The insurance data for this month came out earlier than expected, and I plan to share with everyone specific information on Friday morning. Without further ado, let’s focus on the overall situation of passenger cars, Tesla, BYD, and a few traditional automakers.

Overview

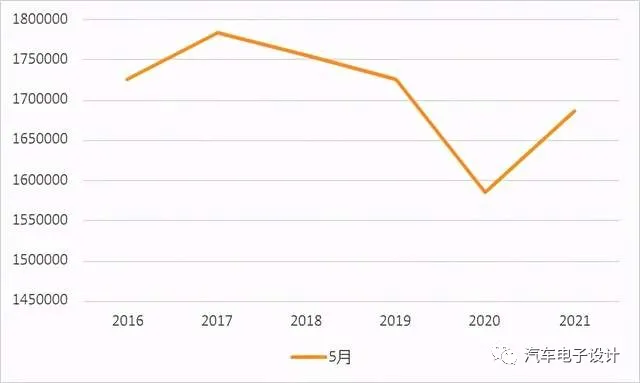

First of all, let’s take a look at the overall industry situation. From the overall perspective, the insurance data for May 2021 is 1.6859 million vehicles, a YoY increase of 6.4%. This is the first time this year that YoY growth has been within two digits compared to last year’s pandemic. It is projected that June will be lower than 2020 according to trends.

However, it is worth noting that May is a turning point in the overall trend. May is traditionally a peak season in previous years, with no fewer than 1.7 million units except for 2020, and it has indeed fallen below this number in 2021. In reality, the entire industry is suffering from a chips shortage, which is most directly reflected at the end of Q2.

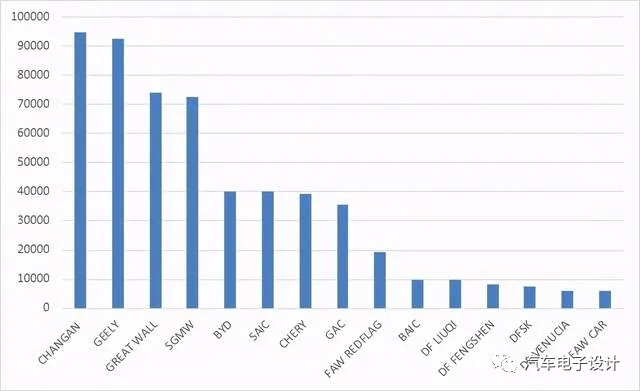

Self-owned automakers are divided into 90,000-level Changan and Geely, 70,000-level Great Wall and Wuling, and 40,000-level BYD, SAIC Motor, Chery, and GAC. The top 8 are still working hard to maintain the overall scale.

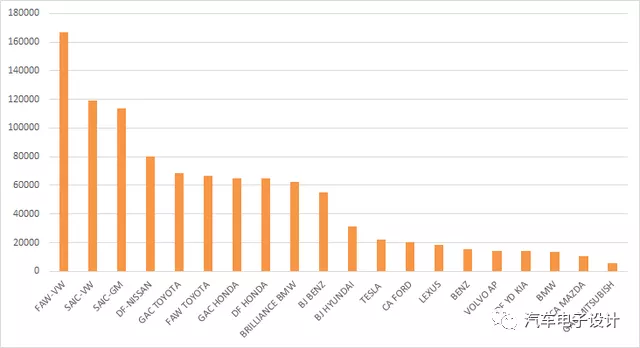

The insurance data of luxury cars is still spectacular, but it can be seen that the joint ventures that can maintain their scale are mainly Volkswagen, General Motors, and Japanese automakers, while the difficulty of joint ventures is gradually increasing.

Let’s move on to the insurance data for new energy vehicles.

New Energy Vehicles

1) Tesla

What we are most concerned about is Tesla, and I shared some thoughts on this yesterday.The insurance data is out. In May, the sales volume of domestically produced Tesla cars was 22,000, an increase of 85% MoM and 94% YoY. In May, the Model 3 sold 9,352 units in the domestic market, an increase of 45% MoM from 6,438 in April, but a decrease of 18% YoY from last May’s 11,362. Model Y delivered 12,744 units in May (after increasing production capacity), an increase of 131% MoM from 5,516 in April.

From the current situation:

-

Model Y, with a price of over 300,000 RMB, has surpassed the Model 3, which costs over 250,000 RMB for the first time in China. This trend should continue in the long term.

-

The delivery volume of Model Y is mainly related to the delivery of the previously backlogged orders. The damage risk to the Tesla brand caused by public opinion needs to be fully displayed in June.

-

Tesla’s long-term development in China is full of challenges and variables.

2) BYD

From the data in May, the number of insured BEVs for BYD was 14,545 units, and the number of PHEVs was 10,000 units, totaling 24,500 units. The wholesale retail data from the China Association of Automobile Manufacturers was higher than the insurance data, which can be understood as a later delivery situation. Among pure electric vehicles, the Han model still maintains a scale of 5,000 units, while other models are between 1,000 and 2,000 units. Currently, it seems that BYD’s pure electric strategy still relies on a large number of vehicle models.

I think it’s necessary to do a special discussion on DMi’s PHEV. I’ll do some research. In May, the output of the Qin Plus was still good. Based on DMi’s Qin Plus, it achieved a monthly output of 3,400 units, and the output of the Song Plus was also increased to 1,600 units. These two DM-i models accounted for half of their sales.

Note: Without DM-i, BYD’s PHEV will likely hover around 5-6K. The main sales focus now is on the Han DM and Tang DM. There is a difference in positioning between these two DM-i models and the other two models, leading to a sales overlap. Of course, it is a devastating blow to BYD’s gasoline cars.

3) New Forces

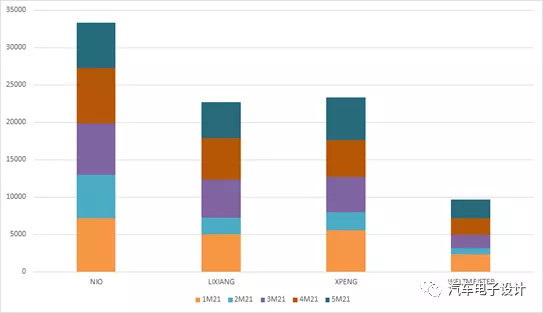

No information provided in the given text.I still tend to put NIO, XPeng, Ideal and WM together. The data of insurance purchases in May were 6078, 5737, 4844, and 2552 respectively. It is quite obvious that WM is falling behind.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.