*This article is reproduced from the autocarweekly WeChat account.

Author: Financial Street Lao Li

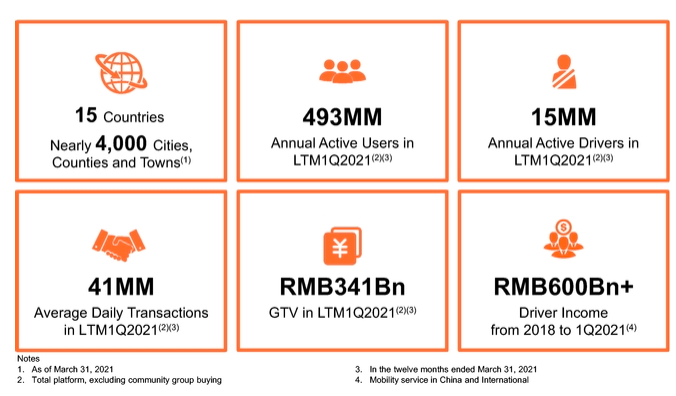

There are two giants in the global shared travel industry, one is Uber and the other is DiDi. The latter has a trend of surpassing the former.

In the past year, shared travel companies have been recognized by the capital market. Uber’s market value has doubled from 50 billion US dollars to over 100 billion US dollars. In China, the shared travel industry has also received widespread attention from primary financial investment and industrial investment. It is a trillion-level track, and the industry leader is DiDi, which is the benchmark that global capital needs.

After a long wait, on June 11th, DiDi officially submitted its IPO prospectus to the SEC (US Securities and Exchange Commission), and is expected to become the largest IPO in the US by a Chinese company after Alibaba.

Every time a leading Chinese stock is listed on the US stock market, it attracts global attention. In recent years, the performance of leading Chinese stocks in the US stock market has been good. Today, Lao Li will discuss with everyone the barriers to shared travel and what kind of company DiDi really is, and how much elasticity DiDi’s market value has.

Is shared travel a profitable business?

During the Dragon Boat Festival holiday, Lao Li read many interpretations of DiDi’s IPO. To be frank, most of them are from external perspectives, blind people touch the elephant. Many people around Lao Li are also discussing it. Some friends in the automotive industry have not read the prospectus and started to talk about it indiscriminately. They lack both an industrial perspective and a capital perspective, and these views often distort the rhythm.

Compared with the intelligent electric vehicle industry, the concentration of enterprises in the shared travel industry is very high. There are only a few leading companies in the domestic shared travel industry chain, which means that the real information in the industry will be very limited. Lao Li participated in the financing of a top state-owned travel company last year and worked hard to complete the due diligence.

Although the capital market has its own rules, it emphasizes truth-seeking and data-oriented. Before understanding a company, you need to understand the corresponding industry. The concept of shared travel is very broad. The following mainly refers to the ride-hailing represented by DiDi. Last year, Lao Li discussed with a researcher from Revocean whether ride-hailing has increased social productivity, and did not get an answer, but there is one point of consensus: Ride-hailing is not a technological revolution, but it solves the supply and demand of travel needs through technological innovation business models.

The supply side of ride-hailing concentrates full-time and part-time vehicles to enhance transportation capacity. On the demand side, passengers’ offline needs are realized online, increasing the choices of express, special, carpool, and ride-sharing, expanding consumption scenarios. In fact, from this year’s data, the domestic ride-hailing market is still in the rising stage. As long as the economy grows, user demand will increase. After a lot of struggles, the pattern of the domestic ride-hailing industry has been initially formed.The laziest way to invest in A shares is to buy the leading companies. For intelligent electric cars, you should purchase stocks in Tesla and NIO. Similarly, for ride-hailing companies, paying attention to the leading companies is essential as it reveals the industry’s structure.

Domestic ride-hailing companies can be divided into three tiers. The first tier is Didi, which leads the entire industry and has a dominant advantage in terms of traffic and technology. The second tier consists of companies represented by T3 Travel and Caocao Travel, which are both comprehensive transportation companies relying on strong corporate resources to obtain a considerable market share in specific cities. The third tier mainly includes small local ride-hailing companies that have basic transportation capacity but no platform. They are new players in the market.

