Overview

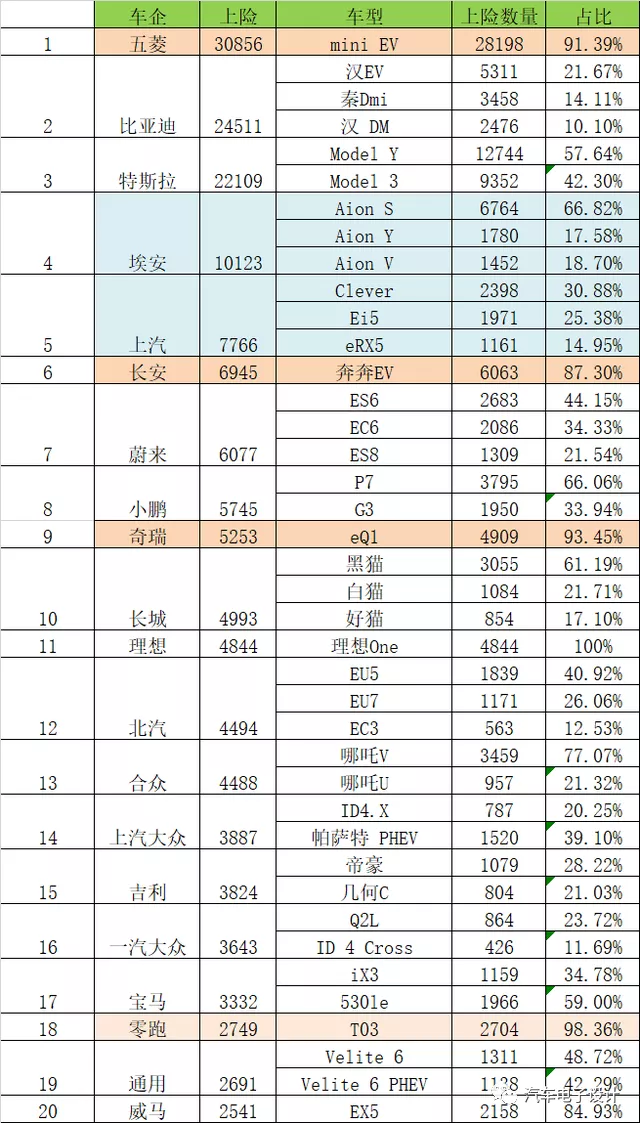

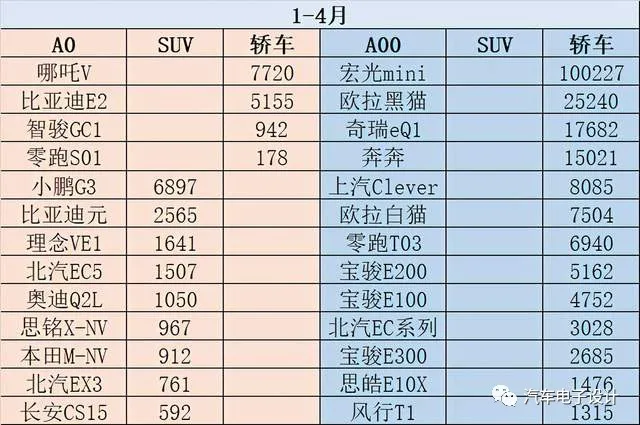

From this table, we can analyze the competitive landscape of the top 20 car companies in terms of their insurance rankings.

Micro-car Companies: In the table, Wuling, Changan, Chery, Great Wall, Hezhong, and Leapmotor all essentially adopt the same strategy, focusing on the pure electric A00 and A0 segments. After Wuling has paved the way, there is essentially no major differentiation between the companies. In the 30,000 RMB (120 km) and 50-60,000 RMB (300 km) segments, companies only differ in cost, with no distinguishable features.

