Author: Wang Lingfang

Since the Biden administration took office, it has been engaged in positive competition with China in various advanced technology fields. Lithium batteries are no exception. On June 7th, the US Department of Energy’s Office of Vehicle Technologies released the “National Blueprint for Lithium Batteries”. The lithium blueprint sets five goals, the core of which is to establish the US’s lithium battery material, component supply, independent production, recycling, and scientific research leadership capabilities.

In terms of research and development, the US Lithium Blueprint proposed long-term goals to be achieved by 2030: accelerate research and development, demonstrate and scale revolutionary battery technology including solid-state and lithium metal batteries, achieve production costs lower than $60/KWh, with energy density of 500 Wh/kg and without cobalt and nickel.

[Follow “Electric Vehicle Observer” on WeChat and reply to the dialog box with “US Lithium Blueprint” to obtain the English report and translation of “National Blueprint for Lithium Batteries 2021-2030.”]

National Competition: China is Leading

From the US perspective, China and Europe have already taken a lead in the power battery field. In May 2015, China released its “Made in China 2025” strategy, and in May 2018, the EU released its “Strategic Action Plan on Batteries.” They will gain pricing advantages based on economies of scale, process learning, and control of critical inputs, thereby impacting US competitiveness.

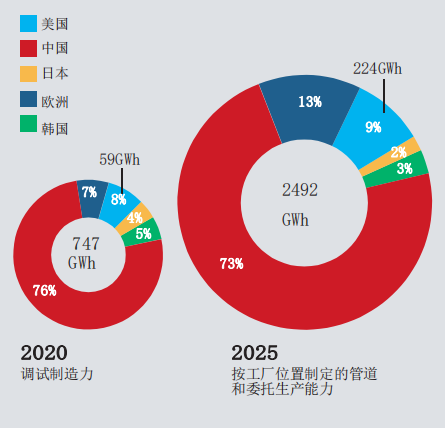

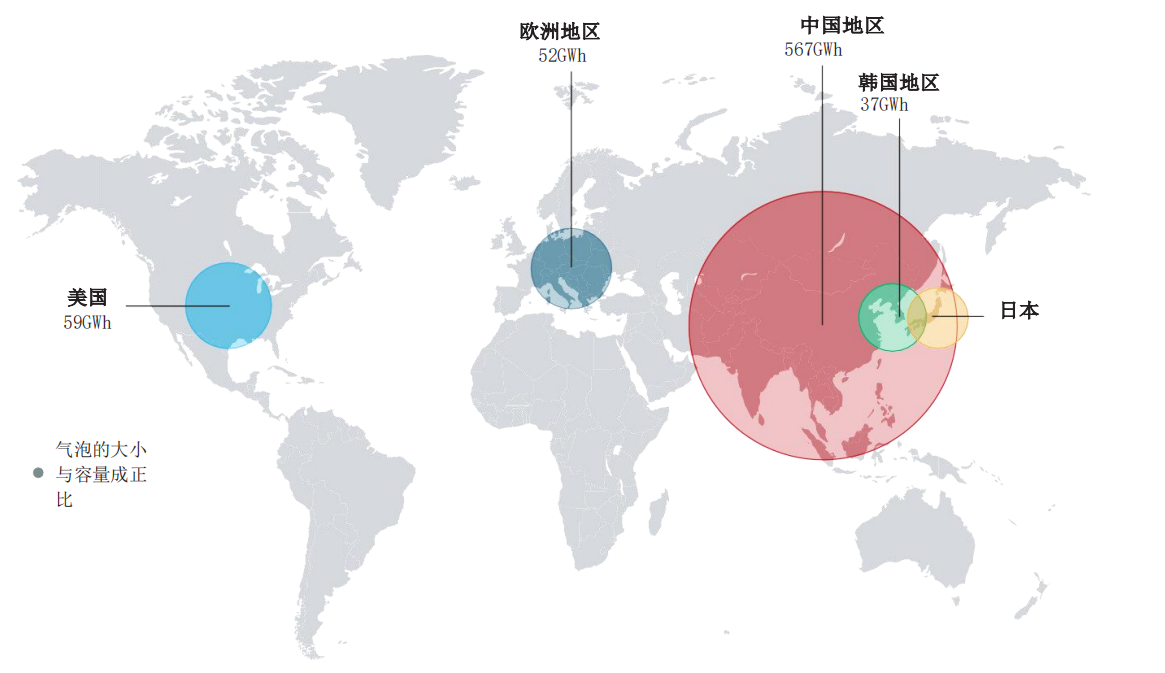

The US Lithium Blueprint mentions that the lithium-ion battery industry seems to be at a critical point, with costs having decreased nearly 90% since 2010. This technology is disrupting the original structure of the global transportation industry and has the potential to reshape the global transportation industry in the next few decades. In 2020, the US accounted for approximately 8% (about 59 GWh) of the 747 GWh of worldwide lithium-ion batteries produced for electric vehicles, while China accounted for approximately 76%.

According to data provided by the American Lithium-ion Battery Blueprint, the global electric vehicle battery manufacturing industry is expected to grow to 2,492 GWh by 2025, with Chinese capacity reaching 1,811 GWh. This will enable the production of cost-competitive electric vehicles and could account for up to 25% of global passenger EV sales in 2020.

According to data provided by the American Lithium-ion Battery Blueprint, the global electric vehicle battery manufacturing industry is expected to grow to 2,492 GWh by 2025, with Chinese capacity reaching 1,811 GWh. This will enable the production of cost-competitive electric vehicles and could account for up to 25% of global passenger EV sales in 2020.

On the other hand, the outlook for battery supply in the United States is not optimistic. Bloomberg predicts that by 2028, there will be 3.2 million electric vehicle sales and 200 GW of lithium-ion based grid storage in the United States. Assuming an average electric vehicle battery capacity of 100 kWh, the US would require 320 GWh of lithium-ion battery production capacity to meet demand for passenger EVs.

