To evaluate whether Tesla has been affected by the recent controversy in China about its braking system is relatively difficult in the short term. Due to export factors, it is impossible to judge based on the manufacturing quantity of Model 3 alone, as Tesla needs to achieve its Q2 sales target by transferring some cars abroad. Therefore, the evaluation of the brand’s impact and sales impact can only be assessed strictly by assessing the upper insurance data. As the total number has a certain neutralizing effect, it may be better to evaluate the effect based on the split data from January to May.

Here is my preliminary conclusion:

The impact of this incident on Tesla has been significant in third to fifth tier cities, where the penetration rates of Model 3 and Y were making progress, reaching 10%. However, the impact of public opinion on these customers has caused a rapid decline. This is extremely unfavorable for Tesla’s greater sales target this year.

In Shanghai, a very friendly city to Tesla, demand has been slowing down at a very noticeable rate. May was less than one-quarter of the peak seen in March. In the short term, we can consider that ordinary consumers’ blind and fanatical support for Tesla is starting to diminish.

Overall, the situation in first-tier cities remains stable. Due to the previous supply reasons, new second-tier cities still have some filling, and it may show clearly in June how much worse Q2 is than Q1. For example, the number of Model 3 insured in Q1 was about 52,400; it may drop to around 25,000 (estimated) in Q2, shrinking by half. Of course, Model Y in Q1 was only 16,700, and it may increase to more than 30,000 (estimated) in Q2. Overall, it is expected to drop from 70,000 to 55,000-60,000 (estimated), indicating a significant decline.

Note: This is only a research method, and the Q2 forecast is an estimate.

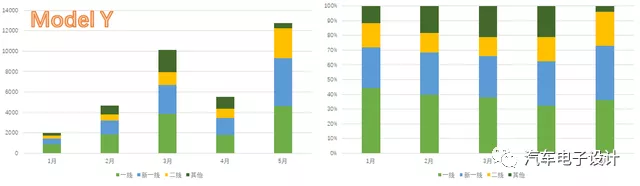

1) Model Y

Model Y is actually popular in China. Except for the suspension in April for maintenance, it was originally in a good trend of entering the market. But there is an interesting phenomenon: the demand proportion of Model Y suddenly decreased in third to fourth-tier cities (this may be due to delivery reasons). This phenomenon is somewhat similar to Figure 2, which means that in third to fourth-tier cities, uninformed people have put direct pressure on consumers who want to buy Tesla. This is currently a significant observation. Besides, the proportion of cumulative orders for Model Y towards new second-tier cities and a higher proportion of two-tier cities is also increasing. Therefore, I tend to believe that the speed of cumulative orders for Model Y in first-tier cities is also slowing down.

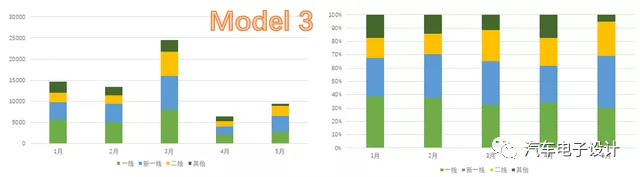

2) Model 3Compared to Model Y, the situation of Model 3 is even more obvious. The absolute number of insured vehicles has shown a significant decline compared to January to March. Moreover, the proportion of first-tier and new first-tier cities has increased again, which is not a good thing for Tesla’s future market expansion.

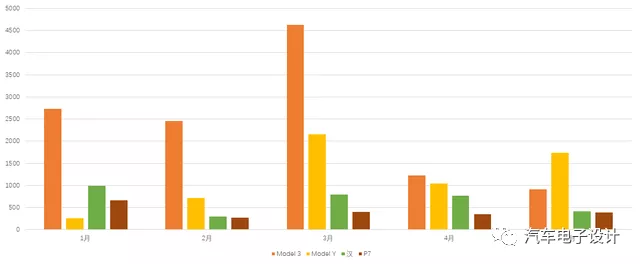

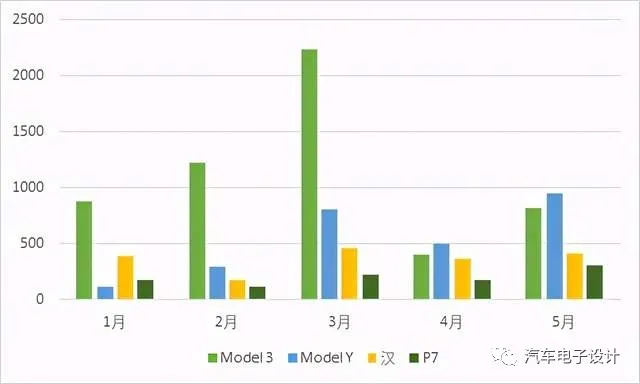

3) Tesla’s headquarters in Shanghai

In Tesla’s headquarters in Shanghai, we can see that Model 3 is declining. Shanghai is a very sensitive city. The number of insured Model 3 vehicles has fallen from the highest peak of 4,627 in March to 913. Model Y has maintained a number of 1,735. The gap between Model 3 and the two competing products, Han EV and P7, has also narrowed to about 500 vehicles.