Dispersed Categories: BYD and SAIC are quite similar, with a diverse range of products in both BEV and PHEV. However, among the TOP 3 in BEV, excluding the Han EV, their market shares are not particularly high when viewed in each sub-market.

Single Product: Represented by Tesla, only 1-2 products hold a high market share. In fact, overall, they have taken away the market share of fuel vehicles. NIO, Xpeng, and Ideal, which are in the top ranks, also have a similar strategy to compete with Tesla.

EA and BAIC: these two companies still focus on the pure electric sedan market in the 2B market, and then focus on the personal market for other products under the same brand.

Joint Ventures:Represented by Volkswagen, BMW and General Motors, they are currently having difficulty producing BEVs compared to PHEVs. The strategy for BEVs still has a few problems according to their plans.

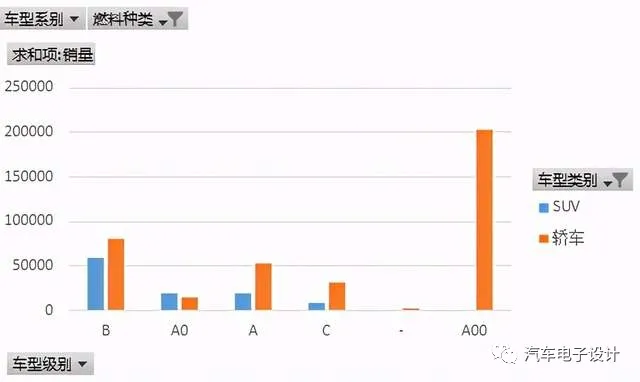

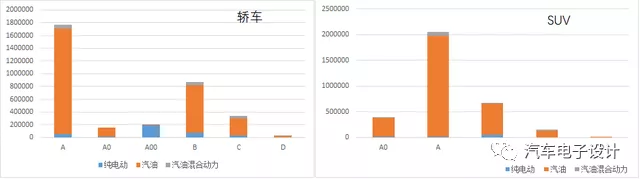

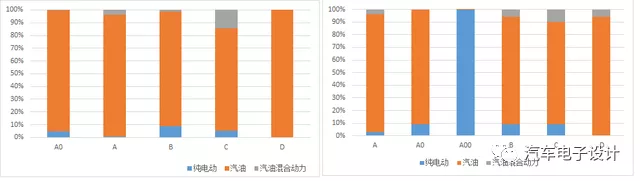

As shown in the following figure, we can understand that the less market share A00 has, the more it can stand firm in various models, thus ensuring long-term development. When the pure electric A00 sedan accounts for more than 50% of all pure electric sedans and more than 33% of total sedan market, it can stand firmly in other spectra for long-term development.

Breakthrough of A00 Micro-cars

The following graph is particularly interesting. China’s insurance data for the first four months of 2021 shows that A00 sedans have accounted for 99% of the market share of electric vehicles, hybrid (including PHEVs), and gasoline vehicles combined. In other words, after several companies focused on developing pure electric A00 cars, China has successfully completed the full electrification of the A00 segment.

The increase in overall penetration rate mainly occurred in A00 vehicles, with the best state being around 10% for others.