However, according to Benchmark Mineral Intelligence, the US lithium-ion battery production is expected to be only 148 GWh by 2028, which is less than half of the predicted demand, and US capacity will be insufficient to meet domestic needs.

In addition to the electric vehicle market, the demand for advanced batteries is also expected to grow for energy storage. Bloomberg predicts that global deployment will exceed 1095 GW by 2040.

The American Lithium-ion Battery Blueprint believes that these predictions indicate a threat to the US. American companies will not be able to benefit from the growth in the domestic and global markets, which could affect their long-term financial survival. The supply chains of the US transportation, utility, and aviation sectors are expected to be very fragile and require the development of critical technologies. Without action, the US risks long-term dependence on foreign batteries and key materials.

To participate in the lithium-based battery market, the US needs a strong supply chain to mass-produce the most advanced and reliable electric vehicle and grid storage batteries.

Concerns in the US

The application of US lithium-ion batteries mainly includes electric vehicles, fixed storage, aviation, and defense, with a particularly significant increase in demand for electric vehicle batteries.

Automobile industry concerns national economy and people’s livelihood

The automobile industry is an industry that the United States cannot abandon.According to the U.S. Lithium-Ion Battery Blueprint, battery development and production are of strategic importance to the United States. This is not only part of the transition to a clean energy economy, but also a key factor in competing in the automotive industry. The automotive manufacturing industry promotes economic growth by $1.1 trillion each year. An estimate in 2017 showed that approximately 10 million jobs in the United States are directly related to the automotive industry and 5% of U.S. employment depends on the automotive industry. In terms of emissions, transportation accounts for about 28% of total greenhouse gas (GHG) emissions in the United States, making it the largest contributing sector to GHG emissions in the United States.

Therefore, occupying the battery market is crucial to the survival of American companies in the future, otherwise they will lose competitiveness.

Bloomberg predicts that global electric vehicle sales will reach 56 million units in 2040, of which 17% (approximately 9.6 million electric vehicles) will enter the US market. If all the batteries for the estimated 96 million electric vehicles predicted by Bloomberg are manufactured abroad, it will lead to about $100 billion in imports. It is worth noting that the automotive industry has always accounted for 5.5% of the US gross domestic product.

The demand for lithium-ion batteries is also significant in the energy storage, aviation, and defense markets in the United States besides the automotive sector.

Regarding energy storage, by the first half of 2020, lithium-ion batteries accounted for 98% of commissioned utility-scale storage projects. The annual deployment of lithium-ion-based fixed energy storage is expected to increase from 1.5 GW in 2020 to 7.8 GW in 2025 and 850 GW in 2030.

