Going on 100-man Conference Launches Media Focused on Evolution of the Automotive Industry Chain

Author: Zheng Wen

Software-defined cars will continue to be mentioned and tested repeatedly until they become a common understanding just like “an apple falling on Newton’s head”.

The creator of this argument is Wang Jin, the Former senior vice president of Baidu and head of the unmanned driving department who is also known as the “First Chinese Unmanned Driving Person”. He once mentioned that “In the early 1980s, the electronic system code for a car was only 50,000 lines. Nowadays, the electronic system code for a high-end luxury car can reach up to 65 million lines of code, which is 1,300 times more than the previous one.”

In the era of autonomous driving, the amount of code will explode even further. Bosch once predicted that the code carried in L2 level autonomous driving cars would reach about 100 million lines; L3 will reach 200 million to 300 million lines; and for L5 automated driving, the code will directly jump to one billion lines.

If the thousand-fold change in software code is just the tip of the iceberg, the iceberg beneath is the industrial chain reconstruction brought about by software-defined cars. Many Tier 1 have clearly seen the essence of the changes, and today we will take a look at the details of Bosch’s transformation.

At this year’s Shanghai Auto Show, Bosch launched its latest ADAS platform and domain controller in China based on its Smart Vehicle Architecture™ (SVA) design concept.

Yang Xiaoming, President of Bosch Asia Pacific, said: “We are pleased to introduce Bosch’s latest innovative technology in the Chinese market to support the development of software-defined cars in China. The introduction of these latest innovative achievements will not only further strengthen Bosch’s competitive advantage in the local market, but also reflect Bosch’s long-term commitment to the Chinese market.”

In fact, the birth of “Bosch” represents a strategic arrangement.

In 2017, Delphi spun off its powertrain business as “Delphi Technologies,” while the remaining business was renamed “Bosch” and focused on the development and commercialization of software and hardware technologies in the field of active safety, automated driving, and connected services.

Architecture is the “Soul” of Change

First, let’s talk about Bosch’s SVA architecture. Why would a supplier grab the job of an automaker to do electrical and electronic architecture (E/E)? Because in the era of software-defined cars, the most fundamental impact on car manufacturing is automotive architecture.

A traditional car has more than 70 electronic control units (ECUs), but they are all independent, from different suppliers, without information exchange, and cannot be OTA upgraded like a mobile phone. This traditional car comes from a distributed E/E architecture.Tesla is known as a disruptor in the automotive industry due to its different approach in electronic and electrical architecture compared to traditional automotive companies. In a Model 3 disassembly, a Japanese engineer admitted, “I’m sorry, we cannot do it”. According to Japanese media, even car companies like Volkswagen and Toyota are at least six years behind Tesla in terms of E/E architecture.

So, what makes Tesla’s architecture so advanced? The key is the integration of all the ECU modules into a system, which creates the concept of “domains”.

Tesla divides all ECUs into three domains: Central Computing Module (CCM), Body Control Module – Left (BCM LH), and Body Control Module – Right (BCM RH). The CCM includes the functions of Advanced Driver Assistance System (ADAS), Infotainment system (IVI), external connections, and in-vehicle communication system domains. The BCM LH and BCM RH are used to achieve the functions of traditional body and convenience system, chassis and safety system, and some power system.

Of course, we can easily infer two points: Firstly, cars that can achieve similar functions may have fundamentally different automotive architectures. Secondly, E/E architecture in the more advanced stage will eventually achieve vehicle centralization from domain-centric to all ECUs.

This is the first blue ocean that Ampere Computing Systems saw in the demand for E/E architecture from the distributed to domain-centric. At CES 2020, Ampere introduced the design concept of the Smart Vehicle Architecture (SVA), which mainly aims to solve the challenges of the next-generation intelligent connected vehicle travel and autonomous driving.

However, Ampere’s introduction of architecture does not include content on module partitioning, only that it consists of three key systems: computing, network and power. Perhaps its function is similar to Geely’s SEA architecture. The entertainment, air conditioning, seating, and other functions of the cockpit are in one part, the chassis, power, and other functions are in one part, and the autonomous driving part is an independent component.