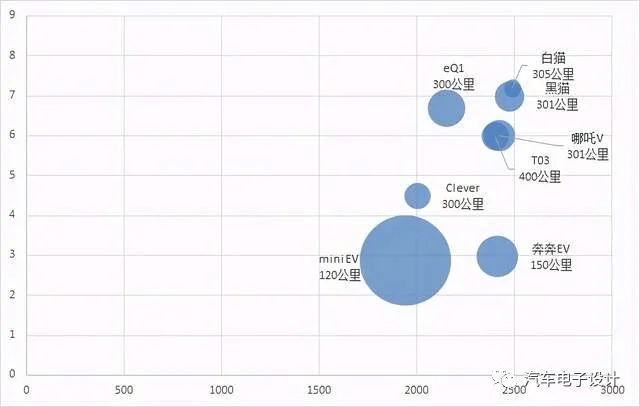

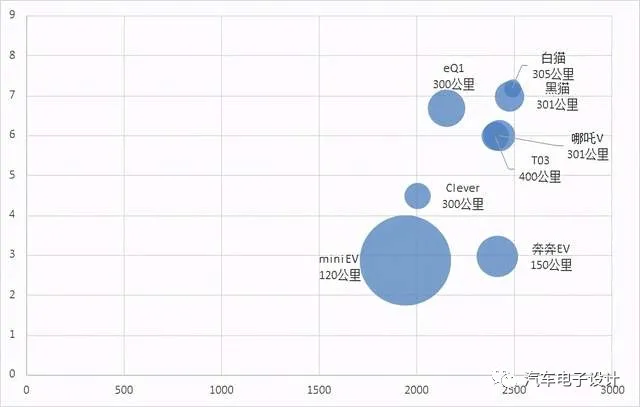

The core factor is still price. We size the installed insurance quantity in May by bubble size, draw a bubble chart of wheelbase and price, and add the cruising range to make it understandable.

1) With a wheelbase of 2 meters and a configuration of 120 kilometers for commuting, a price of less than 30,000 yuan becomes the gold standard. Later entrants like Changan can differentiate themselves by adding wheelbase, cruising range and charging the same price.

2) The rest is to match a larger wheelbase with cruising ranges of 300 and 400 kilometers, and a price of less than 60-70,000 yuan (there will be some floating discounts at the terminal).

This tactic can basically be used by any company that needs fuel consumption credits and can bring down 99% of this type of product. With no internal combustion engine as opponent, it is entirely BEV homogenization.

In this brutal price homogenization, the only way to differentiate from 3,000-kilometer-100-plus-thousand-yuan cars is to produce 300-kilometer-60-70-thousand-yuan cars (with subsidies). This directly brings down the pricing system of around 100,000 yuan. From this perspective, the tool property directly affects A0-level SUVs and sedans, and currently only NEZHA V, BYD E2, and Xpeng G3 have sold over 5,000 units in 4 months. To some extent, the failure of controlling A00 in Shanghai means that launching pure electric A0-level sedans and SUVs won’t have a good outcome. The emergence of A00 means small pure electric vehicles won’t thrive, either – this was the same case for BYD Yuan EV, which was once a great car model.

Summary: The first round of A00 pure electric vehicles was linked to subsidies, which had long-term effects and led to changes in subsidy policies. The second round of A00 policy is linked to the promotion of electric vehicles to rural areas and affordability, and currently it seems the only thing affecting the development of this category is the fact that previously these vehicles were not profitable and needed to be boosted by credits. After the increase in raw material prices and supply shortages, car companies will configure quantities according to their own needs. If it weren’t for this supply chain issue, Wuling could produce 50,000 vehicles per month while Ora and Changan could produce 20,000 each without difficulty. On Sunday, we will discuss the differences between Volkswagen and Tesla. In this highly-crowded niche market, the strategy is similar to that used in cheap smartphones, but there is no great business model. Ultimately, electric vehicles still have to move up in the market.

Summary: The first round of A00 pure electric vehicles was linked to subsidies, which had long-term effects and led to changes in subsidy policies. The second round of A00 policy is linked to the promotion of electric vehicles to rural areas and affordability, and currently it seems the only thing affecting the development of this category is the fact that previously these vehicles were not profitable and needed to be boosted by credits. After the increase in raw material prices and supply shortages, car companies will configure quantities according to their own needs. If it weren’t for this supply chain issue, Wuling could produce 50,000 vehicles per month while Ora and Changan could produce 20,000 each without difficulty. On Sunday, we will discuss the differences between Volkswagen and Tesla. In this highly-crowded niche market, the strategy is similar to that used in cheap smartphones, but there is no great business model. Ultimately, electric vehicles still have to move up in the market.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.