Similar to electric vehicles, electric airplanes have great potential for future development.

Recently, the market for electric vertical take-off and landing (eVTOL) aircraft in the United States has grown rapidly for urban package delivery and air mobility for up to 4 passengers. The global eVTOL aircraft market is expected to reach between $162 million and $1 billion by 2025. The next aircraft to take off will be a full-electric or hybrid electric commuter aircraft with about 10 passengers. Such aircraft also require advanced lithium-ion batteries with high specific energy and power density.

In the defense sector, although it only accounts for a small part of the commercial market for advanced batteries due to the unique nature of weapon system batteries, it is of strategic importance. The military requires thousands of unique types of batteries every year, with an annual procurement amount of more than $200 million from the Defense Logistics Agency (DLA).

Without a complete battery supply chain, the supply of the Department of Defense will also face challenges in the United States.

The United States cannot tolerate relying entirely on foreign suppliers to meet these demands.

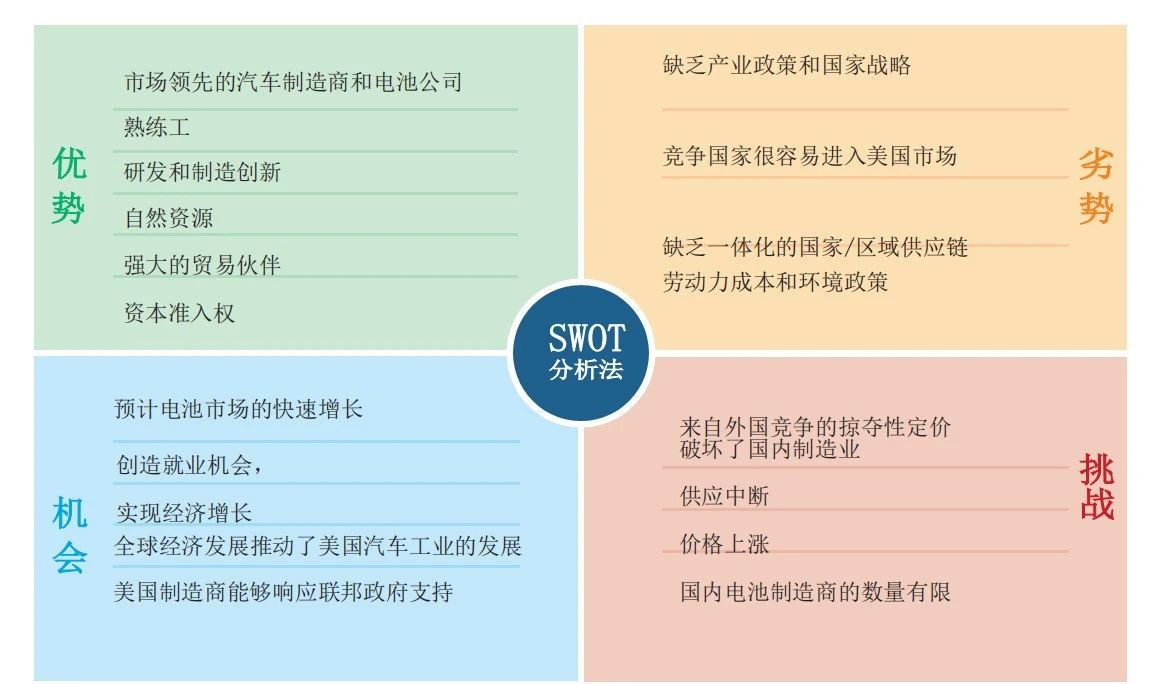

Therefore, the United States has made an important decision to vigorously develop the lithium-ion battery industry.Before we can develop, we need to take a pulse on the foundation of the United States. The Lithium Battery Blue Book conducted a SWOT analysis on the development of lithium batteries in the United States.

The analysis suggests that, compared to foreign counterparts, the United States generally encourages private sector, market-driven methods of industrial development. Various federal and state policies influence the development of battery storage systems, but these policies are usually not coordinated at the government level.

“Long-standing advantages, including the R&D capabilities of American companies, universities, and national laboratories, may be weakened by weak intellectual property protection and technology transfer policies.”