“After this concept was introduced, it received extensive approval from the industry. We are now cooperating with many car manufacturers to gradually promote SVA applications in the next stage of new models,” said Yang Xiaoming. Of course, the architecture advantages he introduced are also the advantages of domain-centric architecture.

It is worth noting that AnPafu’s architecture strategy focuses on the “computing platform”, and its supercomputing platform OSP is the brain of the SVA architecture. The computing platform is the core competitiveness of the automotive architecture. The computing power limits the speed of intelligent networking of automobiles and determines whether high-level automatic driving can be achieved.

For example, the computing power of many current computing platforms is not even as good as that of an iPhone 7, while truly autonomous driving cars require computing power exceeding 500 iPhone 7s. Currently, AnPafu’s computing platform has been applied to L3-level Audi A8, which can be said to be in the forefront of the industry.

But we are still far from our ideal blueprint.

The powerful role of “domain controller”

We have already learned about the concept of domains above. Generally speaking, typical domains include five, namely powertrain, chassis control, body control, ADAS, and entertainment systems.

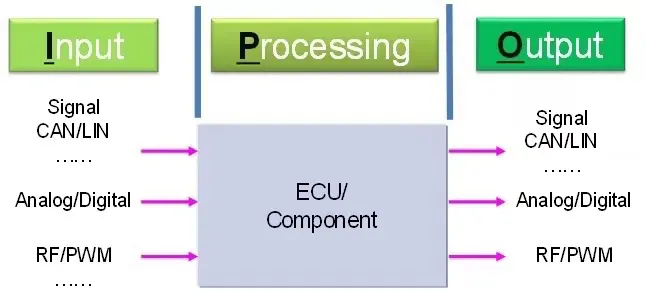

As we know, the more functions a traditional car needs to achieve, the more ECU units it needs, and basically, one ECU unit realizes one function. For example, door control and steering assistance each require an ECU unit (as shown below, a simple input, output and a microcontroller). As the level of vehicle electrification continues to increase, the number of ECUs is also increasing rapidly, with more than 100 in total. Thus, the number of ECUs that a single domain can accommodate will become more and more.

With so many ECUs distributed in different parts of the car, it not only brings about complex wiring design but also mixes up logical control. Therefore, for each domain, we deliberately use a high-performance ECU to manage complex function allocation and distribution work, and this ECU that is responsible for these “trifles” is the “domain controller”.

The emergence of domain control directly simplifies the logic of implementing automotive electronic functions.

In the vehicle, the domain controller plays the role of a hub and processor node, which can meet the distribution and data exchange, and computing needs of physical devices (various sensors, peripheral devices, and braking devices) inside the vehicle. The domain controller may seem simple in principle, but its simplification of the automotive architecture and the improvement of automotive performance are crucial steps.

AnPafu has undoubtedly also seen the growth point of this part of the business. The domain controller is also a component of the AnPafu Intelligent Automotive Architecture (SVA™), and it will launch the first domain controller and begin mass production in 2022.

Due to the birth of domain controllers, Gu Xin, Technical Director of Asia-Pacific Region of Powertrain Electronics/Electrical Architecture Business Division at Bosch, said that “Bosch’s research has found that through the architecture of domain controllers, we have achieved 60% automation installation in a customer project. The degree of automation installation also depends on the design of components. With Bosch’s unique product portfolio, we fully have the ability to bring this solution to the market.”

Intensive Competition in ADAS

ADAS domain controller should be the most concerned one among all the domain controllers. In the past, OEMs needed to install a set of ADAS system functions, including Lane Departure Warning ECU, Traffic Recognition ECU, Forward Collision Warning ECU, Park Assist ECU, Blind Spot Detection ECU, and Park View ECU, to name but a few. Now, an ADAS domain controller can achieve all these functions.

ADAS domain controller is also a key focus for Bosch.

