Author: Sun Xiaoshu

Editor: Chris

“If lithium doesn’t work, sodium batteries are also an option.” Yuqun Zeng’s statement at the Ningde Times shareholder meeting on May 21 ignited a small wave of enthusiasm for sodium batteries. This begs the question:

-

What is sodium battery technology?

-

Can it replace lithium batteries and change the landscape of power batteries?

-

Is the sodium battery that Ningde Times plans to release around July worth waiting for?

What is Sodium Battery?

In fact, sodium batteries are not a new technology. In the 1970s, lithium batteries and sodium batteries were almost equally advanced, and their principles were very similar.

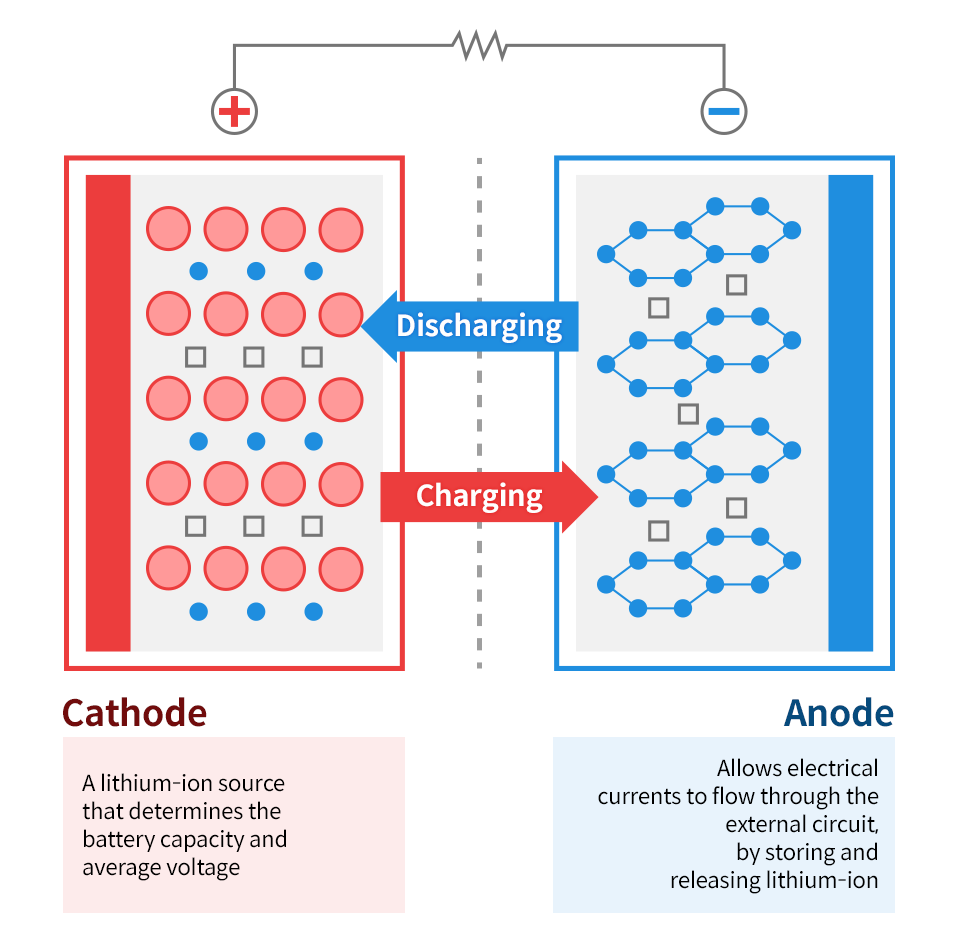

The essence of how batteries work is redox reactions, but unlike other batteries, sodium-ion batteries and lithium-ion batteries are both “rocking-chair batteries”.

Taking lithium-ion batteries as an example, the two electrodes of the battery are filled with an electrolyte, through which only lithium ions can pass while electrons can only move between the electrodes through the external circuit. The internal electrochemical reaction is divided into two parts:

-

Cathode: Reduction reaction, lithium ions receive electrons and embed into the cathode;

-

Anode: Oxidation reaction, lithium ions lose electrons and detach from the anode.

The charging and discharging process of lithium-ion batteries is the process of lithium ions and external electrons embedding/detaching from the cathode and anode. Since lithium ions shuttle back and forth between the cathode and anode, lithium-ion batteries are vividly known as “rocking-chair batteries”.

In the late 1980s, the electrode material of lithium-ion batteries made a breakthrough, with cobalt oxide as the representative positive electrode material, and graphite-based negative electrode material combination. This allowed lithium-ion batteries to achieve excellent performance and was later commercialized by Sony, thereby replacing nickel-hydrogen rechargeable batteries.

It was precisely the research maze of electrode and electrolyte materials that created the development gap between sodium batteries and lithium batteries.

Although they are both “rocking-chair batteries,” the graphite negative electrode material that is commonly used in lithium-ion batteries today cannot be used in sodium-ion batteries because sodium ions are much larger than lithium ions and will destroy the layered structure of graphite.

