This video is about the main content of the Inter Battery exhibition in South Korea, but it reflects some interesting things. With the regional development of electric vehicles and battery industries, it has become increasingly evident that South Korean batteries are beginning to ally with the United States (currently, apart from supplying Europe, most South Korean batteries are produced and sold domestically). Therefore, we will discuss the overall situation and technological progress in both aspects.

South Korea’s “Secondary Battery Industry Development Plan”

At this year’s “Inter Battery 2021,” South Korea’s Minister of Industry and Resources, Moon Sung-yuk, met with major leaders in the domestic battery industry such as LG to discuss the “Secondary Battery Industry Development Plan,” which will be announced in July. Moon also shared a joint cooperation plan between the United States and South Korea regarding the American Battery Supply Chain in a meeting with President Joe Biden last month, with plans to announce the development plan for the charging and battery industry in mid to late July. We will actively seek opinions on battery industry strategies so that enterprises can carry out business activities positively.

Young-hyun Jeon, CEO of Samsung SDI, Dong-seop Ji, Head of Battery Business at SK Innovation, and Dong-myeong Kim, Vice President of LG Energy Solution, stated that they will strengthen their strategy of targeting the global electric vehicle battery market by expanding their cooperation with the market. The direct motivation behind this is the trade agreement between the United States, Mexico, and Canada, which stipulates that car manufacturers must produce 75% of their components in these three countries to avoid tariffs. Therefore, the future widescale promotion of electric vehicles must include the establishment of production bases in North America. Specifically,# SK Innovation President Ji Dong-seop said at the exhibition that Blue Oval SK, Ford’s joint venture in the United States, is seeking to build 4-5 new battery production factories (60GWh) at different locations.

Jeon Young-hyun, the president of Samsung SDI, revealed that Samsung is considering entering the US market and the possible way is still through joint ventures with car companies, with Stellantis and BMW currently having more opportunities.

A senior official from LG Energy Solution stated that the company will soon announce the establishment of a battery joint venture with Hyundai Motor in Indonesia (1.2 billion US dollars, 10GWh), and Hyundai is also entering the joint production of battery cells.

The precursor of over 90% of the key raw materials for battery cathodes comes from China, and POSCO Chemical, EcoPro BM, L&F, and Cosmo Advanced Materials & Technology are making efforts to supply their own precursors domestically. EcoPro BM has set a goal of building two precursor production bases in Pohang, Gyeongbuk, and increasing the output of precursors from the current 24,000 tons to 50,000 tons. POSCO Chemical is considering increasing the proportion of precursor production to 60%, while L&F is seeking to expand the precursor production capacity.

Three Korean battery companies’ exhibitions

1) SK’s technology path

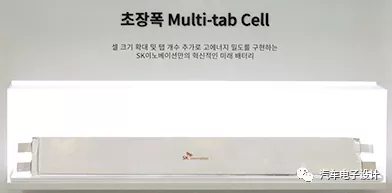

At SK’s technology exhibition, the focus was on safety, fast charging, and long battery life.

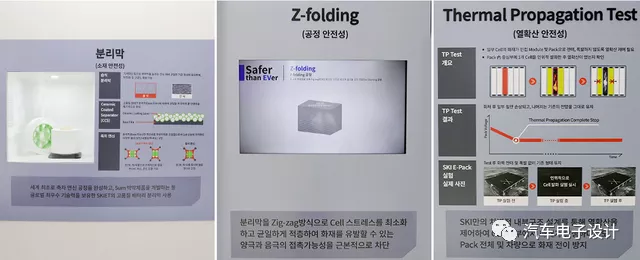

Safety design: mainly including 5-micron diaphragm technology, Z-type stacking technology of positive and negative electrodes, and thermal runaway protection technology at the PACK level.The first key lies in the separator produced by SK IE Technology. Using its very own technology, SK IE Technology is capable of manufacturing a thin yet robust separator with a thickness of 5 micrometers, which is just one twenty-fifth of the thickness of human hair. A thin separator facilitates the movement of ions that produce electricity, leading to higher output and faster charging. However, a separator that is thin but poorly made can easily tear and cause fire.

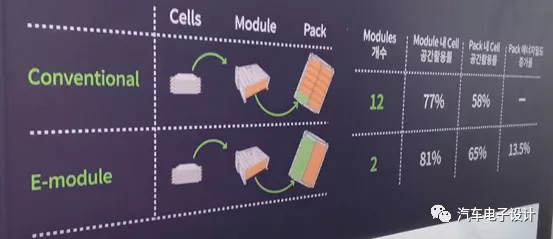

The second key to SK Innovation’s safe batteries is its “Z folding” technology. This technology involves zigzag-wrapping the anode and cathode, thus greatly reducing the possibility of two materials coming into contact and ensuring precise manufacturing even in high-speed production systems.Last but not least, SK Innovation’s battery pack technology has thermal propagation test. Thermal propagation test refers to a safety measure where heat does not spread to surrounding cells when a fire occurs in some cells in a battery pack, where dozens of battery cells are lined up. Fundamentally, SK Innovation’s self-designed E-pack can block heat, so it can prevent spreading fire.

Fast charging technology: The goal of fast charging is to reach 80% charge in 30 minutes by 2020, to achieve 18-25 minutes by 2021, and to reach within 15 minutes by 2026.

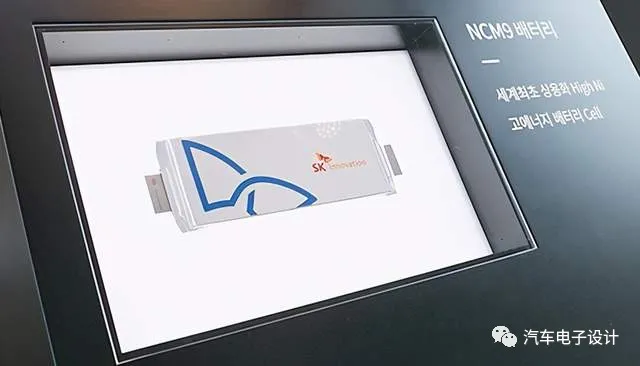

Long endurance: SK’s main approach is to achieve NCM9 in 2022 and high nickel up to Ni 94% in 2025.

The more important thing for SK is to consider shifting towards cylindrical batteries and prismatic batteries as European customers are beginning to move in this direction. In this regard, it is interesting to note that Mercedes-Benz’s EQA and EQB are also considering compatibility with prismatic and pouch batteries, and SK has become a major supplier to Mercedes. Together with support for ID4, this presents a challenge for LG’s supply in Europe. The graph below shows SK’s existing customers and future expansion.

The more important thing for SK is to consider shifting towards cylindrical batteries and prismatic batteries as European customers are beginning to move in this direction. In this regard, it is interesting to note that Mercedes-Benz’s EQA and EQB are also considering compatibility with prismatic and pouch batteries, and SK has become a major supplier to Mercedes. Together with support for ID4, this presents a challenge for LG’s supply in Europe. The graph below shows SK’s existing customers and future expansion.

Summary: The Korean battery industry may be driven as a national strategy in the future, and it is highly linked with the United States, which means that we are in a strategic competition. We will provide separate information on the two videos from LG and SDI in the future.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.