Author: Huang Xiaoshan

In mid-May, news of a joint complaint by a Guangzhou charging operator against Xiaoju Charging’s “Either Or” monopolistic market spread rapidly within the charging industry. However, in the following two to three days, the news disappeared from the entire network. What happened? What is the reason behind it? Who is Xiaoju Charging?

“Electric Vehicle Observer” obtained this complaint letter and also consulted the complaining companies to restore the beginning and the end of the matter for everyone.

According to Tian Hua, the person in charge of a Guangzhou charging operator who participated in the complaint, “The deleted report is actually inaccurate. A total of 46 charging operators participated in this joint complaint, not 29, and there is more negative sentiment expressed among them. Our joint complaint was just to report the current situation and demands of charging operators to the leaders.”

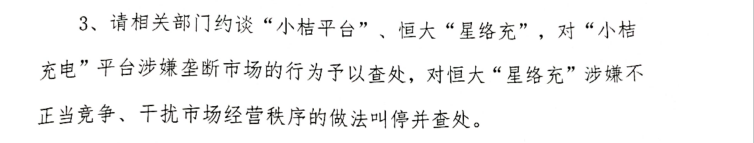

In addition to the policy demands raised to the relevant departments in the complaint letter, the main content is “about the suspected monopoly behavior of Xiaoju Charging, a platform under Didi, and the alleged unfair competition of Xingluo Charging, a platform under Evergrande, which interferes with market business order.”

The joint complaint of the 46 operators against Xiaoju Charging was an outbreak of accumulated contradictions between operators and platform vendors. The love-hate story between Xiaoju Charging and charging operators has updated another chapter.

Xiaoju Charging suspected of monopoly

The 46 charging operators who participated in this joint complaint are mostly enterprises that use Xiaoju Charging’s SaaS direct-to-platform, and a small part of them are interconnected with Xiaoju Charging. The scale of the participating operators’ stations ranges from a few charging gun heads to more than 100, with a total of more than 2,200 charging gun heads, which are mostly small-scale operators.

So what is SaaS direct-to-platform, and what is interconnected? Why is there such a way of cooperation?

SaaS stands for Software-as-a-Service. The charging operator’s station is open to the public, so it needs two ports: one is a customer-facing client, generally including APP, WeChat public accounts, small programs, etc., which provide users with functions such as inquiry, recharge, and scan code; the other is the operation and maintenance management end for the charging operator, which can achieve remote management and control of charging pile hardware operation.The two ends of the charging operator either choose to self-develop, outsource, or use the charging equipment company’s own, and the corresponding problem is that self-development is expensive, outsourcing is unreliable, and equipment company’s own is not user-friendly. However, software happens to be the strength of internet companies like Didi. They provide SaaS services and do both the client and backend for the operator.

Interconnection is relatively simple. The charging operator already has its own background system, and by connecting the background with Xiaojv Charging Platform, Xiaojv Charging’s users can charge at the operator’s stations.

According to Tianhua, “The reason why we cooperate with Xiaojv Charging is that we value Didi’s huge volume of rental and ride-hailing traffic, as well as their superior software platform and data capabilities. The corresponding cost we need to pay Xiaojv Charging for charging service fees is 10-20%, and the proportion varies among different companies.”

According to the complaint, there are two provisions in the contract signed between the operator and Xiaojv Charging as follows:

-

Article 2.5: Without the consent of Party A (editor’s note: Xiaojv Charging), Party B (editor’s note: the operator) shall not conduct cooperation with other entities engaged in the same or similar business as Party A with the same or similar substance as this Agreement on the charging station project agreed upon under this Agreement.

-

Article 13.2: If Party B violates any of the following provisions, Party A has the right to demand that Party B pay liquidated damages according to the standard of RMB 1 million per station for its breach behavior. (If its breach involves multiple charging stations, the total amount of liquidated damages will be RMB 1 million multiplied by the number of charging stations involved): (1) Party B violates the provisions of Article 2.5 of this Agreement…

The complaint points out that this provision is highly exclusive and directly limits the charging operator’s cooperation with other platforms.

