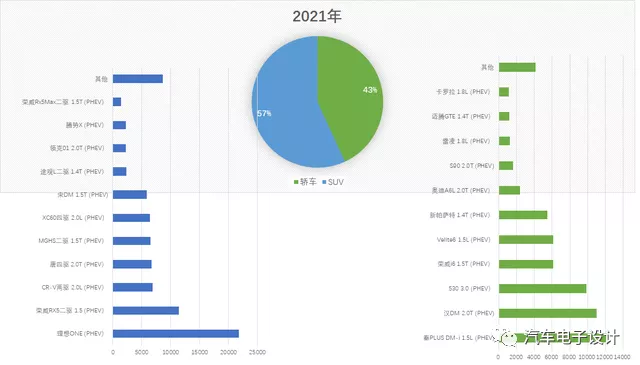

- From the production data for 2021, sedans accounted for 43% of the PHEV market (62,373 units), while SUVs accounted for 57% (82,297 units).

The top three sedans in this market are Qin DM-i, Han DM, and 530 PHEV version, all of which have accumulated production of around 10,000 units.

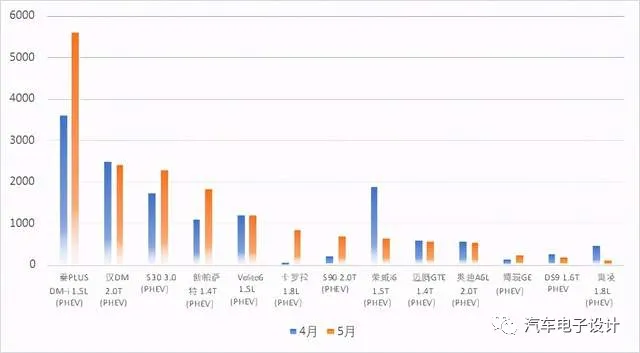

The Qin PLUS DM-i 1.5L (PHEV) had monthly production of 3,597 and 5,612 units in April and May respectively, showing a clear upward trend, and accumulatively producing 12,177 units. I will focus on this model later.

The Han DM 2.0T (PHEV) had monthly production of 2,496 and 2,417 units in April and May respectively, with an accumulated production of 11,008 units.

The 530 PHEV had monthly production of 1,738 and 2,290 units in April and May respectively, with an accumulated production of 9,841 units.

- In the SUV PHEV market, the situation is as follows:## Markdown text in English

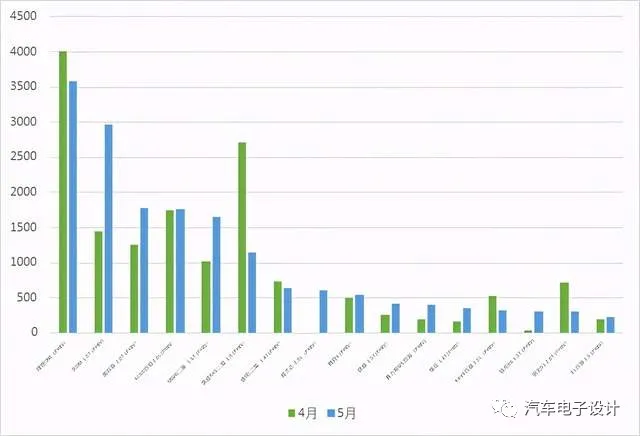

Ideal One PHEV had a production target of 4,000 units in April and 3,582 units in May, with a total output of 21,730 units.

Roewe RX5 had a production of 2,712 units in April and 1,140 units in May, with a cumulative output of 11,364 units. MG HS 1.5T PHEV, with a front-wheel drive, had a sales volume of 6,500 units and was mainly exported overseas.

BYD’s two SUVs, Song DMi, had a production of 1,441 units in April and 2,962 units in May, with a total of 5,863 units, showing a fast growth. Tang PHEV had a production of 1,249 units in April and 1,777 units in May, with a total of 6,690 units.

Similar to the SUV market, DM-i’s production is also increasing among sedans, while most other automakers maintain stable supplies of plug-in models.

Overall, in the SUV market, the upcoming model change of Ideal One may provide a boost, with Song DM-i showing a relatively high growth rate, while other models do not stand out.

Therefore, the most prominent change from the overall market perspective is still the long-awaited DM-i, which has had a significant impact on production. With 5,045 units produced in April and 8,045 units in May, the overall market would have dipped below 30,000 units without these two models.

BYD DM-i Situation

1) Production, Sales, and Insurance

I compared the production and sales data from the China Association of Automobile Manufacturers (CAAM) with the insurance data. Production and sales data from CAAM are consistent, while insurance data are delayed in time, so differences between them are understandable.

Note: Han DM and Han EV both had a lag period, with Tang DM still in the destocking phase and in a stable sales volume stage.

Sales of DM-i are steadily increasing, with around 8,500 units sold in May, compared to 5,000 in April, representing a significant increase. Of these, the Qin PLUS DM-i accounted for 5,542 units, while the Song DM-i approached 3,000 units.

Sales of DM-i are steadily increasing, with around 8,500 units sold in May, compared to 5,000 in April, representing a significant increase. Of these, the Qin PLUS DM-i accounted for 5,542 units, while the Song DM-i approached 3,000 units.

The strategy of DM-i this time is to differentiate itself from DM-p by emphasizing fuel efficiency and price. Therefore, from the data of the insurance market, it is similar to Ideal ONE, with the characteristic of relatively dispersed sales (due to price considerations, even surpassing Ideal ONE). In terms of sales distribution, the top ten cities for Qin and Song DM-i in January-May 2021 accounted for 43% and 32%, respectively. The proportion of the largest city in each region was less than 10%, which was completely different from most PHEVs, and did not only concentrate on restricted cities (this point is important, as initial demand did not come from restricted cities, and future demand for licenses is not prominent).

Although the proportion of Shanghai for Qin DM-i is the highest, it is only 9%, while Shenzhen is 6%, and Hangzhou is 4%.

As for Song DM-i, its insurance distribution is more limited, making the overall distribution even more dispersed than Qin DM-i.

Currently, PHEV is mostly driven by private demand, with DM-i accounting for 90% of personal consumption, 8%-10% for unit purchasing demand, and low demand for operation. Because BYD’s configuration is provided in a descending order from high-end to low-end, the sales of the 110km and 55km pure electric range versions of the Qin PLUS DM-i are evenly split at 50%, while the sales of the 110km version of the Song PLUS DM-i account for 75%. This is related to the current supply of the manufacturer, which initially provides high-priced models and gradually moves to lower battery capacity models.Regarding the updates of DM-i based products, the incremental growth of BYD’s PHEV in the second half of the year is still expected. Currently, it is not limited to cities with purchase restrictions and has achieved a certain degree of price parity. With a high proportion of private consumption and a wide distribution of sales territory, this actually opens up a development mode for PHEV. Whether the demand meets what BYD claims depends on everyone’s assessment of the difficulty of charging small batteries.

Summary: I am actually looking forward to a breakthrough in plug-in hybrid technology, but in practice, if someone has already developed the habit of driving a PHEV, they may as well directly buy a pure electric vehicle with a range of more than 600 kilometers. If there is no way to charge it, buying a PHEV and not charging it is no different from an HEV. After the subsidy, purchase tax, and license plate benefits are taken back in early 2023, there will be a vacuum in demand. Whether PHEV can be successful still depends on the situation in 2023.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.