Tesla’s Sales Performance in May: Model 3 rebounds significantly

In April, Tesla experienced a sharp drop, followed by a large increase in May; In the first two weeks of May, sales went down and then bounced back to a new high in the last two weeks. What really happened to Tesla’s sales performance in China?

According to the report, the number of Tesla’s insured vehicles in May increased by 85% compared with that in April, indicating that the vehicle protest incident at the Shanghai Auto Show at the end of April did not have much impact.

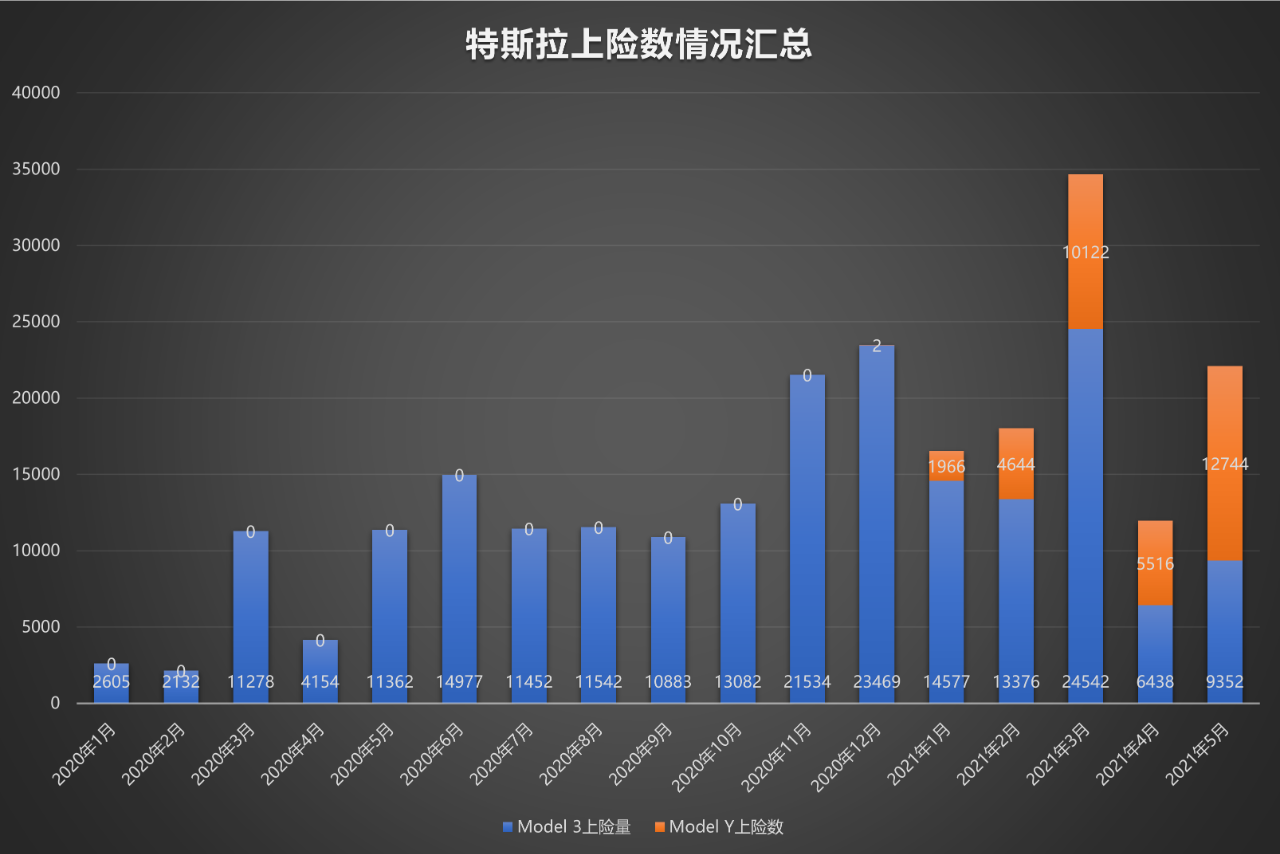

The main reason for the growth in the number of Tesla’s overall insured vehicles was the delivery of a large quantity of Model Ys, which reached 12,744 units in May and set a new high for monthly insured vehicles. In addition, after a massive drop in April, Model 3 bounced back with 9,352 units insured in May.

