In recent years, with the various chip supply crises faced by China’s manufacturing industry, the security of chip supply has become an important factor for the development of the high-tech industry. The sudden outbreak of the COVID-19 pandemic in 2020 caused huge fluctuations in automobile production and expectations, causing significant disturbances in the global automotive supply chain. A prominent issue is how to ensure the long-term and stable supply of chips in China, given that automotive electronic components are becoming increasingly important as cars undergo digital transformation.

Issues in the Automotive Chip Supply Chain

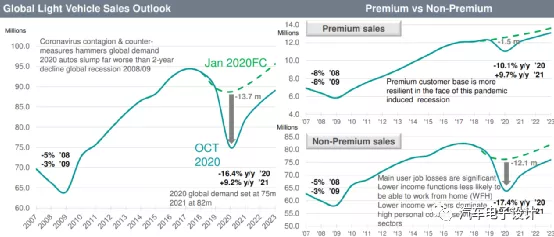

Automobile production can be highly volatile, as shown in the figure below. Due to the interruption of overall production and sales due to the pandemic earlier this year, major automobile manufacturers cut back on orders to component companies. As the end of the year approached, the production of automobile semiconductor chips, with a delivery time of 6-9 months, could not keep up with this demand. As a result, major automobile companies around the world are facing chip shortages.

This issue is global in scale. In the first quarter of 2021, Volkswagen reduced production of 100,000 cars at its plants in Europe, North America, and China; Nissan has been forced to cut production of its best-selling Note sedan since January; and Honda will reduce production of several models over the next few months. Due to a shortage of semiconductor chips, production at a factory in Kentucky, USA, owned by Ford Motor Company has been completely shut down. Renault, Daimler, and General Motors are also struggling with the pressing issue of chip shortages.

In mid-January in China, data from the China Association of Automobile Manufacturers showed that production by 15 key enterprises had completed 523,000 vehicles, a year-on-year decrease of 27.4%. Among them, passenger car production completed 436,000 vehicles, a year-on-year decrease of 29.3%, while commercial vehicle production completed 87,000 vehicles, a year-on-year decrease of 16%. In China, the shortage of chip supply will affect the stability of the country’s automotive industry. The shortage of automotive chips will have an impact on the entire automotive industry in China, and “ensuring supply” has been a hot topic for automakers over the past year and beyond.

From this perspective, the chip shortage is a cyclical problem, but for China’s automotive industry, considering the extension security of suppliers in China is important given the volatility and long-term development to ensure stability. In January, representatives of domestic automakers, including SAIC-GM-Wuling, proposed to quickly mobilize resources from various departments, establish a TDC chip localization working group, and ensure that the company’s production capacity would not be affected by suppliers.

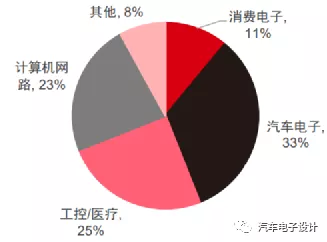

Automotive ChipsThe global automotive chip market size was approximately USD 47.5 billion (RMB 307.6 billion) in 2019. Classified by application, microprocessors (MCUs and SOCs) account for 30%, followed by analog circuits at 29%, and sensors and logic circuits at 17% and 10% respectively. However, domestically produced automotive chips in China are less than RMB 15 billion, accounting for only 4.5% of global production capacity. Key components such as MCUs are imported at a rate of over 80%-90%. In 2018, the top ten automotive chip companies worldwide were foreign-based according to revenue.

Taking MCUs in automotive electronics as an example, MCU microcontrollers integrate the central processor, memory, flash memory, counters, A/D conversion, serial ports, and other peripheral interfaces into a single chip, forming a chip-level computer with different control functions for various applications. MCUs are widely used in various electronic devices such as mobile phones, PC peripherals, household appliances, remote controls, and also in automotive electronics, industrial stepping motors, and robotic arms control, widely used in smart homes, consumer electronics, network communications, and industrial control. They are in high demand in automobiles, so the first major market application area for MCUs is automotive electronics.

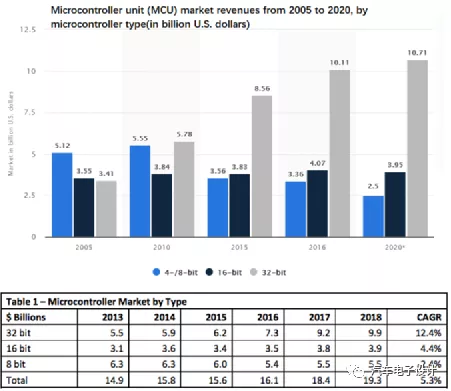

Looking at the entire industry, in the field of MCU chip technology, low-end MCU products such as 4-bit, 8-bit, and 16-bit MCUs have high domestic self-sufficiency rates, while the mid-to-high-end MCU market is primarily dominated by foreign giants such as STMicroelectronics, NXP, Renesas, Infineon, and Microchip Technology. Internationally leading MCU products can meet the product performance and technical requirements of automotive, industrial control, and consumer products. Compared with imported brands, domestic MCU manufacturers are still small in size and are more prevalent in lower-end categories.