It took Didi 8 years to transform from a small unknown company to an industry leader. Like many internet companies, Didi experienced ups and downs during its transformation from weak to strong and found a sustainable operational model for ride-hailing services.

There are generally three operational models for domestic ride-hailing companies. The first is the pure platform model, where enterprises only exists online and have no transportation capacity. Didi’s early C2C and current Gaode aggregation modes belong to the pure platform mode. The advantage of this model is that the assets are lightweight and have traffic, but the company cannot control the transportation capacity, resulting in the inability to achieve fine-grained operations or tap into the after-market.

The second model is the pure transportation capacity model, where enterprises have their own vehicles which are connected to major platforms as entrance. After the platform takes a cut, the remainder belongs to the company, making it more like a traditional transportation company.

The third is the “platform + transportation capacity” model, where companies have their own online platforms and offline transportation capacity. Currently, Didi, Caocao, and T3 Travel are all mostly operating under this model, with a portion of self-operated capacity and an external network of capacity. The advantage of this model is that companies have complete control over online and offline resources, being unrestricted by any particular condition, which is the necessary step for becoming an industry leader.

Shen Nanpeng once said that internet giants are constantly exploring and eventually finding the most suitable path. Didi has found a suitable path – platform + transportation capacity, quickly occupying the resources on this path.

Drivers and vehicles in each city are limited resources. Didi developed CarPartner (CP) and DriverPartner (DP) companies a long time ago, grasping many core resources. When Caocao and T3 entered the market, they could only either self-develop transportation capacity or attract drivers with more preferential conditions, but they could not achieve the scale of Didi. Even T3, a state-owned company, also had to rely on external financing to achieve market operation.

Is Didi’s Stock Worth Buying?

Whether a stock is worth buying depends on the company’s fundamentals and financial situation.

The prospectus of a giant company can not only help investors understand its finances, but also provide valuable data about an industry. It is the most comprehensive and closest-to-the-reality source of information. Whether it is Tesla and NIO in the US stock market, Ningde Times in the A-share market, or Didi today, their prospectuses contain a wealth of information worthy of analysis. After Didi’s prospectus was released, many analysts immediately started researching and verifying the previous due diligence results of the team.

Li also participated in part of the work and dissected Didi’s financial situation with everyone.

Didi released financial data that could easily be misunderstood. From the overall financial situation of the company, it is a completely unprofitable company: in the past three years, Didi has respectively lost RMB 8.6 billion, RMB 2.8 billion and RMB 8.4 billion. As a listed company, it has been losing money for three consecutive years. However, in Q1 of 2021, Didi made a profit of RMB 5.5 billion. Many friends may be curious, why did Didi, which has been losing money for three consecutive years, make a profit of RMB 5.5 billion in Q1 of 2021?

The answer can be found in the prospectus. Didi spun off its community group buying company, “Chengxin Youxuan”, confirmed unrealized revenue of RMB 9.1 billion, and disposed of some assets to obtain approximately 500 million US dollars. With multiple calculations, the investment income for Q1 of 2021 reached RMB 12.361 billion, significantly boosting the financial report.

If you look closely at the three tables, you will quickly realize that you have been “tricked”. Although Didi does not make money as a company, its business is very profitable. Why is this?# Didi’s Business Revenue and Plan

Didi’s business revenue is divided into three main categories:

- China transportation services, which includes ride-hailing, taxi, designated driver, ride-sharing, etc. and has the largest revenue proportion, maintaining about 140 billion yuan annually and steadily growing.

- International transportation services, which includes international ride-hailing and food delivery, among others.

- Other services, which includes bike-sharing, e-bikes, car rental, logistics, autonomous driving, financial services, etc.