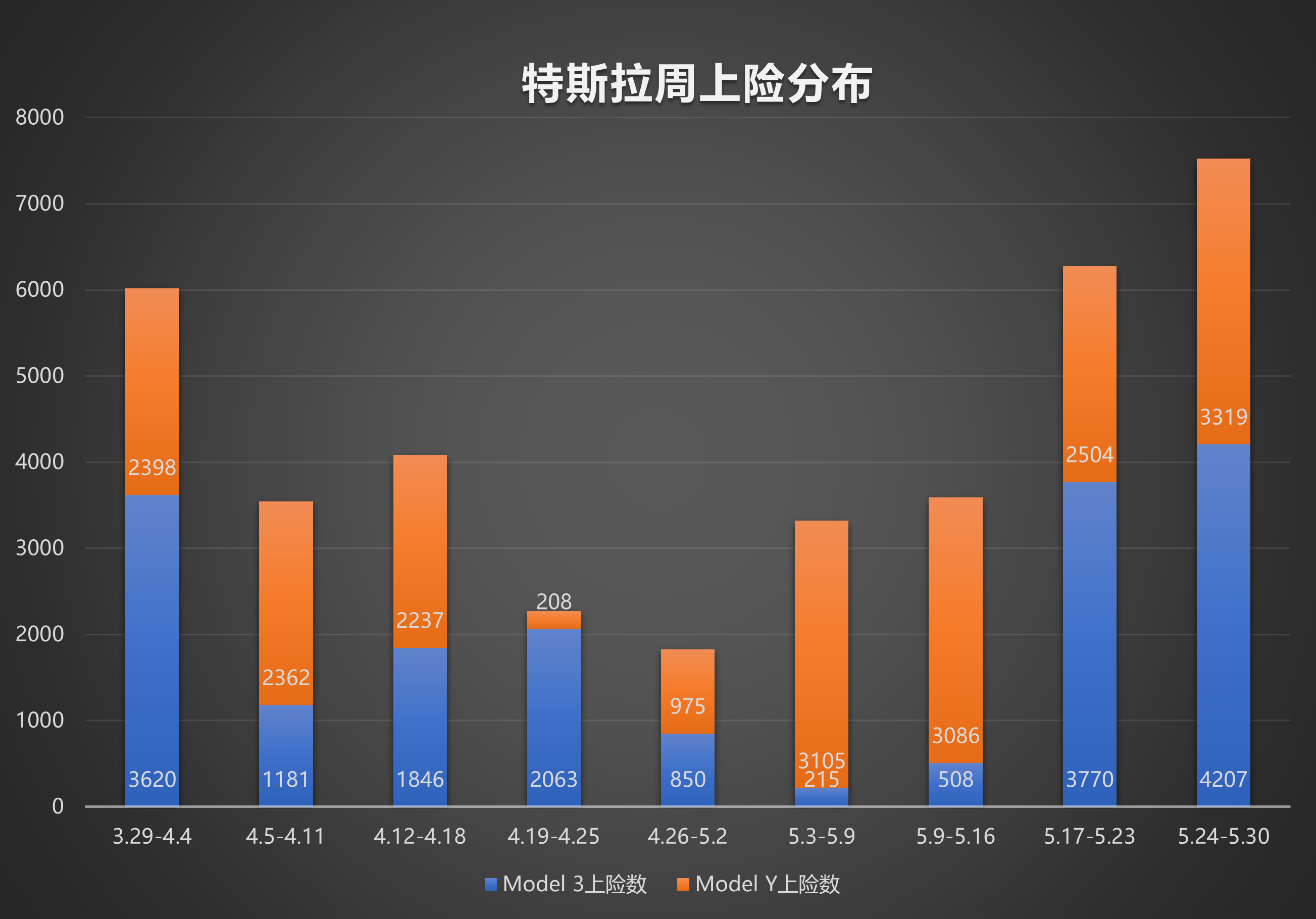

What’s particularly noteworthy is that despite the sharp decline in Model 3’s insured vehicles in the first two weeks of May, it rebounded significantly in the last two weeks. Judging from the data in May, the demand for Tesla is still strong. Moreover, the sharp contrast in weekly data also indicates that using the production capacity of Model 3 in Shanghai factory for export is probably the only reasonable explanation.

However, it should be noted that rumors, such as the protest incidents, and secret units banning Tesla from entering, are eating away at Tesla’s demand. Meanwhile, there are more and more optional brands for intelligent electric vehicles.

June’s sales performance will be an important observation point. On the one hand, June is the last month of the second quarter, and Tesla’s entire company needs to sprint in sales. On the other hand, the cumulative first batch of orders for Model Y should have been almost digested. Therefore, if Tesla wants to maintain its sales at a high level, it might need to lower its price and aim for more consumers.

