On June 2, 2021, Great Wall Motors signed a 10-year strategic cooperation agreement with CATL to achieve deep cooperation in the field of new energy. The attendance of the chairmen of both parties also highlights the importance of this signing.

As early as 2012, Great Wall Motors began to conduct research on power battery technology. In the end of 2016, it set up the Power Battery Business Unit, and in 2018, the battery business unit was independently established as the Honeycomb Energy Technology Co., Ltd. Half a year ago, Great Wall Motors just released the DHT hybrid product line, and it is now on the eve of listing. Signing a long-term contract with CATL at this time is worth pondering.

On the other hand, on May 31, CATL’s market value surpassed one trillion, becoming the first company in the GEM to have a market value of more than one trillion. However, on the same day, Morgan Stanley lowered its rating on CATL’s stock from “neutral” to “underweight” and issued a target stock price of RMB 251.

In addition, car companies led by Tesla and Volkswagen have publicly stated in the past year that they want to build their own battery factories, and both are currently major customers of CATL. Speculations about the future prospects of CATL abound. Will the trillion-dollar market value be a starting point or an end point? Will car companies collectively break away from CATL in the next few years?

Amidst controversy, let’s take a look at the changes happening in the industry.

Why are they building their own factories?

To prevent insufficient capacity

At the Battery Day in September last year, Tesla stated that the current expansion speed of global battery capacity cannot keep up with the growth rate of future new energy vehicles. In the future, Tesla’s demand for battery capacity may be greater than the total capacity of several leading battery suppliers, including LG, Panasonic, and CATL.

Tesla has already experienced delivery problems caused by insufficient battery capacity. Even now, the production delays of Cybertruck, Roadster 2, Semi, and other models using 4680 cells have happened several times. In addition, due to battery production difficulties, the Tesla Model S Plaid Plus model, which uses 4680 cells, had to be cancelled.

To prevent this situation from happening, Tesla has decided to proactively build its own battery factory in addition to continuing to purchase batteries from suppliers to supplement capacity. This part of the capacity is expected to reach 100 GWh per year by 2022 and 3,000 GWh per year by 2030.

To prevent this situation from happening, Tesla has decided to proactively build its own battery factory in addition to continuing to purchase batteries from suppliers to supplement capacity. This part of the capacity is expected to reach 100 GWh per year by 2022 and 3,000 GWh per year by 2030.