Difficulties in Penetrating the Domestic Automotive MCU Market

In the field of automotive electronic chips, the application range of MCUs ranges from powertrain and vehicle control to information entertainment and driver assistance. From engine control units to control units for wipers, windows, electric seats, air conditioning and other areas, automotive electronics cannot exist without MCUs, which are also the carriers of automotive software. Each car needs to use at least 70 MCU chips.

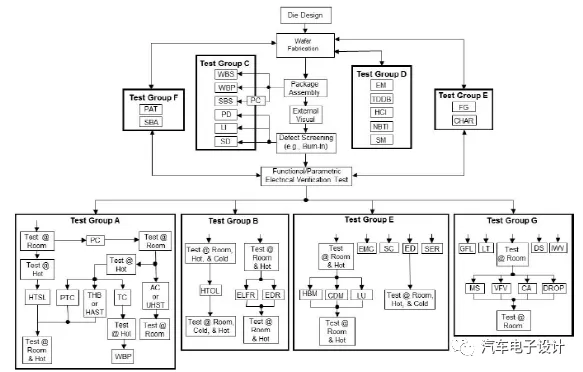

1) Basic requirements for automotive-grade MCUs.In the automotive field, products must possess high reliability and safety characteristics. The automotive-grade MCU itself has stringent requirements for reliability, consistency, stability, and operating temperature range to ensure the safety of the vehicle under different operating conditions. Products must meet a series of automotive electronic standards and specifications before they can be pushed into the market. To this end, the International Automotive Electronics Association has introduced the following three standard specifications for automotive-grade MCUs to ensure the safe operation of automotive electronic products: AEC-Q100 reliability standard, IATF 16949 specification for quality management in supply chain that meets zero defects, and ASIL functional safety assurance level that complies with ISO26262 standard.

2) Development Environment of Automotive MCUs

With the widespread adoption of functional safety requirements and software management in automotive electronics, MCUs need to have good automotive software tools to help Tier1 and Tier2 suppliers simplify and shorten the time required to build ECUs. These tools include runtime embedded software, toolboxes compatible with MATLAB/Simulink®, various driver programs, libraries, stacks, and boot program software, as well as MCU initialization tools that support AUTOSAR Microcontroller Abstraction Layer (MCAL) and operating system (OS) code generation.

More importantly, due to the unified global requirements and deployment of existing automotive companies and international Tier1 companies, many latecomers have been excluded from the outset. Domestic MCU companies can only start with domestic Tier1 or Tier2 companies and begin with self-owned brands with less control constraints on ECU.

From the current perspective, the promotion of chip localization by enterprises like Wuling is a great opportunity.

Development Path of Domestic Automotive MCU Enterprises

From the current entry point, domestic enterprises’ entry into the MCU mainly falls into two categories. One is based on the import of 8-bit MCUs in the automotive electronics market. The 8-bit MCU, as a relatively simple microcontroller, is usually used as an end control in automotive ECU components, such as lights, wipers, doors and windows, switches, air conditioning panels/power, start-stop devices, voltage regulators, and seat controls, etc. Microchip and NXP are currently widely used in these ECUs. Since many simple controllers do not require large MCU resources and do not have too high ASIL functional safety levels, they only comply with AEC-Q100 certification. Brand influence, long-term mass production verification, and industry recognition are the factors that can make them widely used in the automotive field.

The first generation of products introduced by ChipON in 2009 was defined as “automotive grade”. Starting from 2012, it entered the automotive aftermarket and achieved mass production. It was the first domestic company to launch an 8-bit car-grade MCU, but this field received little attention from enterprises.

32-bit MCUs are more widely used in the field of automotive electronics applications, with more applications in node control and ECUs that require slightly more complex functions or stronger functional safety requirements. With the increase in demand for certain functions, some terminal ECUs that use 8-bit MCUs have also upgraded their processing performance to 32-bit MCUs in order to improve the user experience and enrich the functions. For example, for the seats, if simple control of 3 motors with 6 phases is required, an 8-bit MCU is sufficient to meet the requirements. However, to increase the user experience, functions such as memory, ventilation and heating, diagnostic and bootloader functions need to be added, hence the original 8-bit MCU is not enough and needs to be upgraded to a 32-bit MCU. If classified according to whether functional safety is required, they can be divided into three application categories: non-functional safety, ASIL-B, and ASIL-D.

Components without functional safety requirements come more from body control and in-vehicle ECUs, such as seats, air conditioning panels, lighting control, Tbox, OBC, in-vehicle wireless charging, and in-vehicle display screen co-controllers. Some of this part uses the KEA series of 32-bit MCUs, the traditional series of MCUs from Renesas, and the S32K1 series of MCUs with ASIL-B functional safety levels.