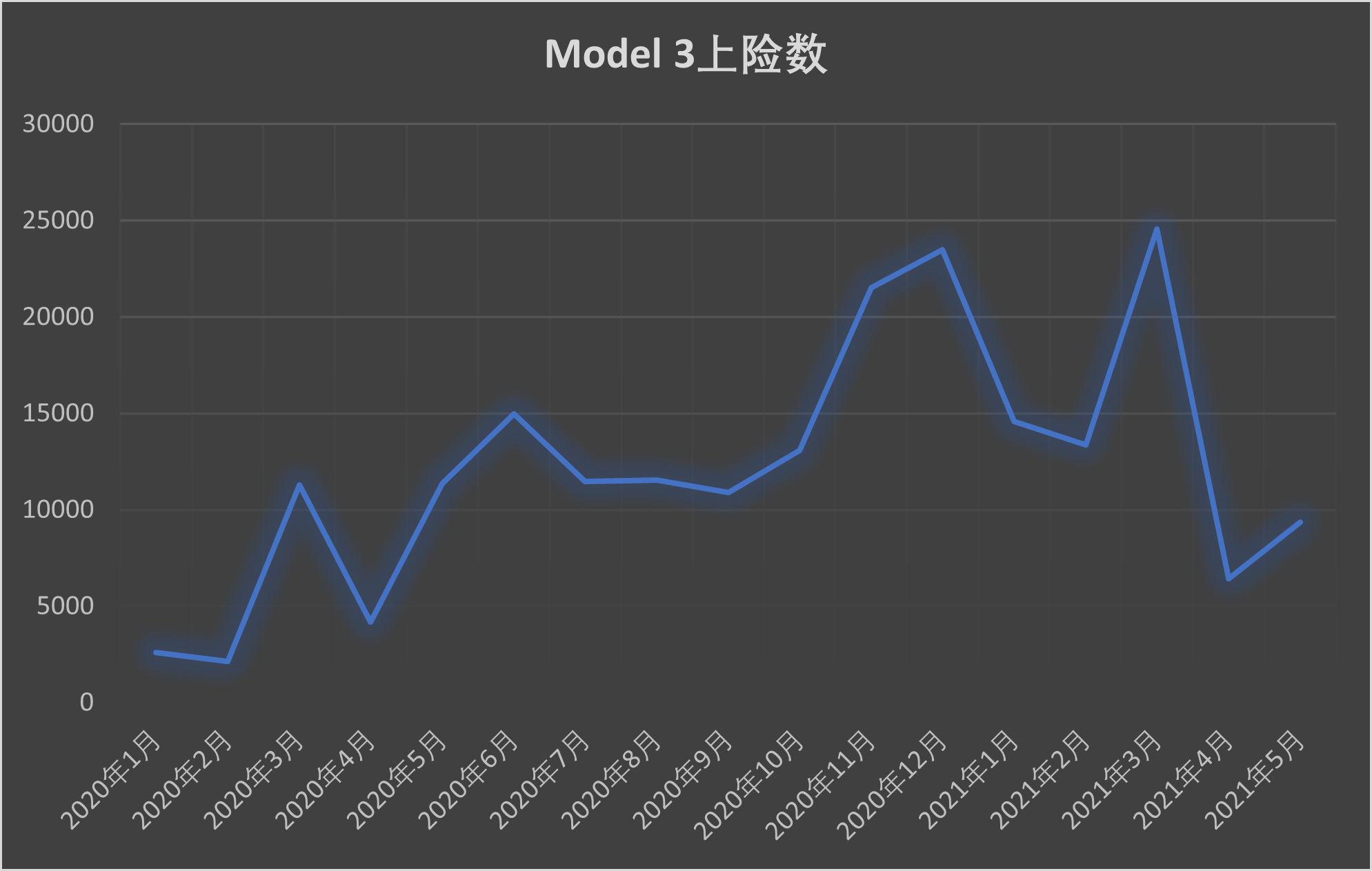

Remarkable Rebound of Model 3

After the Shanghai Auto Show, the number of Tesla’s insured vehicles experienced a drastic decline.

Model 3’s weekly insured vehicles fell to the hundreds from April 26 to May 16, but it then rebounded to 3,770 and 4,200 vehicles during the late May, achieving a remarkable rebound.

Judging from its weekly insured vehicles, Model 3 went through a low delivery state for 3 weeks starting from April 26. However, in terms of production, according to the information from securities companies, the production status of Tesla’s Shanghai factory remained normal in May, as the monthly output remained around 22,000 vehicles.Production remains unchanged, domestic deliveries decrease. The most likely reason is that Tesla used their production capacity for exports during this period.

According to data from the China Passenger Car Association, Tesla delivered 9,208 Model 3 cars in China in May and exported 11,527 units during the same period, with a total volume of about 22,000 units, which is in line with their production capacity.

Did Tesla actively or passively shift Model 3 production capacity to supply overseas? Judging from the May delivery data, the demand for Tesla Model 3 in China is still relatively high. Therefore, this may be an active move by Tesla.

Will Model Y be available with LFP battery?