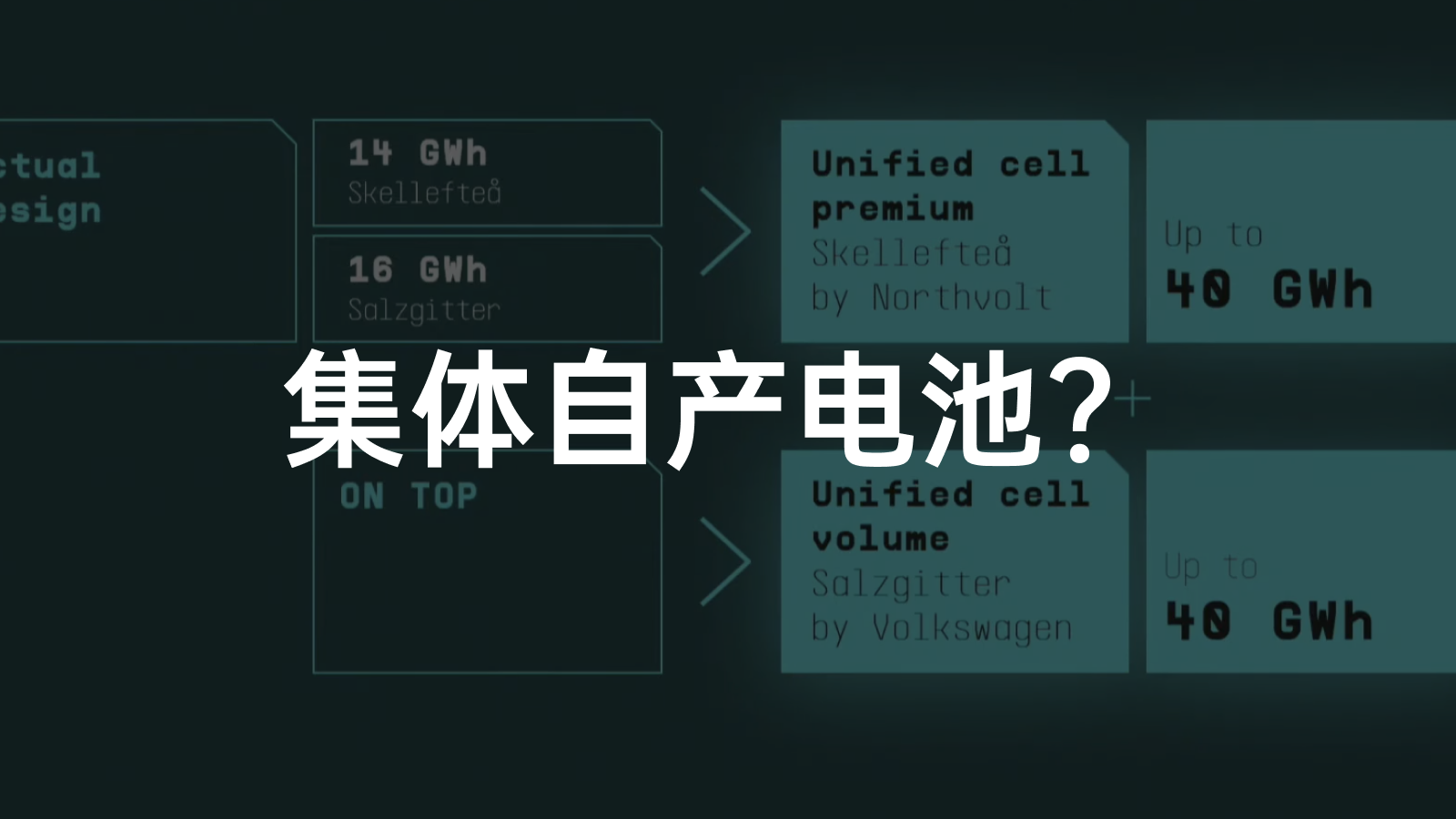

Volkswagen also showed similar concerns at their own Energy Day, with plans to establish six battery factories in Europe with partners before 2030, each with an annual capacity of 40 GWh, totaling 240 GWh.

Simply put, these two self-built factories are a case of “provisions before troops” as a precautionary measure for the upcoming growth of the new energy market.