The update of the trade structure of the United States-Mexico-Canada Agreement (USMCA), which supports the American economy’s deep decarbonization, provides an opportunity to improve the United States’ competitive position. But as China is rapidly expanding its capacity, the United States must profit from it.

Five Targets

Based on the SWOT analysis, the United States has set five goals for the development of lithium batteries.

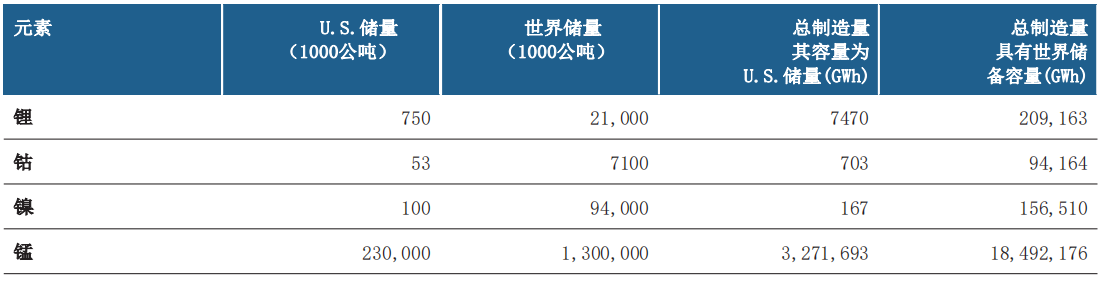

Goal One: Ensure access to raw materials and refined materials, and find alternatives to critical minerals in commercial and defense applications.

The Lithium Battery Blueprint believes that a robust, secure lithium battery base requires a reliable supply of raw materials and refined materials while also striving to develop sustainable alternatives to achieve supply diversity. The goal is to reduce the dependence of American lithium battery manufacturing on scarce materials, particularly cobalt and nickel, to develop a stronger, safer, and more resilient lithium battery supply chain.

Comparison of US mineral reserves and production capacity:

Goal Two: Support the development of materials processing bases that can meet domestic battery manufacturing demand.

Currently, the United States relies on international markets to process most of its lithium battery raw materials. By producing no-cobalt, no-nickel positive electrode active materials, developing new processes to reduce battery material costs, and reducing battery costs to 60 USD/kWh by 2025, it hopes to achieve no-cobalt and no-nickel by 2030.

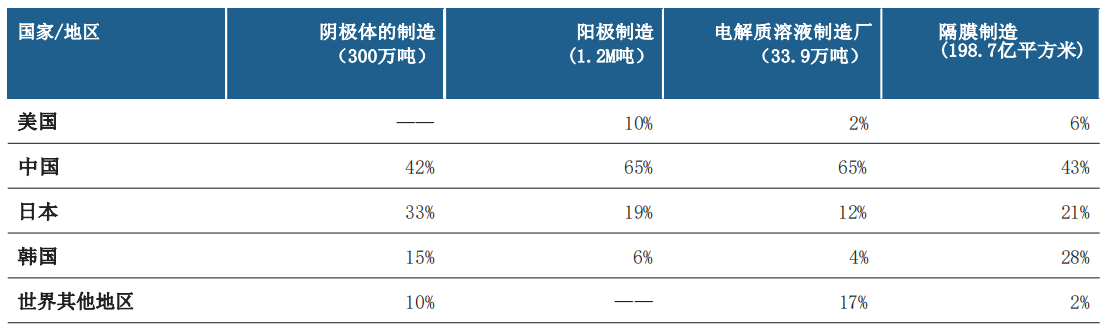

Proportion of major lithium battery production countries’ primary materials in total:

Goal Three: Stimulate the development of domestic electrode, battery, and battery pack manufacturing industries.Over the past decade, battery energy storage technology has made significant progress, with an increase in battery energy density and an 85% reduction in battery pack costs, reaching $143/kWh in 2020. In order to support the development of electric vehicles, a unified incentive policy for domestic battery and battery pack production is still needed. By 2025, functional battery standards suitable for defense, electric vehicle, and grid applications should be established. By 2030, the manufacturing cost of electric vehicle battery packs should be reduced by 50%.