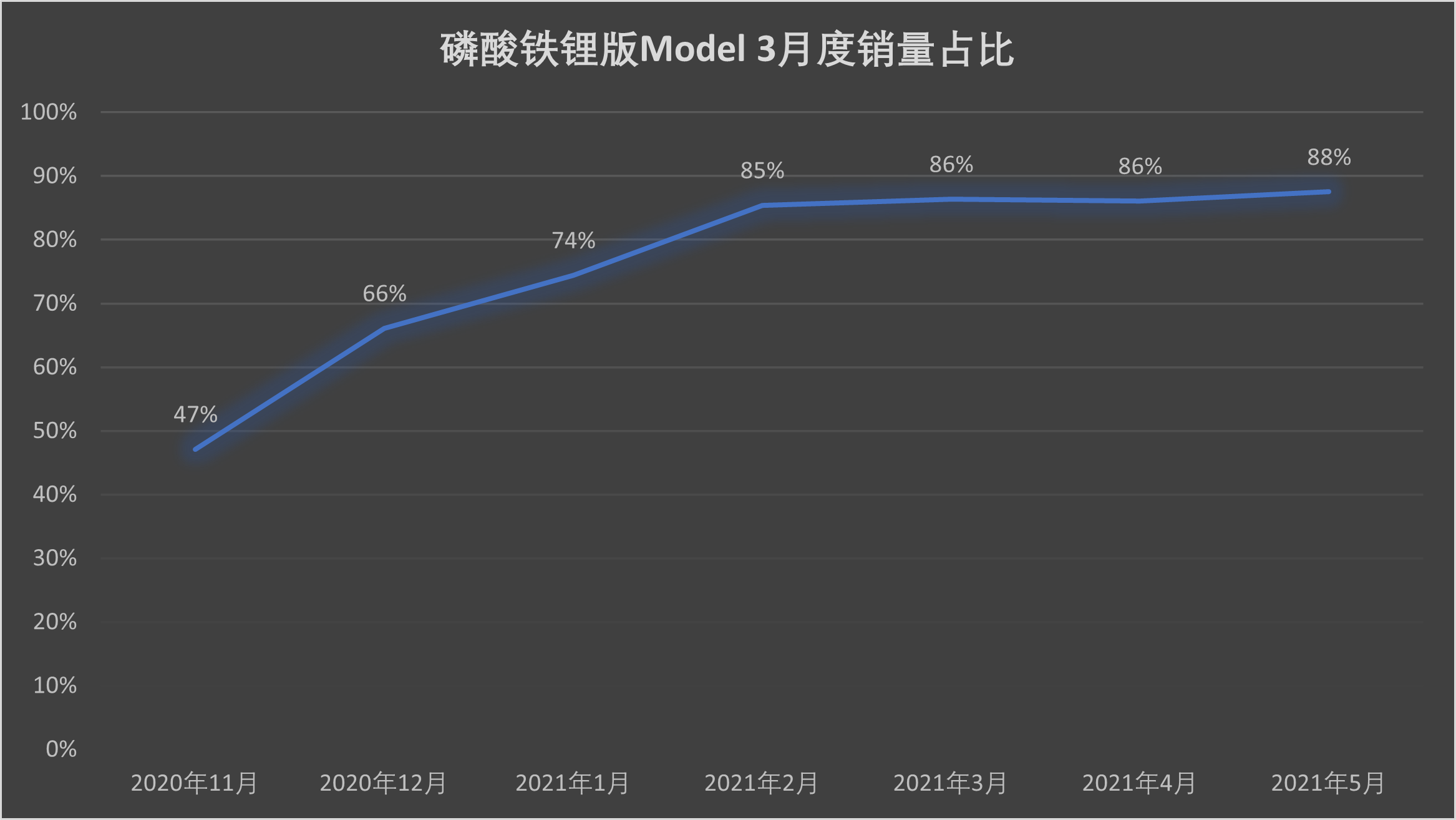

More than 83% of Model 3 customers this year chose the LFP battery version.

In the first five months of this year, the number of Model 3 LFP battery versions that were insured reached 57,190, while the number for the ternary battery model was only 11,095.

Looking at the percentage of monthly insurance coverage for LFP battery version Model 3, their sales are gradually increasing. In the future, more than 90% of Model 3 owners may choose to buy the LFP battery version Model 3.

