Introduction

The smart connected vehicle industry is on the eve of mass production. It is no longer just about cars or transportation, and it’s not just about operators. The mode of operation is constantly evolving. Although this industry is not yet fully mature, if we do not integrate it into our lives soon, the cake may have already been split.

Compared with traditional navigation maps, high-precision maps are a common basic technology for intelligent connected transportation. Its service targets are not only human drivers, but also smart connected/autonomous vehicles. Let’s take a look at what several map-making companies are doing.

Intelligent Connected Vehicle Trend Is On the Rise, But Challenges Remain

In the 14th Five-Year Plan, an entire chapter is dedicated to defining China’s digital construction framework, which clearly states specific work goals for intelligent vehicles, new energy vehicles, the Internet of Things, and intelligent transportation. It provides very detailed definitions for the entire industry.

In February of this year, the state issued the “National Comprehensive Three-Dimensional Transportation Network Planning Outline,” which requires all regions and departments to implement it seriously in conjunction with the actual situation. The planning outline puts forward a very key indicator of the development of smart transportation: by 2035, it is hoped that all infrastructure will be digitized and networked by about 90% in approximately 15 years. This is a huge market space worth paying close attention to.

In recent years, the domestic smart connected vehicle industry has developed rapidly, showing four characteristics:

-

First, the policy is led by a very positive attitude, and various local governments are constantly introducing relevant laws and regulations. In March, the “Shenzhen Economic Special Zone Intelligent Connected Vehicle Management Regulations” publicly solicited opinions. It is proposed that after registration and licensing, intelligent connected vehicles such as unmanned driving can travel on the road just like traditional cars.

-

Second, the scale of landing projects has gradually increased in recent years. From demonstration projects worth 40-50 million yuan, to now spending billions of yuan, even hundreds of billions of yuan. Local governments have already noticed that the landing of autonomous driving will bring economic benefits.

-

Third, from the current situation, vehicles equipped with smart connected terminals may experience explosive growth in the short term. The “Development Strategy Outline of Intelligent Vehicles” stated that 50% of new cars produced in 2025 must be connected to the network, and it is possible to achieve 100% by 2022-2023.

-

Fourth, the current standards have solved the first step of the problem. Different manufacturers, suppliers, and automakers have found a common language, but the standard framework of public security, land, transportation, and telecommunications industries has not yet been integrated, and various ministries are working hard to promote it.

Guo Panshi, deputy director of the Four-Dimensional Map New Vehicle-Road Cooperative Research Institute, pointed out that to make this thing a reality in a stable and smooth manner, there are still some problems that need to be solved:

-

The first is that there are many projects, but the applications are relatively simple. The collaborative perception ability of V2I only exists in some demonstration projects, which are almost non-existent in mass production.

-

Second, automakers are very concerned about V2X, but there is a major problem with mutual recognition among different automakers. The mass production of high-level application scenarios is in short supply.## Application and Positioning of Intelligent Connected Vehicle Industry Map

What role can high-precision maps play in the intelligent connected vehicle industry?

-

Firstly, in the cloud, maps operate 24/7 and exchange data with the cloud. This requires coordination between road-end and vehicle/manufacturer servers, as well as new road-side coordination which includes smart services and highways.

-

Secondly, at the edge, edge computing is an essential part of roadside perception. In addition to traditional perception algorithms, it also requires spatial standards, calibration of all perception information (including cameras, LIDARs, and millimeter-wave radars) in a unified space, as well as map stitching and fusion algorithms, to ensure that information is recognized in the same language.

-

Thirdly, at the vehicle end, space benchmarks are crucial in the future production and scaling process. This includes all sensors and a large number of roadside and onboard terminals, as well as cloud information, which must interact and match in a unified geographic spatial framework. Tunnels and underground areas have no space perception, and the only reference point is the map.

-

Finally, the map itself needs to consider typical application scenarios in the “vehicle-road” system. For the first time, maps are being used in a true sense as a common language for interaction between manufacturers and infrastructure providers. Through intelligent connectivity, the map has established more accurate matching and correlation relationships. In the future, the map will extend to many business models, such as fee systems based on calls.