The China transportation services also have a good profit performance, with adjusted EBITA increasing from -270 million yuan in 2018 to 3.96 billion yuan in 2020, and even reaching 3.62 billion yuan in Q1 of 2021. Therefore, it is easy to see that Didi’s current revenue-generating business in China is profitable, contrary to what the outside world describes. The reason for Didi’s overall loss is that the company has invested a lot of funds into new fields outside of transportation services in order to prepare for its second and third growth curves, as stated in its prospectus.

During the Dragon Boat Festival, many friends were discussing how the same-stock different-voting structure can be very helpful for a company’s development, which is very well exemplified by Didi. Cheng Wei is indeed a leader with strategic vision, and the investment background of Liu Qing and Zhu Jingshi would not be satisfied with just China ride-hailing services. Although the shareholding structure shows that the combined holdings of SoftBank, Uber, and Tencent are as high as 41.1% (SoftBank 21.5%, Uber 12.8%, Tencent 6.8%), Cheng Wei and Liu Qing’s respective shareholdings are only 7% and 1.7%. However, with the same-stock different-voting structure in place, Cheng Wei and Liu Qing have more than 48% of the voting rights, and the eight core executives have more than 50% of the total voting rights.

The management team has absolute control over the business, which is good news for the secondary market shareholders because the management team will continue to grow the business and the market value of the company. The use of the raised funds by Didi also reflects this strategy:

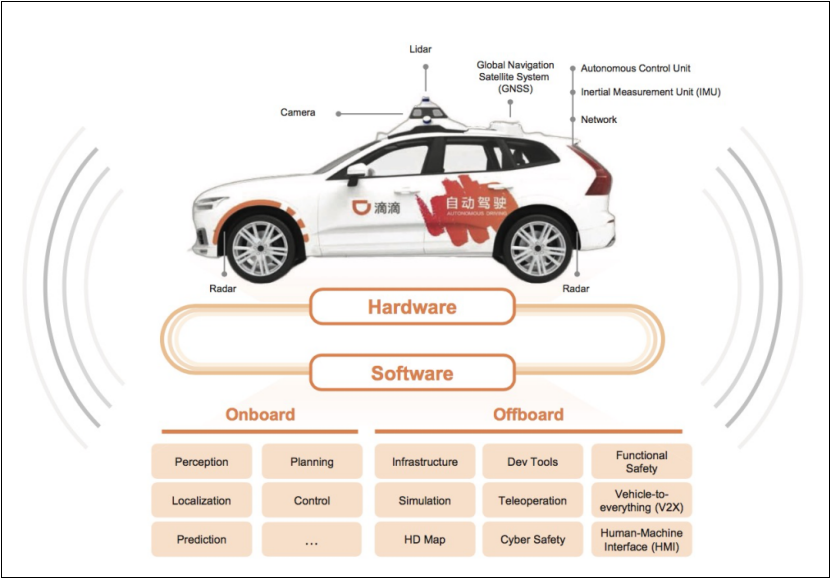

- Approximately 30% of the funds will be used to expand the international market outside China.

- Approximately 30% will be used to enhance their technology capabilities, including shared transportation, electric vehicles, and autonomous driving.

- Approximately 20% will be used to launch new products and expand existing product categories to improve user experience.

- The remaining funds may be used for operational capital needs and potential strategic investments.# Where is the Imagination of DiDi?

What is DiDi’s first curve? The domestic ride-hailing business. What is DiDi’s second curve? It could be overseas business, autonomous driving, or other commercial applications. This is the story mentioned earlier. The essence of the story is creativity. Zhang Lei has been emphasizing creativity in “Value”. The biggest moat of a company is not its users, not its brand, but its creativity.

The reason why the revenue and market value of traditional car companies are stable is that the only growth curve for car companies is vehicle sales. Among smart electric car companies, NIO has not sold many cars, but its market value has reached 100 billion US dollars because of its imagination. The company may have multiple growth curves in the future.