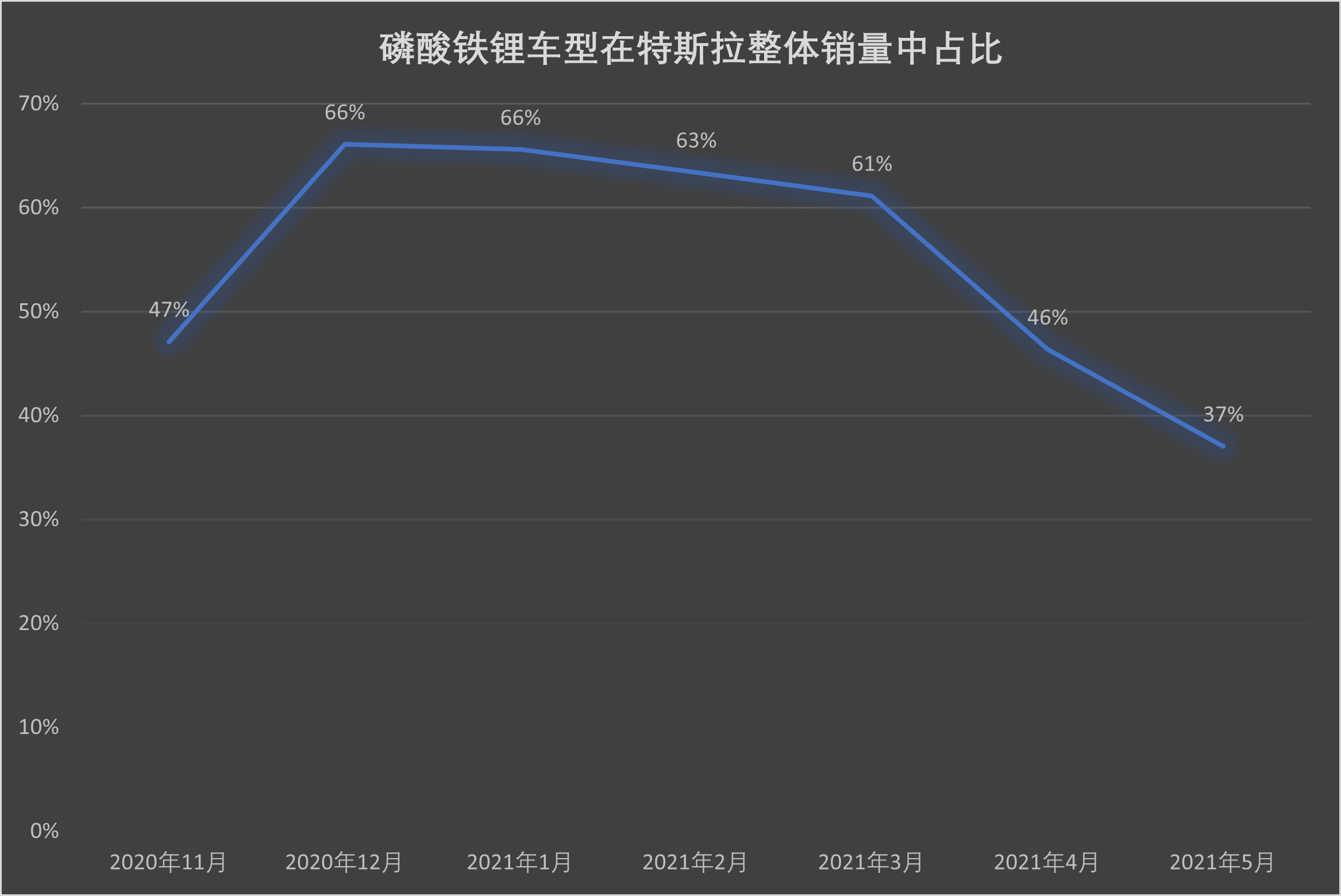

In terms of overall sales, LFP battery models once accounted for more than 65% of Tesla’s overall monthly sales. However, after the release of Model Y, this figure dropped to 37%.

There are rumors that Tesla will launch a version of LFP battery for Model Y in July, which could further lower the starting price of Model Y to below CNY 300,000, making it eligible for state subsidies for new energy vehicles.

After receiving subsidies, the terminal retail price of the LFP battery version of Model Y may be less than CNY 280,000.

While the specifics of the LFP battery version of Model Y are still unclear, one thing that is certain is that the LFP battery model will be Tesla’s main driver of sales in the future.

From December 2020 to March 2021, LFP battery models accounted for more than 60% of Tesla’s monthly sales, with an average monthly insurance coverage of more than 23,000 units. In months with lower LFP battery ratios, Tesla’s monthly insurance coverage did not exceed 18,000 units on average.Clearly, lithium iron phosphate batteries are crucial to boosting Tesla’s sales. In the future, Tesla may further increase the proportion of lithium iron phosphate battery models in monthly sales.

The essence of the lithium iron phosphate version is that Tesla has explored more consumer-accessible space with a low-cost solution. Its launch should be when the high-priced three-element version orders are almost consumed.