Battery manufacturing capacity in 2020 by country or region is shown below:

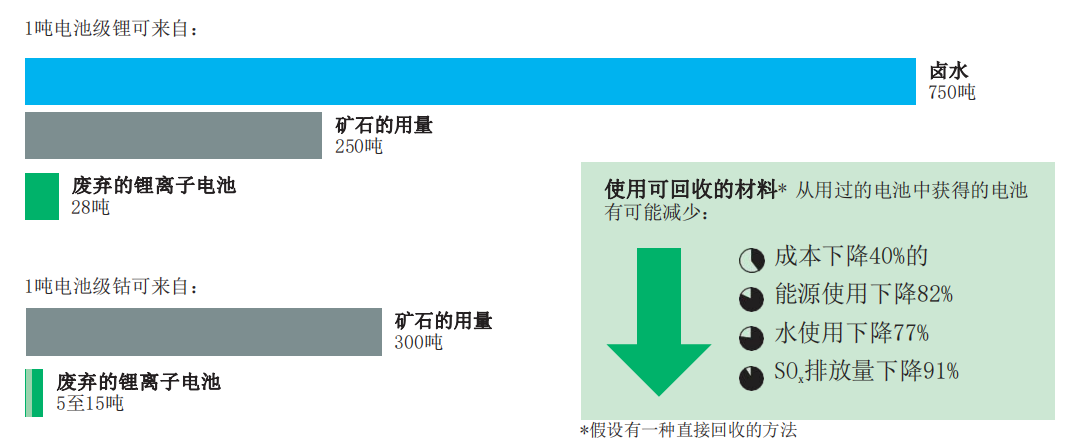

Objective four is to achieve large-scale recycling of batteries and critical materials and establish a complete competitive value chain in the United States. The US Lithium-Ion Battery Blueprint believes that the recycling of lithium-ion batteries not only reduces the limitations caused by material shortages, enhances environmental sustainability, but also supports a safer and more resilient domestic supply chain. Currently, the net cost of recycling for end-of-life electric vehicle batteries, as well as the cost of transporting recyclers’ batteries currently classified as hazardous waste, accounts for more than half of the end-of-life recycling cost.

In addition to recycling supply, discarded electric vehicle batteries can also transition to secondary applications, including grid storage. Second-life batteries will require better methods for sorting, testing, and balancing battery packs.

By 2025, successful methods for collecting, sorting, transporting, and processing recycled lithium-ion battery materials should be established, with a focus on cost reduction. By 2030, incentives should be developed to achieve 90% recycling of consumer electronics products, electric vehicle, and grid storage batteries.

Objective five is to maintain and advance the United States’ leading position in battery technology by vigorously supporting scientific research, STEM education (science, technology, engineering, and mathematics), and workforce development.The US Lithium Battery Blueprint believes that establishing a competitive and fair domestic lithium battery supply chain in the rapidly accelerating electric vehicle and energy storage market is only one part of the new zero-carbon energy economy, moving towards high-performance and low-cost globally. Focusing on the development of new generations of lithium battery materials (solid-state electrolytes), as well as new materials, electrode and battery manufacturing processes, remains essential to maintaining US leadership. Intellectual property protection must also be highly emphasized during this process.

By 2025, establishing standardized partner relationships for technology transfer and pre-application testing agreements to ensure that battery technologies invented in the US remain in the country. By 2030, the US aims to produce revolutionary batteries, including solid-state and lithium metal batteries, on a large scale, with production costs below $60/kWh, achieving specific energy densities of 500 Wh/kg, and achieving cobalt- and nickel-free.

It can be seen that the US lithium battery blueprint does not specify specific production capacity requirements, primarily emphasizing the construction of the industry chain and technological development.

Especially at the technological level, the US is trying to surpass China: in China’s “Energy-saving and New Energy Vehicle Technology Roadmap 2.0”, by 2030, power batteries will be classified into three major technological directions: energy, power and energy combined, and power type, with the highest energy density requirement for power and energy combined batteries, only reaching 400 Wh/kg in 2030 and adjusted to 500 Wh/kg until 2035. Meanwhile, the US aims to achieve an energy density of 500 Wh/kg for special batteries by 2030.

In terms of cost, by 2030, the battery cost for China’s power batteries will range from 320-1000 yuan/kWh according to different routes; however, the US aims for $60/kWh, with costs basically comparable to China.

The US has ambitious plans for the development of lithium-ion batteries, and we will have to wait and see what the specific results will be.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.