NavInfo: Map as an Infrastructure

NavInfo has a series of self-driving and map planning algorithms. They believe that maps will be an infrastructure in the future, perhaps without the huge market space of sensors, but still very important.

NavInfo has been advancing intelligent connectivity with manufacturers and internet start-ups, creating an AI car-road collaboration solution – Intelligent Car Brain. The product layout and solutions include navigation, connected vehicles, chips, and big data. In terms of car-road collaboration, there are mainly maps, positioning, V2X map service platforms, and self-driving solutions.

-

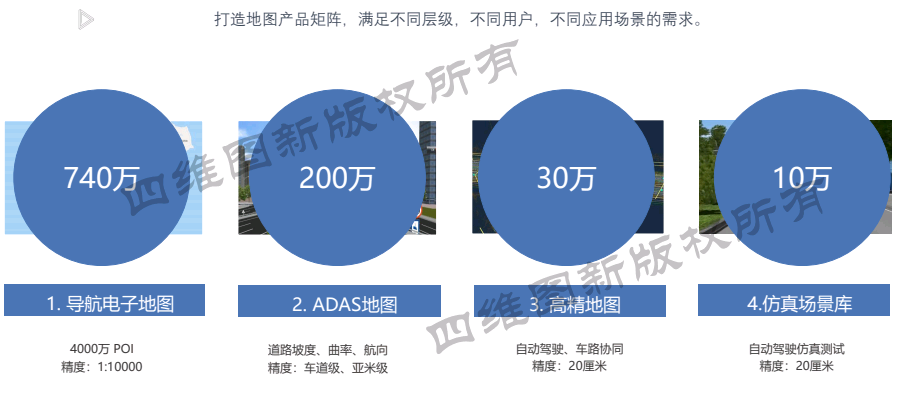

Maps are NavInfo’s strength, and the whole product matrix has four categories: conventional navigation maps, assisted self-driving/advanced autonomous driving maps, high-precision maps for assisted car-road collaboration, and simulation scene libraries for autonomous driving simulation testing applications, which may develop into basic data for building digital economy twin cities in the future.

-

High-precision Location: Sixi Technologies, a subsidiary of Navinfo Group, specializes in satellite navigation-based positioning solutions. Currently, it has released some solutions for ordinary mobile terminals and vehicle terminals, providing 24-hour service. In addition, the fusion solution based on high-precision maps that has been popular in recent years has already been applied to mass-produced cars. Navinfo’s location system can combine satellite signal-based positioning under normal conditions, as well as some specific scenarios where satellite signals are insufficient.