At this year’s Shanghai Auto Show, Bosch launched a new generation of ADAS platform, which is an important part of Smart Vehicle Architecture (SVA). The new generation of ADAS platform from Bosch is fully compatible with emerging domain control architecture in the industry, which helps OEMs to develop new functions and services that can be remotely iterated and upgraded, thereby creating new business models.

This platform fully considers the issue of scalability, supporting various functions ranging from basic safety compliance to advanced driving assistance, automated driving cruise, and automatic parking, making it suitable for all segmented markets and with significant cost advantages. The system also allows integration of future-developed technologies and functions (including automated driving technology and functions developed in cooperation with Motional), laying a foundation for upgrading to a higher level of automated driving.

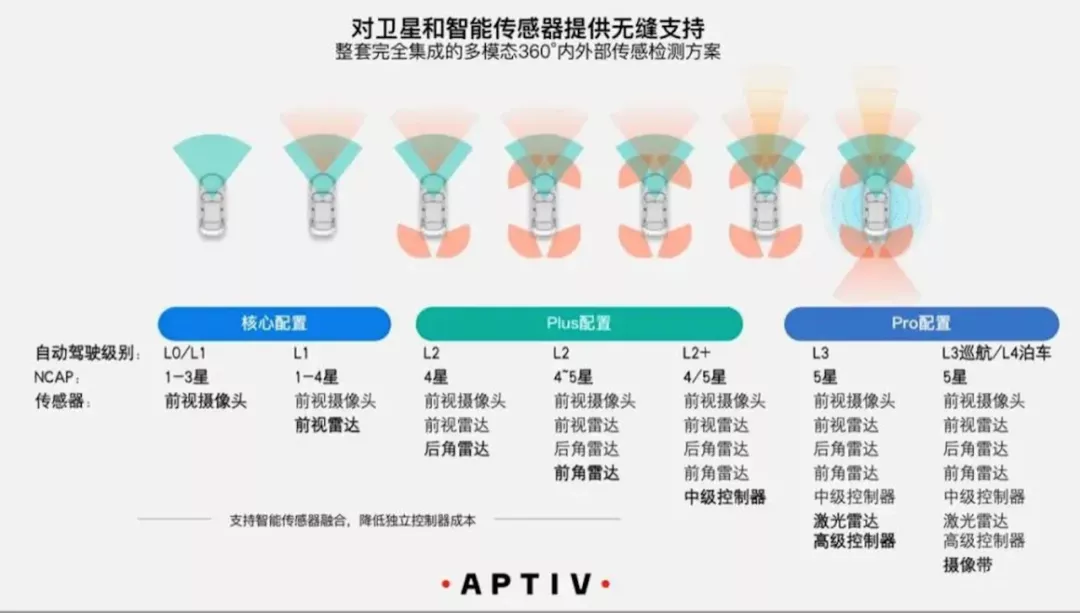

Bosch’s ADAS platform has three levels of configuration:

The basic entry-level configuration consists of a front camera, a medium-range radar, and related software, which helps the entire vehicle to meet the basic safety requirements of NCAP at a lower cost, such as common adaptive cruise, automatic emergency braking, lane assistance, and lane departure warnings.

The intermediate-level configuration 3R1V scheme adds a corner radar, which can achieve blind spot detection, door opening warnings, rear alert systems, congestion assistance, etc., meeting the L2 level of automated driving technology, with high cost-effectiveness. The intermediate-level configuration 5R1V scheme further adds more complex driving assistance functions, such as high-speed highway assisted driving and emergency braking when overtaking.

Advanced configurations can basically achieve full automatic driving from the departure point to the destination in specific scenarios. For example, when the parking lot map information is covered, full automatic driving from the parking lot to the parking space can be achieved; in the high-precision map covered section, full-automatic driving for the whole section including automatic driving, automatic lane changing, and entering/exiting ramps can be completed according to the navigation information.

