Author: Big Eyes

Introduction

If there is one car company that has been in the news the most in China, it must be Tesla. There hasn’t been a clear statement regarding the brake failure incidents that have occurred repeatedly in various regions, even to this day. The driving data around the time of the incidents was only obtained through a big commotion caused by a Tesla owner at the Shanghai Auto Show. Actually, for Tesla, meeting the needs of individual car owners isn’t difficult. However, considering that Tesla’s current ownership in China is already high, with Model 3 and Model Y selling over 20,000 units each month, it would be a big burden for Tesla if car owners frequently asked for driving data.

Review of Tesla Incidents

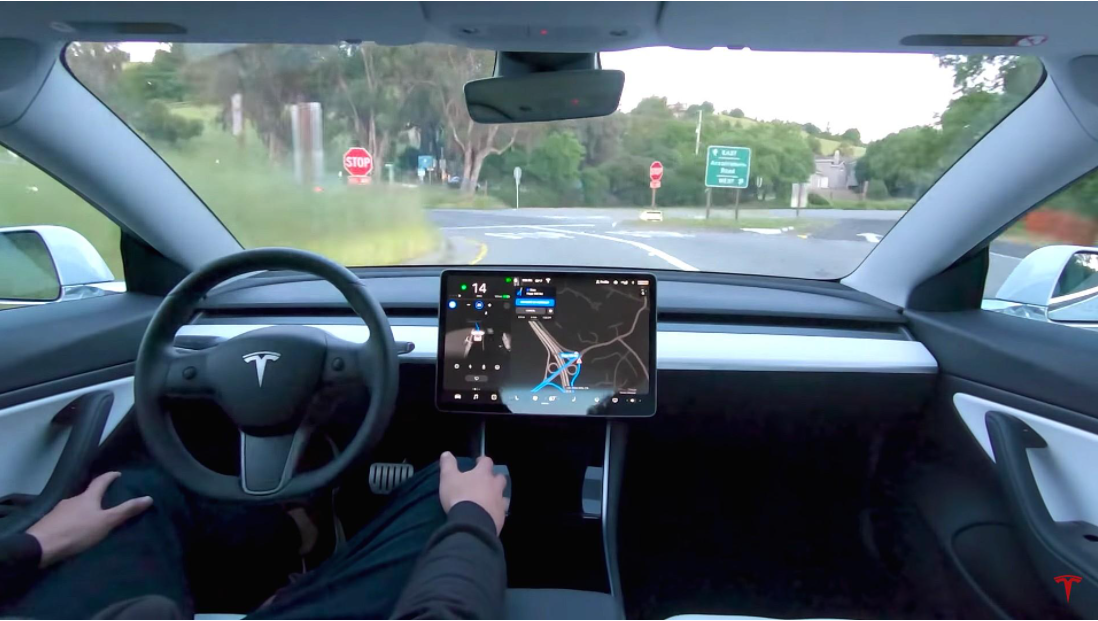

In fact, the turmoil at the Shanghai Auto Show and a series of ambiguous “brake failure” incidents have overshadowed Tesla’s biggest problem. For Tesla, its sensors all around are not only a perception system but also a continuous data source for training controllers for automatic driving systems such as Autopilot. Especially with the 8 cameras that Autopilot relies on, which are the future core sensors for Tesla’s automatic driving system that lacks lidar. However, cameras that take pictures anytime and anywhere will directly transmit the pictures taken to Tesla’s servers in the United States. We cannot assert that Tesla will share relevant data with the US government and military, but after the Federal Express Huawei incident, we cannot rule out this possibility.

In addition to external sensors, Tesla also installs sensors inside the car. Elon Musk himself has admitted that when testing the latest version of FSD in the United States, Tesla installed a camera to monitor whether the driver was dozing off or distracted when running the latest FSD test version, using it as a basis to disqualify relevant personnel from the FSD test program. However, Tesla’s monitoring behavior has not only failed to gain consumer recognition, but also means that consumers are being monitored by Tesla without their knowledge. Moreover, since the camera is a wide-angle camera, it can also monitor the behavior of rear-seat passengers, which means that even the most basic reason for the FSD test version doesn’t exist. Although Tesla later explained that installing a wide-angle camera was a preparation for future self-driving rental cars, all of these explanations seem very futile in the face of the facts.To address related issues, Tesla is building data centers in China to keep all collected data in the country, avoiding the so-called cross-border transmission issues, particularly in the context of the issuance of data security-related laws and regulations by central and industry regulatory departments such as the Cyberspace Administration of China, the Ministry of Industry and Information Technology, and the Ministry of Transport. Additionally, Tesla is planning to establish a platform for customers to directly query vehicle operation data. After customer identification and authentication, Tesla’s customers will be able to access their vehicle status data through the platform, simplifying related processes and avoiding the reoccurrence of conflicts between vehicle owners.

Data is becoming a new battleground for intelligent connected vehicles and even countries’ competition

For Tesla or other mainframe manufacturers that hope to make a breakthrough in the field of intelligent connected vehicles, they are just as data-hungry as the most mainstream internet companies today. Whether it is for autonomous driving or smart cockpits, road data or driving behavior data is a crucial part of the continuous iteration and optimization of the system. Without data, there is no so-called deep learning, and even the best model cannot function properly. For mainframe manufacturers, relying solely on their own fleet is not enough to collect sufficient data. Self-owned fleets are costly, not only resulting in insufficient data collection but also limited coverage of scenarios. For mainframe manufacturers, the best way to accumulate massive data and make use of it is to use the vehicles sold to collect data, which is the most important reference for continuous optimization of the autonomous driving controller and the various systems including the vehicle networking system.

At the national level, European and American countries are gradually strengthening the protection of data cross-border transmission, particularly for geographic coordinate information related to military and political affairs as well as consumers’ personal privacy information. Previously, South Korea strongly opposed providing domestic coordinate data to Google. It was only after Google established a data center in South Korea that Google Maps included that part of South Korea. Currently, as countries’ awareness of data protection increases, European and American countries even unite to create a data self-flow alliance to build a new data alliance that isolates China. For China, we have the world’s largest consumer market, which means we have massive amounts of data. Therefore, before foreign governments form a blockade against China’s data, we must keep the most critical data locally as a basis for future negotiations with foreign governments.From the perspective of developing the digital economy, restrictions on cross-border data transmission also bring great business opportunities. Previously, companies like Apple and Microsoft invested in and established data centers in Guizhou, which also played a significant role in boosting the local economy. For Tesla, leaving the data locally is just the first step. Running related databases requires a large number of professional personnel, bringing considerable job opportunities. At the same time, as data export restrictions become increasingly strict, Tesla can reduce its operating costs by transferring some of its data analysis and processing functions from the United States to China. In the future, it is not unthinkable for Tesla to transfer the functions of software writing or algorithm optimization to China as well. The transfer of these functions is an investment worth billions of dollars and a demand for hundreds or even more professional talents. Compared to moving manufacturing or export functions to China, China needs these soft power transfers more.

The competition in the global data field has just begun!

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.