At the same time, Xiaojv Charging has occupied half of Guangzhou’s charging market by promoting through various forms of sales, squeezing other platforms’ charging stations, and having dominant market power. Therefore, the operators believe that this situation may violate Article 17 of the Anti-Monopoly Law of the People’s Republic of China, which prohibits operators with dominant market positions from engaging in the following behaviors of using their dominance: (4) Limiting trading parties to only trade with it or with designated operators, and Article 5 of the Interim Measures for the Prohibition of Monopoly Agreements, which defines “monopoly agreements” as agreements, decisions, or other coordinated behaviors that exclude or restrict competition.

According to Tianhua, at present, the joint complainant’s charging station is still operating normally on Xiaojv Charging, and the Guangzhou Administration for Market Regulation has accepted and started an investigation.

After the incident, Tianhua said that Xiaojv Charging proposed a supplementary agreement with the operators and asked the operators to withdraw their complaints.

“In Tianhua’s view, the supplementary agreement is still the same old tactics, and even more harsh, it is completely an unequal treaty.”The supplementary agreement he presented shows that firstly, Xiaojv charging allows operators to cooperate with other platforms, but only with platforms recognized by Xiaojv charging. Xiaojv charging has the right to decide whether to connect or disconnect.

Secondly, the operator needs to make appropriate adjustments/modifications to the software or hardware of the charging pile according to the docking requirements of Xiaojv charging, and can only connect after confirming that it meets safety conditions.

Thirdly, the operator cannot carry out subsidies, promotions and other activities with other platforms at the same time. Xiaojv charging has the right to adjust the management and operation strategies of operator’s stations according to actual situations.

Finally, the supplementary agreement still maintains the breach of contract clause under which operators are required to compensate 1 million yuan for each station.

“Regarding this supplementary agreement, all operators who participated in this joint complaint refuse to sign,” said Tian Hua.

Shortly before publication, Tian Hua provided Xiaojv charging’s latest solution, called the “Waiver Notice of Terms,” which exempts operators from the restrictions under the aforementioned Article 2.5 or similar terms. This notice appears directly on the charging management backend interface provided by Xiaojv charging for operators. Operators must click to confirm in order to access information such as station status, order data, and business turnover, which are daily operations for the operators.

“The way this notice is presented is quite irregular, and the means of forcing us to click confirm to enter the backend is too brute. Currently, we are still waiting for the results of investigations by relevant departments,” Tian Hua said.

Why was there a joint complaint?

“The situation of conflict between charging operators and Xiaojv charging was bound to happen sooner or later, but it was unexpected that the conflict would break out so soon,” said Zhang Bing, a former employee of Xiaojv charging.

He further pointed out, “When Xiaojv charging dominated a local market alone, charging operators would continue to cooperate. However, once other platforms began to offer crazy subsidies, Xiaojv charging’s traffic and orders dropped. Due to platform restrictions, charging operators were unable to cooperate with other platforms, and contradictions began to surface.”

In addition, the number of pure electric rental cars of Didi in any city is limited, but the number of charging operators is constantly increasing. When the demand side is relatively stable and the supply side continues to increase, the market has a zero-sum game for stock market, and the price war in the local market begins. Everyone fights for the limited market share, and contradictions become intensified.

Meanwhile, Tian Hua said, “On the one hand, they use exclusivity through the agreement to prevent us from cooperating with other platforms. On the other hand, besides collecting 10-20% service fees, Xiaojv charging also competes with other platforms on price and requires us to subsidize, which makes the already meager service fee income even less.”What made Tian Hua even more angry was that after the joint complaint incident, DiDi’s public relations deleted the articles on the entire network, which made him feel the huge gap in power between small companies and large platforms.

Questioning another Guangzhou operator Xu Bo, he stated that in addition to not allowing access to other platforms, there are several reasons for the outbreak of the conflict:

-

In the early days, Xiaoju Charging quickly occupied the market and understood the market supply and demand relationship by connecting to the data of existing operators in the market through interconnection. After that, it supported SaaS direct-connected operators with more control power, and built charging stations around the high-quality stations of interconnection operating companies. This has already caused strong dissatisfaction among interconnection operating companies.

-

Regardless of whether it is interconnection or SaaS direct connection, Xiaoju Charging has the right to independently adjust the on-off status of the charging station on the platform, and the charging service fees, in order to control the flow and orders.

-

For SaaS direct-connected operators that entered later, Xiaoju Charging requires that they must purchase the hardware devices recommended by its internal team. External purchased charging devices are not allowed to be connected to Xiaoju Charging.

After many contradictions accumulated for a long time, they finally broke out in the end.

Who is Xiaoju Charging?

