There have been a lot of recent news about power batteries in the automotive industry, involving top and second-tier battery enterprises in China.

1) CATL plans to build a large-scale battery factory in Shanghai to supply Tesla with half of the world’s power batteries and energy storage cells.

2) Great Wall Motors and CATL have signed a 10-year strategic cooperation agreement.

There seem to be two conflicting things here. The core issue is that Tesla was the first to rush to build a battery production line, while Great Wall Motors claimed to build its own 200GWh battery factory. Why do both domestic and foreign automotive companies aspiring to do great things in the battery industry want CATL to ensure supply? In fact, it is compatible. From the perspective of 2021, there will be many practical difficulties in the investment and construction of power batteries for car companies. At present, in the competition for cars, the focus is on increasing quantity. If there are not enough batteries for the orders, it will miss a huge momentum and leave space for other competitors. During this climbing period, having a product with price competitiveness and ensuring supply chain security is the top priority.

Tesla’s Battery Supply

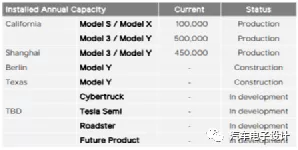

Tesla has always been in short supply of batteries in the United States. In a sense, the biggest bottleneck in Tesla’s production capacity expansion, after solving the problem of money, is battery production capacity. After coming to China, a large part of the problem was solved. China has two suppliers: CATL and LG. This has increased Tesla’s production capacity.

According to Reuters, CATL’s new capacity is 80GWh, which is equivalent to 1.27 million cars with 62kWh if calculated based on the ratio of two kinds of specifications, 55kWh and 78kWh, in 2:1. Based on this allocation, it is estimated that a considerable portion will be allocated to the energy storage field. The logic here must be matched with the existing factory capacity of Tesla, which means that it is directly related to Tesla’s failure to acquire land in Shanghai (this news was announced on May 10th, and Tesla abandoned its plan to export from China as the global export hub).

Therefore, in my personal opinion, if Tesla positions itself in the US, Europe, and China, and expands China into an export base for 1 million, or even global energy storage, this can be matched. If Tesla suspends this placement, especially after the surging demand in the United States, building its own 4680 in the United States and building capacity with LG + Panasonic is another option. This is a choice that needs to be made in the global competition for leadership in the new energy automotive industry between China and the United States.

Great Wall Motors’ Battery Supply

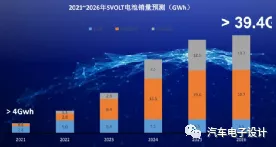

In March of this year, Wei Jianjun, Chairman of Great Wall Motors, revealed that its battery production capacity plan for 2023 is 200GWh (this is a plan not to be achieved in 2023).According to the plan, Hive Energy aims to achieve a capacity of 200 GWh by 2025. Looking back at the earliest plan, the annual capacity of the first phase of the Jintan factory in 2021 was 4 GWh (commissioned in February 2020), and the second phase, with a capacity of 8 GWh, was commissioned in January 2021. The third phase will increase the capacity to 18 GWh (the Nan Taihu New Area in Huzhou will be built with an annual capacity of 20 GWh, doubling the demand of the Yangtze River Delta to 40 GWh). There may be detailed plans for the construction from 100 GWh to 200 GWh in the future.

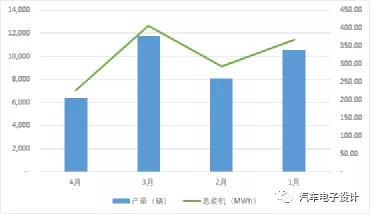

In reality, Great Wall’s production of new energy vehicles was 26,799 units in the first four months of 2021, corresponding to a battery demand of 1,293.29 MWh. The production capacity was clearly suppressed in April, which caused delays in the delivery of the Euler series.

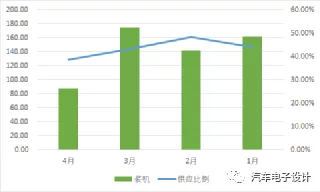

According to the data, Hive Energy’s supply to Great Wall is 565.6 MWh (annualized at around 1.6 GWh), accounting for 43.7% of the total. According to data from the China Association of Automobile Manufacturers, Hive Energy’s total installed capacity this year is 0.57 GWh, and most of it is provided to Great Wall. There are two possibilities:

1) During the climbing phase of Hive Energy, the overall material cost and the cost of cell production will differ due to the purchase demands of 150MWh per month and similar demand of around 8 GWh from Contemporary Amperex Technology Co., Limited.

2) Due to this characteristic, it is necessary for Great Wall to make trade-offs with regard to the battery status and price both at Hive Energy and Contemporary Amperex Technology Co., Limited. Given that the current market sector of Euler is in a price-sensitive area, this is an area that needs to be weighed carefully.

3) Looking a few steps ahead, failure to obtain batteries means losing orders when everyone needs batteries to drive the vehicle, which requires long-term services for short-term gains. Even the most well-regarded automakers also need to produce vehicles for the end consumer.

Conclusion

In the stage of fierce competition, the midstream of the entire industry chain, namely battery supply, is the most critical. This is also the direct reason why there is no good allocation mechanism and no formation of secondary supply in new energy vehicles. When the supply is not tight, you can find secondary supply, but when the supply is tight, the secondary supply may not be able to cope with it. In the actual game between car companies and battery companies, only by establishing stable supply relationships at the beginning and expanding capacity to the level of 500,000 units (calculated based on 60kwh, about 30 GWh) can companies like Tesla have a say.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.