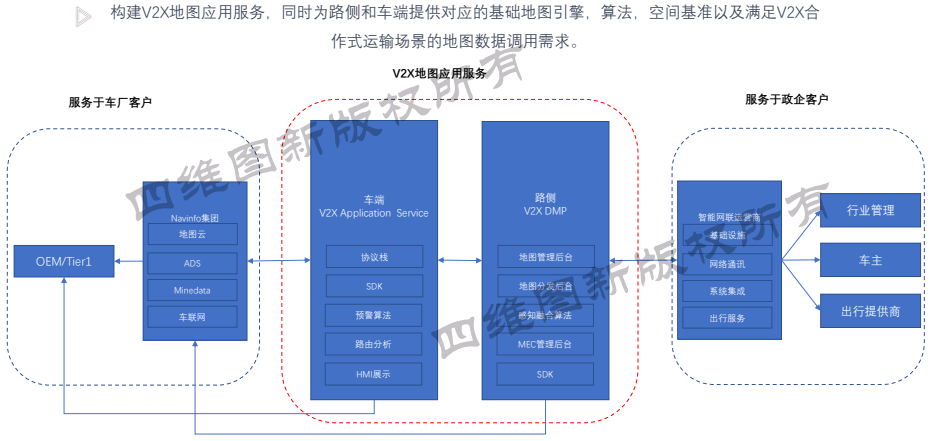

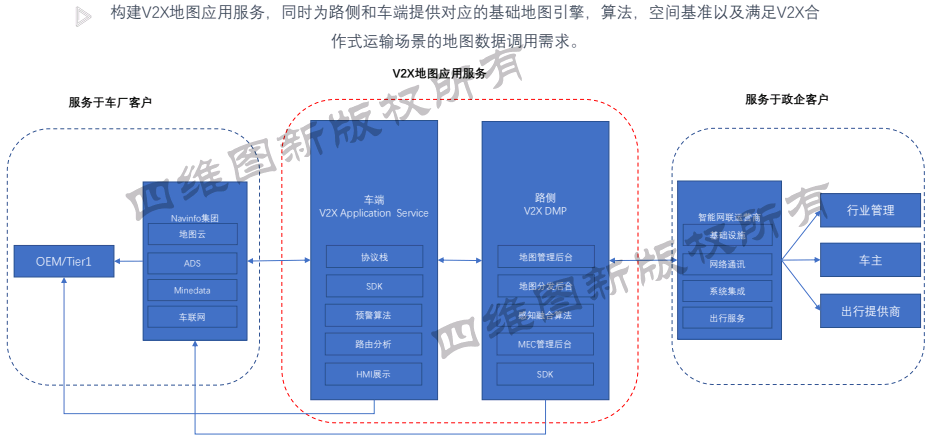

- V2X Solutions: This includes two main parts. One is the Dynamic Map Services Platform (DMP), which can integrate all communication, computation, analysis, and spatial reference from road-side sensors, compile it into a format that V2X protocol can recognize, and distribute and push it to the vehicle end, cloud end, and road side, while ensuring 24-hour uninterrupted communication. The road-side DMP platform is the delivery product landed in various experimental areas, demonstration areas, smart highways, and smart parks.

The other is vehicle-side application. Currently, most automakers do not use maps to handle front-end collision scenarios. Instead, when the vehicle senses a certain distance is reached, the preceding vehicle emits an emergency collision signal to prompt the following vehicle to brake urgently. Strictly speaking, this action is not necessary if the two cars are not in the same lane, but the algorithm currently lacks this judgment information and may produce misjudgment in turning scenarios. Therefore, Navinfo has partnered with some automakers and software vendors to incorporate map-related algorithms and information into the entire context application. The last mile of this process may be the most important work that decides the safety of autonomous driving.

Shanghai Jingzhong: Picking up the Missing Pieces for Map Location

As stated above, regardless of autonomous driving, and only considering vehicle positioning, the decisions made when vehicles detect whether they are in the same lane or not should be completely different. Therefore, the decision of the vehicle must be combined with its current position. This requires reliable and accurate maps. However, the full-domain positioning is still missing in scenes such as elevated bridges and underground garages. At present, all existing solutions, such as inertial navigation, vehicle-end multimodal fusions, and scene-based positioning, are expensive. The deployment of radar in underground garages puts high demands on vehicles, which are challenges that have hindered the development of the industry.

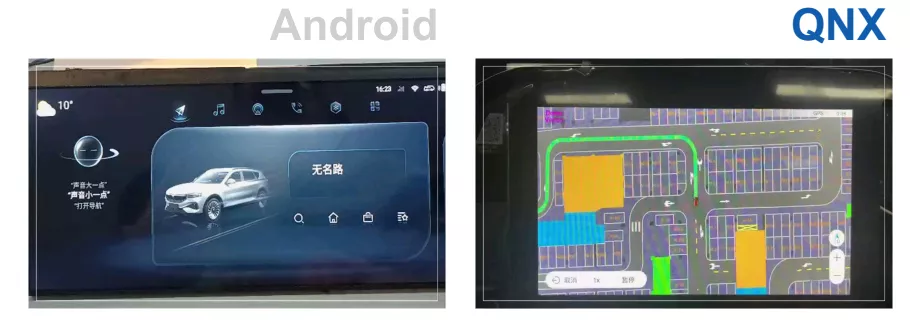

Hu Weirong, Senior Vice President of Shanghai Jingzhong Information Technology, said that using high-precision maps to achieve underground positioning and parking navigation can solve drivers’ parking anxiety and enable high-precision maps to land quickly.By analyzing the driving behavior, drivers firstly check if there are parking spaces available at their destination, and then try to reserve a parking spot in advance. They navigate using either the in-car or mobile navigation system to guide them to the designated parking space. When leaving, they need to locate the parking spot again, and follow the directions from the entrance of the parking lot to the space.

