I have recently carefully sorted out the next steps of various automakers at home. There are several things that must be shouted out by automobile companies, which are electric vehicles, software (XXX.OS), and autonomous driving. With the need to do everything and cannot lack anything, everyone feels a little confused. In the competition of automotive operating systems, especially the most intuitive cockpit system, there are currently several approaches abroad:

The high-profile automotive OS faction (XXX.OS): Tesla was the first to develop its own OS in this area. Following Tesla’s footsteps, German automakers also adopted a follow-up strategy. First, Volkswagen (VW.OS) proposed to develop its own operating system, followed by Mercedes-Benz (MBUX), and then BMW (iDrive). In fact, it is questionable whether automobile companies invest a huge amount of resources in this field with competitive investment output ratio. With the investment of flagship electric vehicles, we can continue to observe the performance of these three German car companies’ systems.

The low-key automotive OS faction: mainly a few Asian companies, Toyota, Honda, and Hyundai-Kia, all build systems based on Automotive Linux, but the overall characteristics are not extensively publicized.

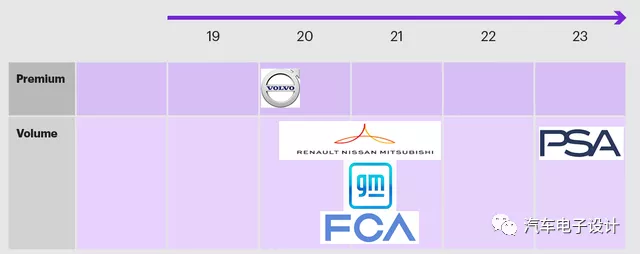

Following Android: Following Android Automotive OS, the first company to adopt it was Polestar 2 of Volvo, and then General Motors, Ford, Nissan-Renault-Mitsubishi, and Stellantis joined this camp.

Can Android Automotive OS Become Big?

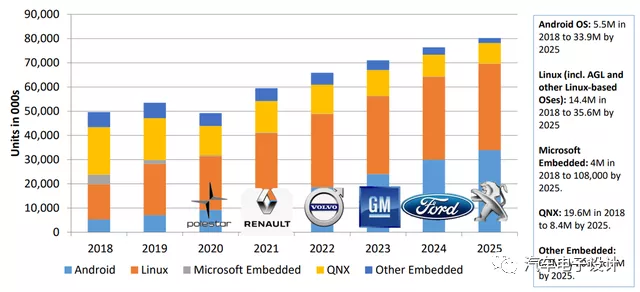

In the “Google Automotive Impact Statement,” there is a prediction about Android OS. It will increase from the current 5.5 million vehicles to 33.9 million in 2025. The main driving force here is that the demand for Android OS will increase significantly in two major markets, Europe and the United States.

Note: Android Auto was previously used to connect smartphones to car entertainment systems (mapping function) by Google, projecting the interface of the car entertainment information system onto the central control screen (reusing functions on the phone, such as messages, calls, media, and navigation). Android Automotive OS is an open-source operating system that runs directly on the car’s information and entertainment system.

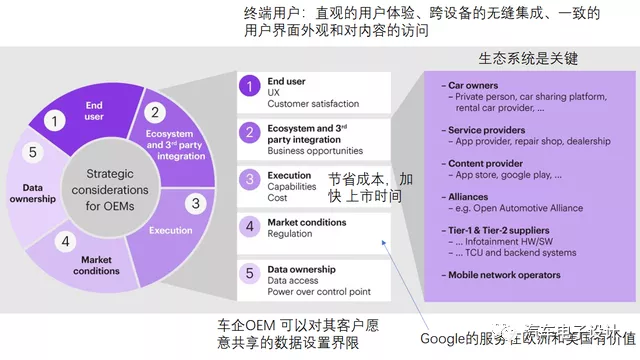

According to my understanding, car companies choose Android Automotive OS for the following reasons:

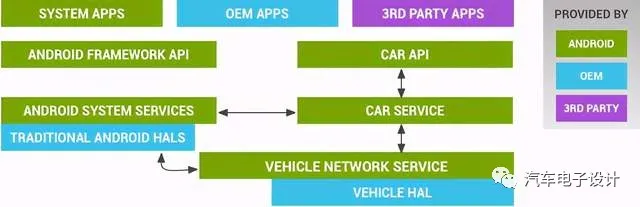

- Providing Android system on native car machines, which is an important feature as an independent device without the need of mobile phone control. In actual design, it ensures the continuation of user habits, focuses on designing functions for driving experience, and strengthens the features of high efficiency and easy operation to ensure safe driving.

- In the ecosystem of Europe and America, Google’s promise to these high-volume car companies is that they can have a large ecosystem without spending a lot of resources. To be honest, even if luxury car companies invest more resources, they may not be able to achieve a similar ecosystem as Google by 2025.

- Saving money and time. The three major American car companies have all invested in the embrace of Android Automotive OS. The primary applications that car companies need to do are the ones they can do with the abilities they have.

- The Hardware Abstraction Layer (HAL) provides a consistent interface for the Android framework (without considering the physical transmission layer). Car companies need to develop the in-vehicle HAL, which is the interface for implementing Android Automotive.

Due to restrictions mainly in Europe and America, this system is basically not feasible in China. Therefore, we understand that the feature of Android Automotive OS revolves around Google services, which is similar to the current situation with cellphones.

The heavily invested Volvo.It’s interesting to note that in 2018, Volvo became the first automaker to announce the integration of Android Automotive OS in their vehicles, including the 2021 Polestar 2, 2021 Volvo XC40 P8 & Recharge, 2022 Volvo XC60, 2022 Volvo S90, 2022 Volvo V90, and 2022 Volvo V90 Cross Country. However, it’s worth noting that the Polestar 2’s sales performance in China and Europe has been quite different. While the OS system is considered an advantage in Europe (compared to MEB’s infotainment system), it hasn’t shown any distinct superiority in China.

The Android Automotive OS main interface is divided into four equally sized cards (Google Maps, Google Assistant, Phone, and Apps), with the priority of high-frequency features in the overall vehicle system increasing as that of Maps decreases. Quick icons can also minimize driver distraction. Critical vehicle functions, such as the camera and vehicle controls, are located in the top-left corner near the driver’s seat for easy reach.

In conclusion, choosing Android Automotive OS is an inevitable choice for car companies focusing on the European and American markets with limited resources. If the system performs well, it’s not impossible for Honda and Toyota to make it compatible in the U.S. market by 2025. Some believe that Chinese automakers rely heavily on Huawei, but I believe that foreign car companies lean heavily on Google for intelligent automotive technology.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.