ASIL-B functional safety applications are more about automotive body control, such as BCM, air conditioning power, power management, etc. Sometimes there may be some overlap between non-functional safety and ASIL-B application scenarios, mainly depending on how OEMs make their regulations. At present, there are not many branded MCU manufacturers that can provide genuine ASIL-B level, mainly NXP’s MCUs.

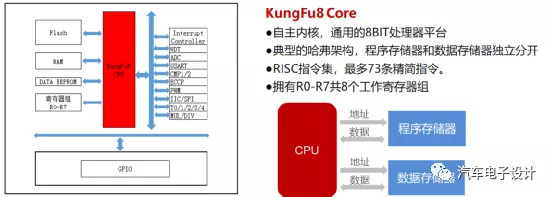

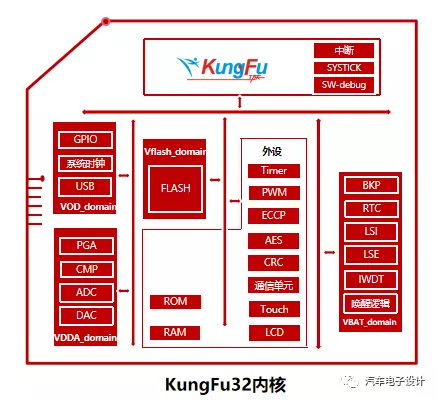

ASIL-D functional safety applications belong to strong functional safety applications; from automotive safety airbags, brake ABS; ESP; electric drive; battery pack BMS, gearbox and three-electric systems (VCU, MCU, BMS); manufacturers that can provide D-level MCUs mainly include Infineon, Renesas, and NXP.The reliable import of automotive chips in China mainly depends on the design requirements of ASIL-B level, and also requires time for functional safety certification. It is an area that needs to rely on accumulation over a long period of time. As one of the earlier domestic suppliers of automotive chips, ChipON has made a leap to the more challenging 32-bit automotive MCU based on the KungFu32 kernel, which has been produced in large quantities since 2019. Currently, a variety of automotive grade MCUs such as KF32A140, KF32A141, KF32A150, KF32A151, KF32A152, and KF32A250 based on the KF32A series have been pushed to the market. The KF32A series MCU for automotive use has the following features:

- Complies with the AEC-Q100 automotive quality certification standard: Grade 1 temperature range (-40~125℃);

- Reliability: ECC Flash/RAM; dual watchdog design; ESD: 8KV (HBM);

- High performance: UP TO 120Mhz frequency; 150DMIPS computing power; UP TO 512KB ECC Flash;

- High integration: 6-channel CAN2.0 interface with speeds up to 1Mbit/s; 4-channel LIN interface; integrated ADC/DAC/PWM/ECCP/PGA/CMP/USB/LCD/Touch and other peripheral resources.

- Chip security: flash programmable authorization operations; built-in AES128 hardware encryption and decryption; built-in hardware variable-bit CRC32 check unit.

On March 10th, 2021, Sunlord Micro announced the completion of its B round of financing with a transaction amount of 300 million yuan. Existing shareholders, including SMIC Ju Yuan, SAIC Hengxiang, Transfar Mohr, and GSI Venture, continued to invest, while Wanxiang Qianchao and Sanhua were introduced, integrating automotive upstream and downstream industry resources to improve market competitiveness. The funds will be mainly used for the development of automotive chips, including multi-core MCU products that meet the ASIL-D level for automotive engines and domain controllers, as well as RF, Ethernet, and bus-type automotive products.Recently, Sunplus Technology unveiled its heavyweight 32-bit MCU KF32A156, which is applied to vehicle body control, at the Guangzhou International Automotive Technology Exhibition. KF32A156 has 512KB Flash, 64KB RAM, and most importantly, supports 2-way CANFD. Moreover, its working range reaches Grade 1 (-40~+125°C), and after mass production, KF32A156 will expand Sunplus Technology’s MCU products from covering 30% of the current vehicle body control unit modules to 70%. In the second half of this year, Sunplus Technology will continue to release various automobile-grade 32-bit MCUs with higher resources, aiming to comprehensively compare with international brands and solve the problem of insufficient chips in key automotive electronic applications that require higher functional safety levels.

Conclusion

The MCU market is a product that spans multiple application scenarios. In the Chinese automotive MCU market, due to the relatively short time and inertia of Tier 1 manufacturers, high barriers, long cycles, strong safety requirements, and late entry of Chinese chip manufacturers, there is a lack of presence of Chinese semiconductor manufacturers. With the consideration of automotive electronic supply chain security, automobile market presents an opportunity for domestic MCU manufacturers to enter.

This article is a translation by ChatGPT of a Chinese report from 42HOW. If you have any questions about it, please email bd@42how.com.