Power Struggle in Interest

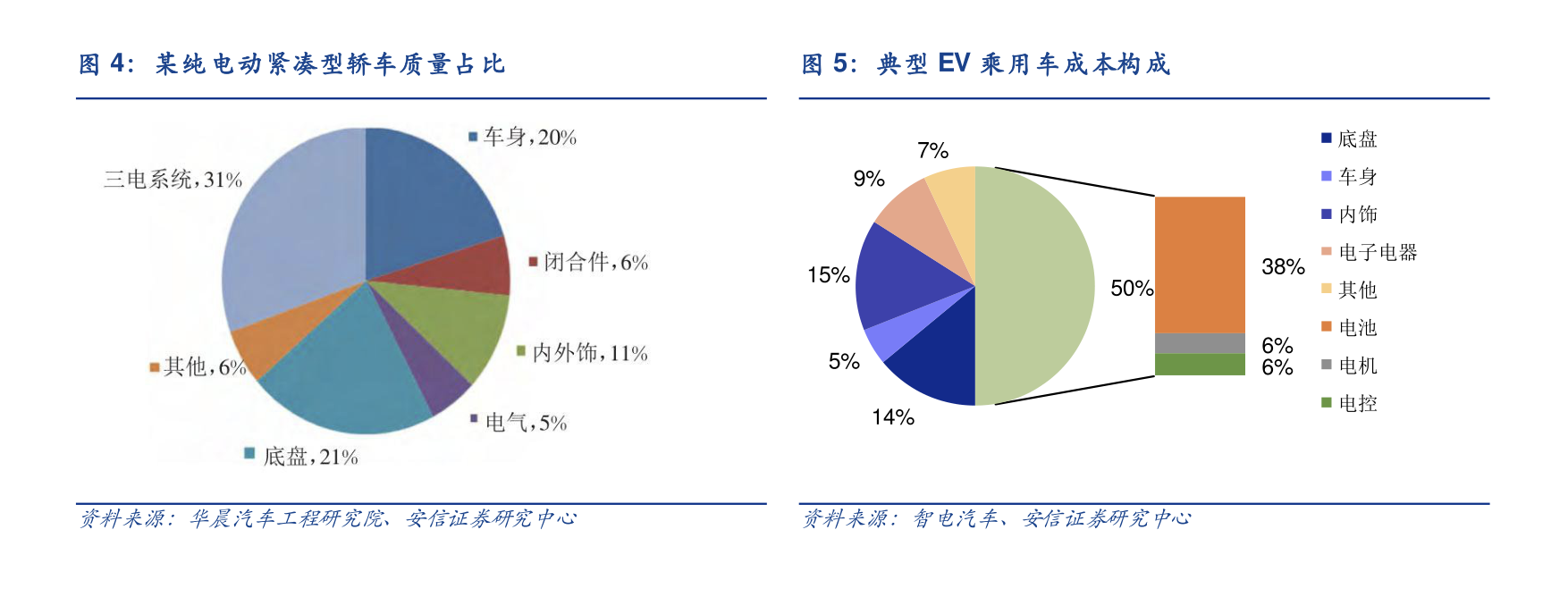

A report by Anxin Securities in July last year showed that the proportion of power batteries in the cost of pure electric vehicles exceeded 30% of the total vehicle cost. Therefore, as economies of scale increase, the importance of batteries for automakers is also proportionally magnified.

The entire Volkswagen Group had sales revenue of 222.9 billion euros and a net profit of 8.82 billion euros in 2020, with a profit margin of 3.96%. Someday, when the Volkswagen Group only sells electric vehicles, the profit from these batteries will be a huge number.

For this major component, automakers who have always occupied the dominant position in the supply chain like Volkswagen naturally do not want to be held hostage and work for others. Competing for the right to speak with suppliers to maximize their own interests is also a matter of course.

And as the electric vehicle industry matures and competition intensifies, automakers hope to gain more suitable battery solutions in production and design for cost control and optimized design for electric vehicles.