However, there are three major challenges to solving the parking problem:

- First, there need to be enough parking maps covering as many first-tier cities and parking lots as possible.

- Second, many underground parking lots do not have satellite signal, which makes it impossible for location-based services (LBS) to work. Therefore, a no-satellite signal underground positioning technology is needed.

- Third, it is necessary to obtain real-time information about parking space availability to know which spots are occupied and which are vacant.

- Fourth, after knowing the parking space status, it should be possible to reserve the parking spot.

Many solutions just provide information terminals at the entrance of the parking lot, but fail to provide directions to the parking spot. As a result, they only solve part of the problem.

Therefore, Jingzhong has collected a sufficient number of parking maps that cover a wide area. Through its service platform, it enables automakers to publish the maps and provide in-car navigation services. Combining high-precision map development with underground positioning algorithms, location-based services are able to work without satellite signals in underground parking lots. When searching for a parked car, drivers can set the starting point at the elevator or other high-traffic locations, scan the parking space when arriving at the parking lot, and use the cloud-to-car-side solution framework to find the parking spot starting from the departure point.

Jingzhong’s manufacturing platform is at the bottom layer of the map production, publishing and service platform, and can provide tens of thousands of parking lots to automakers according to their navigation requirements. The service platform can also be provided to automakers or operators to support parking navigation services.

By the end of 2020, Jingzhong had covered 20,000 parking lots, including both aboveground and underground parking lots of various sizes, covering most large parking lots in first- and second-tier cities, particularly those at transportation hubs, hospitals, and supermarkets where parking space is often limited. By the end of 2021, Jingzhong aims to cover 50,000 parking lots, and 100,000 by 2022.

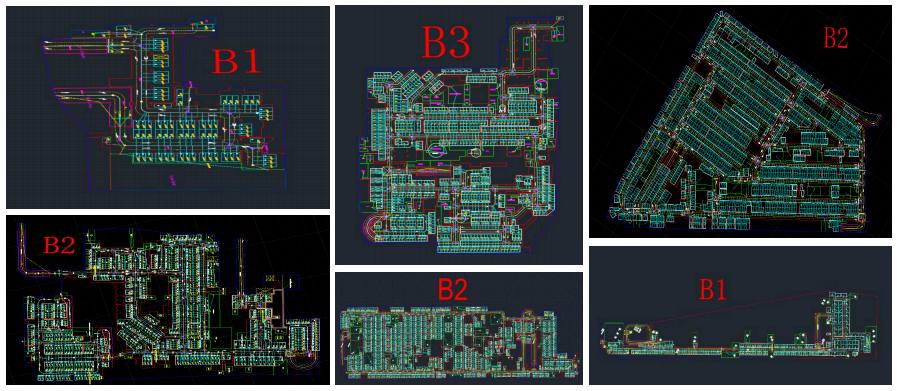

Now, all parking lot data from B1 to B2 channel and B2 to B3 channel have been collected, and they have been collected according to the requirements of automated valet parking (AVP) technology. If AVP can be achieved, the maps will also be used to provide seamless coverage. All details such as the mother library, each floor, parking-related labeling, walls, elevators, stairs, and car-washing facilities have been represented on the map.

To achieve non-source positioning underground, Bluetooth and UWB were previously used, but only Bluetooth was used for calculation. It would cost 30,000 to 50,000 yuan to install it in a parking lot, plus maintenance fees. With thousands of parking lots, no one could afford it. The principle of Jingzhong’s solution is simple. By combining high-precision maps with vehicle bus data, the ground positioning information is used as the initial position, and then combined with vehicle speed and steering data and high-precision maps, it is possible to achieve non-source positioning underground with a positioning accuracy of 2 to 5 meters, which is already sufficient for parking navigation. The blue line in the figure is the trajectory calculated without correction, and the yellow line is the trajectory calculated with correction algorithm. This algorithm has been tested in hundreds of large parking lots in Beijing and Shanghai. No matter how many laps are run in the parking lot, the results are always the same.