The radius of lithium ions is only 0.076 nm, while the radius of sodium ions is as large as 0.102 nm. If graphite is still used as the negative electrode, after multiple cycles of sodium ion deintercalation, the layered structure of graphite will collapse, and sodium ions will no longer be able to deintercalate, which means that the battery will no longer be able to charge or discharge.

As for the negative electrode alternative materials for sodium-ion batteries, spongy carbon, alloy, titanium compound, and the fifth-group element, etc., although they can handle the deintercalation of larger radius sodium ions, each has its own shortcomings. Taking spongy carbon as an example, the debate between the “insertion-adsorption” versus “adsorption-insertion” sodium storage mechanism has yet to be resolved, let alone the introduction of new negative electrode materials requiring new corresponding binders.The positive electrode materials for sodium-ion batteries are also filled with uncertainties. In addition to conventional sodium metal oxides, manganese dioxide and Prussian blue are also among the technical routes for positive electrode materials. The choice of electrolyte materials is also a problem.

Accompanied by these problems is the low cycle life of sodium batteries. Formerly, the cycle life of sodium batteries was only 1/10 of that of commercially available lithium batteries. At the same time, the energy density of sodium is lower than that of lithium. These factors limit the commercial promotion of sodium batteries, and thus limit the attention of academia and industry.

How does sodium battery make a comeback?

Sodium batteries have regained popularity in the mainstream academic circle in the last decade, and the reason everyone has not forgotten about sodium batteries is because of the abundant content of sodium element on Earth.

The reserves of sodium element on Earth are relatively abundant, reaching 2.4% in the Earth’s crust, and its content in seawater is also relatively rich, which can be said to be inexhaustible.

In contrast, the global reserves of lithium are pitifully small. There are only less than 70 million tons of lithium on Earth, accounting for about 0.0065% of the Earth’s crust. Scientists have estimated that if all internal combustion engines are replaced with battery power, there will not be enough lithium on Earth.

In addition, the distribution of lithium resources is highly uneven, with about 70% of lithium resources in South America, which is greatly affected by geopolitical changes. China is heavily dependent on imported lithium, with its proportion reaching 80%.

With abundant reserves and uniform distribution, sodium resources have cost advantages compared to metallic lithium. At the same time, sodium-ion batteries can minimize the cost of switching to lithium-ion battery production equipment due to similarities in their working principles.

Moreover, because aluminum and sodium do not undergo alloying reactions at low potentials, the collection of negative electrode current collectors in sodium-ion batteries can replace the expensive copper current collectors with lower-cost aluminum, which is expected to further reduce costs.

Breakthroughs in materials research are also important reasons for the return of sodium batteries to the mainstream.

Sodium batteries have made progress in positive electrode materials such as copper iron manganese systems and nickel systems, and research on carbon-based negative electrodes is also becoming mature.

As for the electrolyte, due to the similarity to lithium-ion batteries, sodium-ion batteries can use the same solvents and replace lithium hexafluorophosphate with sodium hexafluorophosphate.

The Institute of Physics, Chinese Academy of Sciences, has announced that they have found a commercially viable low-cost sodium-ion battery, including a complete battery system composed of positive electrode materials, negative electrode materials, and electrolytes, and will begin exploring commercialization routes in the future.

With the technological maturity, the performance of sodium batteries has also improved. The first issue that has been solved is the low cycle life problem.CEO Tang Kun of Innovente Sodium stated that in 2018, their team’s sodium-ion battery had a cycle life of up to 2000. After filling the gap in the cycle life, the advantages of the excellent high and low-temperature performance and safety of sodium-ion batteries can be highlighted.

The energy density of sodium-ion batteries has also been improved to 120 Wh/kg, and some can even reach 150 Wh/kg, while also having a certain fast charging capability. However, compared with lithium-ion batteries, its energy density is still a weakness. After all, Tesla 18650 cell’s energy density has reached 250 Wh/kg.

The difference in energy density between sodium and lithium batteries is determined by material properties, which is difficult to be leveled by technical means. For this reason, sodium batteries are not suitable for power batteries. At least in the foreseeable future, there is no possibility of replacing lithium-ion batteries comprehensively.

So, what is the driving force behind CATL’s persistence in promoting sodium batteries?

Actually, it is worth noting when CATL announced the launch of sodium batteries.

The main information leaked from the shareholders’ meeting on May 21st includes:

-

Downstream customers are urging orders, and the market is booming;

-

Upstream raw material prices are under pressure, considering transferring them downstream;

-

Short-term pessimism about the commercialization process of solid-state batteries.

We can see that under the dual squeeze of strong downstream demand and rising upstream raw material costs, as a global battery supply leader, CATL cannot take it easy.

From January to April 2021, China’s accumulative installed capacity of ternary lithium reached 19.0 GWh, accounting for 60.0% of the total installed capacity, a cumulative increase of 173.4% year-on-year; the accumulative installed capacity of lithium iron phosphate was 12.6 GWh, accounting for 39.8% of the total installed capacity, a cumulative increase of 455.9% year-on-year.

