During the discussion series, there are two important factors in why Tesla has such a large impact on the pure electric vehicle market in China and why the two models on the MEB platform from Volkswagen, which seemed to have a huge investment, perform poorly on uphill climbs. In my personal opinion, the competition has been fierce since 2017. The overall decline in sales in 2020 directly led to the low point of Beijing Automotive Group’s ride-hailing model, while Tesla has raised overall private purchases of pure electric vehicles. Therefore, in the overall spectrum, it is really difficult for competitors to survive in the sub-market of B-class sedans and B-class SUVs, which are dominated by Tesla.

In the A-class market, whether it is SUV or sedan, there was still some private demand before, but after Tesla’s impact, it is difficult to compete by simply relying on competition. Therefore, this market is mainly dominated by 2B.

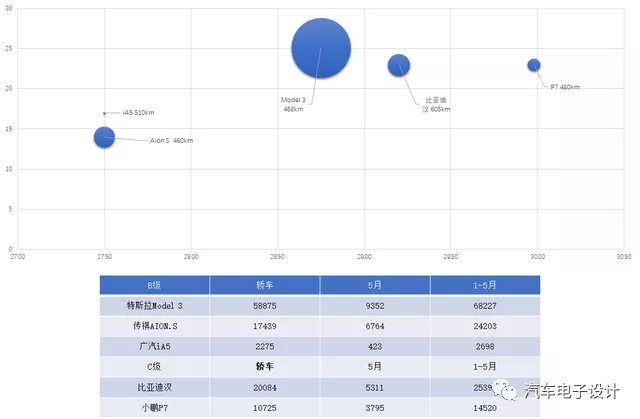

In the B-class market, NIO is the only competitor that can challenge Tesla head-on. This is based on their BAAS model, which is based on service and high-end differentiation, and not purchasing batteries from suppliers. This model is very important to NIO. The second is the new 2B strategy of GAC Motor (including iA5), in which the price war is at its fullest on the B-side.

Han EV and P7 are mainly targeting the Model 3 by having larger vehicles. It is especially difficult for XPeng and BYD’s models with short wheelbases to compete.

In the field of pure electric vehicles, Tesla is a machine for crazy self-expansion. As of May of this year, Tesla has already sold 100,000 units in the B-class and above, with a very high market share. This continuously attracts new customers from fuel cars to electric cars.

Note: I have added the May data of the models later.

The impact of Tesla on the B-class market

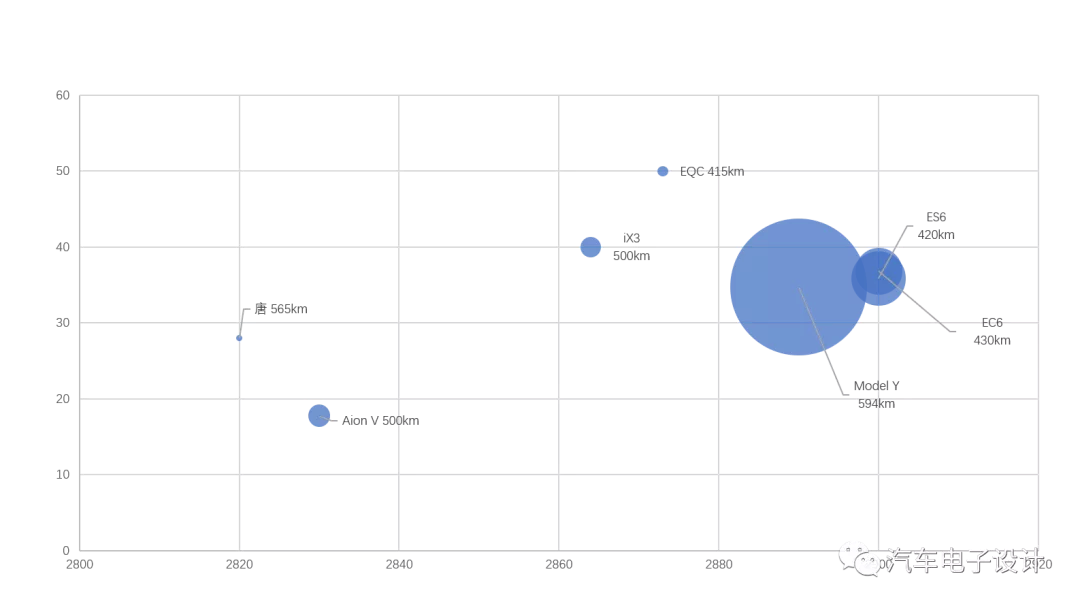

This is a bubble chart of the wheelbase, price and sales volume of B-class SUVs. The play styles are different in these cars:

Model Y: This car mostly takes volume away from fuel SUVs, but also splits some from Model 3.

ES6 and EC6: With the positioning of services and high-end differentiation, the combined sales of these two NIO models in cities with and without purchase restrictions can be matched with the Model Y.