To achieve non-source positioning underground, Bluetooth and UWB were previously used, but only Bluetooth was used for calculation. It would cost 30,000 to 50,000 yuan to install it in a parking lot, plus maintenance fees. With thousands of parking lots, no one could afford it. The principle of Jingzhong’s solution is simple. By combining high-precision maps with vehicle bus data, the ground positioning information is used as the initial position, and then combined with vehicle speed and steering data and high-precision maps, it is possible to achieve non-source positioning underground with a positioning accuracy of 2 to 5 meters, which is already sufficient for parking navigation. The blue line in the figure is the trajectory calculated without correction, and the yellow line is the trajectory calculated with correction algorithm. This algorithm has been tested in hundreds of large parking lots in Beijing and Shanghai. No matter how many laps are run in the parking lot, the results are always the same.

With the positioning problem solved, the next step is mass production. Starting from 2020, Jingzhong has cooperated with many leading OEMs and is expected to achieve mass production in the second half of 2021. The previous navigation solution is still used on the road surface, and when underground, it switches to Jingzhong maps for path planning and navigation using the navigation engine.

The information recognized by the vehicle and park-end can be displayed on the mobile phone, and route planning and navigation can be achieved based on V2X, which is helpful to provide services for 200 to 300 million stock vehicles.

Why Does FAW Nanjing Technology Develop High-Precision Maps in-house?

FAW (Nanjing) Technology Co., Ltd. is an artificial intelligence company established by FAW Group, focusing on AI perception and AI big data development in the early stage. The head of high-precision maps, Chen Xuejuan, introduced the mapping technology that is suitable for small-scale forward-looking research and the innovative business of map inspection features, aiming to better support the development of the entire team’s autonomous driving algorithm.

Under normal circumstances, the high-precision map department of the OEM is only the demand proposer and does not have the ability to independently create or even modify maps. Due to the lack of industry unified standards for high-precision maps, different companies have different utilization rates of high-precision map element information and different business focuses, resulting in a scenario of thousands of people with thousands of ideas.

FAW Nanjing has a clear goal for its high-precision map business, which is quite different from that of map distributors and other OEMs. In the company’s strategic planning, the high-precision map module aims to assist the entire company in autonomous driving. It is not only about purchasing high-precision maps, but also about developing custom high-precision map software and enriching road attributes at any time in a short period of time according to FAW’s different R&D needs. The map department has three major businesses: map production, map engine, and map quality inspection.- Map Production: The ability to produce small-scale maps solves the problem of long production cycles for map vendors and the difficulty of adapting to rapid development iterations. The ability to respond quickly supports the needs of perception, positioning, and control planning.

-

Map Engine: To meet the needs of other modules to read map elements, an interface is provided to guide other modules in using maps smoothly.

-

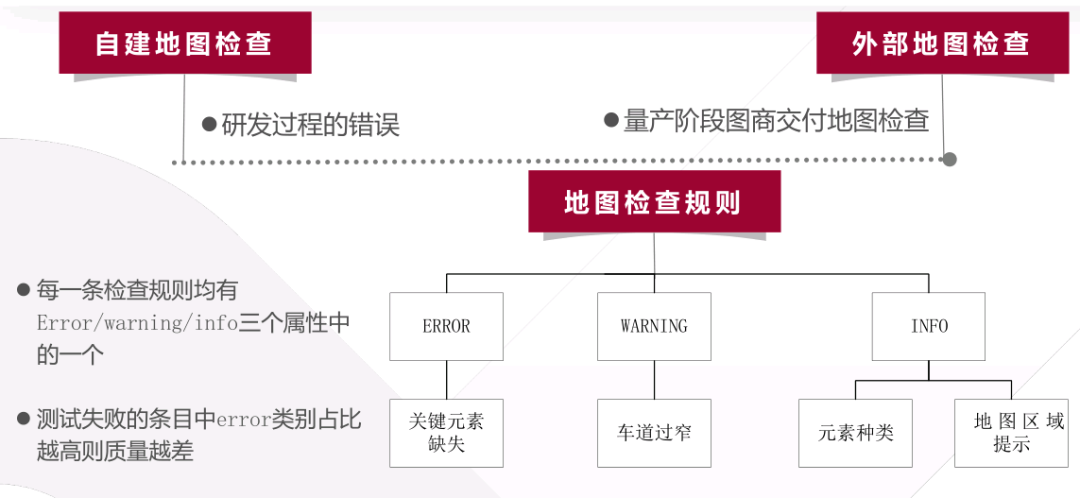

Map Quality Inspection: This is an innovation of FAW Nanjing. Quality inspection may be involved in the entire cycle from research and development to mass production. In the research and development phase, checking for map defects when building maps is necessary to ensure quality. In the mass production phase, it is necessary to judge whether the maps delivered by the map vendor meet the requirements of other modules.