Even if the impact of the epidemic in the same period last year is excluded, the trend of rising lithium-ion battery installed capacity cannot be ignored. Considering that the “New Energy Vehicle Industry Development Plan (2021-2035)” issued by the State Council previously proposed that the sales volume of new energy vehicles in China should reach 20% of the total sales volume by 2025, as well as the global trend of new energy, the strong downstream demand and sustained pressure on production capacity of CATL’s future are self-evident.

Corresponding to the demand is the growth of upstream raw material prices. Among them, the price of the main semi-finished product of the ternary cathode, the ternary precursor, has risen from around 72,000 yuan/ton in July 2020 to around 120,000 yuan/ton in March 2021. The price of lithium iron phosphate cathode material also surged in February, with an increase of nearly 30%.

Under the huge production capacity and cost pressures, it is not surprising that Cen Jieyi stated, “If anyone tries to raise prices indiscriminately here, we will exclude them.“

Under the huge production capacity and cost pressures, it is not surprising that Cen Jieyi stated, “If anyone tries to raise prices indiscriminately here, we will exclude them.“

So, was releasing sodium batteries around July a desperate move for Ningde Times? After all, under current technological conditions, sodium batteries are not yet able to replace lithium batteries.

In fact, Ningde Times has been laying out sodium battery technology for a long time. When the 21C innovative laboratory, which received a 3.3 billion yuan investment in 2020, was officially inaugurated in Ningde, Fujian, it was revealed that research and development would focus on next-generation batteries such as metal lithium batteries, solid-state batteries, and sodium-ion batteries. The sodium battery mentioned by Cen Jieyi was highly likely to have come from this laboratory.

What Ningde Times may be targeting is another vast market.

Experts generally believe that sodium-ion batteries are difficult to have major breakthroughs and it is basically impossible to break through the current power system. However, they can be used in other special application scenarios such as low-speed vehicles or energy storage. Ningde Times may be optimistic about the blue ocean market of energy storage.

Academician Chen Liquan from the Institute of Physics of the Chinese Academy of Sciences has made a detailed analysis of China’s energy storage industry, pointing out that with the accelerated construction of 5G base stations, China will need to build or renovate at least 14.38 million base stations, with a capacity to accommodate 155 GWh of batteries. This will greatly increase the demand for energy storage batteries.

Faced with huge market prospects, sodium-ion batteries are expected to dominate the energy storage market with low cost, long life, and high safety. Winning the energy storage market means that Ningde Times can find a new profit pool.

On the other hand, the application of sodium batteries in the energy storage market can also effectively alleviate the supply pressure of lithium batteries.

In 2021, the demand for lithium carbonate in the energy storage field is about 40,000 tons, and the total industry is about 400,000 tons. Looking long-term, by 2025, the demand for lithium carbonate in the energy storage field is expected to be 180,000 tons, and the total industry will be 1.05 million tons.

In other words, if sodium-ion batteries are used in all energy storage fields, the expected demand for lithium carbonate will decrease by 17%, greatly relieving the supply and price pressures of raw materials in the power battery industry.

Battery Giants Anticipate the Future

Ningde Times’ release of sodium batteries can be said to be a double-edged sword strategy. It can not only open up new markets under the dual timing of the maturation of sodium battery technology and the gradual growth of the energy storage market, but also indirectly ease the production capacity and cost pressures of lithium batteries.

In fact, not only Ningde Times but also Tesla is optimizing the allocation strategy of lithium resources. Tesla’s adjustment has been proceeding smoothly. In fact, as early as last year, Tesla had begun to test the scale of phosphate iron lithium batteries in China.

Of course, this is stimulated by multiple factors such as battery subsidies policy adjustment and China’s mature phosphate iron lithium battery industry, and the cost advantages of iron lithium relative to ternary lithium have changed. However, the reason behind it is also to alleviate the pressure of installing ternary lithium batteries.Tesla is, in fact, the world’s third-largest lithium battery production manufacturer, following Ningde Times and LG Chem, and is facing significant production pressure. Since 2018, the annual production capacity of batteries at Tesla’s Gigafactory in Nevada has remained at 32 GWh for several years, and the pressure on power supply will undoubtedly increase after the launch of the Cybertruck.

To cope with the supply and cost pressure of raw materials, in Q1 2021, Tesla’s energy storage product, Megapack, has switched from ternary lithium to iron phosphate lithium batteries. According to relevant sources, Tesla’s iron phosphate lithium battery distribution will also be launched successively in Europe and North America. The adjustment of Tesla’s lithium battery configuration strategy is accelerating.

Ningde Times set off this wave of sodium battery enthusiasm, which is not an emergency measure, but rather a response to be prepared. Its deep motivation is to open up new business growth points by deploying sodium batteries in the field of energy storage, while easing the pressure on lithium battery raw materials.

“Our technology is also developing, and our sodium battery is mature. Sodium chloride can’t be speculated because there is too much salt.” This statement seems to both encourage themselves and criticize upstream companies.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.