After DiDi went public, it faced the same problem. In the view of Mr. Li, DiDi has already done enough business in the domestic ride-hailing market, which is large enough, but the goals of DiDi’s top management are obviously not so narrow. Perhaps in the eyes of DiDi’s top management, the layout is planned as follows:

The domestic ride-hailing market is stable, with a slight increase each year, which is the basic part. It can support DiDi’s market value from zero to 100 billion US dollars, but it is difficult to push DiDi from 100 billion to 300 billion or even higher. It is also difficult for DiDi to transform from a domestic top Internet company to an international top technology company. To achieve a higher corporate positioning and a larger corporate volume, DiDi must solve the problem of growth curve.

This can also be seen from DiDi’s pricing. The fair price of DiDi’s internal equity incentive is only 47.71 US dollars. Calculated, DiDi’s pre-IPO valuation is only 53.9 billion US dollars, which is far from the expected 100 billion US dollars.

Mr. Li also discussed with some friends, and everyone thinks that DiDi’s low price is smart. On the one hand, it can relieve capital pressure during tense periods and retain the impression of Chinese Concept Stocks. On the other hand, the lower price can better retain DiDi’s growth potential and give sufficient space for international business and autonomous driving.In people’s impression, Didi is a start-up enterprise that relies on financing development with travel services as its core revenue. Over the past eight years, Didi’s travel business has achieved profitability. Unconsciously, Didi has begun to incubate international and autonomous driving businesses with the entrepreneurial model of that year.

The international business will promote Didi’s globalization, and the autonomous driving business will promote Didi’s transformation into a technology company. If optimistic, according to a valuation of 100 billion US dollars and a common increase in scale of 10%, after Didi goes public, these two businesses are expected to receive 3 billion US dollars of funds respectively. This is not a small amount of money. After all, Baidu’s investment in car-making last year was only 20 billion yuan, and Geely’s vast platform investment was only 18 billion yuan.

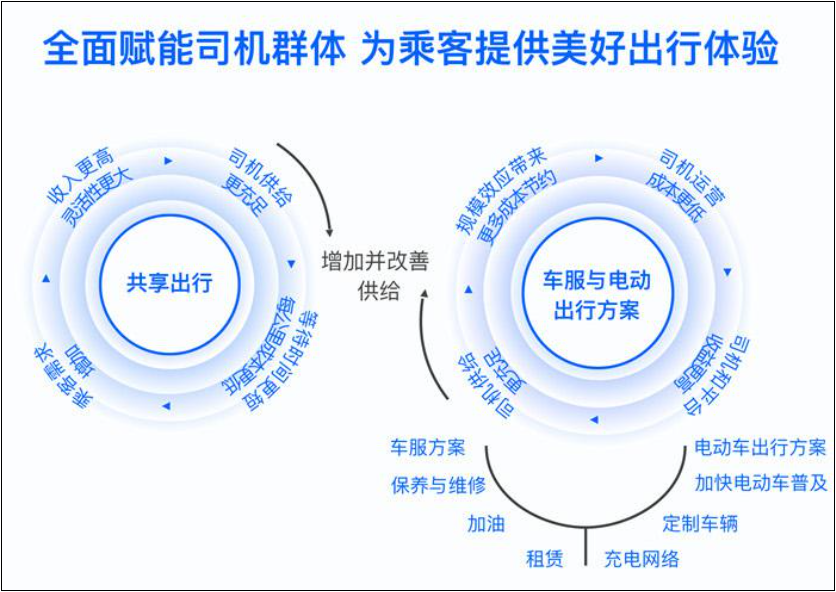

In addition, Didi has also extensively deployed upstream and downstream automotive businesses. In the past few years, Didi has extended its tentacles to custom vehicles, finance, maintenance, used cars, charging piles, and other fields. Didi mentioned the “dual-wheel” strategy in the prospectus, and shared travel is one wheel, while car services and electric travel solutions are another wheel. Whether it is cooperation in car-making or in the aftermarket, they are important links in Didi’s dual-wheel strategy, not the main business.

Friends in the automotive industry are keen on discussing whether or not to make cars. However, in the capital market, it is not important who makes cars or who doesn’t make cars. Any profitable business is a good business. There is no doubt that Didi is making money faster than making cars.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.