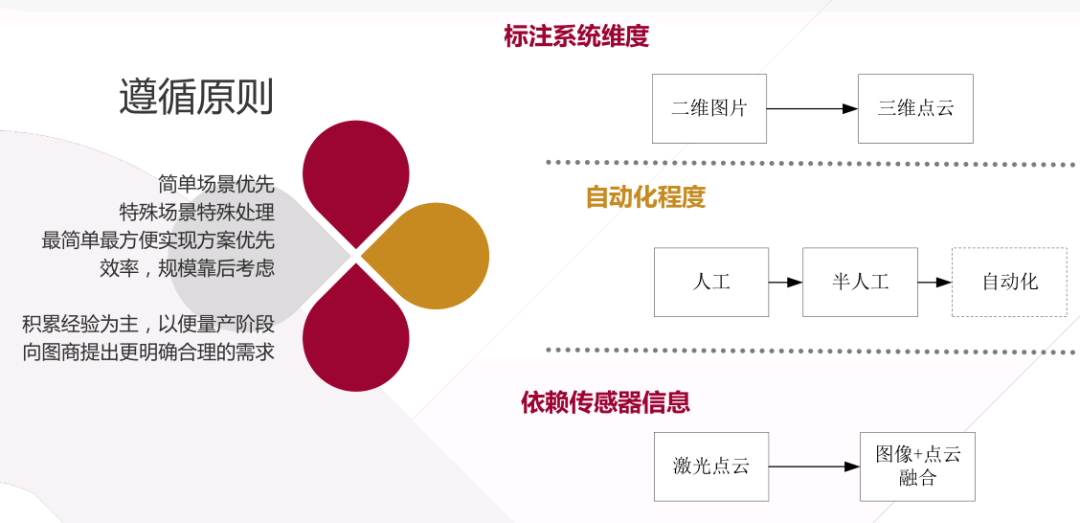

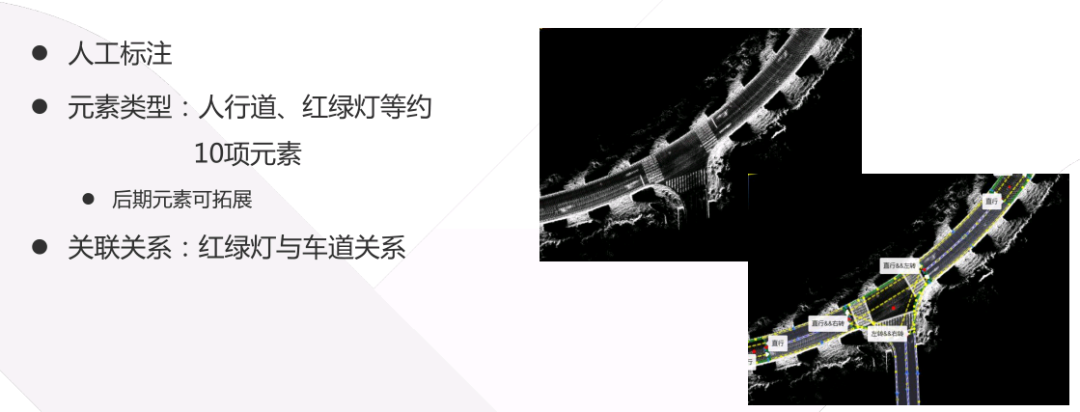

FAW Nanjing currently uses a two-dimensional annotation system, not a three-dimensional point cloud. This very basic annotation system can also meet basic needs, as most elements are attached to the ground and traffic lights are handled separately.