The data released by the China Society of Automotive Engineers show that in 2020, the penetration rate of L2-level intelligent connected vehicles was approximately 10%, and the sales volume of L2-level new vehicles was less than 3 million units. By 2025, the penetration rate of L2 and L3-level autonomous driving vehicles will soar to 50%. It can be imagined that the market scale is huge. Huaxing Capital believes that ADAS will become a standard configuration for vehicles in the next ten years, and by 2025, the penetration rates of ADAS in a broad sense and L2 function should each be no less than 70% and 28%.

A report on the Chinese ADAS market published by Technavio pointed out that by 2021, Bosch, Continental, Delphi (now Aptiv), DENSO, and Mobileye will be the most competitive players in the Chinese ADAS market.

Both macro predictions and micro analyses show that the logic of automobile operation is becoming more and more similar to that of computers, and suppliers have also seen opportunities and markets from them.

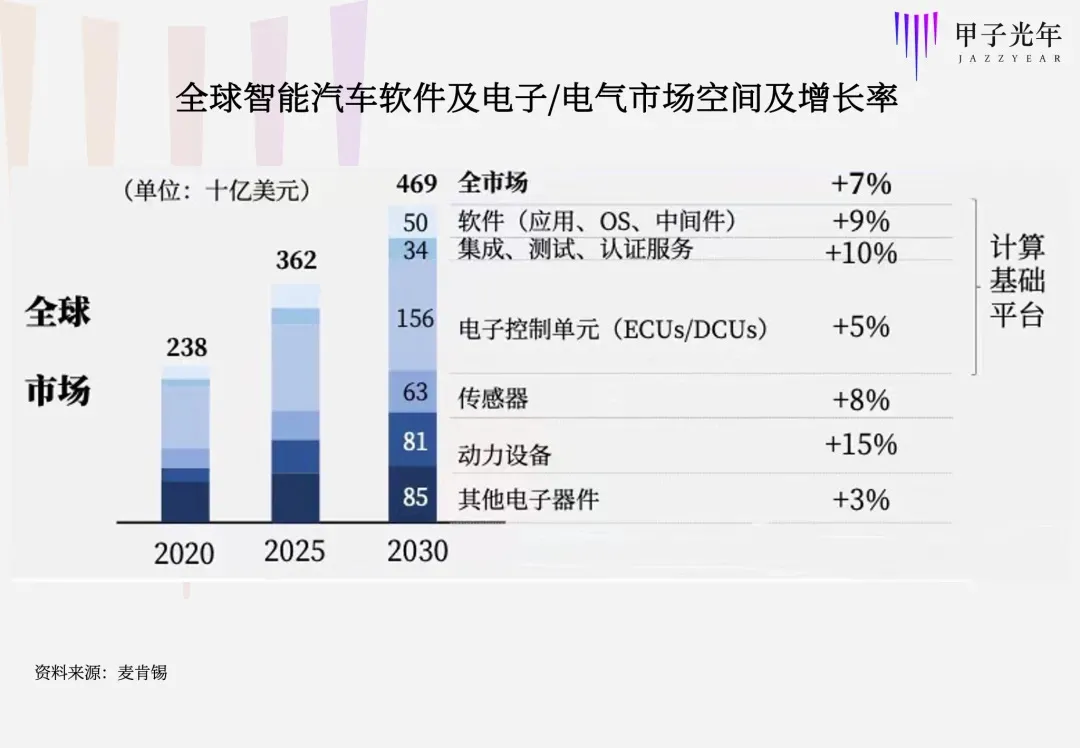

After all, no one can refuse the vast blue ocean predicted by McKinsey: by 2030, the global market size of intelligent automotive software and electronics will reach $469 billion, almost twice that of 2020.

Bill Gates once mocked the automotive industry, saying that if General Motors worked as hard as the computer industry, we would all be driving cars that cost $25 and get 1000 miles to the gallon of gas. At that time, General Motors retorted that if cars really were like computers, they would crash twice a day for no apparent reason and you would have to reinstall the engine when you rebooted them. And then, just before you hit a tree, they would ask you “Are you sure?”

However, today, the transformation is proceeding at a visible speed.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.