Xiaoju Charging’s official website has a very good description of itself: “Xiaoju Charging is a new energy charging brand under DiDi Chuxing. It gathers high-quality charging facilities and provides fast, affordable, and trustworthy charging services for new energy vehicle owners as an all-round and one-stop charging service platform.”

Going back to 2017, at this time, DiDi had already dominated the online ride-hailing world and was looking for new strategic business and growth points.

In early November 2017, Cheng Wei, the founder, chairman and CEO of DiDi Chuxing, announced that DiDi had jointly established a global new energy vehicle service company with the Global Energy Interconnection Development and Cooperation Organization, supporting the new energy vehicle industry by building a charging and swapping system, energy storage, battery reuse and other supporting facilities. By 2020, DiDi will be the first to promote more than one million new energy vehicles on its platform.

Later, there was no news about this joint venture, but in early January 2018, Xiaoju Charging was officially launched on the DiDi driver app for trial operation.

In February of the same year, DiDi and Teld New Energy formed a joint venture “Xiaoju Teld New Energy”, and then began to cooperate with various charging operators in China for interconnection.

According to Wu Hai, an early employee of Xiaoju Charging, at that time, DiDi was promoting the “Flood Stream Alliance” and was working with major automakers to develop customized vehicle models for joint operation on the DiDi platform. Due to the fact that they were all electric vehicles, they faced the problem of charging, and the Automotive Asset Management Department established this business section.The reason why Didi’s drivers can be bound to the Didi platform is that the charging fees can be directly deducted from the income earned from providing services, and drivers do not need to download other apps or pay for recharging from other platforms. Together with various operating subsidies, Xiaoju Charging firmly grips the driver-side market.

“Xiaoju Charging has gone through roughly 3 stages,” said Wu Hai. The first stage was when it first started in 2018, hoping to become an aggregate trading platform that mainly cooperated with existing charging operators to provide charging services for Didi’s large number of drivers by connecting back-end data.

In the second stage, Xiaoju found that the quality and service of existing charging stations were uneven and difficult to standardize, and that the operators had no control ability. So, it built its own station for a period of time, but found that the investment in building stations was too complicated and could not be quickly replicated on a large scale.

The third stage is the current model, interconnection + SaaS direct connection. It adopts interconnection for large operators or ones that are unwilling to engage in direct connection, and direct device connection for small operators with no software capability.

With the continued expansion of its business, Xiaoju Charging began to focus on developing SaaS direct-connected operators, encouraging more people to participate in the investment in charging station construction as franchisees. At the same time, Xiaoju Charging has reached cooperation agreements with charging equipment companies such as Shenghong and Zhongheng, gradually forming comprehensive services that provide recommended charging equipment, software platform, traffic import, and financial leasing and other forms of support.

At this point, Xiaoju Charging has combined its business advantages with Didi’s own resources to the extreme: huge user traffic, rapid product iteration, financial capital strength, and efficient rhythm of promotion, which allows Xiaoju Charging’s business to flourish fast. According to its official website, Xiaoju Charging has already cooperated with over 100 operators, covering more than 10,000 charging stations nationwide, and has over 100,000 rapid charging gun units.

According to the data provided by Wu Hai, in September 2020, Xiaoju Charging’s daily orders exceeded 210,000. The current figure is estimated to be over 300,000. Calculated as an average of 30 kWh per order, it has nearly 10 million kWh of daily energy, making it an unavoidable force in the industry.

According to a certain operator in Xiamen, the proportion of Xiaoju Charging’s orders has reached 60-70% in the area. Such a high proportion indeed shows the power of the platform, but it also makes them hesitant to terminate their cooperation with Xiaoju. The contract terms also do not allow them to access other platforms, otherwise their charging station would be disconnected.

How can the platform and the operators coexist?

How to survive and achieve win-win outcomes is an unavoidable issue between all platforms and merchants.