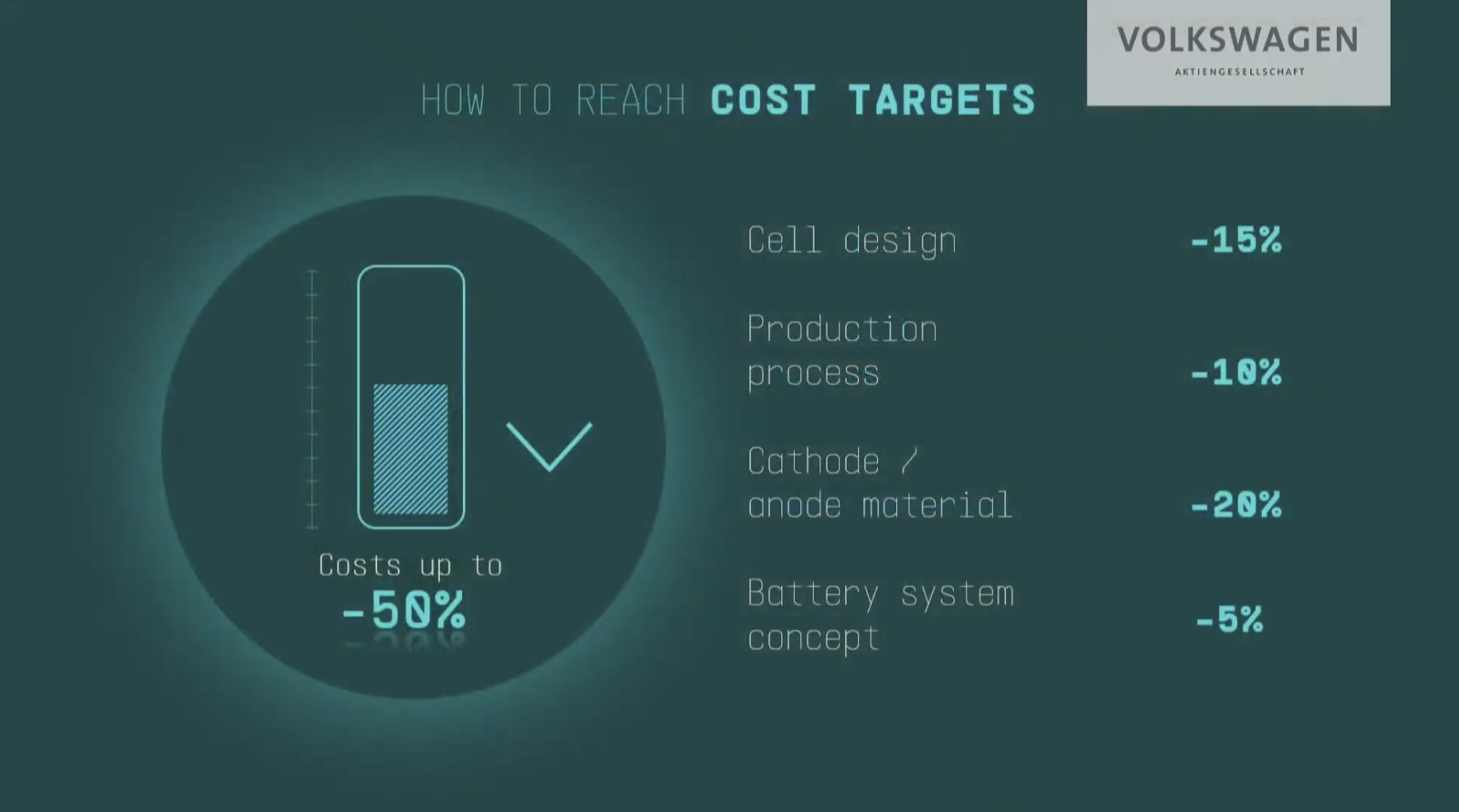

For example, Volkswagen, which is good at using platform-based manufacturing to share the cost of model development, expressed that it will adopt standardized battery cells to unify its own battery cell form and increase the reuse rate of the battery cells in different models. The difference in battery performance and cost is achieved through different electrochemical formulas within standardized battery cells. This approach is like using a uniform bottle for different flavors of canned drinks under the same brand, requiring only one set of molds for targeted manufacturing.These control effects on various stages should not be underestimated after scale effects. For example, for entry-level lithium iron phosphate batteries, the application of standardized cell schemes in battery design can lead to a 15% cost reduction according to the common belief.

From this perspective, it seems that establishing a battery factory would be in the best interests of automakers. However, all of this reasoning is based on an important premise: sufficient scale.

Scale, Automakers’ “Vertical Stratification”

They Can Do It, but Not Everyone Can

“Scale is more important in the era of electric vehicles (EVs) than in the era of conventional cars,” said the CEO of Volkswagen in an interview in March 2021. “The differentiation of EV power systems will not be significant. The real differences are: whether the products have cost advantages, and whether they are of high standards, high quality, and have global scale.”