Looking further down, Aion V relies on a significantly lower price system of 180,000 RMB. The iX3 and EQC are relatively awkward. However, several adjustments of the iX3 may have some effect. According to previous estimates, when the Model Y changes to iron-lithium batteries, the expected price will be around 280,000 RMB, attracting a considerable part of the demand, of course, these are all from fuel cars.For the electric vehicle industry in China, Tesla is the pioneer. With Model Y leading the pack, having a matching product lineup can attract some customers, even if the expected sales volume for a single vehicle may only be 1-2 thousand. Nevertheless, this can still bring stable profits per vehicle.

The story of Model 3 is even simpler. Aion S focuses mainly on the 2B market, with a price lowered to around 130,000 yuan for large corporate customers. Han EV and P7 are bigger and more sophisticated than the Model 3, with one relying on longer driving range and the other on smarter and more diverse options to gain a foothold in the market.

Note: The time window for Han EV and P7 is excellent, as there were no other competitors except Model 3 in the second half of 2020.

Actually, B-class SUVs and sedans still have significant superiority over smaller models. In the private market, at the 200,000-yuan price range, consumers have lots of options to consider.

Why Volkswagen is Slow to Catch On

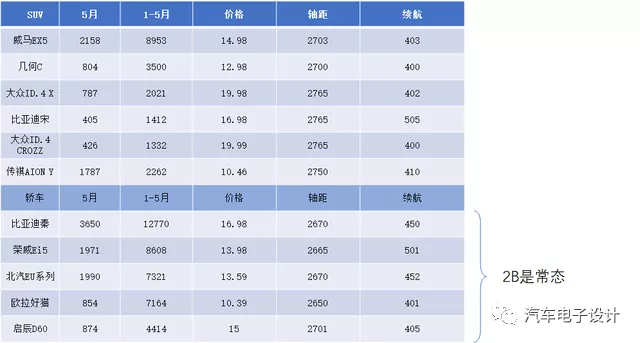

While the private market is focused on B-class models, the A-class SUV and sedan market remains hard to crack. In the first five months of 2021, there were no A-class SUV models with sales exceeding 10,000. The sales of ID.4X and ID.4 CROZZ were not quite good compared to a bunch of other 100,000-150,000-yuan models.

Among A-class SUVs, the best performer is still the EX5 from WM Motor, selling almost 9,000 units in five months and reaching a level of only one-third of the total.

As for A-class sedans, only Catwalk has targeted the female consumer market to attempt to make a breakthrough in the personal market. More than 50% of A-class sedans are still for the 2B market, or even for official vehicles, which has been a segmented market for several years.

I personally think that the biggest problem currently faced by pure electric vehicles is keeping up with Tesla’s pace. All electric vehicle companies ultimately have to compete for customers from traditional internal combustion and hybrid customers. Tesla has always been leading the way in breaking this ice. The market that has been opened up will spill over to other domestic electric vehicle companies if customers are dissatisfied with Tesla’s product strength, service, and quality. This is what happened from H2 2020 to H1 2021, and it’s also the core reason behind NIO, XPeng, and BYD’s high profile currently.

I personally think that the biggest problem currently faced by pure electric vehicles is keeping up with Tesla’s pace. All electric vehicle companies ultimately have to compete for customers from traditional internal combustion and hybrid customers. Tesla has always been leading the way in breaking this ice. The market that has been opened up will spill over to other domestic electric vehicle companies if customers are dissatisfied with Tesla’s product strength, service, and quality. This is what happened from H2 2020 to H1 2021, and it’s also the core reason behind NIO, XPeng, and BYD’s high profile currently.

The problem with MEB is that the planning and iteration time at the German product center is too long. To be successful in Europe, there are no issues due to the intense competition among European electric car companies and the large subsidies available. Trying to integrate online sales and dealer transformation is also feasible. However, there are more constraints in China. Volkswagen, on the one hand, needs to adjust the sales of pure electric cars. Without keeping up with the rapid pace of BEV iteration, it is difficult to get individual consumers to pay. Therefore, there are only two options for subsequent MEB models:

Update the price spectrum and further lower the price system of their A-level SUV.

Update the sales method and transform their still unformed sales model to a traditional model, through the existing large-scale sales system to promote the sales of electric vehicles.

In conclusion, our main expectation for Volkswagen is to break into the A-level SUV and sedan market, expand the 2C market, and differentiate from Tesla’s strategy of surrounding large and medium cities. However, the reality is that currently only the A00 Wuling and Tesla’s B-level cars have opened two routes to replace fuel vehicles. Volkswagen does not have an effective method to increase its product penetration rate to 20%, which means that most traditional car companies face the same problem. BYD’s fuel car base is too low to be representative, so to make a smooth transition from 2022 to 2025, we still need to see how other car companies will respond in the largest A-level market.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.