Note: This is my prediction in the “Analysis of Shanghai’s New Energy Vehicle Registration in May” written on June 9th. It seems that the situation is similar to what I expected. The demand for Model 3 in Shanghai is also declining. According to this analysis, the total amount of Model 3 in the market segment has decreased from the highest peak of 7,981 to 2,623. It is estimated that the number of Model 3 in Shanghai this month is between 1,000 to 1,200. Based on the stable state of the SUV market, it is estimated that the number of Model Y insured vehicles in Shanghai should be around 1,200 to 1,500.

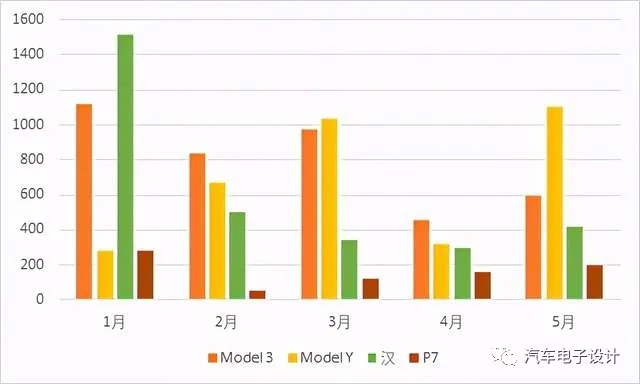

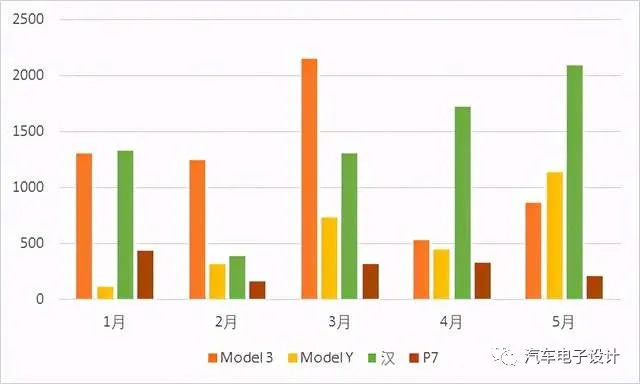

4) Beijing and Hangzhou markets – Neutral markets

Looking at the data of Model 3 from Beijing and Hangzhou, it is not particularly good either. The insured data has dropped from about 1,000 to 594. This makes Model 3 not much different from Han EV in Beijing, and P7 is more like a car in the south. The demand for Model Y remains at around 1,000. With this wave of centralized car purchases, there may be some different situations in June and July.

Hangzhou has also experienced a peak of demand suppression in March, and now Model 3 has stabilized at 800, with Model Y approaching 1,000.

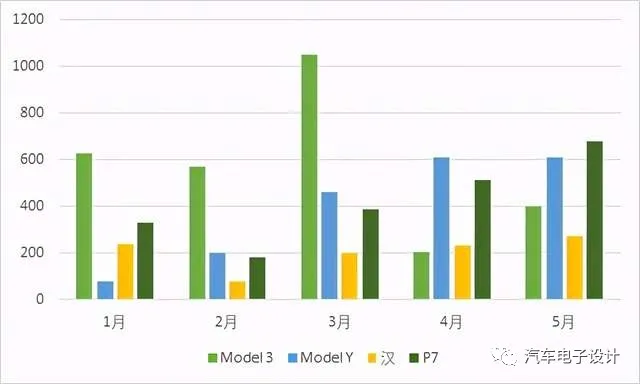

5) Shenzhen market – BYD headquarters

Looking at Shenzhen, Model 3 sales are around 900, with a slight decline compared to before. It seems that Han’s EV gains the most in Shenzhen, with relatively high trading volume. Model Y maintains demand of around 1,000.

6) Guangzhou market – Xpeng’s headquarters

The decline in Model 3 sales in Guangzhou is also quite noticeable, now less than 500, and the demand for Model Y cannot be sustained either. These few cars in Guangzhou are relatively evenly distributed, and P7 has a significant home advantage.

Conclusion: The controversy surrounding Tesla has gradually begun to fade, but the overwhelming guidance for a while still has had a significant negative impact on Tesla’s brand. The degree to which this impact will be demonstrated will likely be revealed after the insurance data for July 10th is released.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.