We still take Volkswagen Group as an example. By 2025, they plan to launch 15 domestically produced models on the MEB platform in the Chinese market and achieve annual sales of 1.5 million electric cars in China. As a comparison, Tesla, the global electric car sales champion last year, sold only about 500,000 cars.

Obviously, only a very small number of automakers have the opportunity and ability to achieve this volume. Therefore, the scale effect of establishing a battery factory is obviously not suitable for all companies.

For automakers, if they cannot achieve better cost and product advantages through scale, then personally engaging in this area would be a thankless task. This theory applies to almost all vertical integrations. For power batteries, which are a major component, the difficulty is even greater.

Automakers, as the final pushers of products into the consumer market, are strong at overall control and integration of various technologies and resources. However, power batteries are still a relatively unfamiliar area for automakers. Personally engaging in this area to some extent means starting from scratch, and the high technical barriers will bring significant resistance.

The Unchanged Truth: Investment Must be Returned, and Specialization is Key

In the power battery industry, suppliers such as LG, CATL, and Panasonic have made long-term investments and accumulations in their own professional fields, which automakers cannot easily catch up with, especially in the areas of electrochemistry research, battery management, and battery safety. Panasonic’s cylindrical battery cells provided to Tesla are a typical example, with high density and good heat dissipation. However, the challenges of cell consistency, cell welding and assembly, and BMS have kept many companies out.

For example, by the end of 2020, CATL had 5,592 R&D personnel, and its R&D investment for the entire year was RMB 3.569 billion, not including the company’s investment and holding in the upstream and downstream industries.And besides the technical challenges, the investment required for developing and producing power batteries is not a small sum. As of the first quarter of 2021, according to statistics on China’s battery industry, more than 20 companies invest in battery production capacity of about 350 GWh, which corresponds to a construction fund of 160 billion yuan, and an average investment cost of 1 GWh of capacity reaches 457 million yuan.

For companies, when it comes to spending money on investment, the cost-effectiveness ratio must be considered, and challenging the mature supply chain giants to achieve better results will require spending a lot of money. Even if the host factory produces better batteries through research and investment, if the investment cannot be offset by the sales revenue of the batteries, it is still a loss-making business. If they choose to export like BYD, the identity of competitors will become something other factories fear.

Therefore, building a battery factory is a high-threshold, high-investment, high-risk undertaking from all perspectives. Even Volkswagen Group, which we mentioned earlier, because its capital investment is limited, the factories and batteries behind the planned 240 GWh battery production capacity are not all produced by itself, and 20% of them are still purchased externally.

In September last year, former Ford CEO Jim Hackett publicly stated at a financial report meeting that Ford would not build a battery factory. The current expansion of the battery supply chain development is rapid, and from the perspective of cost and procurement, building a battery factory by Ford cannot bring any advantages.

Overall, from talent accumulation to supply chain resources, from technical reserves to mass production and supply capacity, the strength of the top power battery suppliers is still difficult to shake. For most of the host factories, considering their own economies of scale and professional capabilities, compared to building their own factories, sourcing batteries from the supply chain is still the safest and most appropriate choice.

Compromise between joint venture, procurement and self-production

The struggle between battery suppliers and host factories is not a recent development. In conflicts and games, the two sides have also developed a business model of joint production.

Ningde Times, famous for its joint venture model, has established deep cooperation with several host factories. From the names of companies like Times SAIC, Times FAW, Dongfeng Times, Times GAC and Times Geely, it is known that the cooperation between Ningde Times and the host factories is close.

Ningde Times and the host factories jointly developed power batteries, and bound their interests through a joint venture model, giving the car companies a certain degree of voice. This model provides a relatively compromised choice.

Under the production capacity gap

According to the research prediction of South Korean SNE Research, the global demand for power batteries will be 406 GWh by 2023, but the production capacity will only be 335 GWh, creating an 18% capacity gap. By 2025, this gap will expand to 40%.

