Shanghai’s License Plate Data Overview

Today, neither the auto association nor the insurance data has been released, but based on the registration data, we can still draw some conclusions. In summary:

-

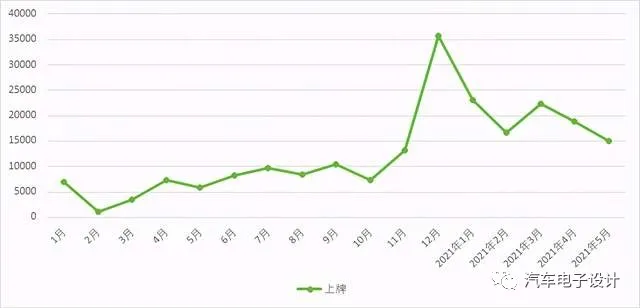

In May, the number of new energy small passenger cars was 15,066, a decrease of 20% compared to the previous month. After experiencing super growth last year, Shanghai’s new energy vehicle market is now contracting.

-

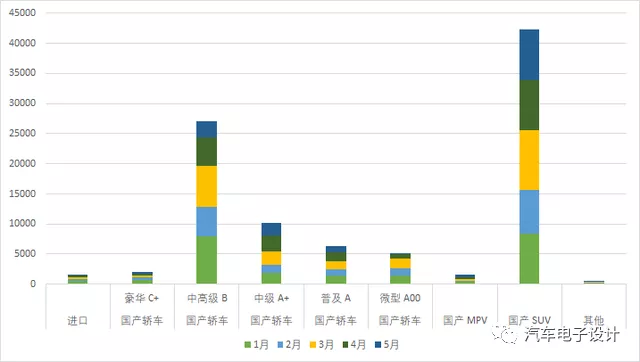

From January to May, a total of 95,791 new energy vehicles were registered in Shanghai, while the total number of registered passenger cars was 260,196, resulting in an overall penetration rate of more than 37% in 2021.

-

In May, only 72 A00-level new energy vehicles were registered, which may be the carryover from the previous month.

-

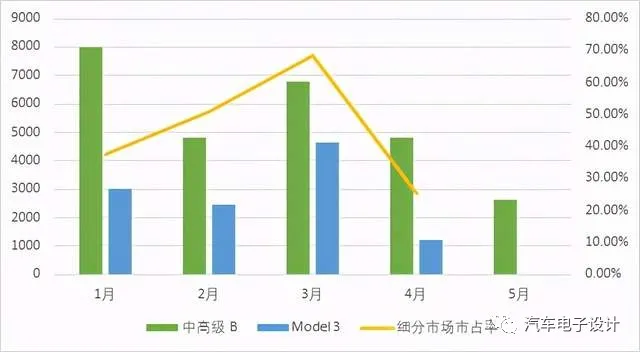

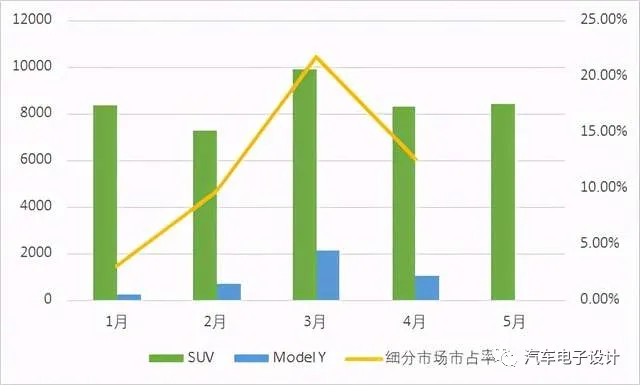

The demand for Model 3 in Shanghai is also declining. According to the subdivision of the Model 3 market, the total sales volume dropped from its peak of 7,981 units to 2,623 units, and it is estimated that there will be 1,000-1,200 Model 3s in Shanghai this month. Based on the stable state of the SUV market, it is estimated that the number of Model Ys insured in Shanghai will be around 1,200-1,500.

Registration Data Overview

As mentioned above, the number of new energy vehicles registered in Shanghai in May was 15,066, which objectively reflects the decline of demand since November last year. In the short term, the number of new energy vehicle registrations in Shanghai may fluctuate in the range of 10,000-15,000 per month. Therefore, it is likely that about 100,000 license plates will be issued in the first five months, and then the number will be controlled to another 100,000 in the remaining seven months, for a total of 200,000 in a year.

