Author: Dàyǎn

Introduction

Recently, the chairman of CATL, Zeng Yuqun, announced that sodium batteries will be released in the second half of 2021. This statement caused sodium batteries, which were originally unknown, to become the focus of the market overnight, and stocks related to the concept of sodium batteries rose sharply. As the world’s largest supplier of lithium-ion batteries, what is the intention behind CATL’s announcement of the launch of sodium batteries? What kind of conspiracy is hidden behind it?

Advantages and Disadvantages of Sodium Batteries

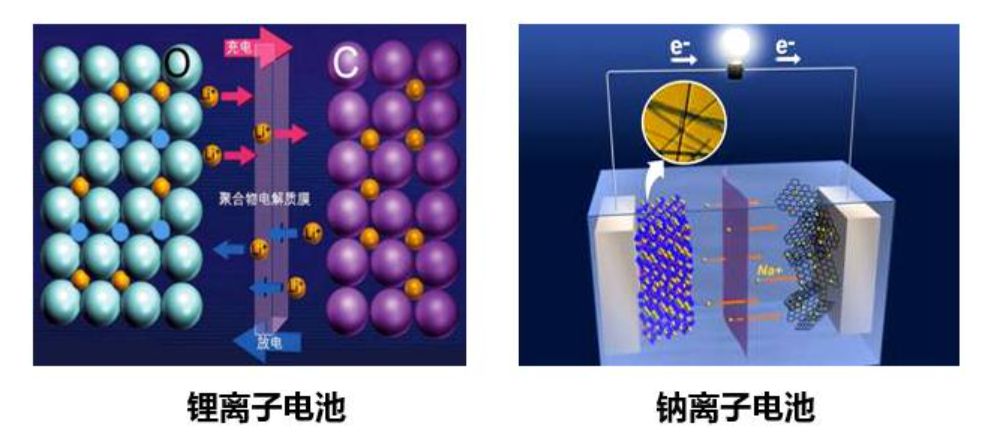

In terms of working principle, sodium batteries are essentially the same as lithium-ion batteries, both of which achieve battery charging and discharging by the insertion and separation of sodium ions or lithium ions between the positive and negative electrodes, with a difference only in the charge carrier being either sodium ions or lithium ions. The positive electrode materials of sodium batteries include transition metal oxides, sodium transition metal phosphates, etc. The negative electrode materials include soft carbon, hard carbon, transition metal oxides, etc. The electrolyte is basically similar to that of lithium-ion batteries.

The biggest problem with sodium batteries is that the energy density is not high enough, even lower than that of many lithium iron phosphate batteries. Currently, the energy density of sodium battery cells on the market generally ranges from 100 to 150 Wh/kg, while the energy density of ternary lithium-ion battery cells can reach around 250 Wh/kg. The energy density of the lithium iron phosphate battery cell has also reached around 180 Wh/kg. In addition, sodium batteries are still in the early stages of research and development, and in the short term, there is no advantage in terms of cost. However, with capacity expansion, the cost of sodium batteries will also decrease.

However, sodium batteries also have incomparable advantages, such as higher core raw material reserves and lower mining difficulty. Moreover, the safety of sodium batteries is better when facing situations such as squeezing and puncture. At present, the raw materials of lithium-ion batteries rely heavily on imports, and we also face a great deal of price pressure. For electric vehicles, the key to promoting them is to keep their price comparable to that of fuel vehicles. Currently, people’s acceptance of lithium iron phosphate batteries is increasing, which proves that people are becoming more rational about the range of electric vehicles and are not blindly pursuing the absolute quantity of range.

Hidden Worries in the Supply Side of Lithium-ion Battery Raw Materials

From the perspective of raw materials, whether it is lithium iron phosphate or ternary lithium-ion batteries, they are inseparable from lithium mines. The lithium reserves globally are relatively limited, with a content of only 0.0065% in the earth’s crust, and most of them are located in Australia and South America, especially South America, which accounts for 70% of the reserves. Currently, the relationship between China and Australia is tense, and South America is America’s backyard. Once the international situation becomes tense again in the future, we may face the possibility that even if we offer a high price, we will not be able to import lithium mines.Compared with lithium, sodium has a higher reserve and is extremely easy to extract. Once the future price of lithium mines continues to rise, the advantages of sodium batteries will gradually become apparent. Consumers around the world not only pursue high-endurance pure electric vehicles, but also have a large demand for electric vehicles that only need to meet daily commuting and have low endurance. From a certain perspective, the demand for the latter is even greater than the former. Just like the Wuling Hong Guang MINI EV, which is currently selling well in China, whether it uses lithium iron phosphate or ternary lithium batteries, it will be affected by the price of lithium mines. Although there is still a gap in energy density between sodium batteries and lithium batteries in the short term, with continuous iterative research and development, it is not impossible to catch up with lithium iron phosphate batteries. Just like BYD’s blade battery, compared with the current ternary lithium battery, there is not much disadvantage in energy density, but the advantages of price and safety stability are enough to make consumers flock to it.

Entering the Energy Storage Field

Compared with the power battery for electric vehicles, the energy storage field is also an area that CATL needs to explore. For CATL, entering the energy storage field can expand its own industrial chain and allow itself to find new opportunities in a broader field. According to the relevant financial reports, in 2020, CATL’s revenue from energy storage systems was RMB 1.943 billion, a year-on-year increase of 218.56%. If we look at it from the perspective of revenue, the gross profit margin of energy storage systems in 2020 reached 36.03%, which is much higher than the 26.56% of power battery systems.

As our attention to green energy increases, the market potential of the energy storage industry is also increasing. According to relevant data, as of the third quarter of 2020, a total of 186.1 GW of electricity storage projects have been put into operation globally, of which pumped storage accounts for 91.9% and electrochemical storage accounts for 5.9%. Compared with pumped storage, which is restrained by geographical environment, electrochemical energy storage will become the main technological route for future energy storage. As of the third quarter of 2020, the cumulative installed capacity of global electrochemical energy storage has reached 10.9 GW, 16.5 times higher than in 2012, and its growth rate is significantly faster than that of pumped storage. Finding a low-cost and high-security energy storage carrier will undoubtedly have a very broad commercial prospect. Sodium batteries are more suitable than lithium batteries as energy storage carriers, both in terms of cost and stability. Therefore, in addition to low-cost pure electric vehicles with low requirements for endurance, CATL hopes to have a wider layout in the energy storage field and become a new business growth point for the company after power batteries.In the field of sodium batteries, there are also a batch of sodium battery companies in China, including Central South University Huizhou Institute of Sodium, Zhejiang Narada Power Source Co., Ltd., who are basically at the same level as their foreign counterparts in technology. In the future, from the perspective of the government, more attention can be paid to the sodium battery technology in the investment of renewable energy projects. Even if sodium batteries are difficult to use in the short term, they still have significant implications for national energy security and the development prospects of the energy storage industry.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.