Under this situation, car companies will get priority responses according to their advantages in products and prices. Ningde Times, which has advantages in product and price, will consider its own greater benefits given the limited production capacity.If automakers don’t want to be at the mercy of others, they can develop other supplier resources in addition to building their own factories like popular Tesla. By developing secondary suppliers, the automaker not only gains more supply security, but also improves its bargaining power in negotiations with Ningde Times. However, these actions taken by the automakers are more focused on their discourse power and risk avoidance, and these moves do not mean that they can bypass Ningde Times in terms of demand.

Automakers that hope to have stable production capacity can also sign long-term quantified cooperation agreements with Ningde Times. However, considering their own interests, Ningde Times requires automakers to keep annual demand fluctuations within ±15%. If the automaker’s procurement does not meet the standard, it will need to pay the difference. For example, the collaboration between Ningde Times and Great Wall mentioned at the beginning of the article is reported to be 10 years and 200 GWh.

On the other hand, in the face of insufficient production capacity under the industry’s high-speed growth, Ningde is also actively preparing. In February this year, Ningde Times announced in a statement that it will invest 29 billion yuan to build power battery bases and energy storage projects in Yibin, Sichuan, Zhaoqing, Guangdong, and Ningde, Fujian. At the end of December last year, Ningde Times had announced an investment of 39 billion yuan in Fuding, Fujian, Yibin, Sichuan, and Liyang, Jiangsu to increase production.

According to SNE Research’s global lithium-ion battery shipments data in Q1 2021, Ningde Times’ installed capacity ranked first again at 15.1 GWh, with a year-on-year increase of 320.8%, and its global market share increased from 25% for the full year of 2020 to 31%. The domestic market share of Ningde Times has even reached 52.67%.