Launching discounts, Tesla sprints for quarterly deliveries

On June 11th, Tesla began offering cash, supercharging, and gift incentives to delivery customers.

If customers choose a loan, they can enjoy a discount loan of 3 or 5 years, with a maximum discount amount of over 22,000 yuan. If customers choose to pay the full amount, they can enjoy a 7000 yuan insurance subsidy.

At the time of delivery, customers can also enjoy free 7500 kilometers of supercharging mileage, as well as 45 days of free EAP use, and a physical car key worth about 1200 yuan.

To sprint for quarterly deliveries, the launch of delivery discount policies is a traditional habit of Tesla.

According to foreign media reports, on June 18, Tesla CEO Musk stated in an internal memo that the next 12 days (June 19-June 30) are very important and require employees to “go all out”.

From the terminal incentives and statements from Tesla executives, Tesla’s intention to sprint for second-quarter deliveries is very clear.

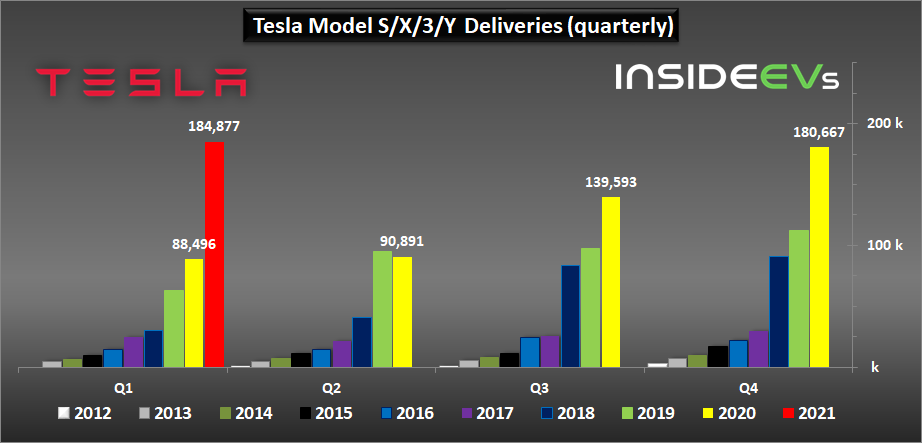

From the quarterly delivery volume, Tesla has maintained a continuous increase in sales for multiple quarters. Especially after Tesla’s Shanghai factory began delivering new cars in the Chinese market in the second quarter of 2020, Tesla’s global sales have continued to rise.

Only in the third quarter of 2020, the quarterly delivery volume of the Chinese market increased by more than 50% for Tesla.

According to “Golden Eye” under CICC on May 31, 2021, the forecast showed that Tesla’s sales in the Chinese market for the second quarter of 2021 may reach 107,000 units (including exports and domestic sales).

If based on the forecast data of CICC, Tesla’s sales volume (including exports and domestic sales) in June in the Chinese market may exceed 45,000 units, setting a new historical record.

In addition, almost all securities analysts consulted by the “Electric Vehicle Observer” still maintain a positive outlook on Tesla’s sales prospects in China.

Although sales forecasts are optimistic, at the terminal level of the market, Tesla, which is gradually recovering from the incident of rights protection at the Shanghai Auto Show, will continue to face the problem of being banned or restricted to use Tesla.

Information obtained from multiple channels shows that Tesla has been prohibited from entering some confidential departments and units.According to the confidentiality regulations, various departments and units with recording and video equipment have strictly managed the scope of use, which is a long-established legal requirement. However, it is relatively rare to include cars as managed equipment.

Recently, it was reported that after Tesla was rumored to be banned from confidential departments, personnel in confidential departments have been prohibited from using Tesla vehicles, which indicates that the incident has the potential to escalate.

In addition, we have learned from a Tesla supply chain insider that Tesla’s production in China in June may have declined sharply.

We will continue to analyze Tesla’s sales in China after we have a clear understanding of the June data.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.