Even if the annotation system is changed from two dimensions to three dimensions, it is difficult to avoid situations where the ground reflectivity of the LiDAR is similar. At this time, it is more reliable to introduce images and rely on data fusion of images and point clouds for annotation. This is the direction of future technology expansion.

The map production process and the main map production solutions are the same, consisting of five steps: data collection, data stitching and processing, annotation, generation of the final map file, and map validation. Currently, autonomous driving vehicles are directly used for map production. One is a car with a mechanical LiDAR installed provided by the FAW Group headquarters, and the other is a car with a solid-state LiDAR installed developed by Nanjing for mass production. The reason for using different map production vehicles is that they are located in different regions, and the initial design plans are different. FAW Group currently only produces maps in places where they have autonomous driving vehicle testing facilities, which currently includes Changchun, Nanjing, and Hainan.

The current map annotation is purely manual, and all element types and lane relationships require manual annotation. Lines and dots on the base map need to be manually drawn, including road relationships and traffic lights. A supplier’s system was used for annotation in the early stages, but it was found not to meet the growing research and development needs, hence the decision to develop their own system to allow for ongoing expansion and enrichment of road information.

Translate the following Chinese Markdown text to English Markdown text in a professional manner, preserving the HTML tags inside the Markdown and only outputting the result:

Translate the following Chinese Markdown text to English Markdown text in a professional manner, preserving the HTML tags inside the Markdown and only outputting the result:

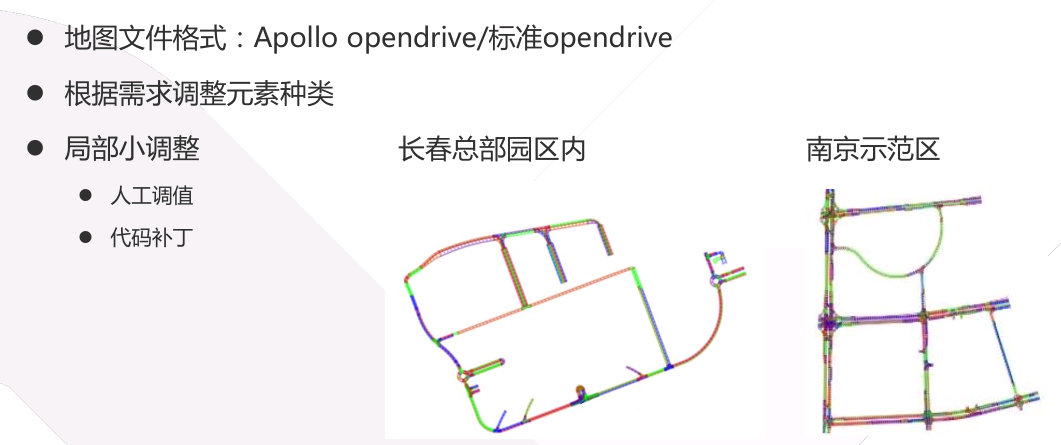

After completing the labeling, the final file will be generated. The L4 system of FAW-NJ is developed based on the Apollo platform, so two types of OpenDrive maps need to be output: Apollo’s OpenDrive and the standard OpenDrive for simulation colleagues. Minor issues can be quickly iterated through patching to avoid wasting time changing the system.

Map inspection system is a key focus for FAW-NJ in the future, and will continue to be improved to become more automated, with more rules constantly added. This way, experience can be accumulated gradually in the R&D phase, to control the maps of map providers in the mass production phase.

Commercial Model Matters

Xu Changqing, the Huawei Wireless Connected Vehicle Market Director, said that the most perplexing thing for map-making companies is that there are no takers for their maps even though the technology is comprehensive. He cited the low usage rate for C-V2X (cellular vehicle-to-everything) as a reason why no one is buying maps or positioning services from map vendors. While waiting for original equipment manufacturers to install PC5 interfaces on their terminal equipment for direct vehicle-to-vehicle communication, Xu said those involved in the industry should use Uu ports to increase deployment. After cars are enabled with such functionality, products on the back-end will be free of charge, so drivers who use them for assisted driving will subsequently birth a new business and commercial model to help the industry make money.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.