Conclusion

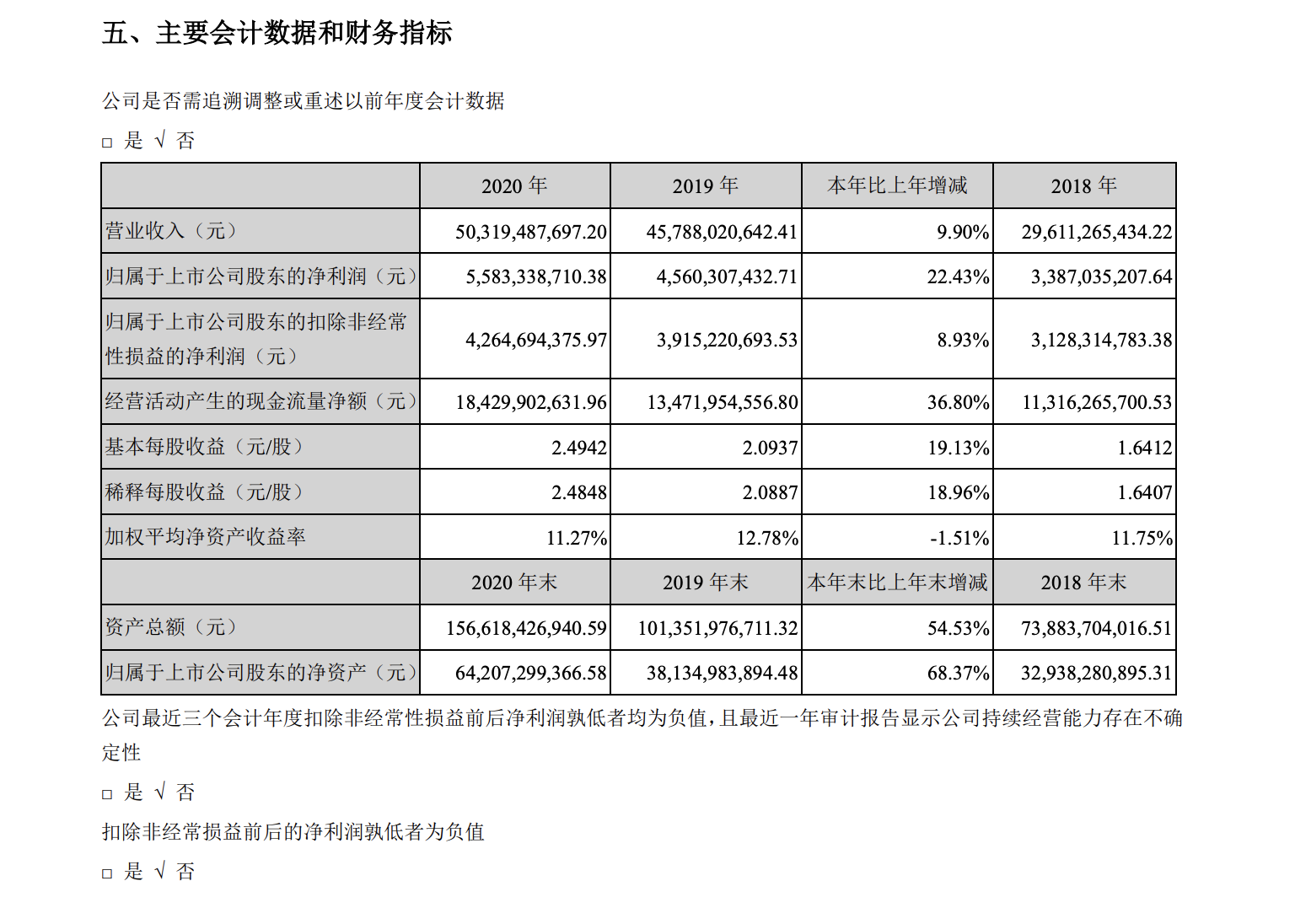

In 2020, Ningde Times’ full-year revenue was 50.319 billion yuan, a year-on-year increase of 10%, and the net profit attributable to shareholders of listed companies was 5.583 billion yuan, a year-on-year increase of 22.43%.

However, while both revenue and profit increased, Ningde Times’ gross margin decreased slightly from 29.06% in 2019 to 27.76%. But this is almost the inevitable challenge for all companies during scale expansion and intensified competition.

Ningde Times has responded to this by stating that although the company’s gross profit margin has declined due to the impact of the epidemic and the decline in power battery prices, the rate of decline has slowed. With the release of production capacity, improvements in manufacturing processes, and deep cooperation in the industrial chain, the company’s gross profit margin will remain at a reasonable level.

The Chinese new energy market grew significantly year-on-year in Q1 2021, and as the largest oligopolist in the power market, Ningde Times, which thoroughly understands the upstream and downstream of the industry and has a significant share of shipments, will still steadily and avidly take advantage of the growth in the industry.

In the 2021 Q1 financial report, CATL’s quarterly revenue reached RMB 19.167 billion, an increase of 112.24% YoY, and the attributable net profit to shareholders was RMB 1.954 billion, an increase of 163.38% YoY.

In the 2021 Q1 financial report, CATL’s quarterly revenue reached RMB 19.167 billion, an increase of 112.24% YoY, and the attributable net profit to shareholders was RMB 1.954 billion, an increase of 163.38% YoY.

Turning to the topic of power batteries, although OEMs do not conceal their wariness towards CATL, for most players in the new energy field, building their own battery factories is beyond their capacity, so purchasing batteries is the norm. On the other hand, the fierce competition among battery suppliers has led to the expansion of the battery industry, cost reduction and product evolution, and OEMs are the beneficiaries of this process. Furthermore, for OEMs, although they could choose to put the eggs in their own basket, considering all factors, CATL with its dual advantages of price and quality is still the first choice.

Even Tesla, the most active in building its own factories, has recently been secretly building a new battery factory in Linyuan with CATL. The planned capacity of the factory may reach nearly half of Tesla’s global demand for batteries and energy storage.

Therefore, in the future, as long as there are no major mistakes in choosing the technical route, CATL’s Matthew effect in the power battery industry will continue.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.