Note: This data is my estimate and may decrease to 180,000, approximately within this range.

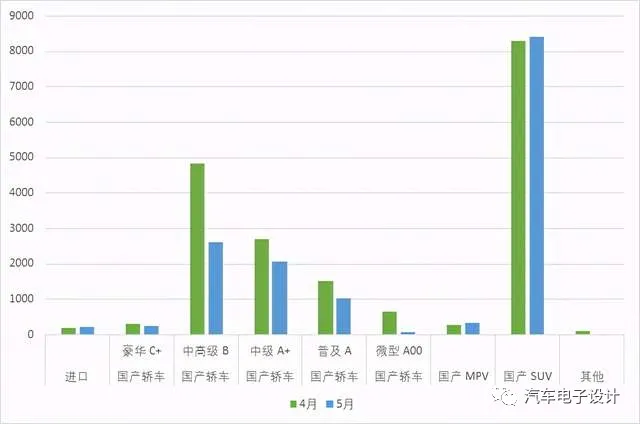

Of the 15,000 vehicles registered in May, only 72 were micro electric cars. 5,000 license plates were issued for this type of vehicle this year, and the biggest decline in sales was in the mid-to-high-end car market where the Model 3 is located. Other markets remained stable, so the impact of the Model 3 on Tesla’s stronghold is still direct.

Looking at the trends of the past five months, SUVs that lean towards personal consumption still maintain very good extendibility, also because of the many subdivisions made to sedans, making SUVs more concentrated.

As shown in the chart below, during the centralized delivery process, Model 3 achieved the highest market share of 68% in Shanghai’s segmented market. Due to the decline of the overall segmented market in May, it is estimated that Model 3 will be between 1,000 and 1,200 units in Shanghai this month.

Due to the stable SUV market and some PHEVs in this segmented market (Roewe eRX5 Plus maintained at about 1,000 units per month), it is estimated that Model Y will reach about 1,200 to 1,500 units in Shanghai in May.

It is estimated that Tesla will achieve 2,200 to 2,700 new licensed units in Shanghai.

New energy data from China Association of Automobile Manufacturers

Here we mainly analyze the data for May. The wholesale sales of new energy passenger cars reached 196,000 units, an increase of 6.7% compared to April, and pure electric wholesale sales reached 162,000 units, while plug-in hybrid sales reached 34,000 units, accounting for 17%. The wholesale sales of A00-level pure electric cars reached 50,000 units, accounting for 31% of pure electric vehicles; A-level electric vehicles accounted for 26% of pure electric vehicles; and B-level electric vehicles reached 47,000 units.

Note: the data here is strange, with retail sales of 185,000 units, which is only slightly lower than the gap between Tesla’s wholesale sales (33,463 units) and retail sales (21,936 units). Tesla does not need wholesale sales, so checking the online insurance data may be more meaningful.

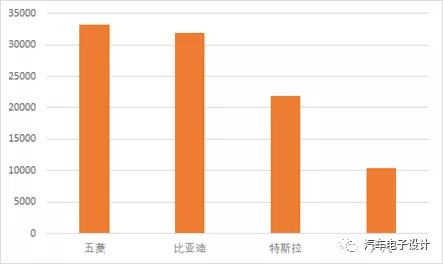

In the retail data, SAIC-GM-Wuling sold 33,175 units, BYD sold 31,908 units, Tesla China sold 21,936 units, and GAC Aion sold 10,395 units. These four companies accounted for 52.6%, or 97,414 units. There are several specific questions:1. The supply of chips and batteries for Great Wall Euler may indeed be a bottleneck, with sales of only 3,597 units in May, a sharp decline of 51.9% compared to sales of 7,476 units in April.

-

According to the announcement by Changan New Energy, they delivered 10,018 units in a single month, but this data may not be listed due to the retail data from the China Passenger Car Association (CPCA) being lower than 10,000. Currently, China Aviation Industry Corporation (AVIC) accounts for a relatively high proportion of Changan’s battery supply.

-

Due to the switch to AVIC as the main supplier, GAC’s retail sales also exceeded 10,000. This is closely related to the overall guarantee of battery supply and is the only company besides Wuling that can switch to CATL.

In my understanding, the supply of batteries and chips from June to August will still have a significant impact on many automakers.

Conclusion: In a few days, we will have monthly data on battery installations and insurance, which will allow us to have a clearer understanding of the situation.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.