Author: Wang Yunpeng

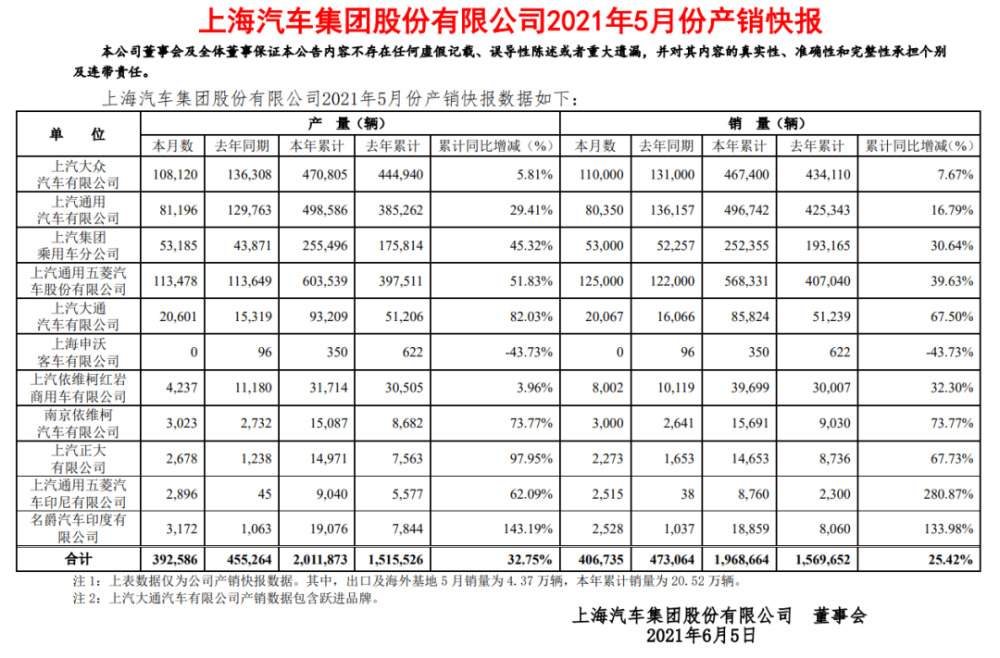

Recently, SAIC Group announced its sales report for May. The data shows that the sales volume of SAIC Group in May was 406,700, a decrease of 14% compared with the same period last year, which was 473,100. Compared with April’s 419,500, it also decreased by 3.05% month-on-month.

In terms of cumulative sales, SAIC Group’s cumulative sales from January to May this year was 1.9686 million, a year-on-year increase of 25.42%. Although the performance in the first five months is different from the situation of double year-on-year and month-on-month decline in May, it is not considered to have much reference significance in the industry. Specifically, due to the impact of the epidemic, the production and operation performance of car companies in the first half of 2020 were not ideal, so the year-on-year sharp increase in sales this year is more of an inevitability.

In addition, from the perspective of SAIC Group’s annual sales target of 6.17 million vehicles, the performance of 1.9686 million vehicles in the first five months is not very impressive. The reason is simple. With only one month left in the first half of the year, SAIC Group has not yet completed one-third of its annual target. Whether this will affect SAIC Group’s completion of its annual sales target is still unknown.

As for specific sales, the data shows that in May, SAIC Group’s SAIC passenger cars, SAIC-GM-Wuling, and SAIC Maxus all performed better than the same period last year, among which SAIC-GM-Wuling ranked first with a score of 125,000 vehicles.

Compared with the continuous upward trend of the above brands, SAIC Volkswagen and SAIC-GM, the two major joint venture brands, are slightly sluggish. In May, SAIC Volkswagen sold 110,000 units, a year-on-year decrease of 16.03%, and SAIC-GM sold 80,350 units, a year-on-year decrease of more than 40%.

Therefore, some in the industry have pointed out that the double year-on-year and month-on-month decline in SAIC Group’s sales in May is not unrelated to the “dragging” performance of SAIC Volkswagen and SAIC-GM, the two major joint venture brands.

SAIC Volkswagen, SAIC-GM “diving”

Regarding the sales performance of SAIC Volkswagen in May, the industry believes that although it is affected by chip shortages, it is more related to the weakness of main selling models such as Lavida and Passat, and the inability of new models such as ID.4X and Weiran to carry the load.

Take Lavida as an example. Although SAIC Volkswagen has not yet announced the latest sales data for Lavida, based on the performance in the first four months of this year, the sales of Lavida in May may still show a year-on-year decline. Looking at the pure electric model ID.4X launched at the beginning of this year, the sales in March and April were 625 and 922, respectively. It can be said that the market performance has not reached expectations.Actually, SAIC Volkswagen’s decline began three years ago. According to statistics, SAIC Volkswagen’s cumulative sales in 2019 were 2.0018 million vehicles, not only a year-on-year decline of 3.07%, but also a loss of the sales champion position, which had been held for 4 years, to FAW-Volkswagen by a gap of 70,000 vehicles.

