Author: Chris Zheng

Tesla is undoubtedly the most battery-hungry car company on earth, no doubt about it. There’s the all-electric semi-truck Semi, and the all-electric pickup Cybertruck behind it. On January 18th, Tesla CEO Elon Musk tweeted, “Battery production is the fundamental limitation that slows down the sustainable energy future. A very important problem.”

In North America, Tesla has joined forces with Panasonic to build the Giga 1 super battery factory in the Nevada desert. In Europe, Tesla is planning a huge battery factory in Berlin with a capacity of 200 GWh per year. What about China?

Insert a piece of news: Just before this article was posted, Reuters released an exclusive story that is highly relevant to the main theme of this article. The translation is as follows:

Reuters cited two sources as saying that CATL plans to build a battery factory south of the Tesla Giga Shanghai factory in Lingang, Shanghai.

The factory aims to support 50% of Tesla’s global demand for batteries for automotive and energy storage businesses, help CATL become Tesla’s largest global battery supplier in the near future, and with a new plant capacity of 80 GWh, which is higher than the total capacity of all CATL’s existing plants (69.1 GWh), second only to Tesla Giga Berlin’s planned 200 GWh per year and NIO’s planned 100 GWh per year at the NEO Park in Hefei.

In addition, the factory will employ about 5,000 workers and produce products that integrate CTC battery cells into chassis, representing the cutting-edge technology of the latest generation of Tesla vehicle engineering and battery system integration.

Finally, insiders warned that CATL has been in talks with the Shanghai government and Tesla, and it is unclear when a final agreement can be reached, or when the new plant can start construction.

Anyway, let’s talk about the new batteries that you can buy next month.

Doubling capacity at the Shanghai factory

Has Tesla encountered any challenges in China? Not necessarily.In 2021, Tesla China continued its sales offensive from 2020, selling 69,227 units of domestically produced Model 3 and Model Y in Q1. Considering the ramp-up in production capacity of the domestically produced Model Y, these two models are now approaching the demand for their counterparts in the same class of fuel-powered cars.

In April, the sales of Model 3 and Model Y were “as usual” cut in half compared to the previous month. Friends who have been following Tesla’s developments for a long time might know that this does not necessarily indicate any problems. The reason for the “as usual” reduction is that Tesla has followed the tradition of delivering at the beginning of each quarter, taking a break and then pushing for sales at the end of each quarter. Therefore, whether or not there is negative public opinion, Tesla’s sales at the beginning of the quarter being cut in half year-on-year is predictable.

Despite negative public opinion caused by Henan Anyang Tesla owners’ rights protection at the Shanghai Auto Show in April and subsequent protests in Xi’an, Guangzhou, Wenzhou and other cities nationwide, the impact is likely to be seen in the Q2 total sales data in June, as Tesla continues its delivery tradition.

Opposed to the low public opinion, Tesla has no plans to slow down its ramp-up of production capacity. Due to the slower than expected progress at the Berlin plant, multiple supply chain sources are stating that Tesla Shanghai plant will continue to expand its capacity and export to Europe, increasing its production capacity to 450,000 vehicles per year as announced in the Q1 report, a year-on-year increase of over 400%.

Behind the huge increase in production capacity is a real problem facing Tesla: battery supply.

In December 2019, Tesla introduced LG Chem as its second power battery supplier, following Panasonic. In June 2020, Tesla introduced a third power battery supplier, CATL.

CATL’s lithium iron phosphate battery effectively reduced the cost of Model 3 batteries, helping Tesla to achieve a new round of price cuts, further entering the low-end market and pushing sales growth.

This time, LG Chem took over from CATL, launching the NCMA four-element battery. According to BUSINESS KOREA’s report, LG Chem is currently testing its NCMA four-element battery and is expected to supply Tesla with it from July, installed in the Tesla Model Y.## What is NCMA Quaternary Battery?

Currently, the mainstream ternary batteries on the market are roughly divided into two technical routes: NCA nickel-cobalt-aluminum batteries and NCM nickel-cobalt-manganese batteries.

However, whether it is NCA or NCM, consumers’ demands for the power battery of pure electric vehicles are consistent: improve safety, increase energy density, and reduce costs.

NCMA may seem like NCA+NCM at first glance, but in fact, the genesis of the Quaternary Battery was a material innovation made by Professor Yang-Kook Sun of the Energy Science and Engineering Department at South Korea’s Hanyang University.

Simply put, increasing the proportion of nickel in ternary lithium batteries can improve the battery’s energy density, allowing more electricity to be stored in the same weight and making the car go farther. But when the nickel content exceeds 90% (i.e., ultra-high nickel batteries), the battery’s thermal stability rapidly declines while the capacity retention rate also begins to decrease, which reduces safety and increases the likelihood of decay.

On the other hand, NCMA batteries add 1% aluminum to the ultra-high-nickel NCM batteries, significantly improving their performance according to Professor Yang-Kook Sun’s research.