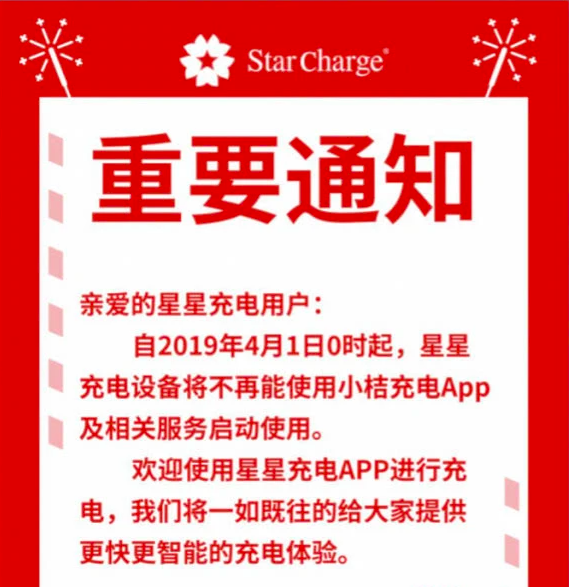

For Xiaoju Charging, this joint complaint event is the second wave of collective resistance from operators.On April 1st, 2019, which was also April Fool’s Day, three major domestic operators in China, Techrise, Xingxing Charging, and Wanma New Energy, announced their withdrawal from Xiaojubei Charging. All charging station data under Xiaojubei Charging was taken offline and users can no longer use Xiaojubei Charging to charge at charging stations under these three operators.

These three operators believed that Xiaojubei Charging should not intervene in the offline charging station construction and compete with the operators.

A senior executive of Techrise who was responsible for this event said that he agreed with the above reasons and added: “If both parties continue to maintain interconnection and cooperation, we operate and construct offline, while Xiaojubei Charging focuses on online flow guidance. This model is beneficial for both parties and is sustainable. However, Xiaojubei Charging cannot use our data to deconstruct our analysis and develop franchisees to build new stations near my well-established stations. Although it is not directly invested by Xiaojubei, in the long run, Xiaojubei will have more and more stations under its control. And franchisees’ cooperation depth is deeper than mine, so there will be unequal resource allocation. We can foresee the situation where we are helping others make clothes for their wedding.”

So, how about the franchisees?

According to a certain operator in Hangzhou, early franchisees of Xiaojubei Charging made a profit, but as more and more operators entered the market, and incremental orders were limited, the market became saturated. “No one can make money anymore, but Xiaojubei Charging will not let you die of starvation through traffic control, nor will they let you eat too much.”

By here, it can be understood that the SaaS-connected operators are equivalent to the Xiaojubei Charging’s regular army, while interconnective operators are more like hired mercenaries. Everything, including traffic, subsidies, and operating strategies, will tend to favor the regular army.

“Xiaojubei Charging has completely copied Didi’s model in the charging industry, attempting to monopolize traffic distribution and benefit allocation. And Xiaojubei’s internal KPI is market share, which will lead to distorted actions under this assessment mechanism,” said Zhang Bing.

However, Zhang Bing also believed that “Xiaojubei Charging has played a positive role in the industry by lowering the entry threshold and quickly attracting and developing many operators. It has also standardized products, services, and site selection, which has improved the user experience.”

The problem not solved by Xiaojubei Charging is how to distribute benefits with operators fairly and maintain fair and just operating strategies.Meanwhile, there are innate defects in the charging market. The platform is established under the premise that the supply and demand are sufficiently dispersed and massive, for example, Didi’s ride-hailing business, where drivers and passengers are dispersed and massive and the market is large enough. On the supply side of the charging market, there are more than a thousand operators of all sizes nationwide, and a hierarchy of enterprises of different sizes has been formed. However, the number of electric vehicles on the demand side is only a few million, and the overall scale of the charging market is still small. With too many hands grabbing at too little food, conflicts are inevitable.

As for more mature markets, their platforms are also facing severe regulatory environments right now.

On April 10th of this year, Alibaba was fined 18.2 billion yuan because it required e-commerce firms on its platform to exclusively operate on its site.

On May 14th, the Ministry of Transport and other eight departments held joint talks with 10 new-style transportation platforms such as Didi, Shouqi Yueche and Cao Cao Travel, etc. The talks requested that the platform companies should face up to their own problems, earnestly fulfill their corporate responsibilities, and immediately carry out rectification.

Government departments have long sounded the alarm about monopolistic behaviors, such as forcing “either-or” choices, abusing market dominance, burning money to seize the market, and implementing “big data discrimination.”

The rare platform status of XJ Charge requires cautious maintenance.

The “Electric Vehicle Observer” also consulted Didi XJ Charge on the collective complaint event but did not receive a reply.

(Tian Hua, Zhang Bing, Xu Bo, and Wu Hai are all aliases.)

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.