In 2020, SAIC Volkswagen’s sales continued to decline by 24.79%, which was higher than the overall level of the automobile market. Even in the second half of 2020, when mainstream joint venture brands achieved year-on-year growth, SAIC Volkswagen failed to reverse the trend of negative growth. Moreover, the Passat, which was the best-selling midsize car domestically in 2019, has almost been out of the top three in sales of domestic midsize cars since 2020.

In 2021, SAIC Volkswagen has been surpassed by SAIC GM several times, falling to the second or even third position within the group. Although it overtook SAIC GM by nearly 30,000 vehicles in May, it still ranked second within the group.

Faced with continuous sales decline, SAIC Volkswagen is not indifferent. It is known that SAIC Volkswagen will launch new models such as the new Tiguan, the new Passat, the new Lingdu, and ID.3. In terms of personnel, SAIC Volkswagen has not only recalled “veteran” Yu Jingmin from SAIC Passenger Car to serve as the Deputy General Manager of Sales and Marketing and the General Manager of SAIC Volkswagen Automotive Co., Ltd. and Shanghai SAIC Volkswagen Sales Co., Ltd., but also conducted a larger personnel adjustment involving 40 people at the end of May, covering marketing, production, audit, mobile internet and other sectors.

It remains to be seen whether this series of self-help measures can help SAIC Volkswagen’s sales to recover.

Compared with SAIC Volkswagen, the decline of SAIC GM’s sales is more obvious. Data shows that SAIC GM’s sales in May were 80,350 vehicles, a year-on-year decline of 40.99% from 136,157 vehicles in the same period last year.

As the holder of brands such as Chevrolet, Buick, and Cadillac, and once having dominated the domestic automobile market, why has SAIC GM fallen to this point? From a production volume of only 81,196 vehicles and a year-on-year decline of 37.43%, the decline in SAIC GM’s sales in May may also be affected by the shortage of chips.

However, looking at SAIC GM’s performance in recent years, the main reasons for its sales decline are Three-Cylinder Engine causing brand image decline, continuous collapse of quality reputation, and inadequate electric transformation.The data shows that SAIC-GM sold a total of 1.4675 million vehicles in 2020, but the sales of new energy vehicles were less than 18,000, a serious imbalance in proportion. Currently, Buick has three new energy vehicle models: the Velite 6 EV, the Velite 6 plug-in hybrid, and the Velite 7 EV. Chevrolet has only one new energy vehicle model, the Bolt EV. In addition, the latest model of its BEV3 platform for pure electric vehicles will not be launched until 2022. In the current domestic market, SAIC-GM’s response to the transformation of new energy is somewhat slow.

Compared with SAIC Volkswagen and SAIC-GM, SAIC Passenger Vehicle Division had a relatively good performance in May. The data shows that SAIC Passenger Vehicle Division sold 53,000 vehicles in May, a year-on-year increase of 1.42%, and its cumulative sales from January to May exceeded 252,300 vehicles, a year-on-year increase of 30.64%.

In terms of specific models, the new Roewe i5 sold over 10,000 units in its first month on the market, breaking the record for sales growth rate of Chinese brand sedans. In May, the sales of the new MG5 exceeded 7,000 units, and the delivery volume of the R brand increased by 22% month-on-month. The delivery volumes of the MARVEL R and ER6 increased by 28% and 15% respectively, continuing to lead their respective subdivided markets.

In addition, SAIC Passenger Vehicle Division also stated that the third-generation MG6 series, the MG Navigator series, and the MG ZS series maintained a relatively good growth momentum in May.

While the sales of its two major joint venture brands declined, how did SAIC Passenger Vehicle Division maintain year-on-year positive growth? In the industry’s view, this is closely related to the improvement of its product strength and market layout.

Taking the new Roewe i5 as an example, the car was launched at the end of April this year, with a price range of RMB 67,900 to 899,000. Although its price is less than RMB 100,000, its product strength is quite competitive. It is known that the new Roewe i5 has been upgraded in many aspects such as exterior design, interior decoration and intelligentization, especially the 720-degree intelligent panoramic view imaging system, which integrates 360-degree ultra-clear panoramic imaging and 360-degree intelligent visual safety assistance technologies that are superior to those in similarly priced vehicles. In less than a year since its establishment, the R brand has set up 100 experience centers in 40 cities across the country. According to the plan, the number is expected to increase to 200 by the end of this year.The performance of SAIC passenger vehicles in May was commendable, but not perfect. In terms of vehicle models, except for a few models such as the new Roewe i5 and Roewe RX5, the sales of other models under SAIC passenger vehicles are almost marginalized. Even the new Roewe i5 and Roewe RX5 have monthly sales that are lower than similarly positioned mainstream independent models such as Geely Emgrand, Changan CS35 PLUS, and Haval H6.

From the sales data, although SAIC passenger vehicles achieved year-on-year growth in May, there was a 2.03% month-on-month decline. At the same time, the cumulative sales of SAIC passenger vehicles in May were only 53,000 vehicles. Not to mention the comparison with the sister companies SAIC Volkswagen and SAIC-GM, there is still a significant gap compared to independent brands such as Changan Automobile, Geely Automobile, and Great Wall Motors.

In other words, the current SAIC group has not yet completely overcome the situation of “strong joint ventures, weak independent brands”, and SAIC passenger vehicles still need to make efforts.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.