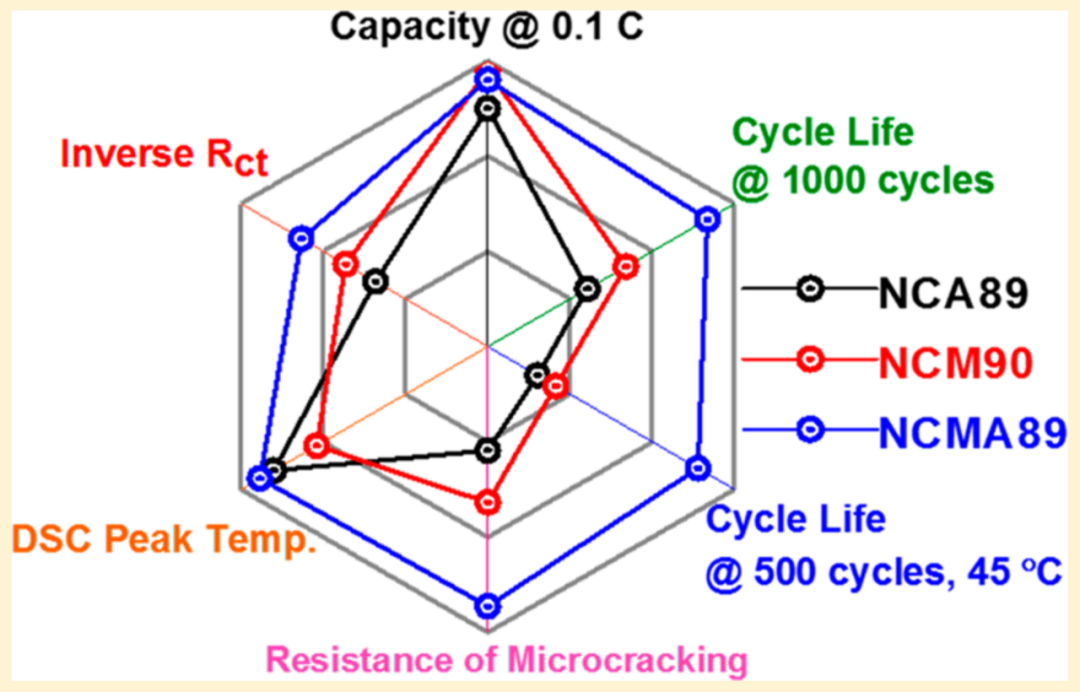

As shown in the figure below, NCMA 89 Quaternary battery outperforms NCA and NCM in six dimensions, including capacity decay and micro-crack suppression, compared to NCA 89 and NCM 90 ultra-high nickel ternary.

For instance, under the conditions of 25°C, 3.0-4.2V, and 1C, after 1,000 cycles of charging and discharging, the capacity retention rates of NCMA 89, NCM 90, and NCA 89 are 84.5%, 68%, and 60.2%, respectively.

If we compare the NCMA battery with the NCM 811 battery that LG Chemical supplied to Tesla, according to the chemical formula, it is apparent that the NCMA battery greatly increases the nickel proportion; meanwhile, the cobalt element has dropped to 5%, and a new 1% aluminum element has been added in place of cobalt.

-

(Li [Ni0.89Co0.05Mn0.05Al0.01] O2)

-

(Li [Ni0.8Co0.1Mn0.1] O2)

In terms of battery performance, this means that NCMA has further increased its energy density compared to 811 batteries, and greatly reduces costs while ensuring safety by adding aluminum doping agents.Let’s talk about energy density. As early as August 2020, Panasonic announced an additional investment of $100 million to Tesla’s Gigafactory 1 in Nevada. Starting from September of that year, the battery energy density produced will increase by 5%, and the battery specifications of Model 3/Y long-range version will increase from 79 kWh to 82 kWh.

However, the domestically produced Model 3/Y long-range version that uses LG Chemical’s NCM 811 battery has a battery capacity of only 76.8 kWh. Equipping NCMA batteries has the potential to match North American models in battery capacity.

Secondly, Tesla’s launch of NCMA batteries is actually a “snatch” move. General Motors released the all-new Ultium battery system on March 4th. The Ultium battery is backed by LG Chemical’s NCMA battery technology.

According to General Motors, the underestimated chemical materials of NCMA, combined with ongoing technological and manufacturing breakthroughs by General Motors and LG Chemical, have the potential to drive down battery costs to below $100/kWh.

$100/kWh has always been a price milestone that Tesla CEO Elon Musk has been concerned about. It is an industry consensus, including mainstream automakers such as VW, GM, and Tesla, that electrification systems supported by $100/kWh can surpass cost competitiveness of equivalent gasoline powertrains.

In less than a month, a better performing and lower cost four-element battery will be available. Will you wait for it?

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.